This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8804-W

for the current year.

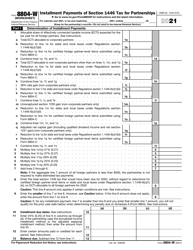

Instructions for IRS Form 8804-W Installment Payments of Section 1446 Tax for Partnerships

This document contains official instructions for IRS Form 8804-W , Installment Payments of Section 1446 Tax for Partnerships - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8804-W is available for download through this link.

FAQ

Q: What is IRS Form 8804-W?

A: IRS Form 8804-W is used to make installment payments of Section 1446 tax for partnerships.

Q: Who uses IRS Form 8804-W?

A: Partnerships use IRS Form 8804-W to make installment payments of Section 1446 tax.

Q: What is Section 1446 tax?

A: Section 1446 tax refers to the tax on effectively connected income allocated to foreign partners of partnerships.

Q: Why are installment payments necessary for Section 1446 tax?

A: Installment payments are required to help partnerships satisfy their Section 1446 tax liability throughout the year.

Q: How often should installment payments be made for Section 1446 tax?

A: Installment payments should be made on a quarterly basis using IRS Form 8804-W.

Q: Are there any penalties for late or insufficient installment payments?

A: Yes, there may be penalties for late or insufficient installment payments of Section 1446 tax.

Q: Can I make installment payments electronically for Section 1446 tax?

A: Yes, partnerships have the option to make electronic installment payments using the Electronic Federal Tax Payment System (EFTPS).

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.