This version of the form is not currently in use and is provided for reference only. Download this version of

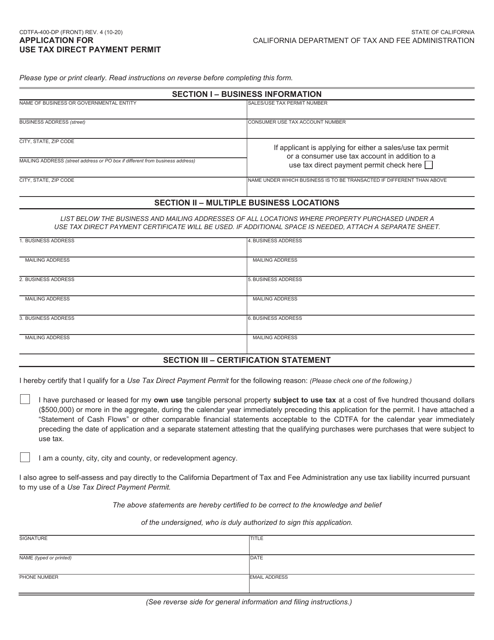

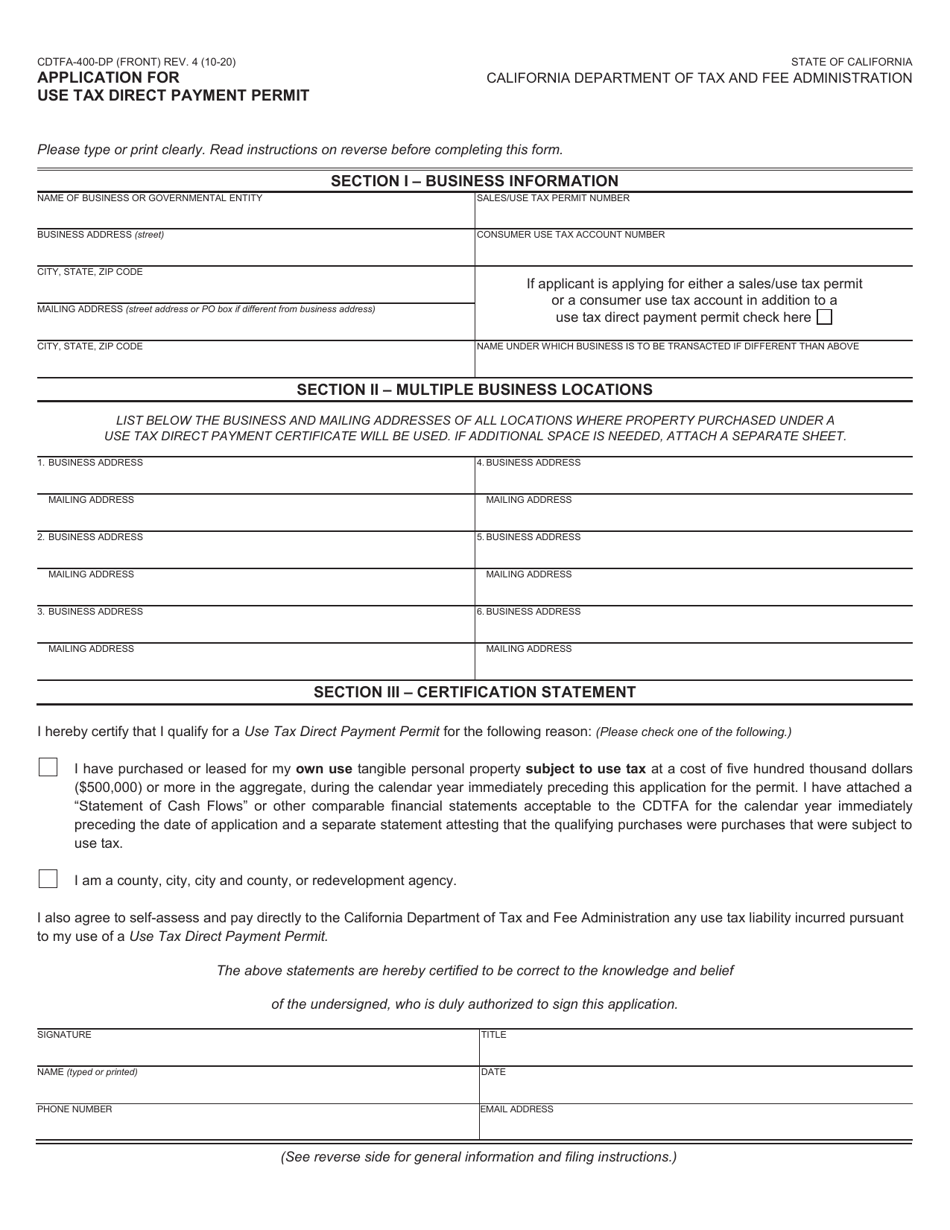

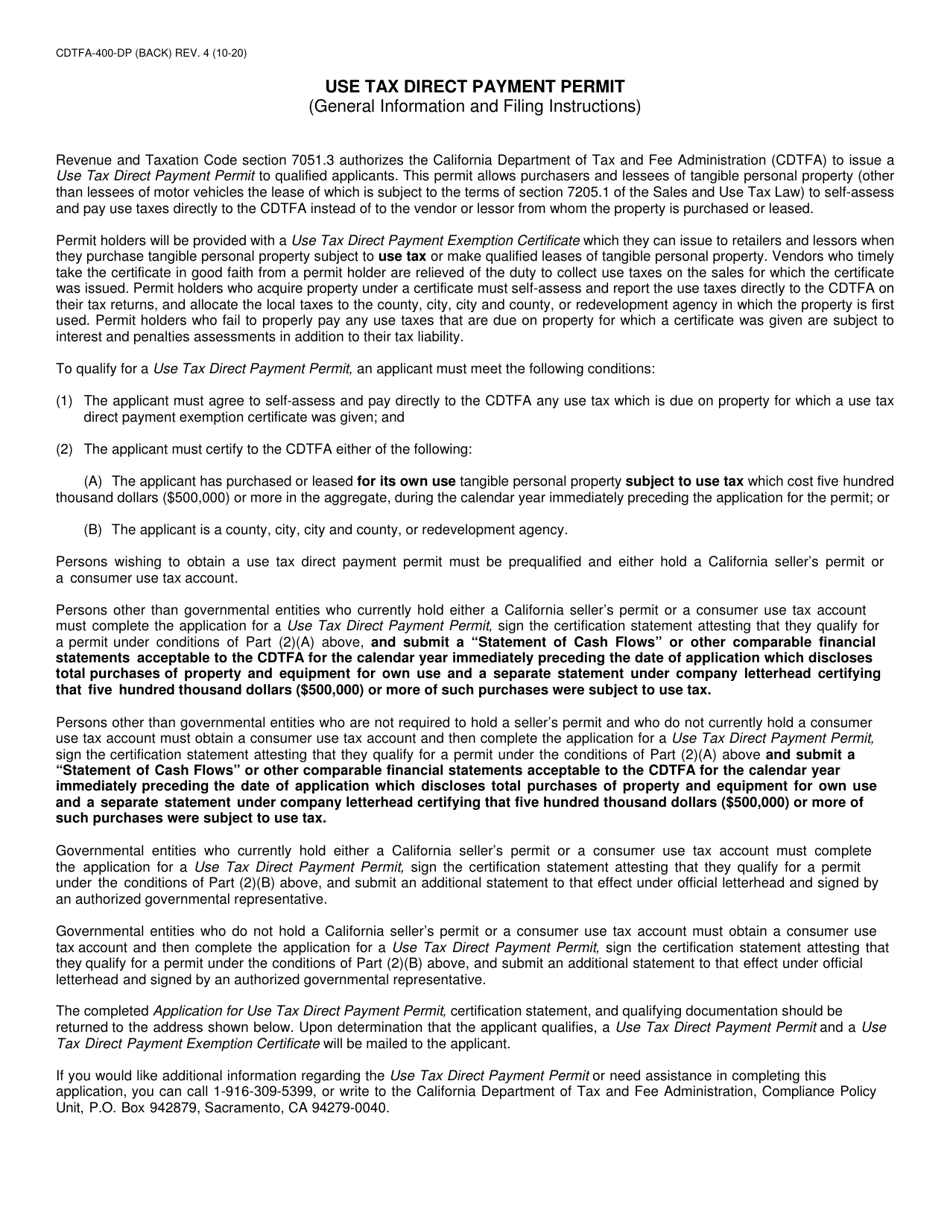

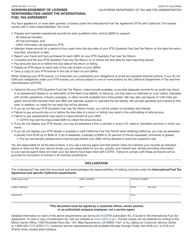

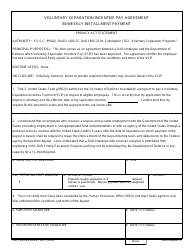

Form CDTFA-400-DP

for the current year.

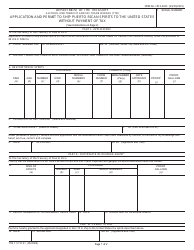

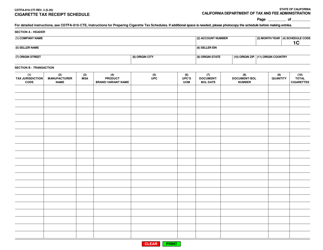

Form CDTFA-400-DP Application for Use Tax Direct Payment Permit - California

What Is Form CDTFA-400-DP?

This is a legal form that was released by the California Department of Tax and Fee Administration - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is CDTFA-400-DP?

A: CDTFA-400-DP is the application form for the Use Tax Direct Payment Permit in California.

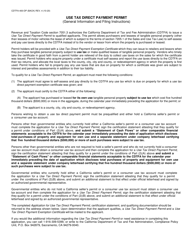

Q: What is the Use Tax Direct Payment Permit?

A: The Use Tax Direct Payment Permit allows businesses to pay their use tax directly to the California Department of Tax and Fee Administration (CDTFA), instead of paying it to their vendors.

Q: Who can apply for the Use Tax Direct Payment Permit?

A: Businesses that are registered with the CDTFA and have a valid California seller's permit can apply for the Use Tax Direct Payment Permit.

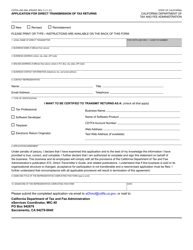

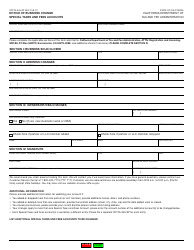

Q: What information do I need to provide in the application?

A: The application requires information such as the business's name, address, seller's permit number, estimated annual use tax liability, and a list of qualified purchases.

Q: Are there any fees associated with the Use Tax Direct Payment Permit?

A: No, there are no fees for obtaining or renewing the Use Tax Direct Payment Permit.

Q: How long does it take to process the application?

A: The processing time for the application can vary, but it typically takes around 4-6 weeks.

Q: What are the benefits of having a Use Tax Direct Payment Permit?

A: Having a Use Tax Direct Payment Permit allows businesses to streamline their use tax reporting and payment process, and it may also help reduce the risk of audit.

Q: Can I use the Use Tax Direct Payment Permit for all my purchases?

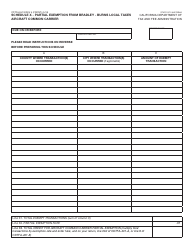

A: No, the Use Tax Direct Payment Permit can only be used for certain qualified purchases.

Q: How often do I need to file and pay the use tax with the Use Tax Direct Payment Permit?

A: Businesses with a Use Tax Direct Payment Permit must file and pay their use tax on a quarterly basis.

Q: Can I cancel my Use Tax Direct Payment Permit?

A: Yes, businesses can cancel their Use Tax Direct Payment Permit by submitting a cancellation request to the CDTFA.

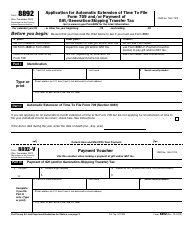

Form Details:

- Released on October 1, 2020;

- The latest edition provided by the California Department of Tax and Fee Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CDTFA-400-DP by clicking the link below or browse more documents and templates provided by the California Department of Tax and Fee Administration.