This version of the form is not currently in use and is provided for reference only. Download this version of

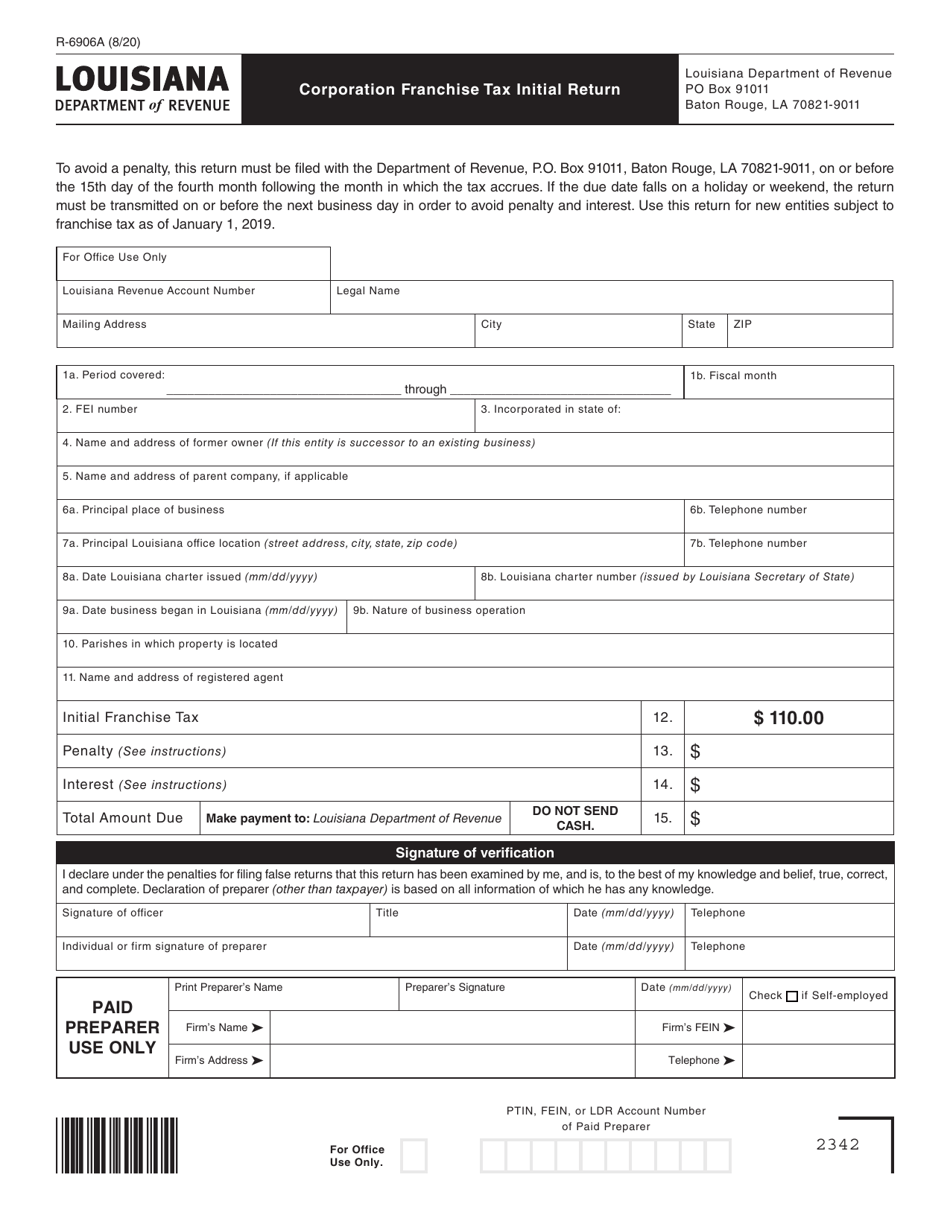

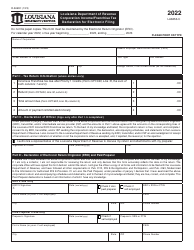

Form R-6906A

for the current year.

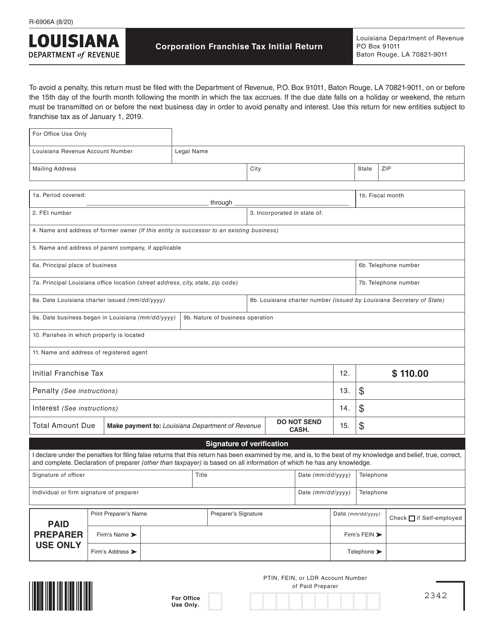

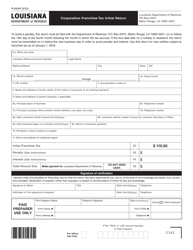

Form R-6906A Corporation Franchise Tax Initial Return - Louisiana

What Is Form R-6906A?

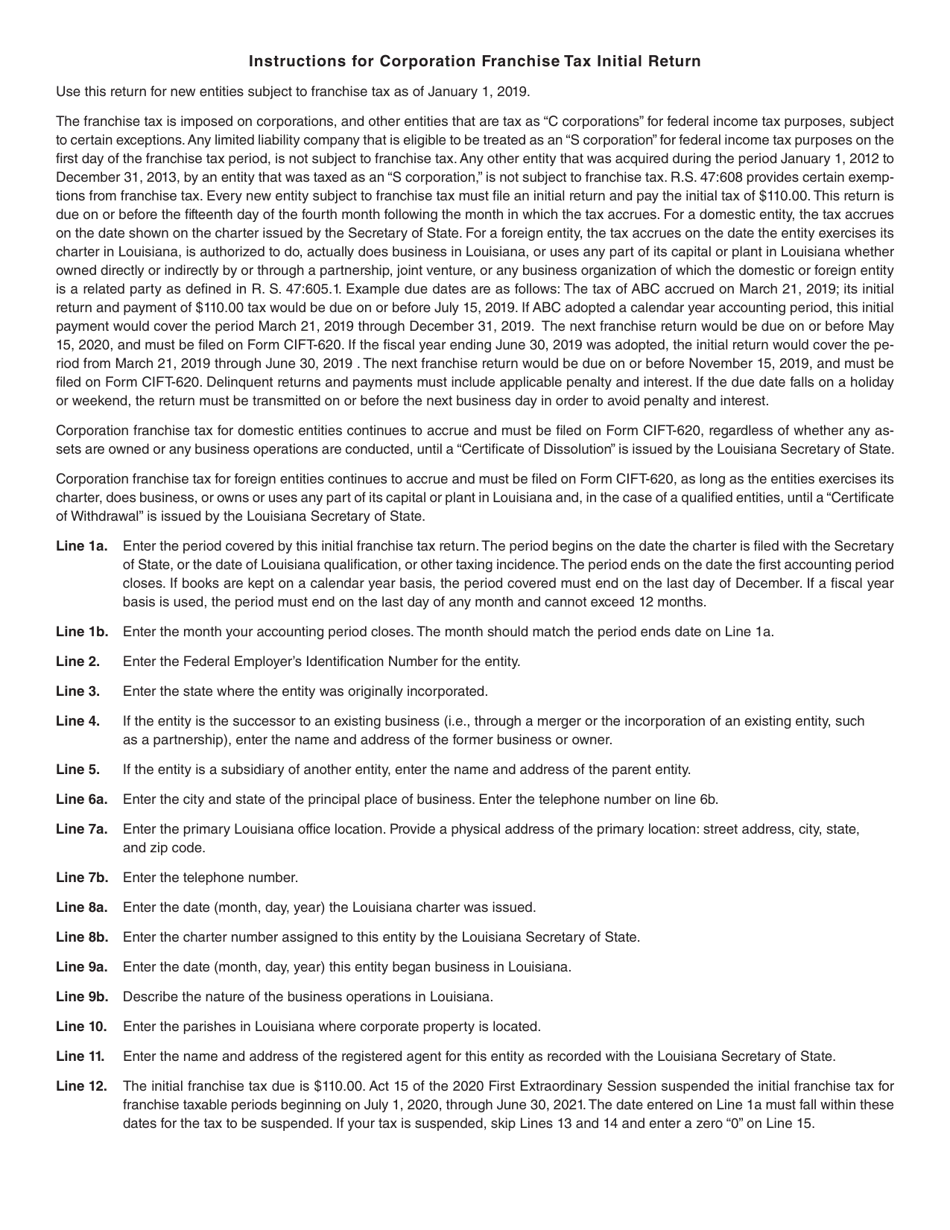

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-6906A?

A: Form R-6906A is the Corporation Franchise TaxInitial Return in Louisiana.

Q: Who needs to file Form R-6906A?

A: Corporations that are subject to the corporation franchise tax in Louisiana need to file Form R-6906A.

Q: What is the purpose of Form R-6906A?

A: The purpose of Form R-6906A is to report and calculate the initial franchise tax liability for corporations in Louisiana.

Q: When is Form R-6906A due?

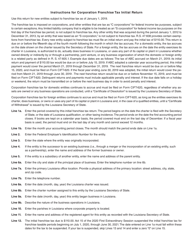

A: Form R-6906A is due on the 15th day of the fourth month following the close of the corporation's taxable year.

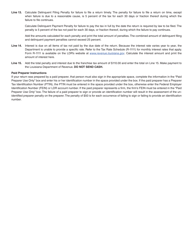

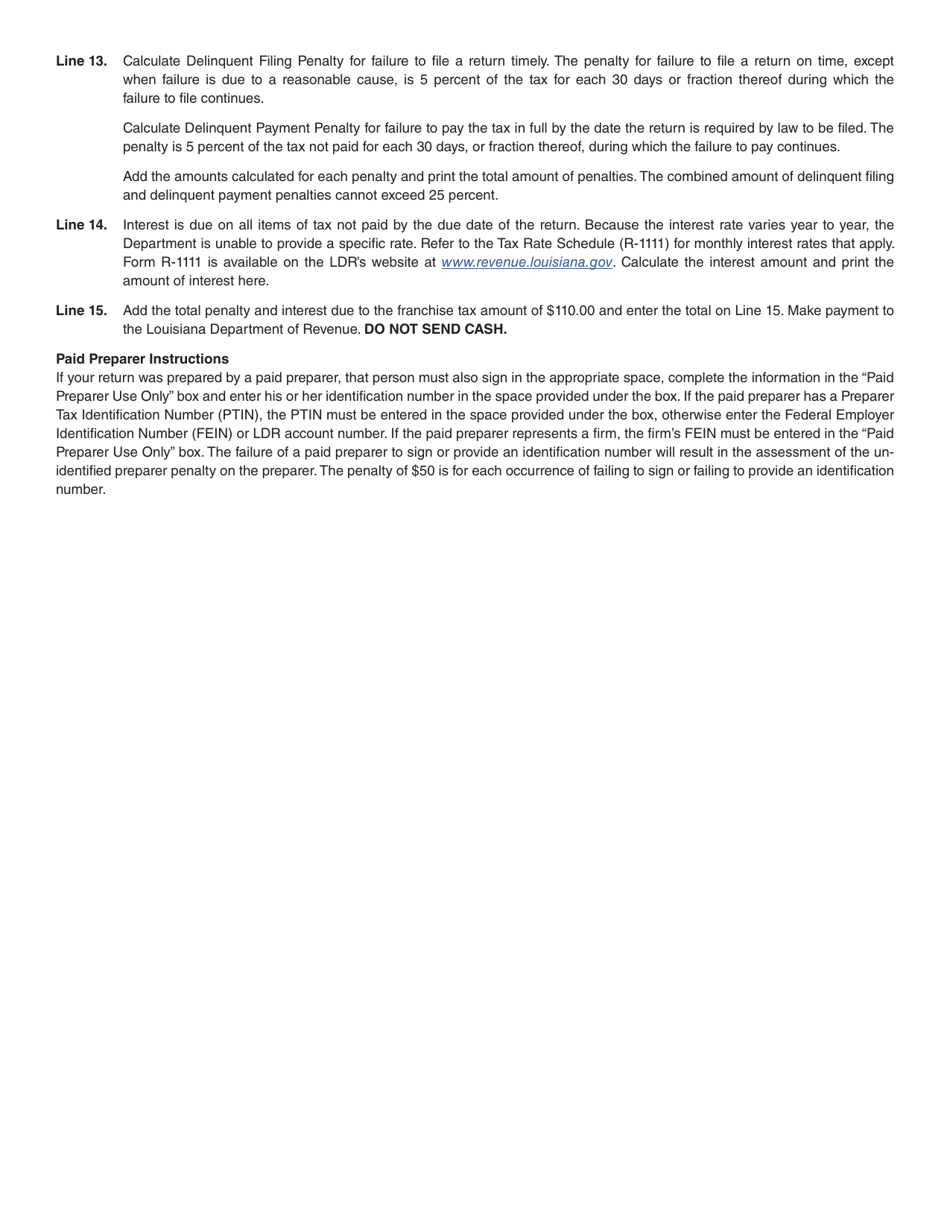

Q: Are there any penalties for not filing Form R-6906A?

A: Yes, there are penalties for not filing Form R-6906A, including monetary penalties and the potential loss of certain tax benefits.

Q: Are there any additional requirements for filing Form R-6906A?

A: Yes, corporations filing Form R-6906A may need to include additional schedules and supporting documentation depending on their specific circumstances.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-6906A by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.