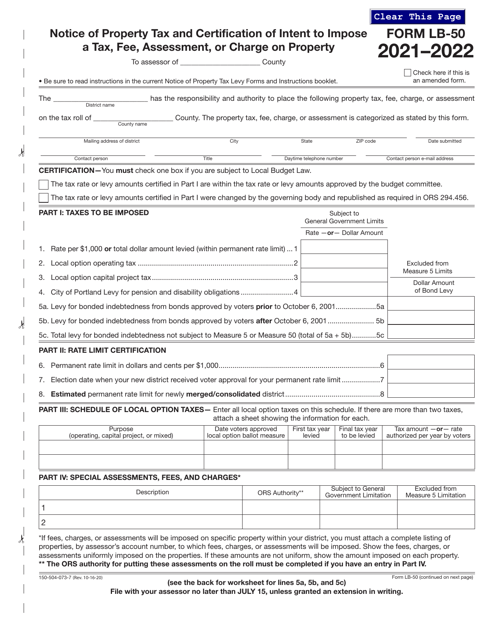

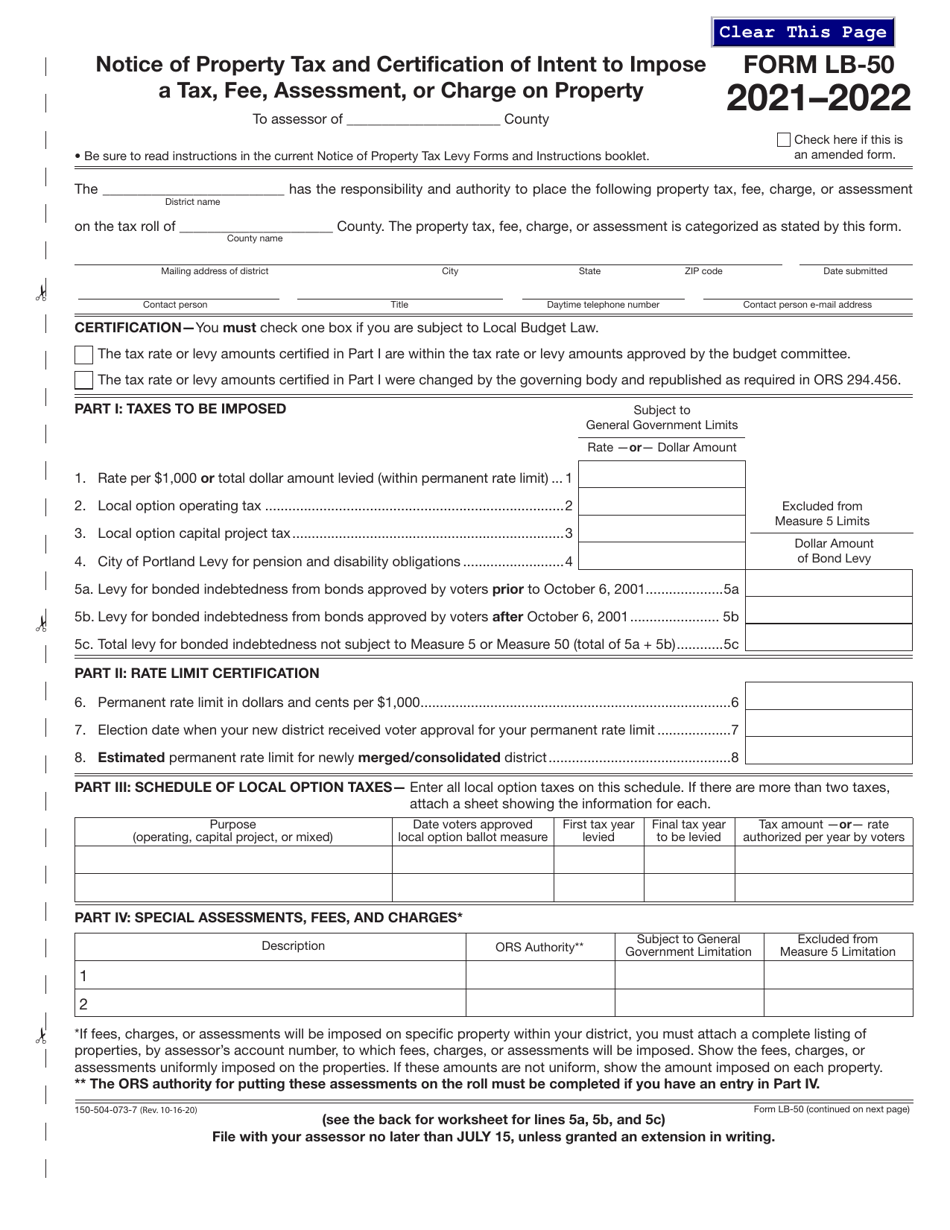

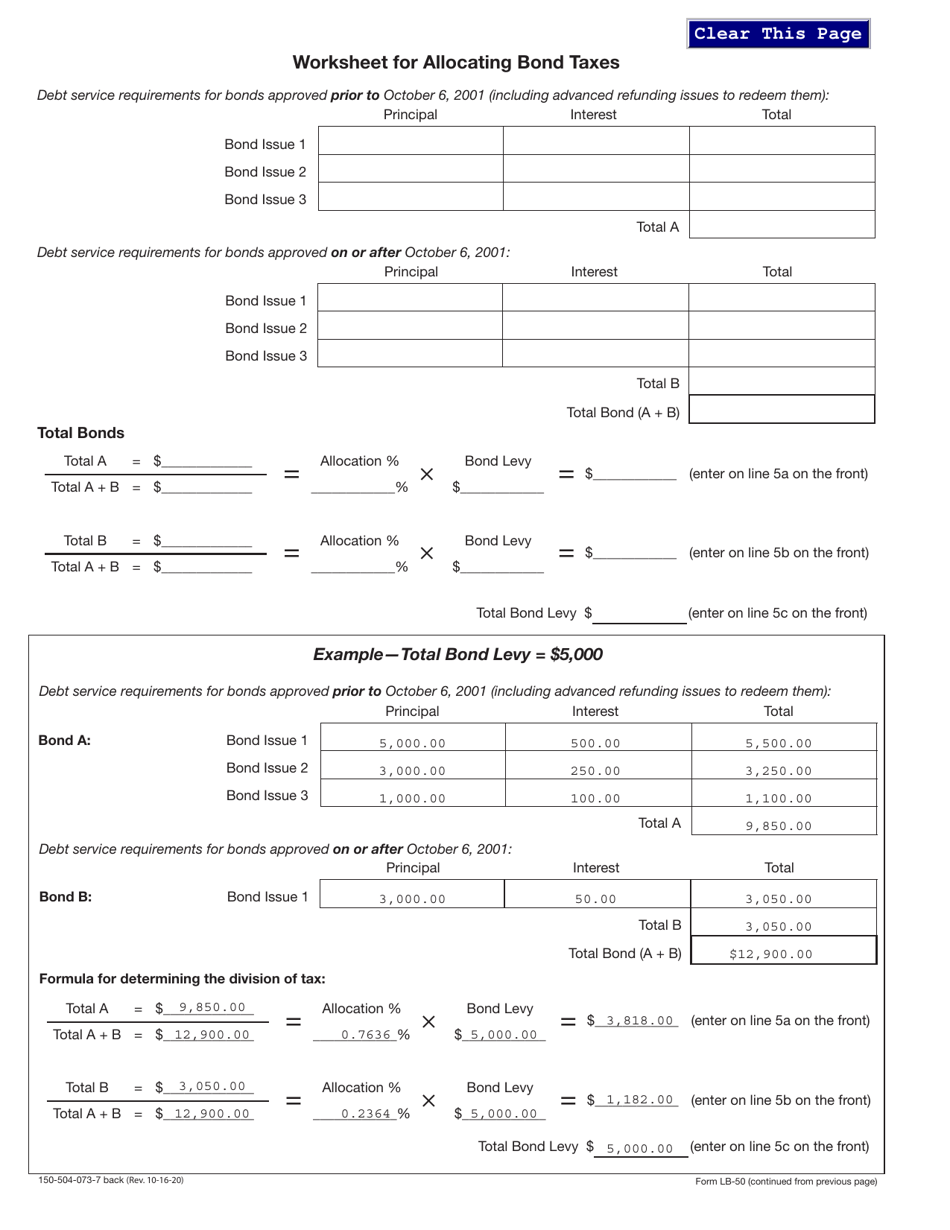

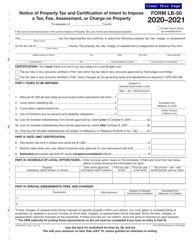

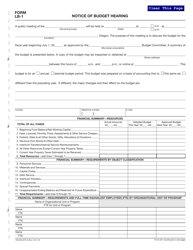

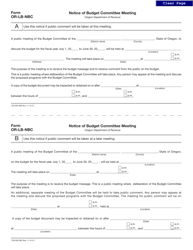

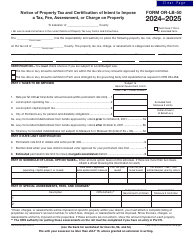

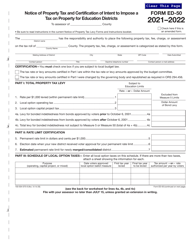

Form LB-50 (150-504-073-7) Notice of Property Tax and Certification of Intent to Impose a Tax, Fee, Assessment, or Charge on Property - Oregon

What Is Form LB-50 (150-504-073-7)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form LB-50?

A: Form LB-50 is a Notice of Property Tax and Certification of Intent to Impose a Tax, Fee, Assessment, or Charge on Property in Oregon.

Q: What is the purpose of Form LB-50?

A: The purpose of Form LB-50 is to inform property owners of any potential tax, fee, assessment, or charge that may be imposed on their property in Oregon.

Q: Who is required to file Form LB-50?

A: Government bodies and agencies that have the authority to impose taxes, fees, assessments, or charges on property in Oregon are required to file Form LB-50.

Q: What information is provided in Form LB-50?

A: Form LB-50 includes details about the property, the type of tax, fee, assessment, or charge being imposed, and the amount or rate of the imposition.

Q: When is Form LB-50 due?

A: Form LB-50 is due on or before July 15th of each year for taxes, fees, assessments, or charges imposed in the following tax year.

Form Details:

- Released on October 16, 2020;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LB-50 (150-504-073-7) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.