This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

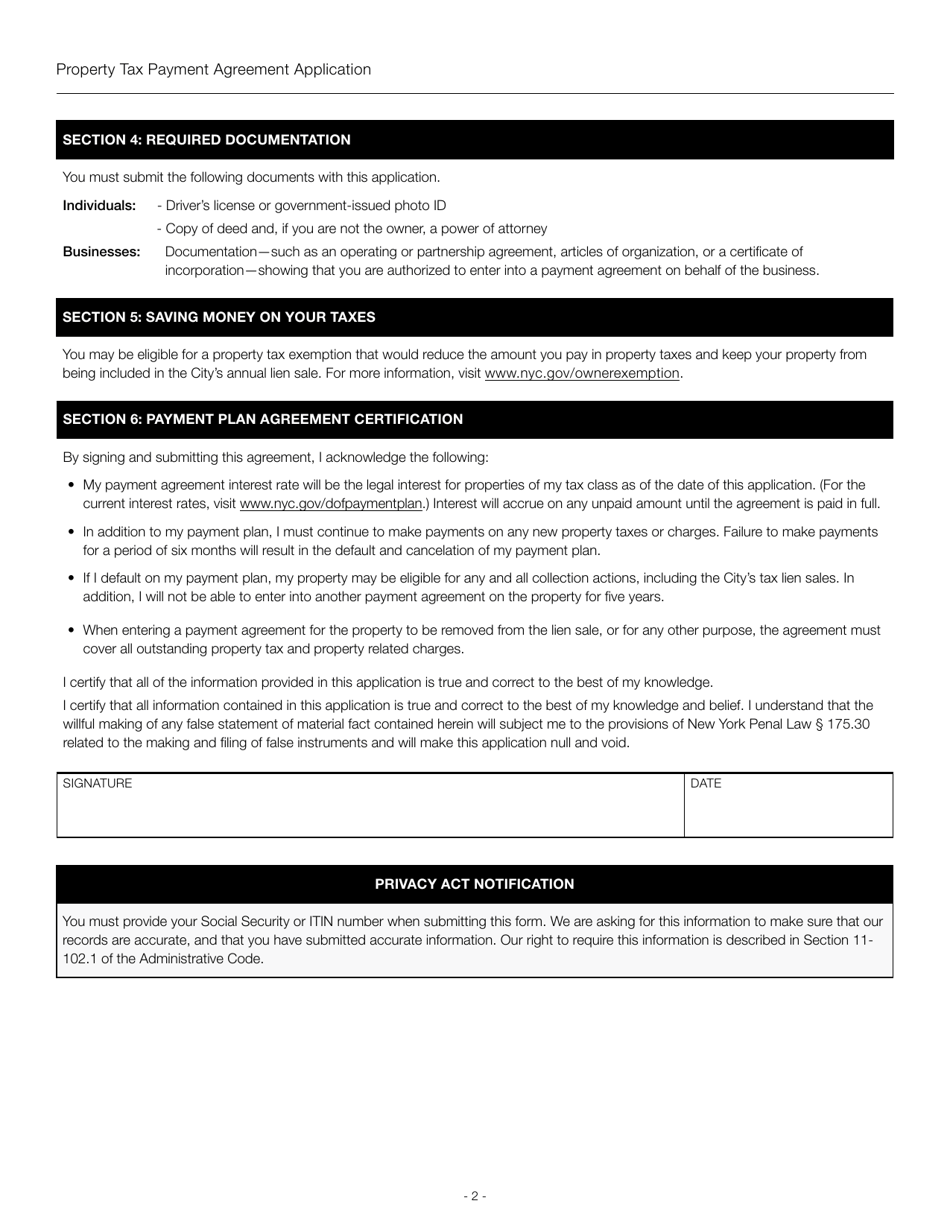

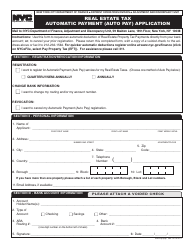

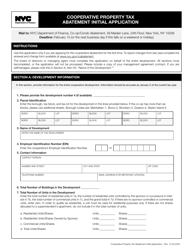

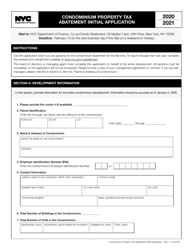

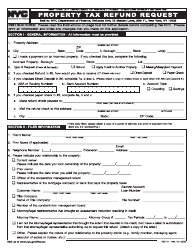

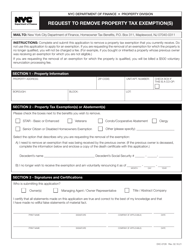

Property Tax Payment Agreement Application - New York City

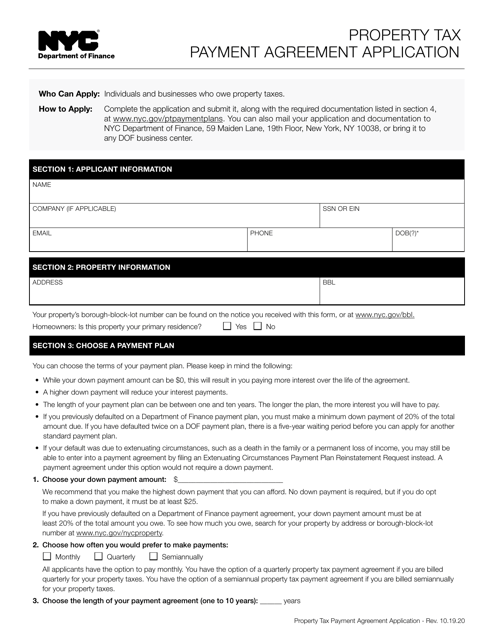

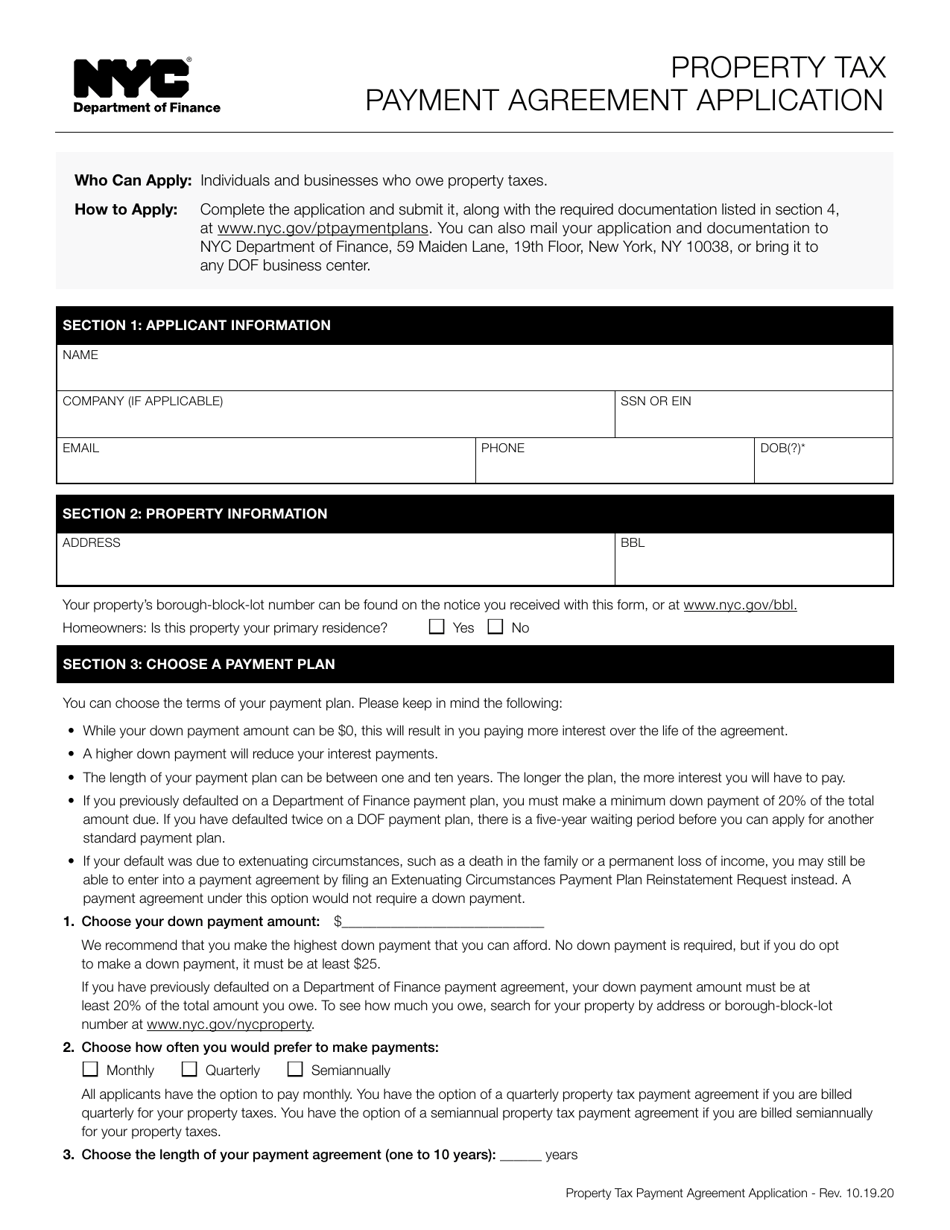

Property Tax Payment Agreement Application is a legal document that was released by the New York City Department of Finance - a government authority operating within New York City.

FAQ

Q: What is a Property Tax Payment Agreement?

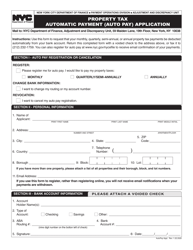

A: A Property Tax Payment Agreement is an arrangement made between a property owner and the City of New York to pay property taxes on a monthly or quarterly basis.

Q: Who is eligible for a Property Tax Payment Agreement?

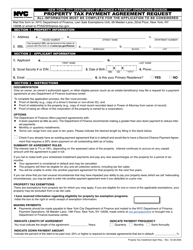

A: Property owners in New York City who are delinquent on their property taxes and meet certain criteria may be eligible for a Payment Agreement.

Q: How can I apply for a Property Tax Payment Agreement in New York City?

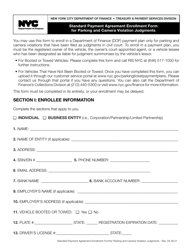

A: To apply for a Property Tax Payment Agreement in New York City, you will need to contact the Department of Finance and complete an application.

Q: What are the benefits of a Property Tax Payment Agreement?

A: A Property Tax Payment Agreement allows property owners to avoid penalties and interest on delinquent property tax payments and provides a structured plan for repayment.

Q: Can I make partial payments through a Property Tax Payment Agreement?

A: Yes, property owners can make partial payments towards their property tax debt through a Payment Agreement.

Q: What happens if I default on my Property Tax Payment Agreement?

A: If you default on your Property Tax Payment Agreement, the City of New York may take legal action to collect the outstanding balance, and you may incur additional penalties and interest.

Q: Are there any fees associated with a Property Tax Payment Agreement?

A: There may be fees associated with setting up a Property Tax Payment Agreement, such as an application fee, processing fee, or installment agreement fee.

Q: Can I negotiate the terms of a Property Tax Payment Agreement?

A: The terms of a Property Tax Payment Agreement are generally non-negotiable, but you can discuss your specific situation with the Department of Finance.

Q: Can a Property Tax Payment Agreement be modified?

A: In certain circumstances, a Property Tax Payment Agreement may be modified to accommodate changes in financial circumstances. Contact the Department of Finance for more information.

Q: How long does a Property Tax Payment Agreement last?

A: The length of a Property Tax Payment Agreement varies depending on the amount owed and the agreed-upon terms. It can range from several months to several years.

Form Details:

- Released on October 19, 2020;

- The latest edition currently provided by the New York City Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New York City Department of Finance.