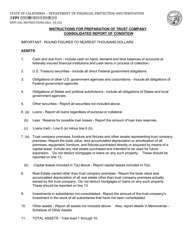

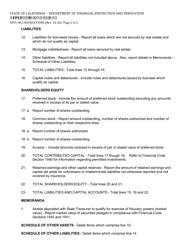

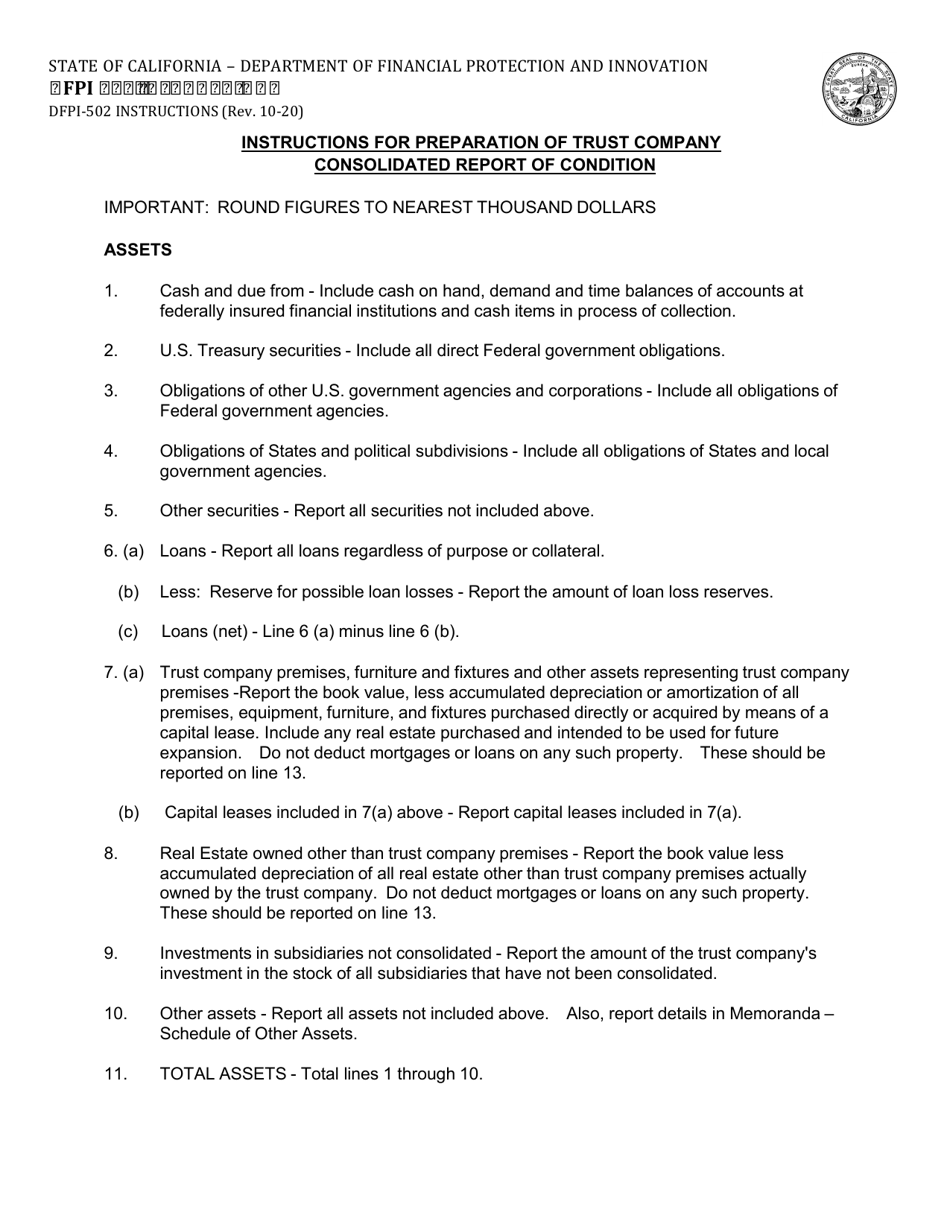

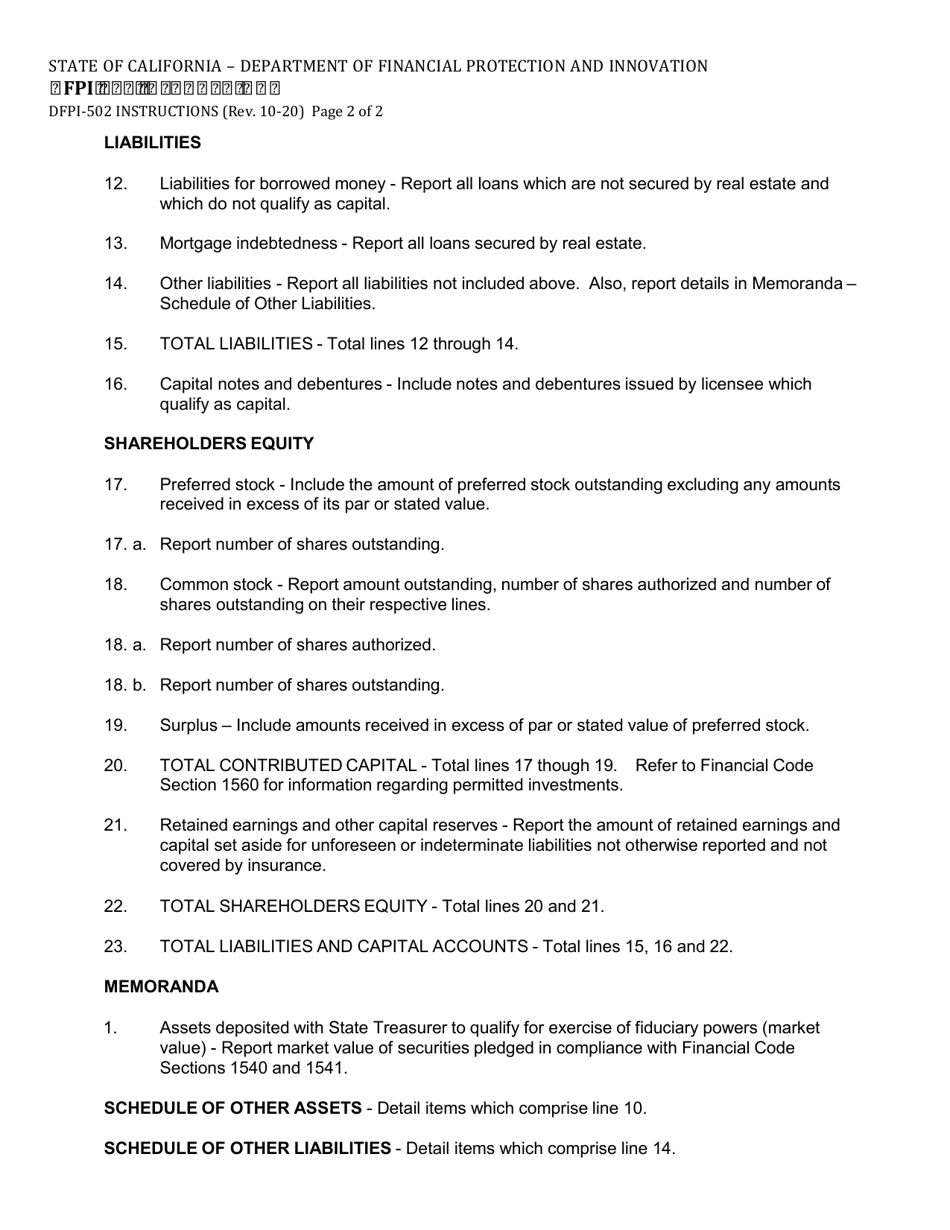

Instructions for Form DFPI-502 Trust Company Consolidated Report of Condition - California

This document contains official instructions for Form DFPI-502 , Trust Company Consolidated Report of Condition - a form released and collected by the California Department of Financial Protection and Innovation. An up-to-date fillable Form DFPI-502 is available for download through this link.

FAQ

Q: What is Form DFPI-502?

A: Form DFPI-502 is the Trust Company Consolidated Report of Condition for California.

Q: Who needs to file Form DFPI-502?

A: Trust companies in California are required to file Form DFPI-502.

Q: What is the purpose of Form DFPI-502?

A: The purpose of Form DFPI-502 is to collect financial information about trust companies in California.

Q: When is Form DFPI-502 due?

A: Form DFPI-502 is due annually, within 90 days of the end of the trust company's fiscal year.

Q: Are there any penalties for not filing Form DFPI-502?

A: Yes, there may be penalties for not filing Form DFPI-502 or for filing it late. It's important to comply with the filing deadline.

Q: What information is required on Form DFPI-502?

A: Form DFPI-502 requires trust companies to provide information about their assets, liabilities, income, and expenses, among other financial details.

Q: Are there any exemptions from filing Form DFPI-502?

A: There may be exemptions for certain trust companies. It's best to consult the instructions or contact the DFPI for more information.

Q: Is there a fee for filing Form DFPI-502?

A: Yes, there is a fee associated with filing Form DFPI-502. The fee amount can be found in the instructions for the form.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the California Department of Financial Protection and Innovation.