This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1099-A, 1099-C

for the current year.

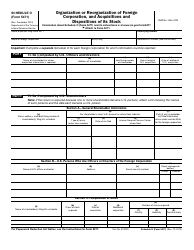

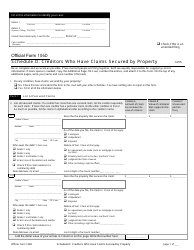

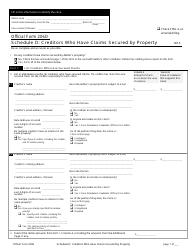

Instructions for IRS Form 1099-A, 1099-C Acquisition or Abandonment of Secured Property and Cancellation of Debt

This document contains official instructions for IRS Form 1099-A , and IRS Form 1099-C . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1099-A is available for download through this link. The latest available IRS Form 1099-C can be downloaded through this link.

FAQ

Q: What is IRS Form 1099-A?

A: IRS Form 1099-A is used to report the acquisition or abandonment of secured property.

Q: What is IRS Form 1099-C?

A: IRS Form 1099-C is used to report canceled debt over $600.

Q: When should I file IRS Form 1099-A?

A: IRS Form 1099-A must be filed by January 31st of the year following the year of acquisition or abandonment.

Q: When should I file IRS Form 1099-C?

A: IRS Form 1099-C must be filed by January 31st of the year following the year of debt cancellation.

Q: Who should file IRS Form 1099-A?

A: The lender or other party who holds the property interest should file IRS Form 1099-A.

Q: Who should file IRS Form 1099-C?

A: The lender, creditor, or other party who cancels the debt should file IRS Form 1099-C.

Q: What information is required on IRS Form 1099-A?

A: IRS Form 1099-A requires information about the property, the borrower, and the acquisition or abandonment date.

Q: What information is required on IRS Form 1099-C?

A: IRS Form 1099-C requires information about the debtor, the creditor, and the date of cancellation.

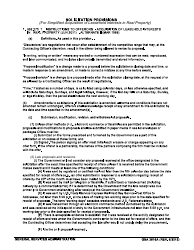

Q: Are there any penalties for not filing IRS Form 1099-A or 1099-C?

A: Yes, there are penalties for not filing IRS Form 1099-A or 1099-C, which vary depending on the circumstances.

Instruction Details:

- This 6-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.