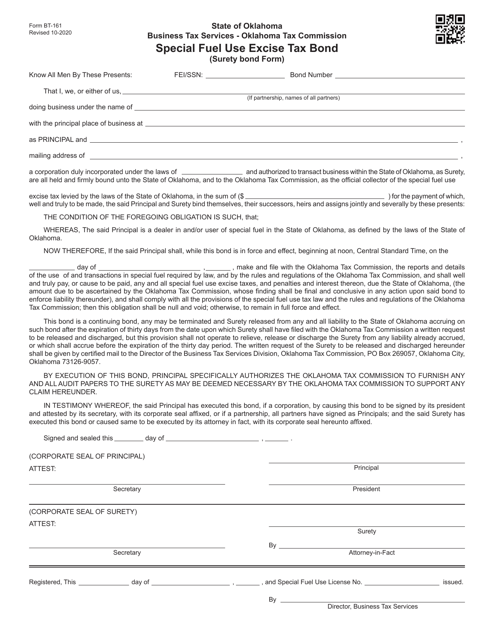

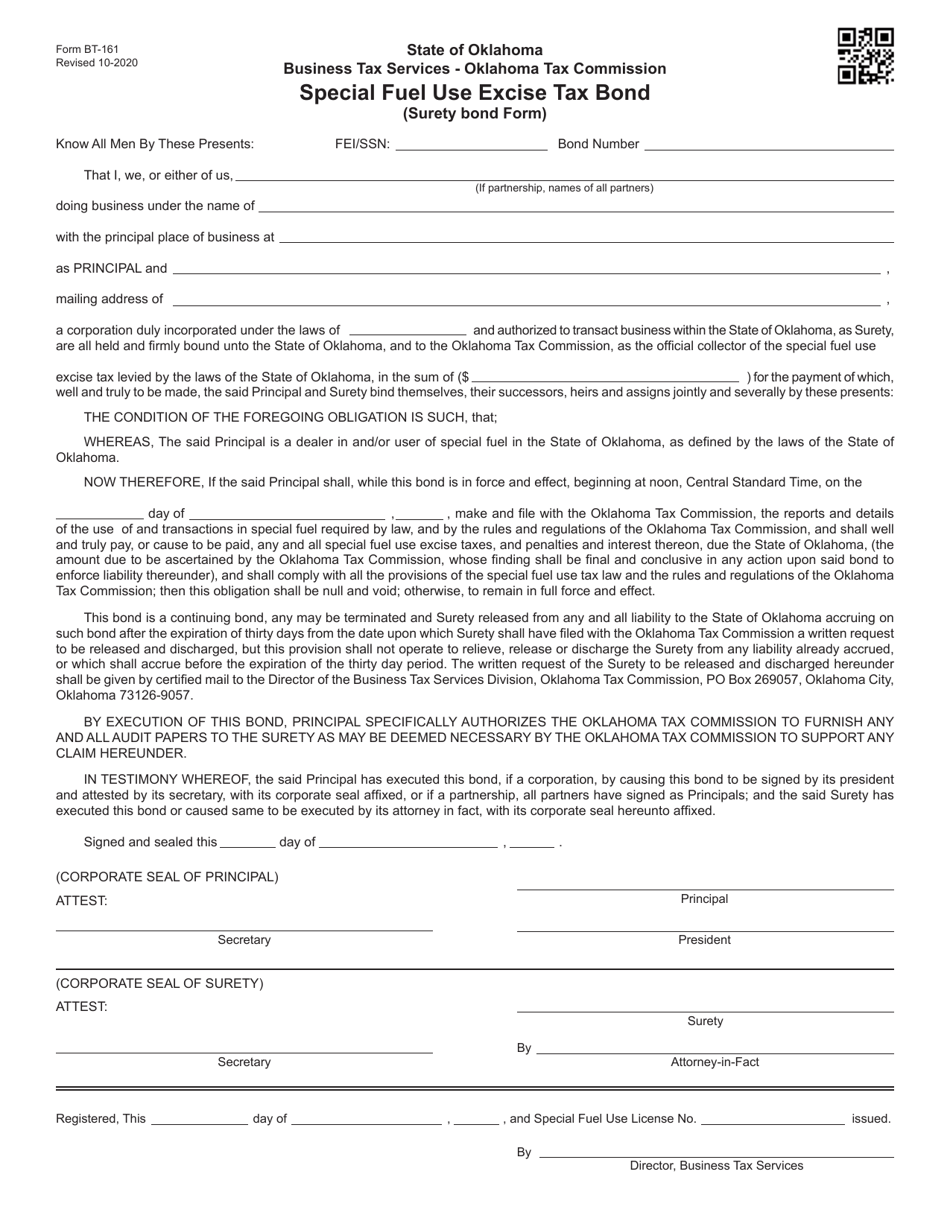

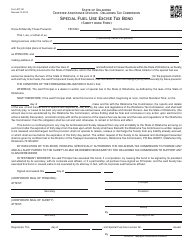

Form BT-161 Special Fuel Use Excise Tax Bond (Surety Bond Form) - Oklahoma

What Is Form BT-161?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BT-161?

A: Form BT-161 is a Special Fuel Use Excise Tax Bond, also known as a Surety Bond Form.

Q: What is the purpose of Form BT-161?

A: The purpose of Form BT-161 is to serve as a bond that guarantees payment of the special fuel use excise tax in the state of Oklahoma.

Q: Who is required to file Form BT-161?

A: Anyone who is engaged in the business of selling, blending, or using special fuel in Oklahoma is required to file Form BT-161.

Q: What is a surety bond?

A: A surety bond is a three-party agreement that ensures the obligations of one party (the principal) to another party (the obligee) will be fulfilled.

Q: What happens if the special fuel excise tax is not paid?

A: If the special fuel excise tax is not paid, the surety bond can be used to cover the unpaid taxes.

Q: What information is required on Form BT-161?

A: Form BT-161 requires information such as the name and address of the principal, the penal sum of the bond, and the effective dates of the bond.

Q: Can I electronically file Form BT-161?

A: No, Form BT-161 cannot be electronically filed. It must be signed and mailed to the Oklahoma Tax Commission.

Form Details:

- Released on October 1, 2020;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BT-161 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.