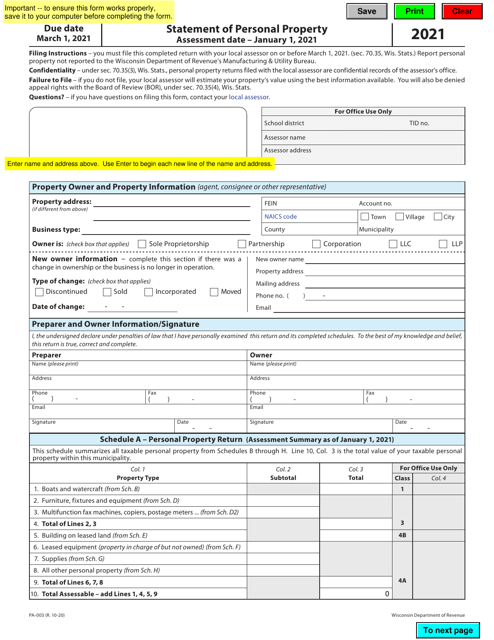

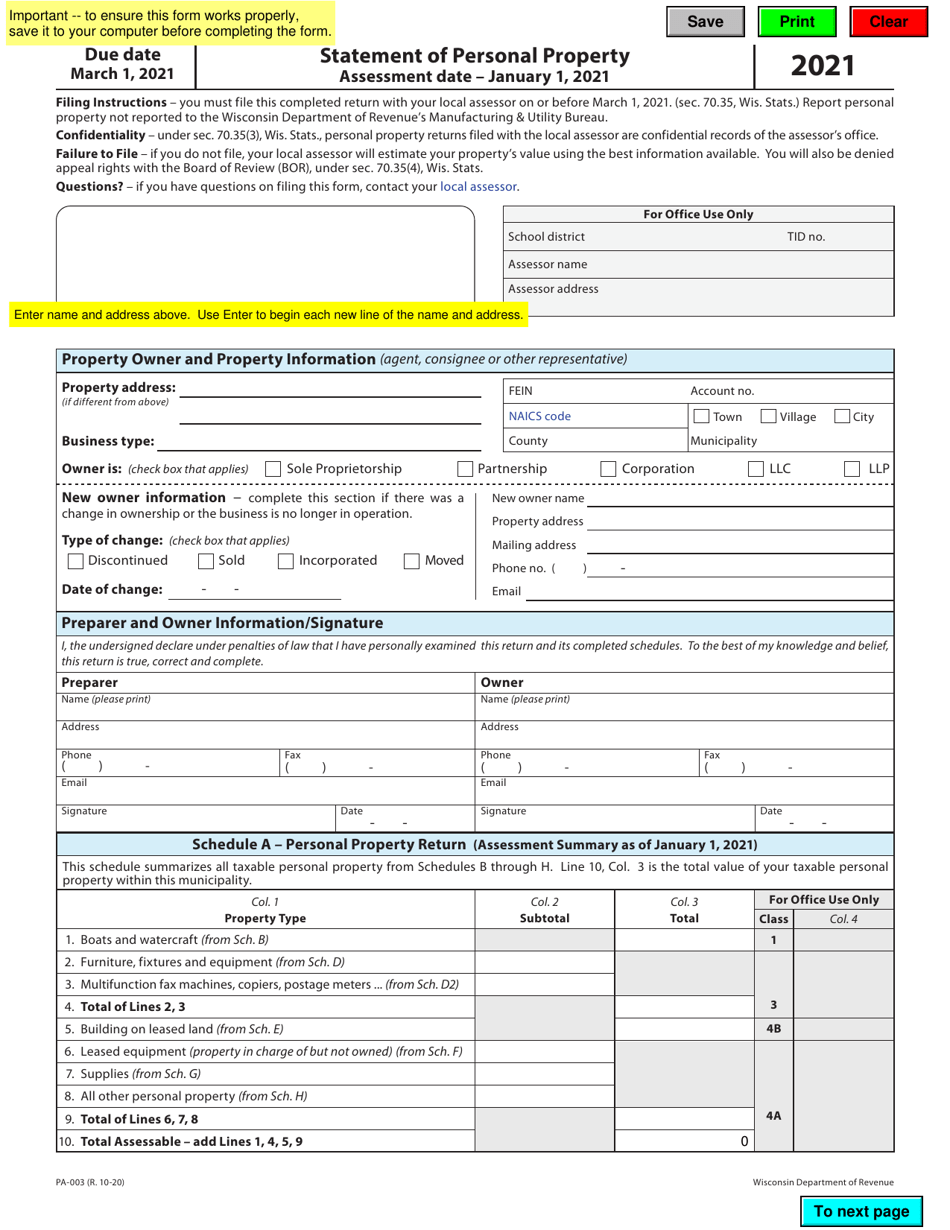

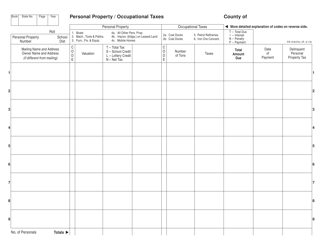

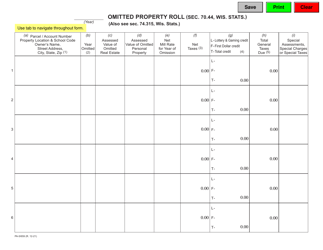

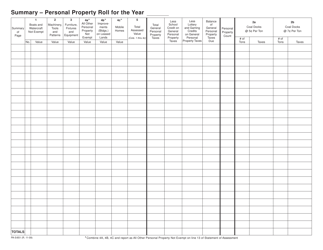

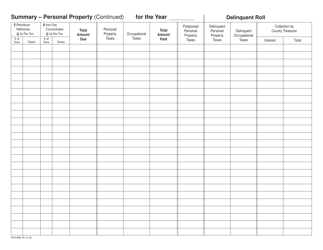

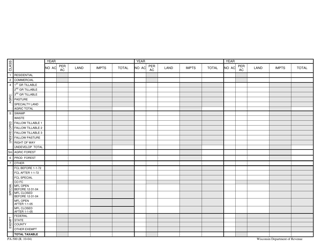

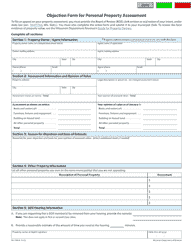

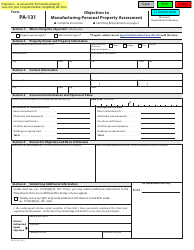

Form PA-003 Statement of Personal Property - Wisconsin

What Is Form PA-003?

This is a legal form that was released by the Wisconsin Department of Revenue - a government authority operating within Wisconsin. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-003 Statement of Personal Property?

A: Form PA-003 Statement of Personal Property is a document used in the state of Wisconsin to report personal property owned by a business or individual.

Q: Who needs to file Form PA-003 Statement of Personal Property?

A: Businesses and individuals in Wisconsin who own taxable personal property with a total assessed value of $1,000 or more are required to file Form PA-003.

Q: When is the deadline to file Form PA-003 Statement of Personal Property?

A: The due date for filing Form PA-003 Statement of Personal Property is March 1st of each year.

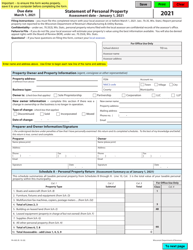

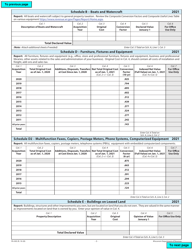

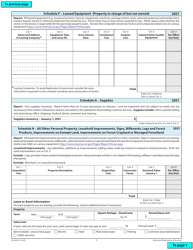

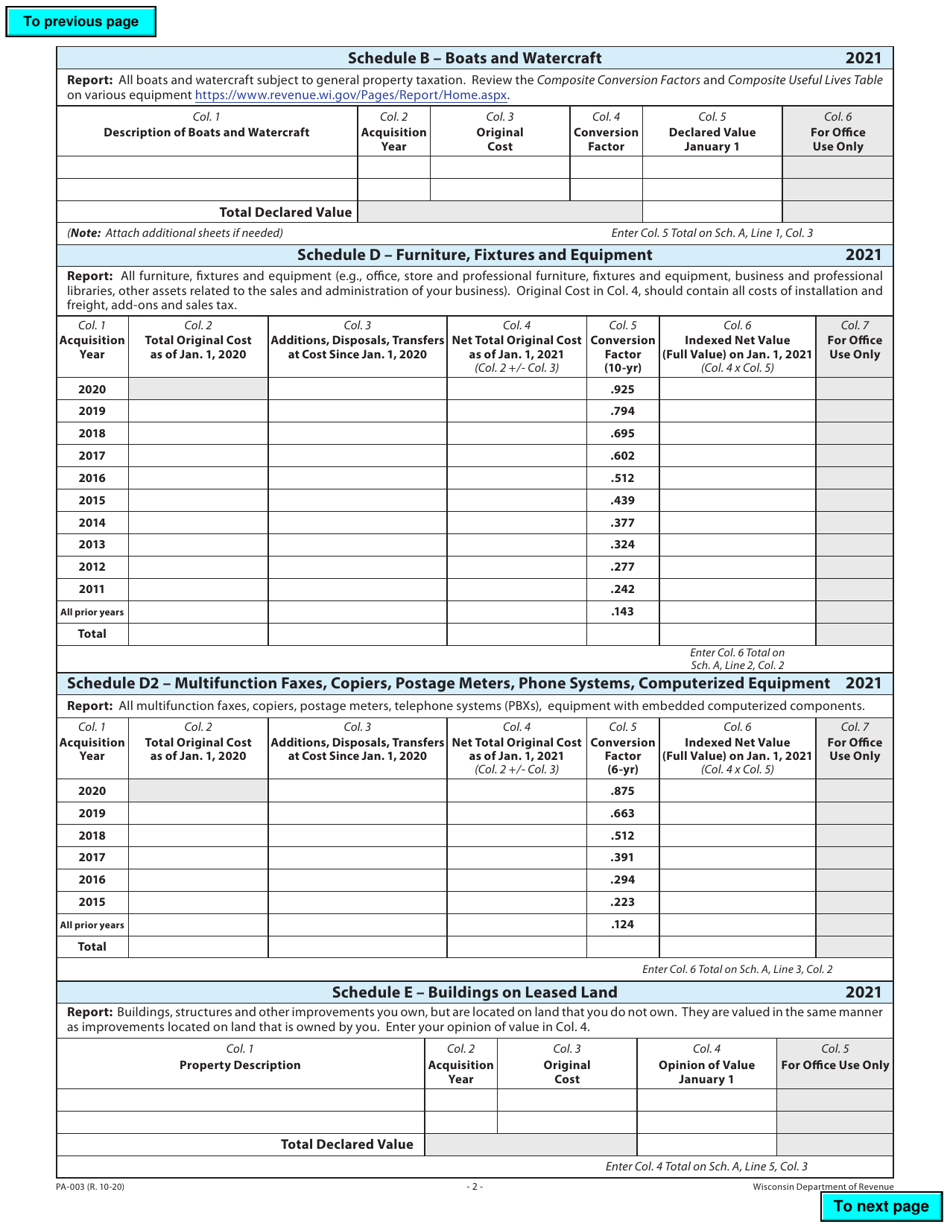

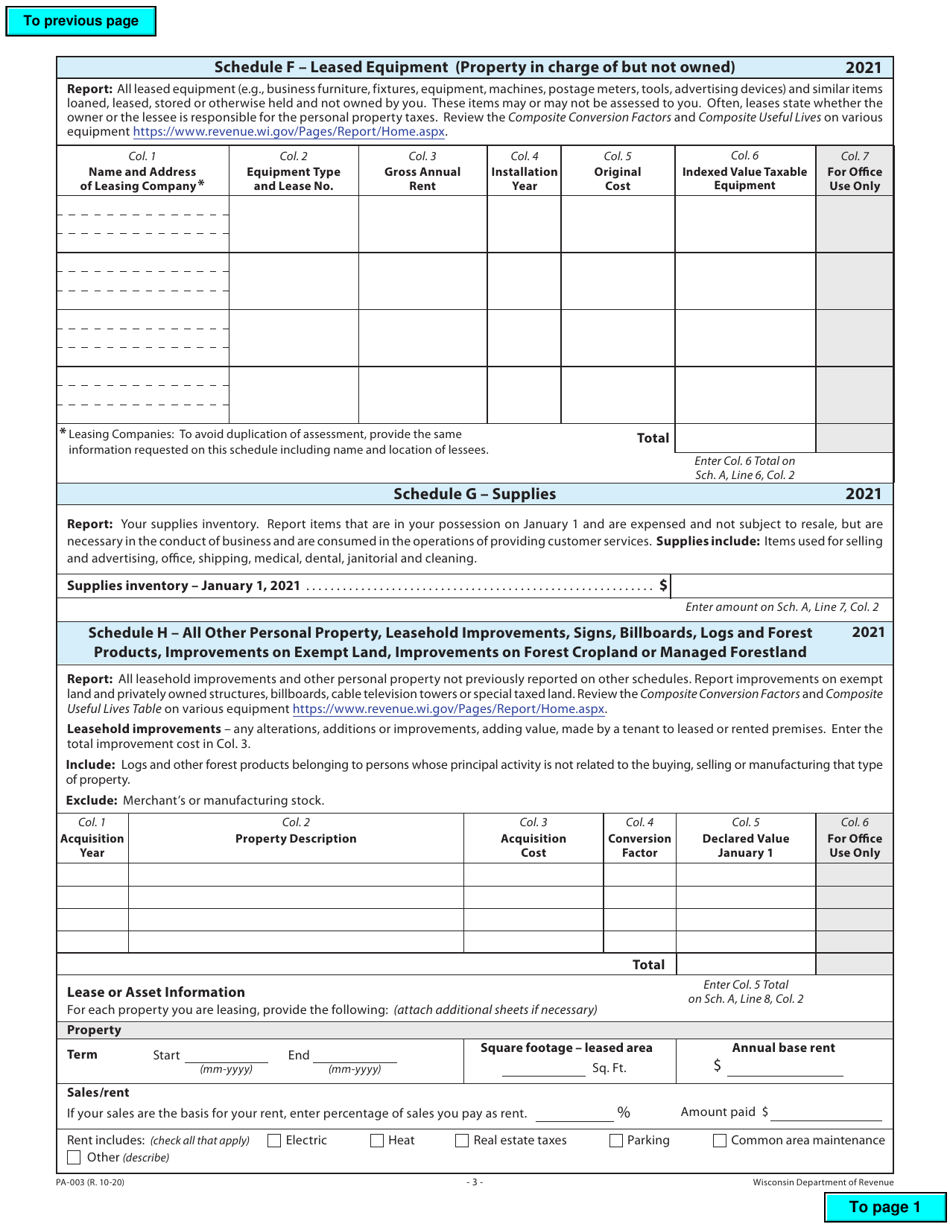

Q: What information is required for Form PA-003 Statement of Personal Property?

A: Form PA-003 requires information about the property being reported, including a description, location, and value. It also requires the filer's contact information and signature.

Q: Are there any penalties for not filing Form PA-003 Statement of Personal Property?

A: Yes, failure to file Form PA-003 Statement of Personal Property or filing a false or fraudulent statement can result in penalties and interest on the unpaid taxes.

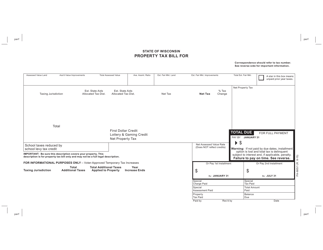

Form Details:

- Released on October 1, 2020;

- The latest edition provided by the Wisconsin Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-003 by clicking the link below or browse more documents and templates provided by the Wisconsin Department of Revenue.