This version of the form is not currently in use and is provided for reference only. Download this version of

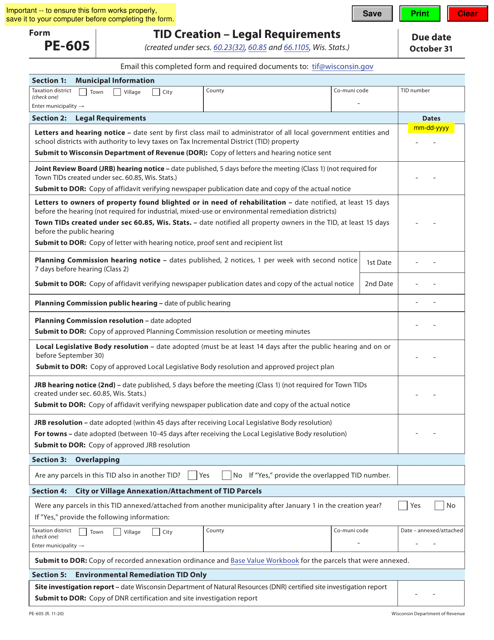

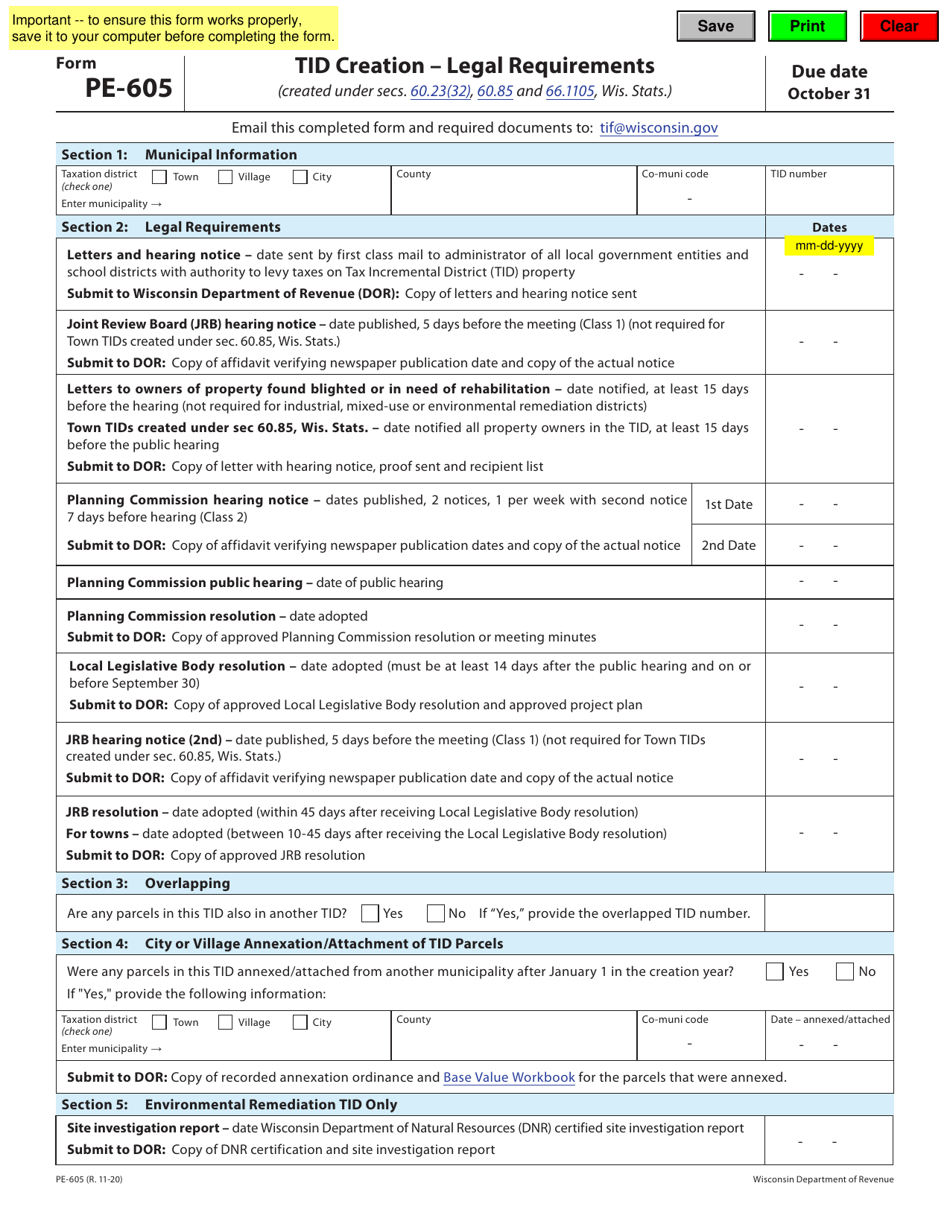

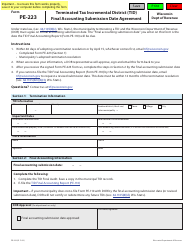

Form PE-605

for the current year.

Form PE-605 Tid Creation - Legal Requirements - Wisconsin

What Is Form PE-605?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PE-605?

A: Form PE-605 is a TID (Tax Increment District) Creation - Legal Requirements form in Wisconsin.

Q: What does TID stand for?

A: TID stands for Tax Increment District.

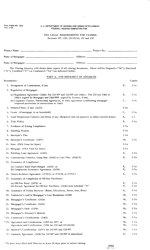

Q: What are the legal requirements for TID creation in Wisconsin?

A: The legal requirements for TID creation in Wisconsin are outlined in Form PE-605.

Q: Why is Form PE-605 important?

A: Form PE-605 is important as it provides the necessary legal requirements for creating a Tax Increment District in Wisconsin.

Q: Who needs to fill out Form PE-605?

A: Form PE-605 needs to be filled out by anyone who intends to create a Tax Increment District in Wisconsin.

Form Details:

- Released on November 1, 2020;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PE-605 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.