This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1040 Schedule J

for the current year.

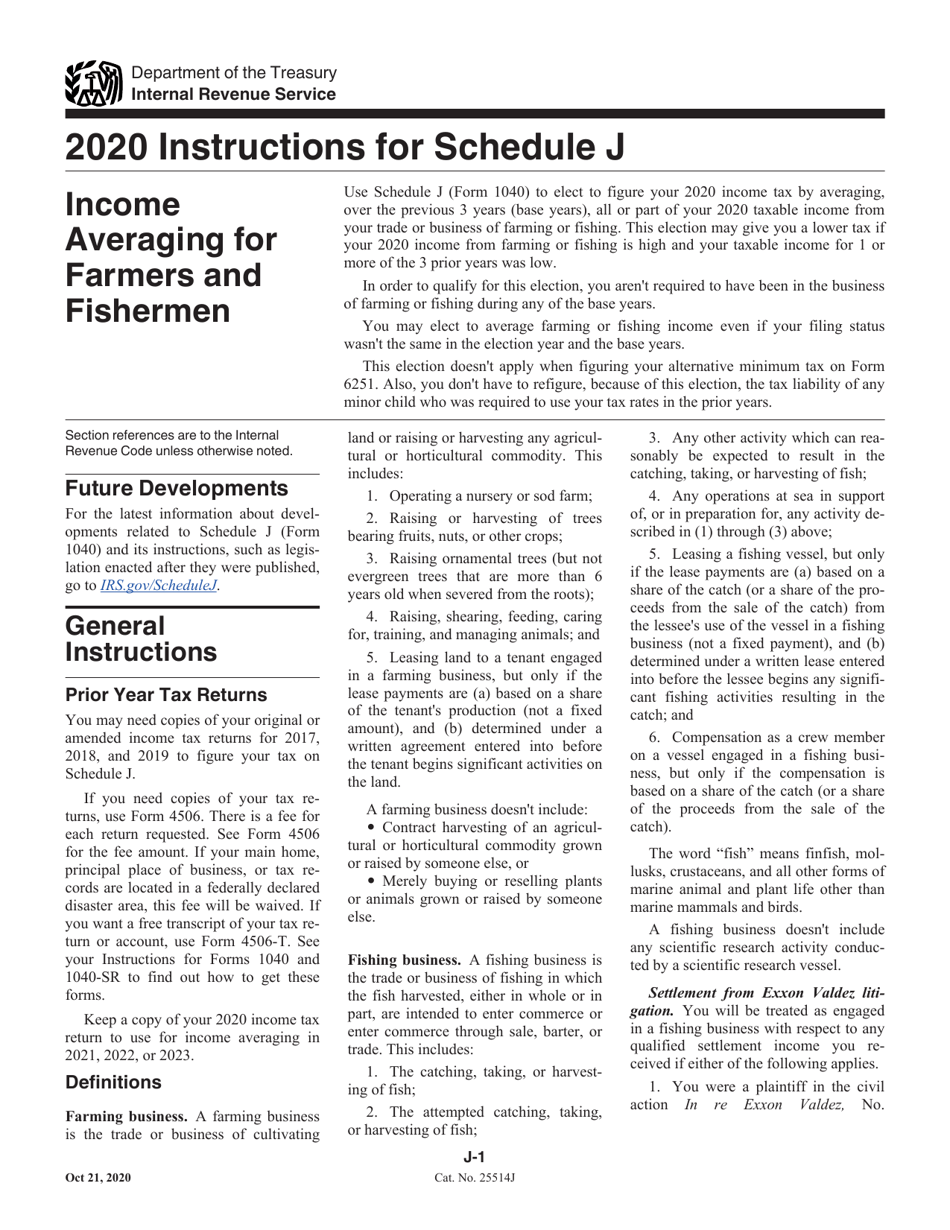

Instructions for IRS Form 1040 Schedule J Income Averaging for Farmers and Fishermen

This document contains official instructions for IRS Form 1040 Schedule J, Income Averaging for Farmers and Fishermen - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 Schedule J is available for download through this link.

FAQ

Q: What is IRS Form 1040 Schedule J?

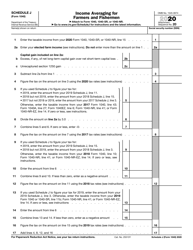

A: IRS Form 1040 Schedule J is a tax form used by farmers and fishermen to calculate income averaging.

Q: Who can use IRS Form 1040 Schedule J?

A: Farmers and fishermen can use IRS Form 1040 Schedule J.

Q: What is income averaging?

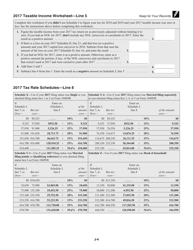

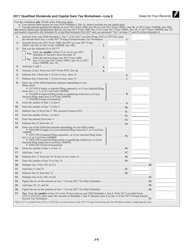

A: Income averaging allows farmers and fishermen to spread their income over several years to reduce their tax liability.

Q: How does income averaging work?

A: Farmers and fishermen can calculate their average income by adding up the taxable income from the past three years and dividing it by three.

Q: What are the benefits of income averaging?

A: Income averaging can help reduce the tax burden for farmers and fishermen in years when their income is higher than usual.

Q: Is income averaging available for other professions?

A: No, income averaging is only available for farmers and fishermen.

Q: Are there any limitations or restrictions on income averaging?

A: Yes, there are certain eligibility criteria and limitations on the use of income averaging. It is best to consult the instructions for Form 1040 Schedule J or a tax professional for specific details.

Q: Is income averaging mandatory for farmers and fishermen?

A: No, income averaging is not mandatory. It is an option available to eligible farmers and fishermen to reduce their tax liability.

Q: Can I carry over unused income averaging amounts to future years?

A: No, any unused income averaging amounts cannot be carried over to future tax years.

Instruction Details:

- This 14-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.