This version of the form is not currently in use and is provided for reference only. Download this version of

Form PE-106

for the current year.

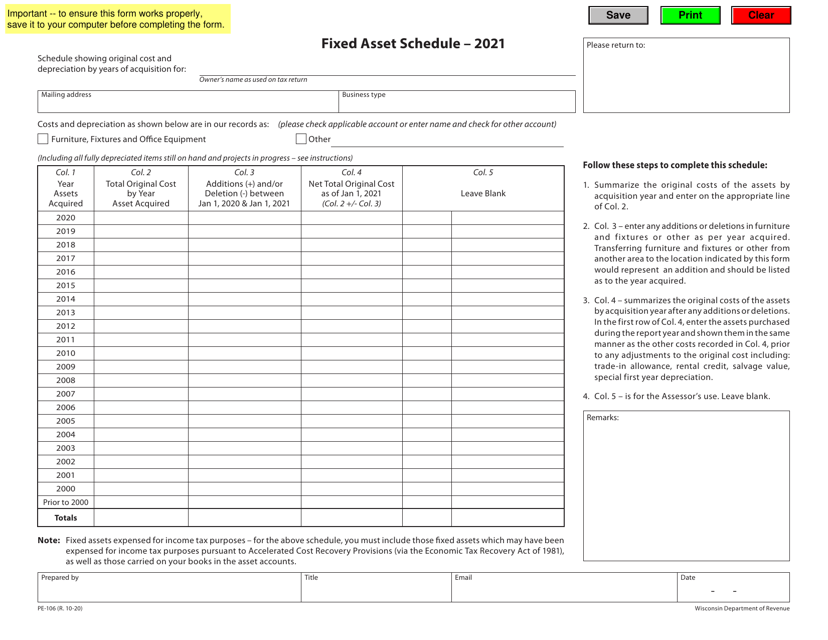

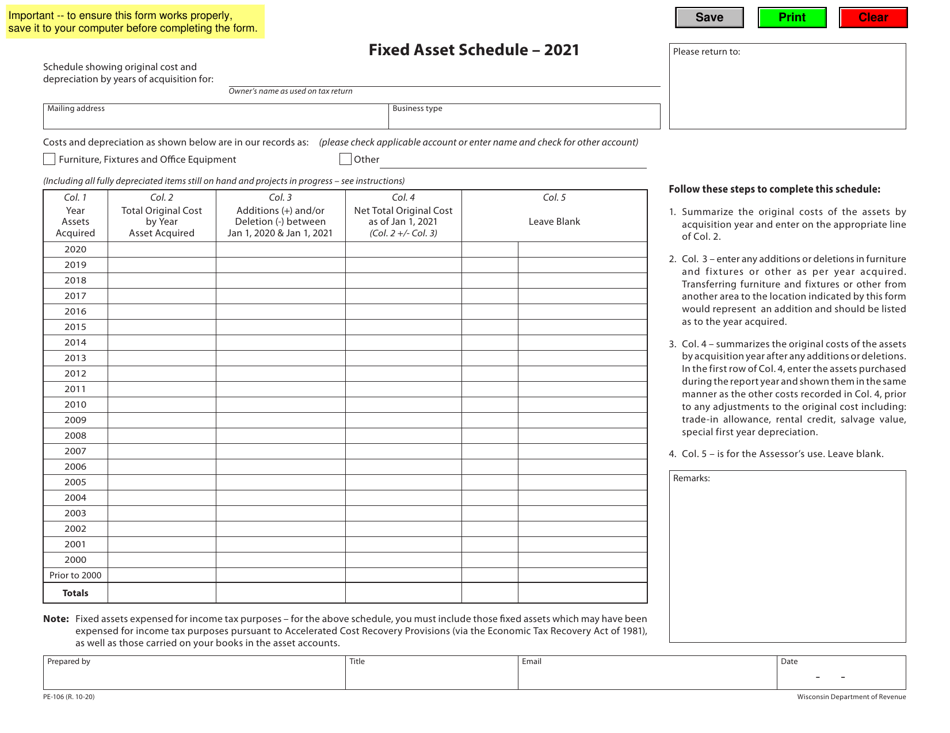

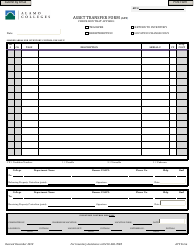

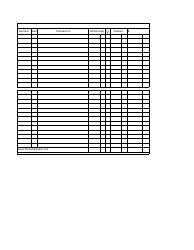

Form PE-106 Fixed Asset Schedule - Wisconsin

What Is Form PE-106?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PE-106?

A: Form PE-106 is the Fixed Asset Schedule for Wisconsin.

Q: What is the purpose of Form PE-106?

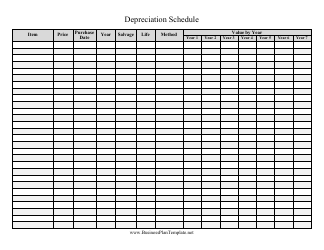

A: The purpose of Form PE-106 is to report fixed assets for tax purposes in Wisconsin.

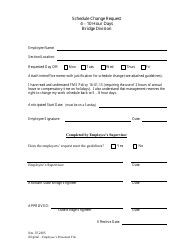

Q: Who needs to file Form PE-106?

A: Businesses in Wisconsin that have fixed assets need to file Form PE-106.

Q: When is Form PE-106 due?

A: Form PE-106 is due on or before April 1st of each year.

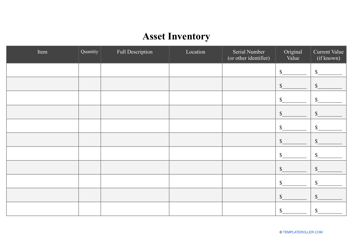

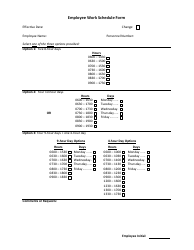

Q: What information is required on Form PE-106?

A: Form PE-106 requires information about the fixed assets owned by the business, including their description, cost, and acquisition date.

Form Details:

- Released on October 1, 2020;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PE-106 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.