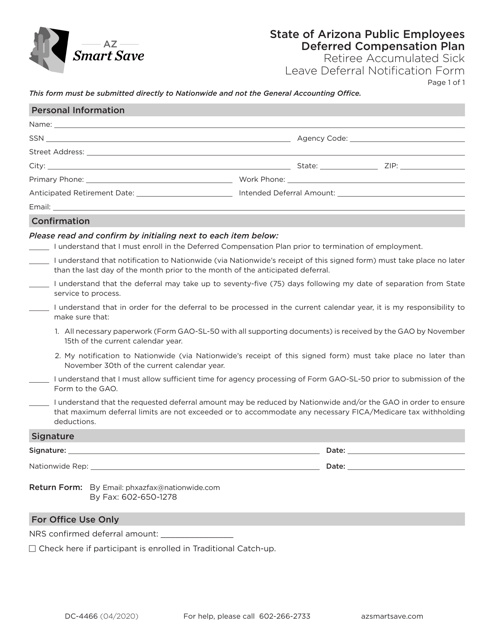

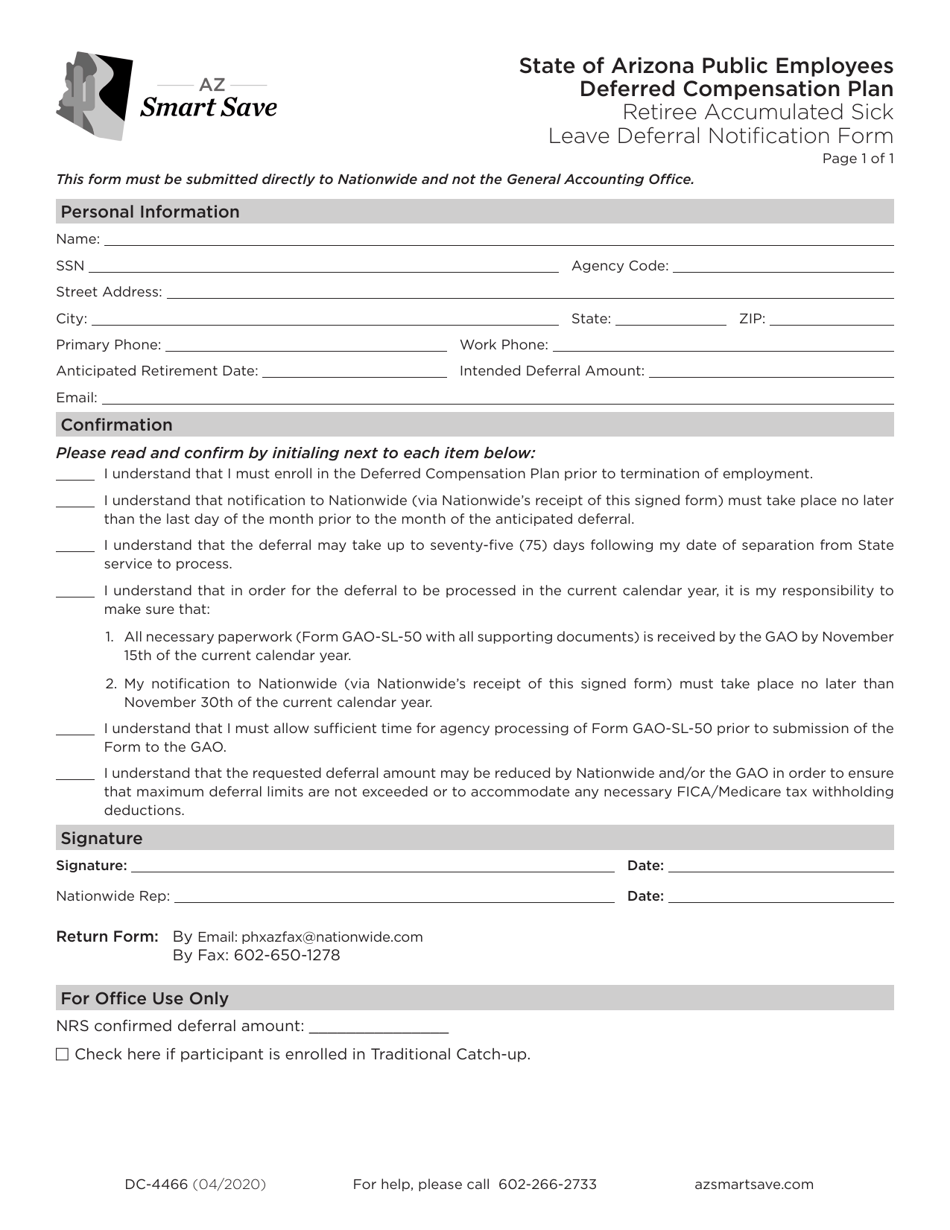

Form DC-4466 Nationwide Rasl Deferral Notification Form - Arizona

What Is Form DC-4466?

This is a legal form that was released by the Arizona Department of Administration - General Accounting Office - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DC-4466?

A: Form DC-4466 is the Nationwide Rasl Deferral Notification Form.

Q: What is the purpose of Form DC-4466?

A: The purpose of Form DC-4466 is to notify the Arizona Department of Revenue of the deferral of the Rural Area Surcharge License (RASL) tax.

Q: Who needs to file Form DC-4466?

A: Businesses that qualify for the deferral of the Rural Area Surcharge License (RASL) tax in Arizona need to file Form DC-4466.

Q: How do I fill out Form DC-4466?

A: You need to provide your business details, including your name, address, and tax identification number, as well as the tax period and the reason for the deferral.

Q: Is there a deadline for submitting Form DC-4466?

A: Yes, Form DC-4466 must be submitted by the due date of the tax return for the tax period.

Q: What happens after I submit Form DC-4466?

A: Once you submit Form DC-4466, the Arizona Department of Revenue will review your request and notify you of the approval or denial of the deferral.

Q: Can I make changes to Form DC-4466 after submitting it?

A: No, you cannot make changes to Form DC-4466 after submitting it. If you need to make changes, you should contact the Arizona Department of Revenue.

Q: Is there a fee for filing Form DC-4466?

A: No, there is no fee for filing Form DC-4466.

Form Details:

- Released on April 1, 2020;

- The latest edition provided by the Arizona Department of Administration - General Accounting Office;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DC-4466 by clicking the link below or browse more documents and templates provided by the Arizona Department of Administration - General Accounting Office.