This version of the form is not currently in use and is provided for reference only. Download this version of

Form OW-8-ESC

for the current year.

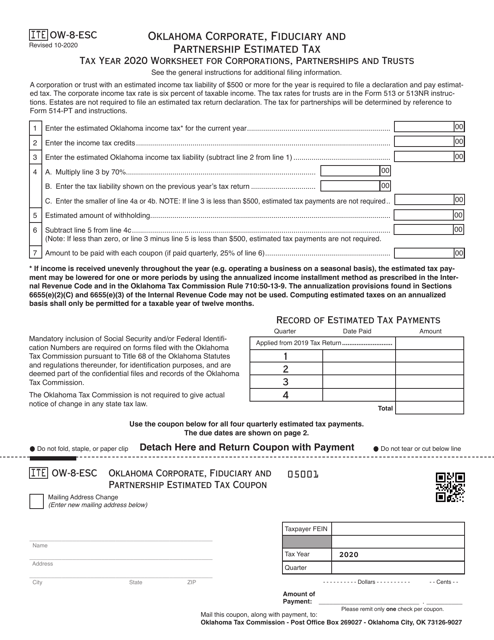

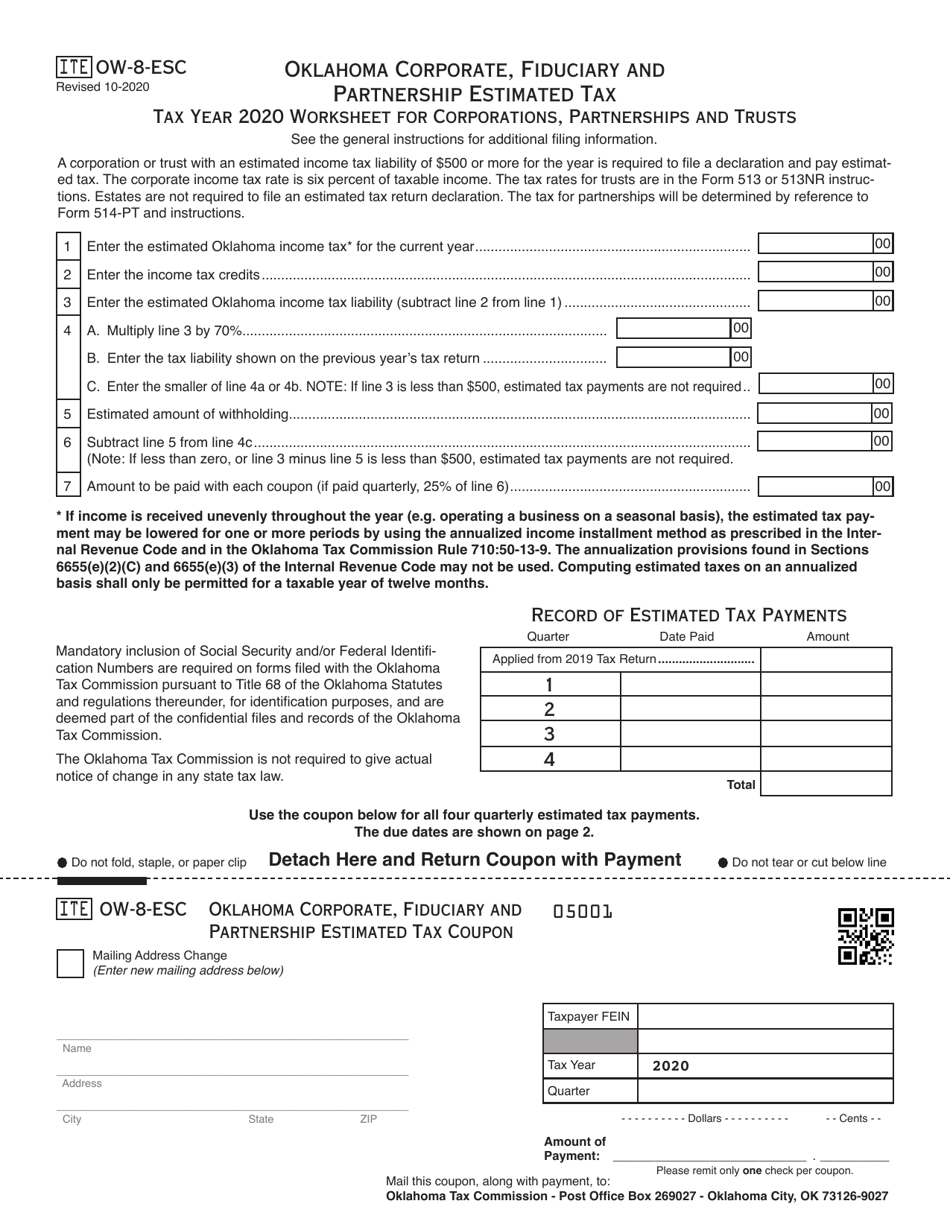

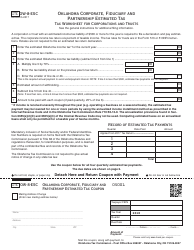

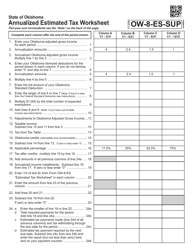

Form OW-8-ESC Oklahoma Corporate, Fiduciary and Partnership Estimated Tax Declaration - Oklahoma

What Is Form OW-8-ESC?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OW-8-ESC?

A: Form OW-8-ESC is the Corporate, Fiduciary and Partnership Estimated Tax Declaration form in Oklahoma.

Q: Who needs to file Form OW-8-ESC?

A: Corporations, fiduciaries, and partnerships who expect to owe Oklahoma income tax are required to file Form OW-8-ESC.

Q: What is the purpose of Form OW-8-ESC?

A: Form OW-8-ESC is used to estimate and declare the amount of Oklahoma income tax that needs to be paid throughout the year.

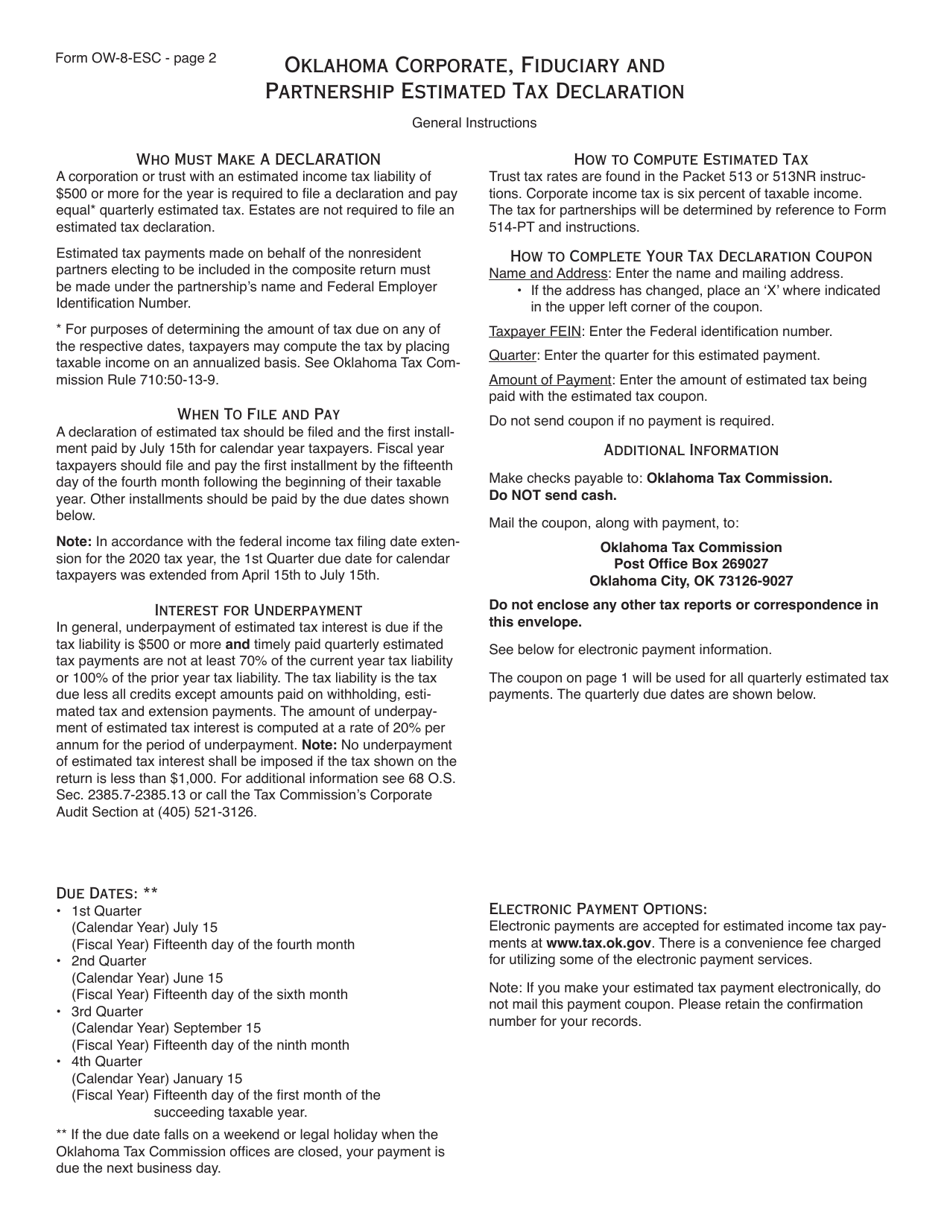

Q: When is Form OW-8-ESC due?

A: Form OW-8-ESC is due on or before the 15th day of the 4th, 6th, 9th, and 12th months of the taxable year.

Q: Are there any penalties for not filing Form OW-8-ESC?

A: Yes, failure to file Form OW-8-ESC or underestimating the required tax payment may result in penalties and interest.

Q: Do I need to attach any additional documentation with Form OW-8-ESC?

A: You may need to attach supporting schedules and documentation depending on your specific tax situation.

Form Details:

- Released on October 1, 2020;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OW-8-ESC by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.