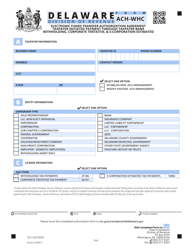

This version of the form is not currently in use and is provided for reference only. Download this version of

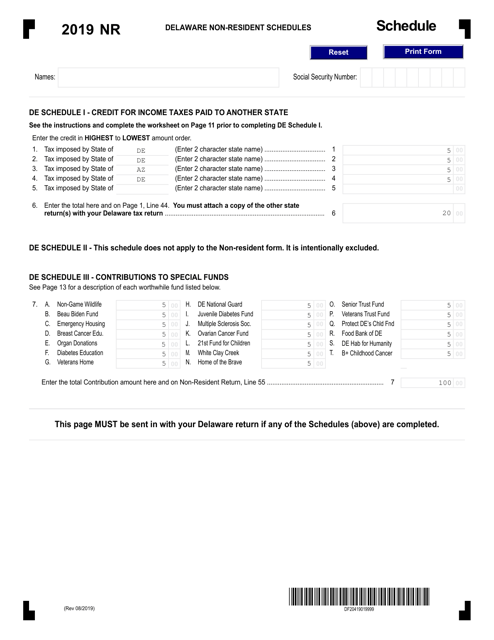

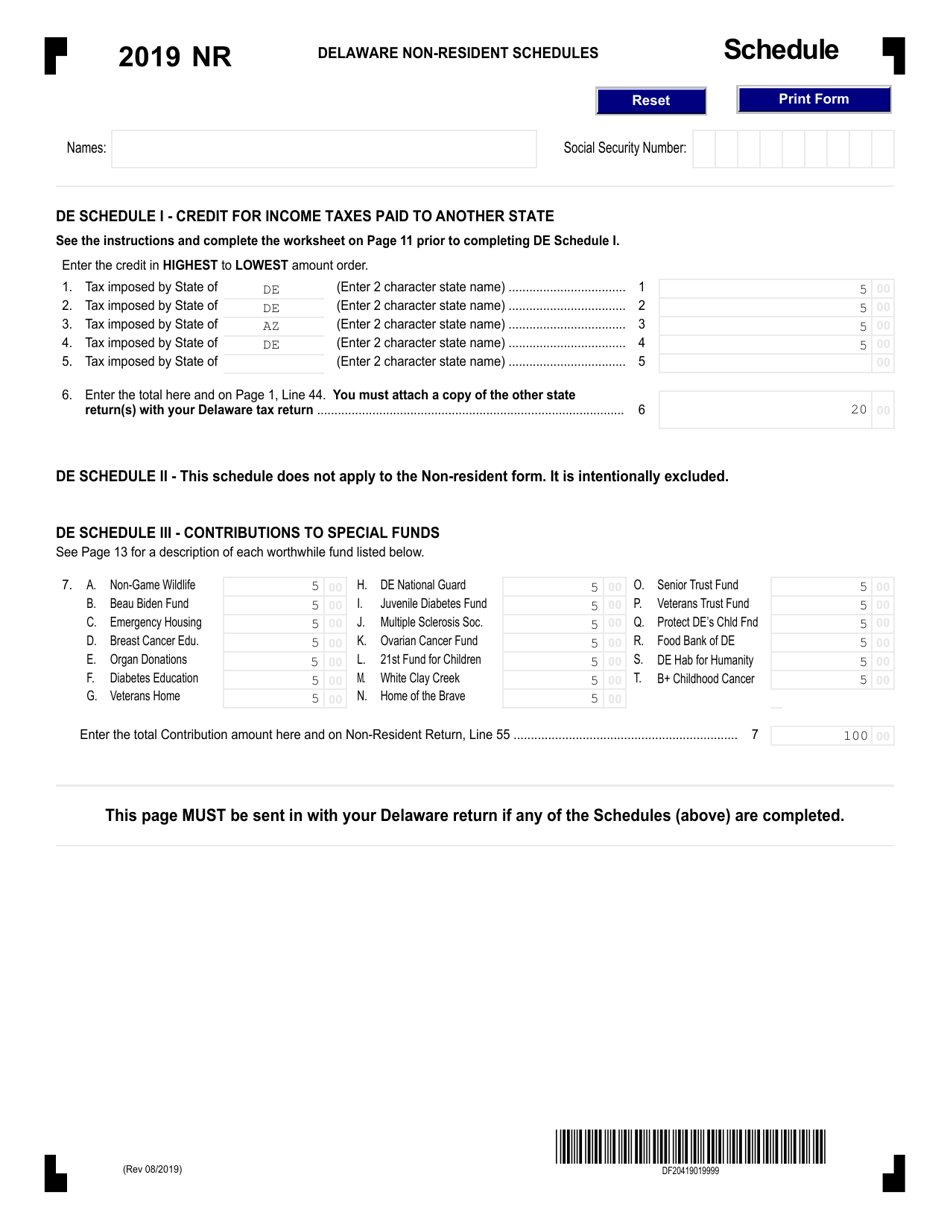

Form 200-02

for the current year.

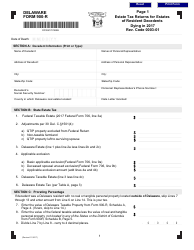

Form 200-02 Delaware Non-resident Schedules - Delaware

What Is Form 200-02?

This is a legal form that was released by the Delaware Department of Finance - Division of Revenue - a government authority operating within Delaware. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 200-02?

A: Form 200-02 is the Delaware Non-resident Schedules.

Q: Who needs to file Form 200-02?

A: Non-residents of Delaware who have income from Delaware sources need to file Form 200-02.

Q: What information does Form 200-02 require?

A: Form 200-02 requires non-residents to report their income from Delaware sources and calculate their Delaware tax liability.

Q: When is the deadline to file Form 200-02?

A: Form 200-02 is due by April 15th of the following year.

Q: Are there any penalties for late filing of Form 200-02?

A: Yes, non-residents who fail to file Form 200-02 by the deadline may be subject to penalties and interest on any unpaid tax liability.

Q: Can I e-file Form 200-02?

A: No, Form 200-02 cannot be e-filed. It must be filed by mail.

Q: Do I need to include any supporting documentation with Form 200-02?

A: Yes, non-residents should include copies of their federal tax returns and any other relevant documents with Form 200-02.

Q: What if I have questions about filling out Form 200-02?

A: If you have any questions about filling out Form 200-02, you can contact the Delaware Division of Revenue for assistance.

Q: Can I file Form 200-02 if I am a resident of Delaware?

A: No, Form 200-02 is specifically for non-residents of Delaware. Delaware residents should file a different tax form.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Delaware Department of Finance - Division of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 200-02 by clicking the link below or browse more documents and templates provided by the Delaware Department of Finance - Division of Revenue.