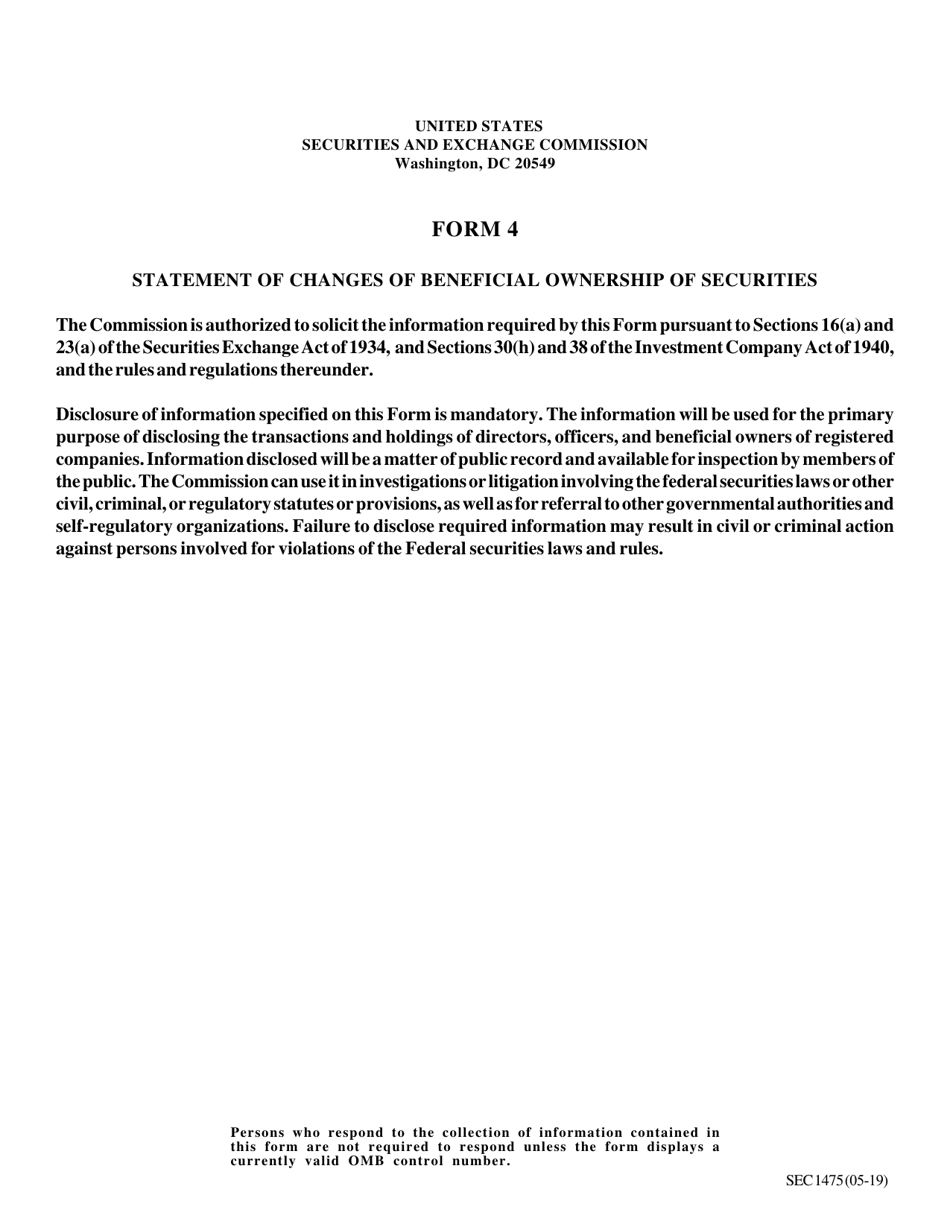

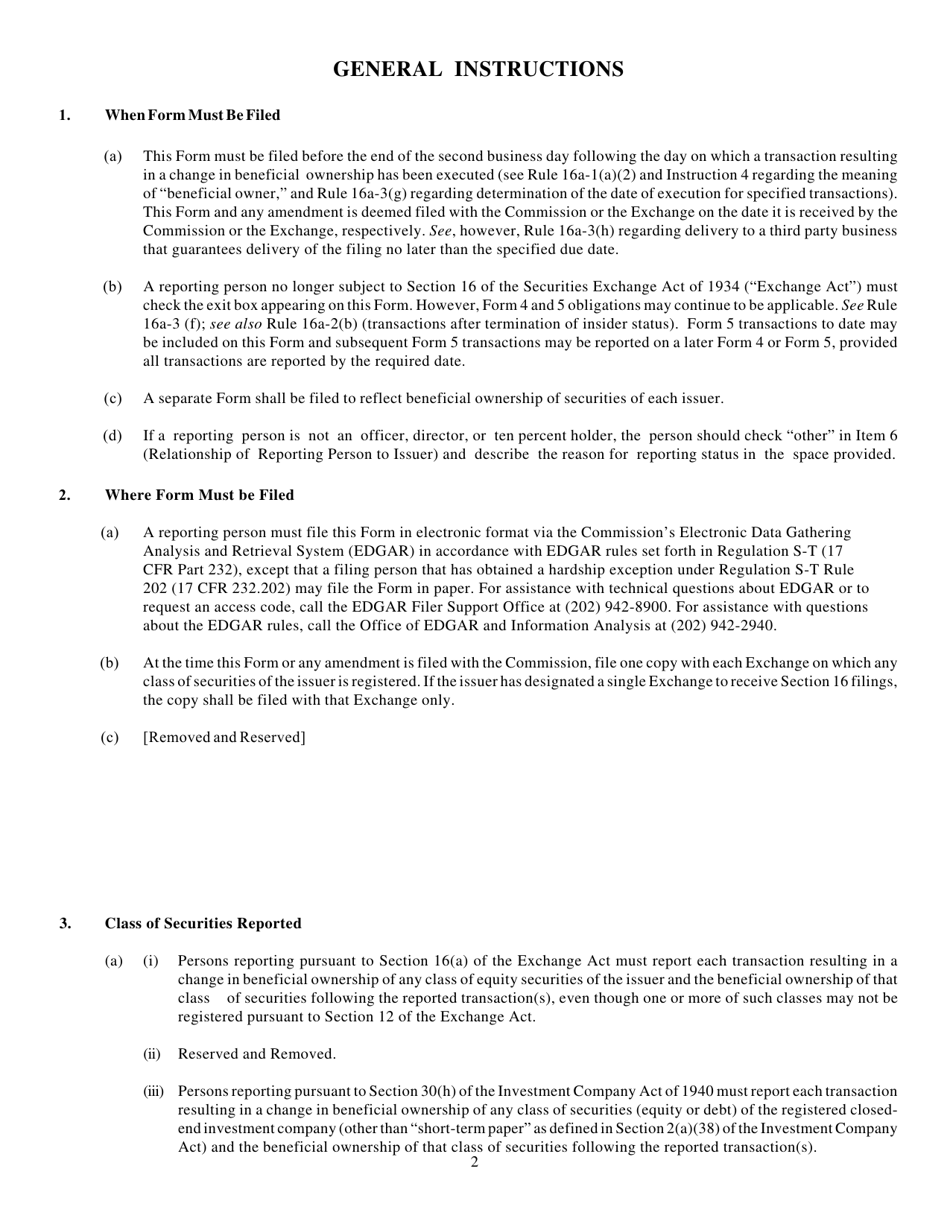

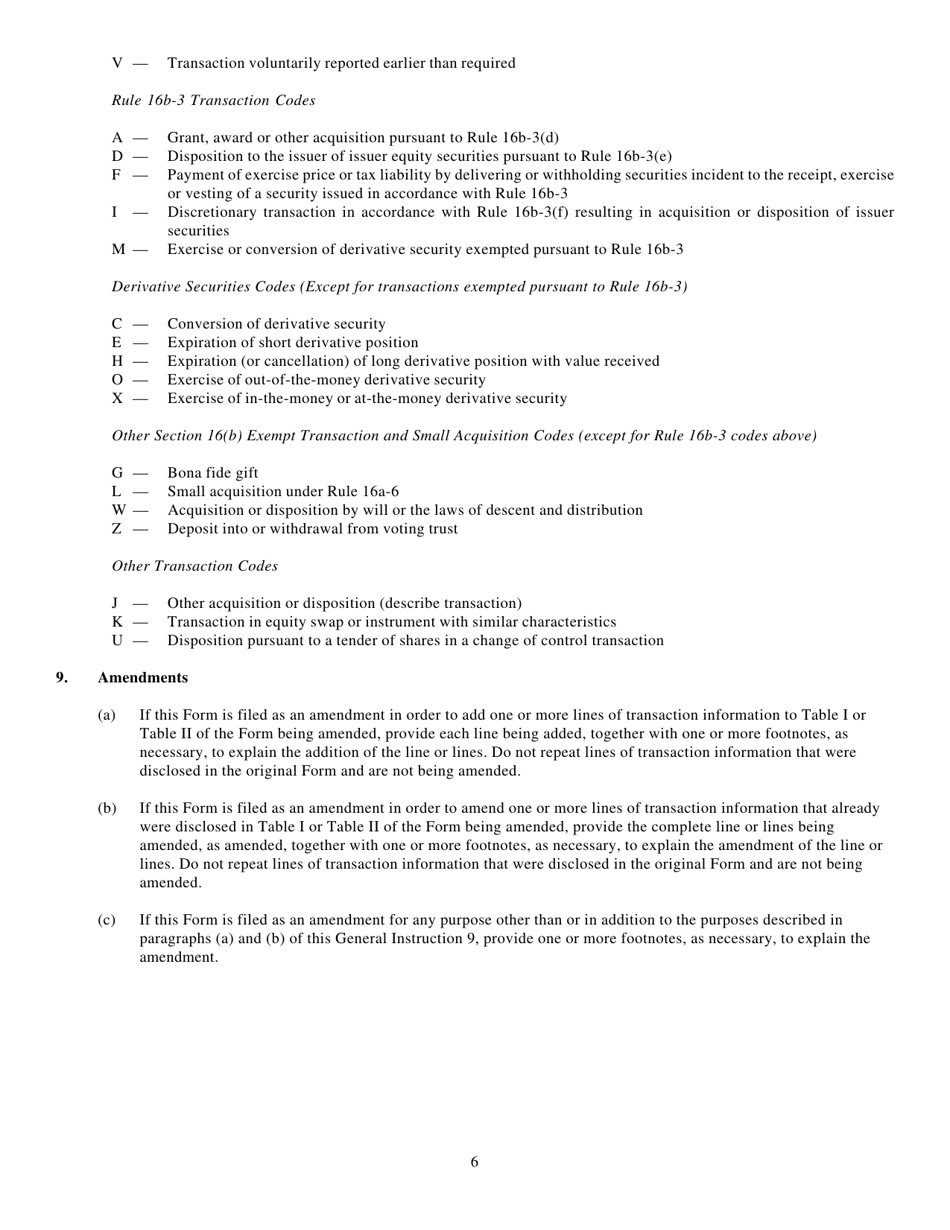

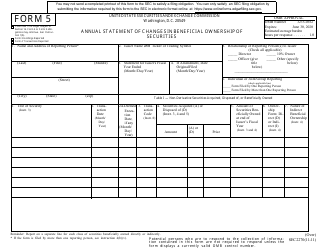

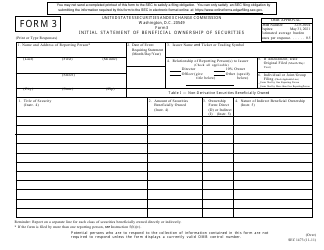

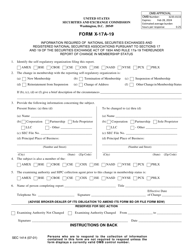

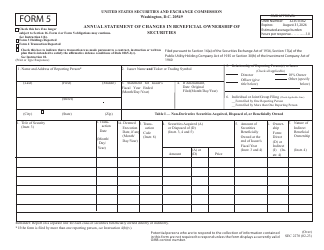

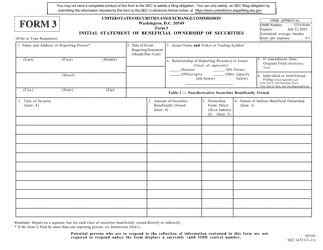

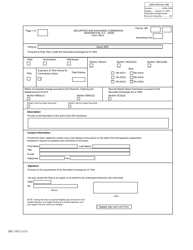

Instructions for SEC Form 1474, 4 Statement of Changes in Beneficial Ownership

This document contains official instructions for SEC Form 1474 , and Form 4 . Both forms are released and collected by the U.S. Securities and Exchange Commission. An up-to-date fillable SEC Form 1474 (4) is available for download through this link.

FAQ

Q: What is SEC Form 1474?

A: SEC Form 1474 is a document used to report the changes in beneficial ownership of securities.

Q: Who is required to file SEC Form 1474?

A: Corporate insiders, such as directors and officers, are required to file SEC Form 1474.

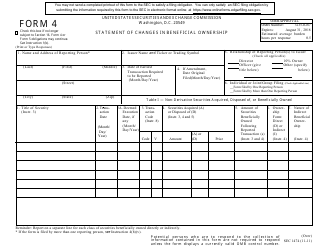

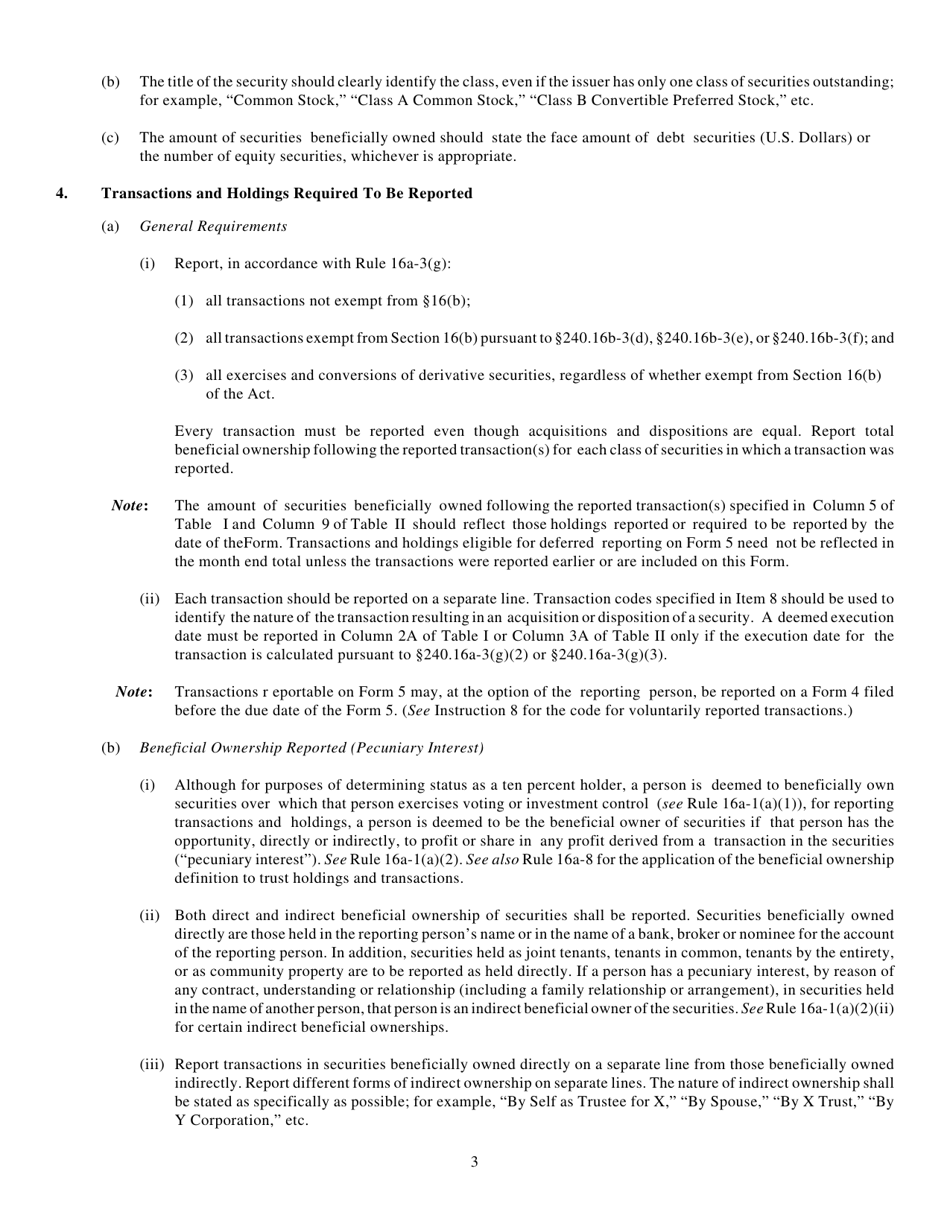

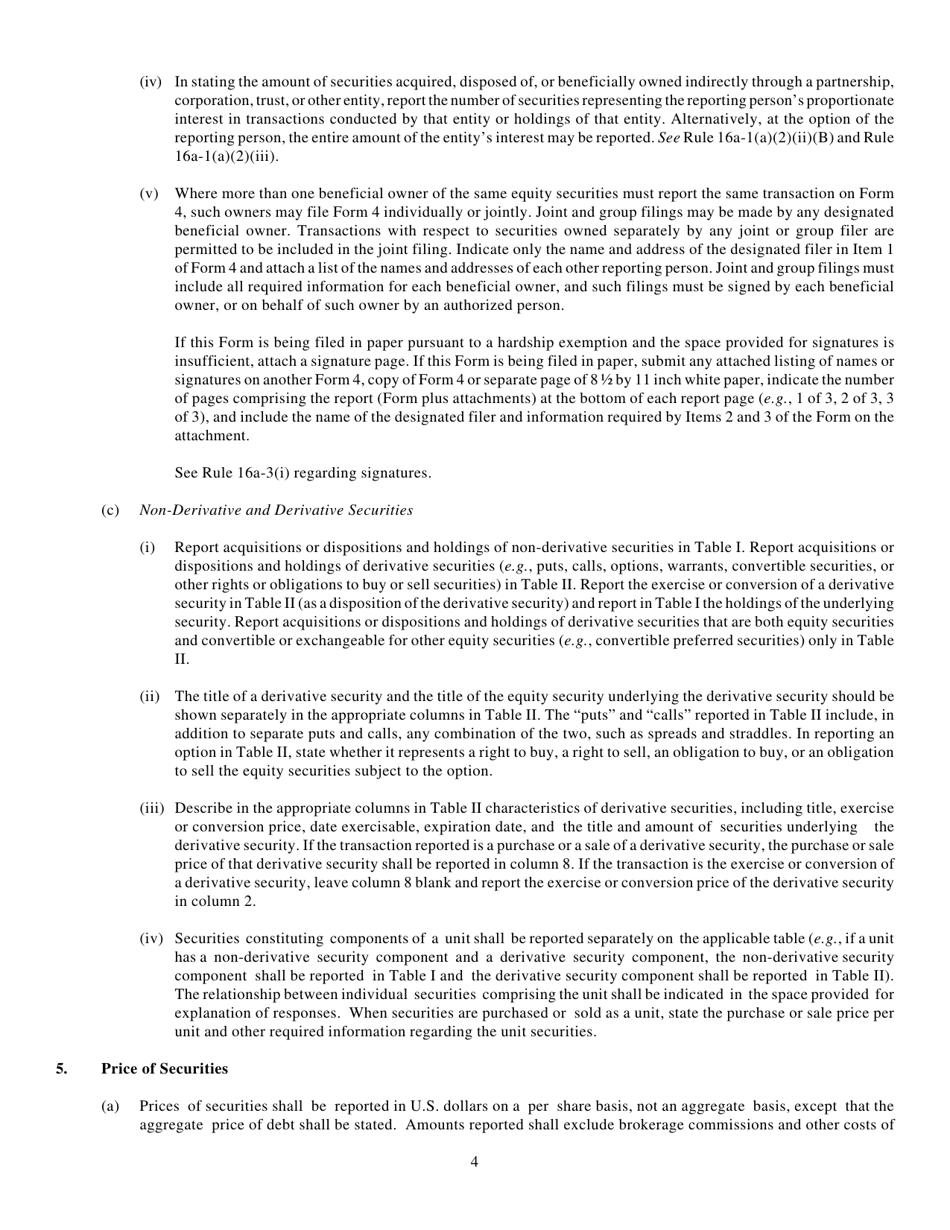

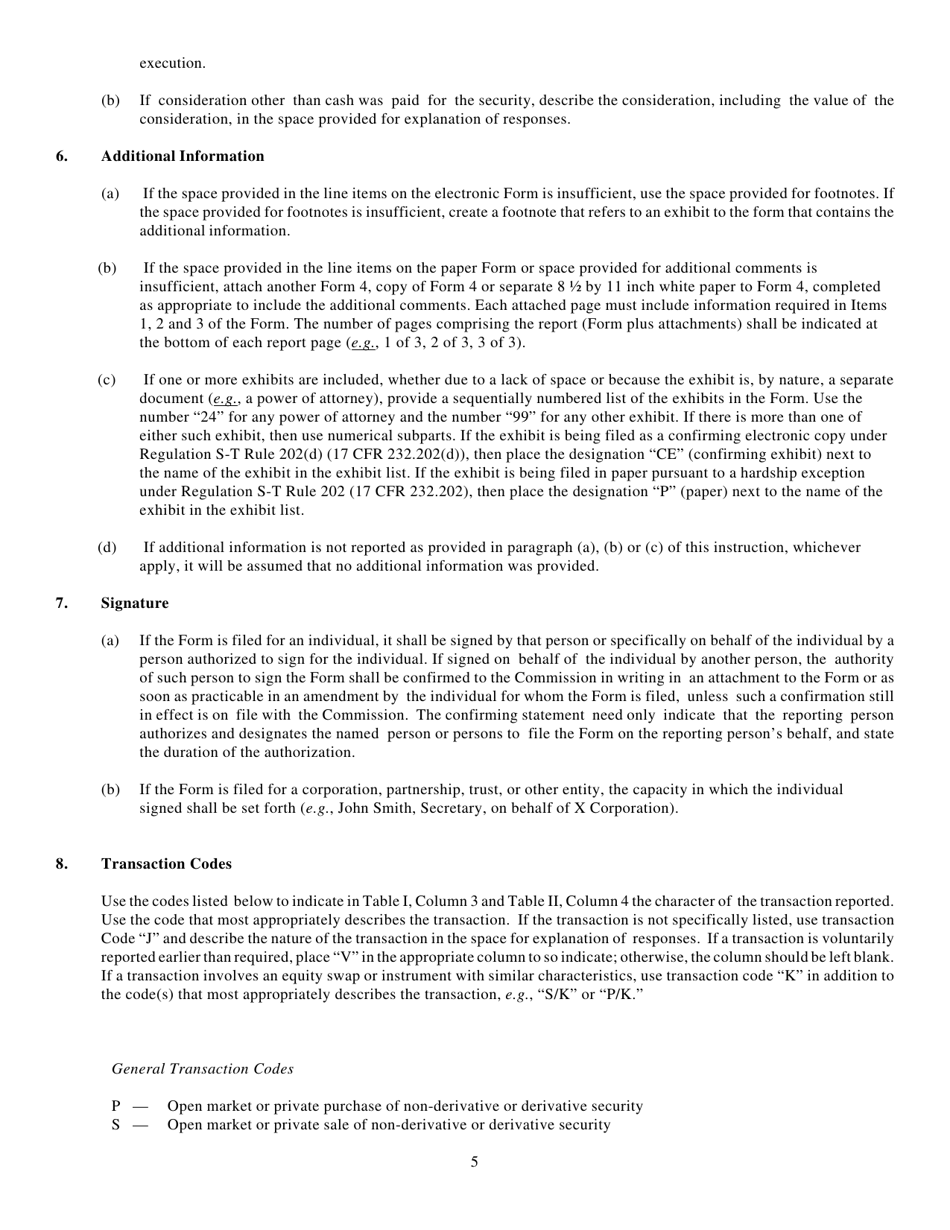

Q: What information is included in SEC Form 1474?

A: SEC Form 1474 includes information about the type of security, the date of the change, and the nature of the change in ownership.

Q: When should SEC Form 1474 be filed?

A: SEC Form 1474 should be filed within two business days of the change in beneficial ownership.

Q: Are there any penalties for not filing SEC Form 1474?

A: Yes, there may be penalties for not filing SEC Form 1474, including fines and potential legal consequences.

Q: Can SEC Form 1474 be amended?

A: Yes, if there are errors or changes to the information in the form, an amended SEC Form 1474 can be filed.

Q: Is SEC Form 1474 required for all types of securities?

A: No, SEC Form 1474 is specifically for reporting changes in beneficial ownership of equity securities.

Q: Is SEC Form 1474 required for both US and Canadian companies?

A: No, SEC Form 1474 is required for US companies only. Canadian companies have their own reporting requirements.

Q: Can individuals who are not corporate insiders file SEC Form 1474?

A: No, SEC Form 1474 is specifically for corporate insiders and is not required for individual investors.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the U.S. Securities and Exchange Commission.