This version of the form is not currently in use and is provided for reference only. Download this version of

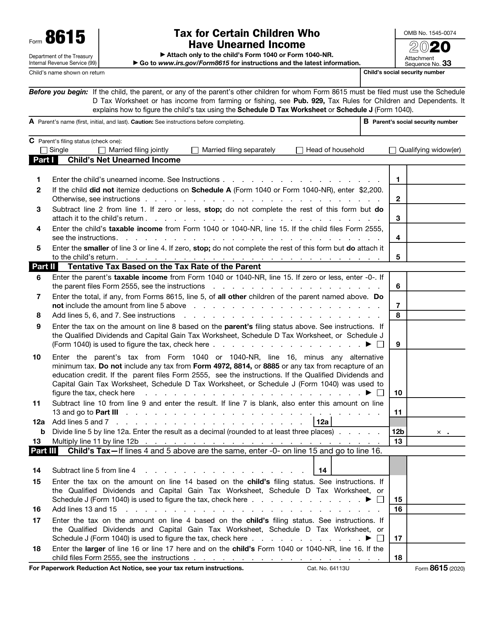

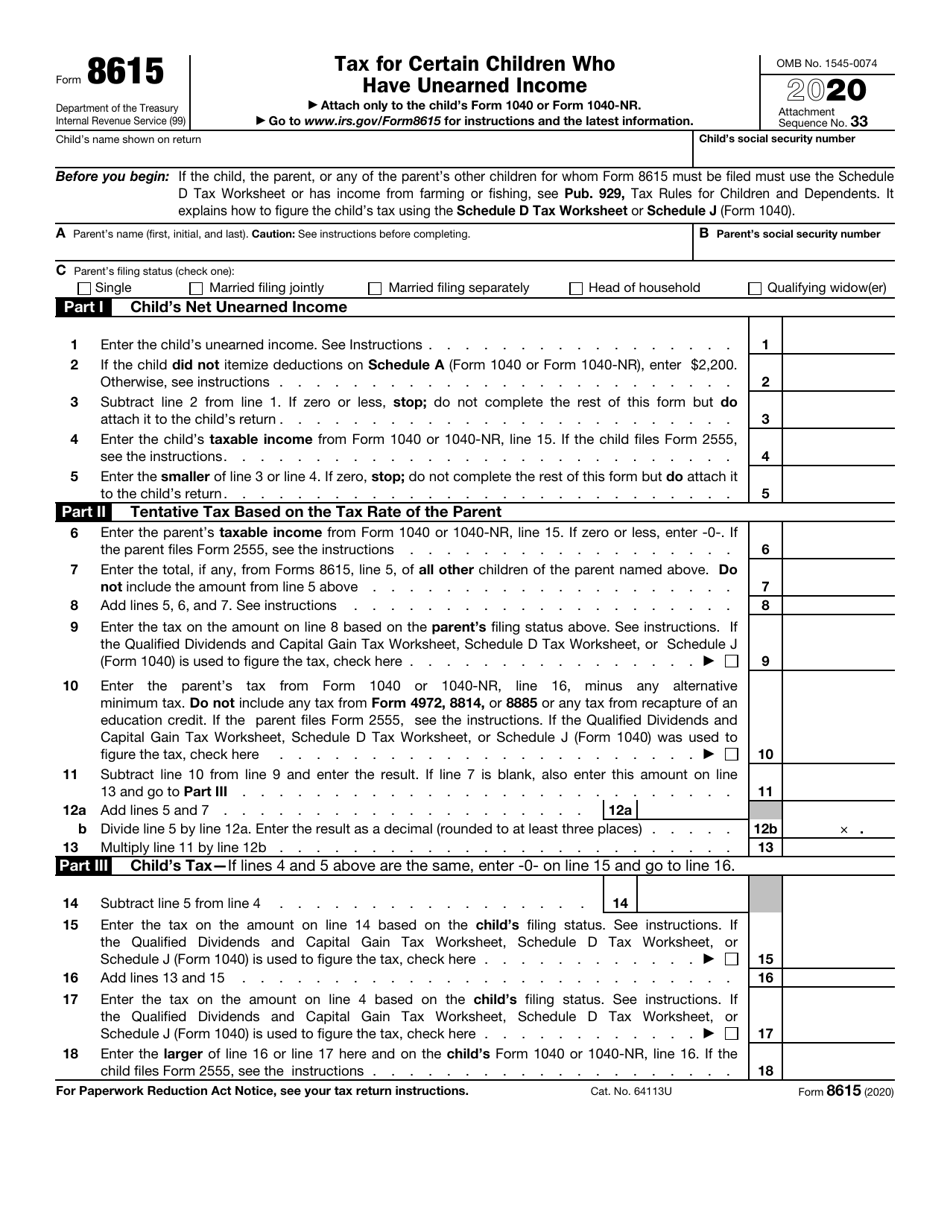

IRS Form 8615

for the current year.

IRS Form 8615 Tax for Certain Children Who Have Unearned Income

What Is IRS Form 8615?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 8615?

A: IRS Form 8615 is a tax form used to calculate the tax liability of certain children who have unearned income.

Q: Who needs to file IRS Form 8615?

A: Children who meet certain criteria and have unearned income may need to file IRS Form 8615.

Q: What is unearned income?

A: Unearned income refers to income that is not earned through employment or self-employment, such as dividends, interest, or capital gains.

Q: What is the purpose of IRS Form 8615?

A: The purpose of IRS Form 8615 is to calculate the tax liability of children with unearned income and ensure they pay the correct amount of tax.

Q: How do I fill out IRS Form 8615?

A: To fill out IRS Form 8615, you will need to provide information about the child's unearned income, as well as certain deductions and tax credits.

Q: When is the deadline to file IRS Form 8615?

A: The deadline to file IRS Form 8615 typically aligns with the regular tax filing deadline, which is April 15th.

Q: Are there any exceptions to filing IRS Form 8615?

A: There may be exceptions to filing IRS Form 8615, such as if the child's unearned income falls below a certain threshold.

Form Details:

- A 1-page form available for download in PDF;

- This form cannot be used to file taxes for the current year. Choose a more recent version to file for the current tax year;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8615 through the link below or browse more documents in our library of IRS Forms.