This version of the form is not currently in use and is provided for reference only. Download this version of

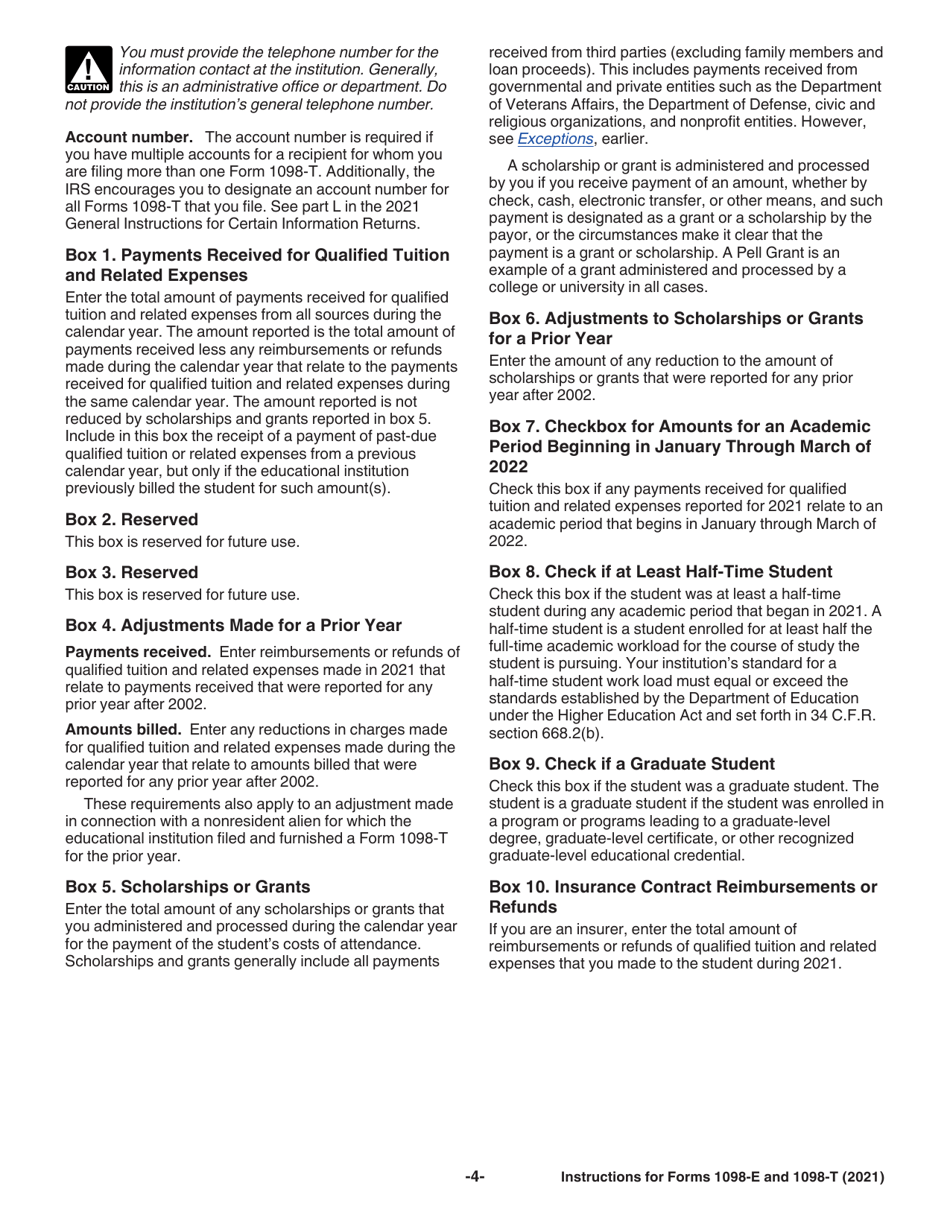

Instructions for IRS Form 1098-E, 1098-T

for the current year.

Instructions for IRS Form 1098-E, 1098-T

This document contains official instructions for IRS Form 1098-E , and IRS Form 1098-T . Both forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1098-E is available for download through this link. The latest available IRS Form 1098-T can be downloaded through this link.

FAQ

Q: What is IRS Form 1098-E?

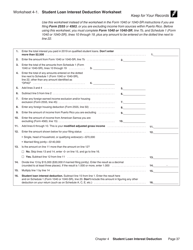

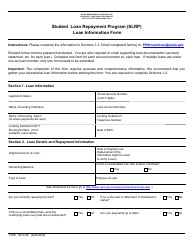

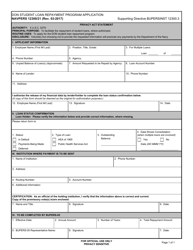

A: IRS Form 1098-E is used to report student loan interest payments made during the tax year.

Q: What is IRS Form 1098-T?

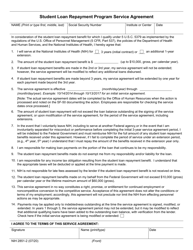

A: IRS Form 1098-T is used to report tuition payments and other education-related expenses for qualifying educational institutions.

Q: Who needs to file Form 1098-E?

A: Lenders or institutions that received $600 or more in student loan interest payments from an individual during the tax year need to file Form 1098-E.

Q: Who needs to file Form 1098-T?

A: Qualified educational institutions that received payments for qualified tuition and related expenses need to file Form 1098-T.

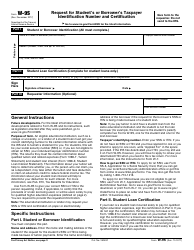

Q: What information is required to complete Form 1098-E?

A: Form 1098-E requires the lender's name, address, taxpayer identification number, the borrower's name, address, and taxpayer identification number, and the amount of student loan interest paid.

Q: What information is required to complete Form 1098-T?

A: Form 1098-T requires the educational institution's name, address, taxpayer identification number, the student's name and taxpayer identification number, and the amounts of qualified tuition and related expenses.

Q: When is the deadline to file Form 1098-E?

A: The deadline to file Form 1098-E is generally January 31st of the year following the tax year.

Q: When is the deadline to file Form 1098-T?

A: The deadline to file Form 1098-T is generally January 31st of the year following the tax year.

Q: Can Form 1098-E and Form 1098-T be filed electronically?

A: Yes, both Form 1098-E and Form 1098-T can be filed electronically.

Q: Are there penalties for not filing Form 1098-E or Form 1098-T?

A: Yes, there can be penalties for not filing Form 1098-E or Form 1098-T on time or for filing incorrect information.

Instruction Details:

- This 4-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.