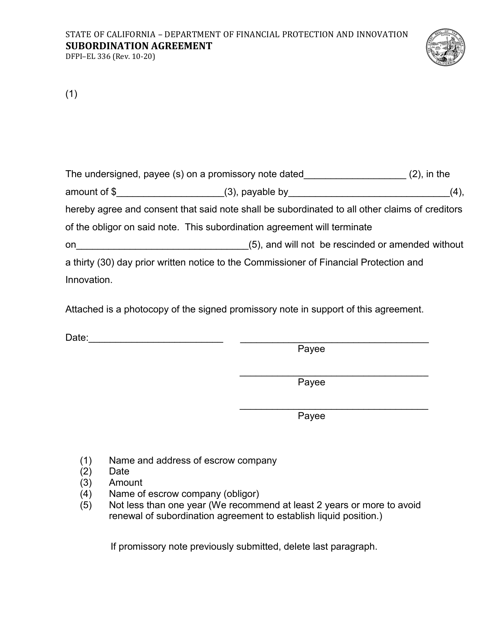

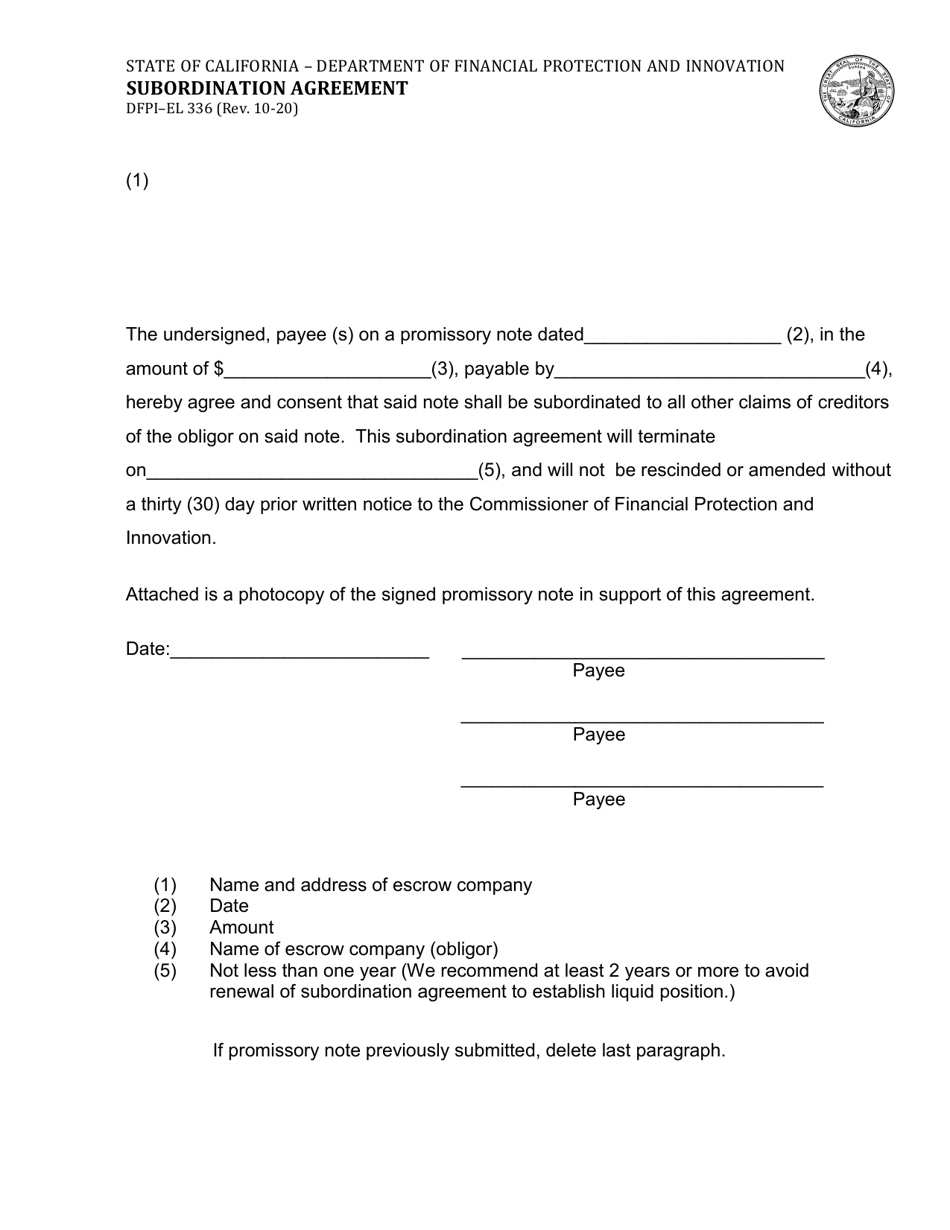

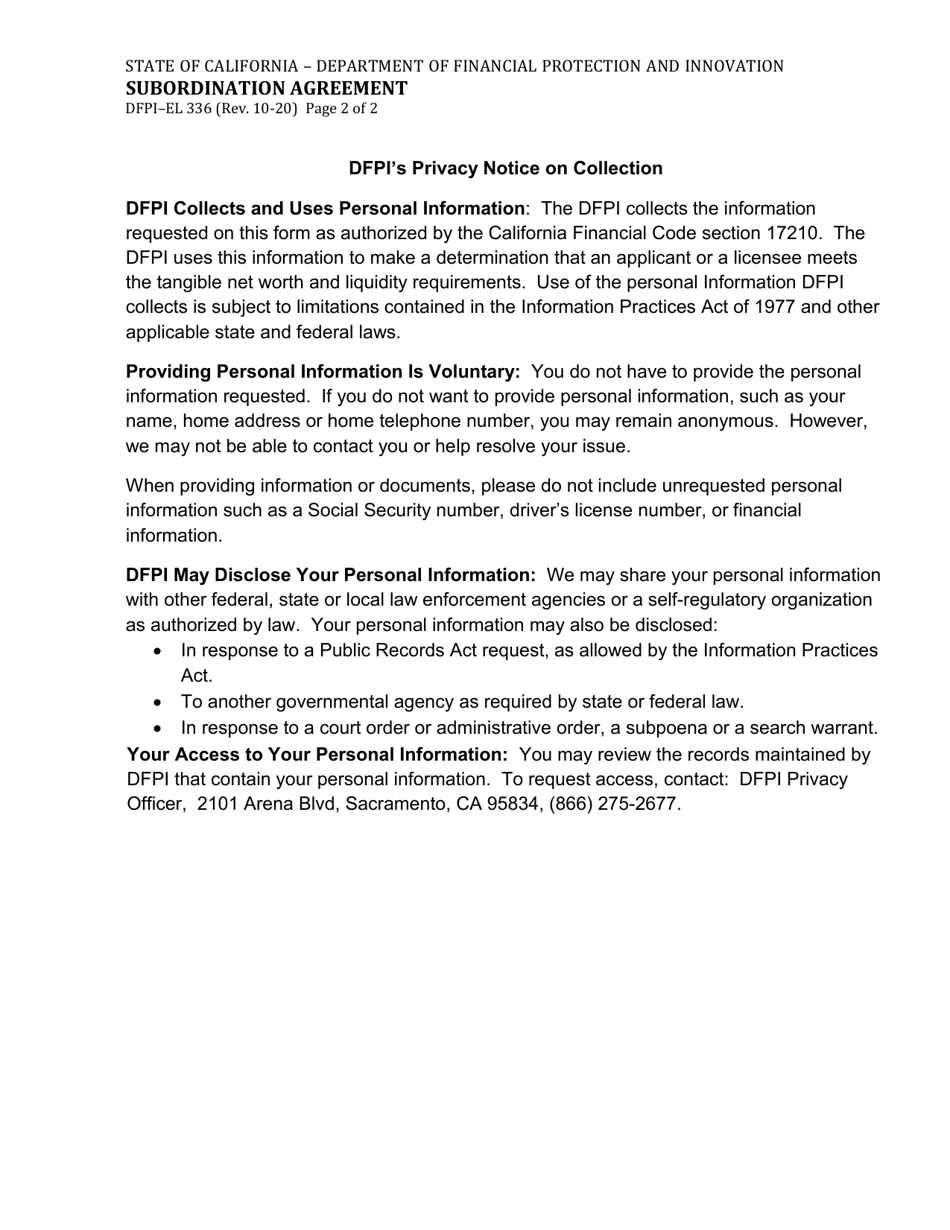

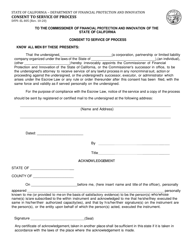

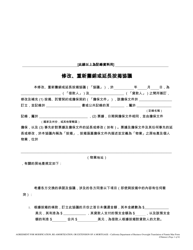

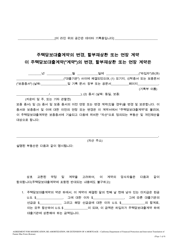

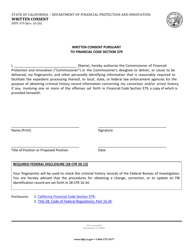

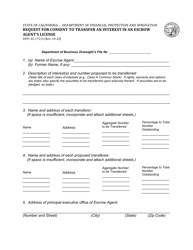

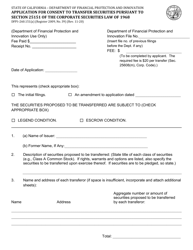

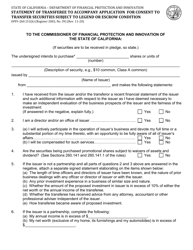

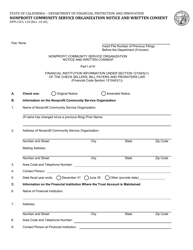

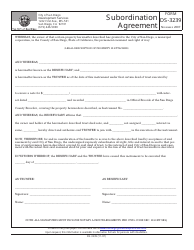

Form DFPI-EL336 Subordination Agreement - California

What Is Form DFPI-EL336?

This is a legal form that was released by the California Department of Financial Protection and Innovation - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

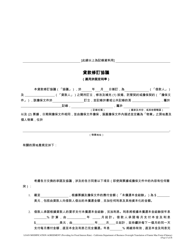

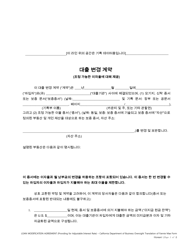

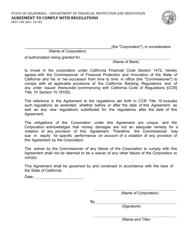

Q: What is a Subordination Agreement?

A: A Subordination Agreement is a legal document that establishes the priority of one party's claim over another party's claim in case of default or bankruptcy.

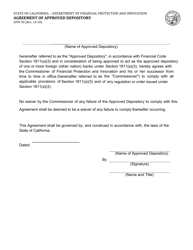

Q: What is the purpose of a Subordination Agreement?

A: The purpose of a Subordination Agreement is to determine the priority of claims in case of default or bankruptcy, ensuring that certain debts take precedence over others.

Q: Who is involved in a Subordination Agreement?

A: A Subordination Agreement typically involves at least two parties: the party with the higher priority claim (the senior creditor) and the party with the lower priority claim (the junior creditor).

Q: Why would someone enter into a Subordination Agreement?

A: Someone may enter into a Subordination Agreement to obtain financing or to facilitate a loan transaction, as it allows for the restructuring of debt and ensures repayment priorities.

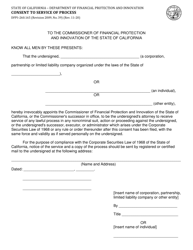

Q: What happens if a borrower defaults on a loan covered by a Subordination Agreement?

A: If a borrower defaults on a loan covered by a Subordination Agreement, the senior creditor would have the first right to collect the outstanding debt before the junior creditor can make a claim.

Form Details:

- Released on October 1, 2020;

- The latest edition provided by the California Department of Financial Protection and Innovation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DFPI-EL336 by clicking the link below or browse more documents and templates provided by the California Department of Financial Protection and Innovation.