This version of the form is not currently in use and is provided for reference only. Download this version of

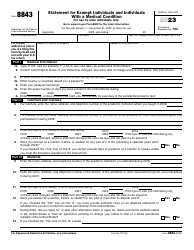

Instructions for IRS Form 8898

for the current year.

Instructions for IRS Form 8898 Statement for Individuals Who Begin or End Bona Fide Residence in a U.S. Possession

This document contains official instructions for IRS Form 8898 , Statement for Individuals Who Begin or End Bona Fide Residence in a U.S. Possession - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8898 is available for download through this link.

FAQ

Q: What is IRS Form 8898?

A: IRS Form 8898 is a statement for individuals who begin or end bona fide residence in a U.S. possession.

Q: What is a bona fide residence in a U.S. possession?

A: Bona fide residence in a U.S. possession refers to living in a U.S. territory or possession with the intention of making it your true and permanent home.

Q: Who needs to file IRS Form 8898?

A: Individuals who begin or end bona fide residence in a U.S. possession during the tax year need to file IRS Form 8898.

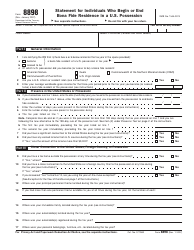

Q: What information is required on IRS Form 8898?

A: IRS Form 8898 requires information about the individual's residency status, the U.S. possession they are residing in, and the dates of residency.

Q: When is the deadline to file IRS Form 8898?

A: The deadline to file IRS Form 8898 is usually the same as the federal income tax return deadline, which is April 15th.

Q: Are there any penalties for not filing IRS Form 8898?

A: Yes, there may be penalties for not filing IRS Form 8898 or for filing it late. It is important to comply with the filing requirements.

Q: Can I file IRS Form 8898 electronically?

A: Yes, IRS Form 8898 can be filed electronically if you are using IRS-approved software or working with a tax professional.

Q: Do I need to attach any supporting documents with IRS Form 8898?

A: There is no requirement to attach supporting documents, but it is important to keep them for your records in case of an audit.

Q: Can I get an extension to file IRS Form 8898?

A: Yes, you can get an extension to file IRS Form 8898 by filing Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.