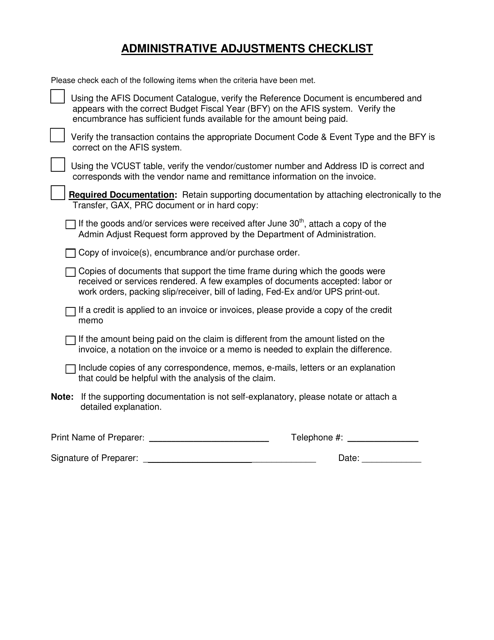

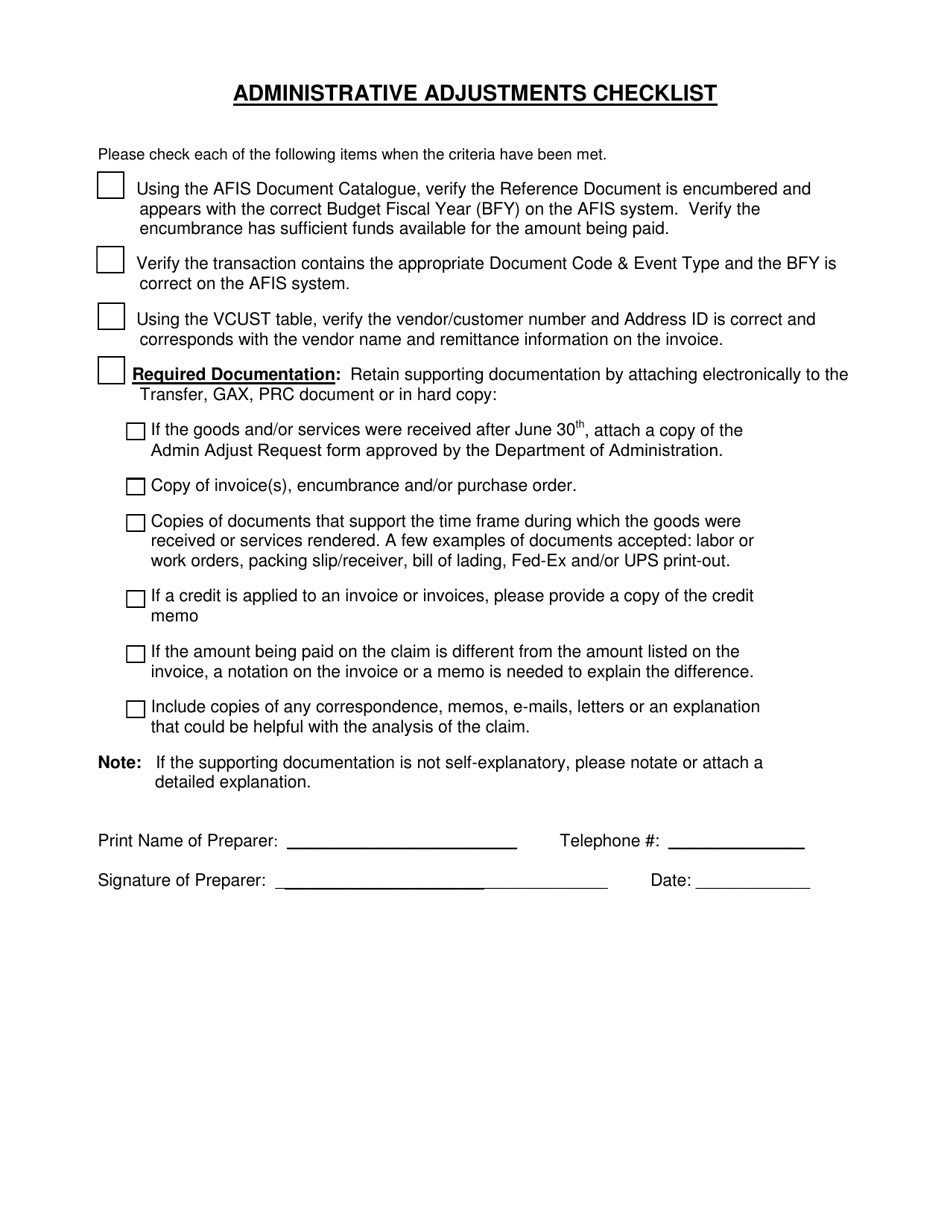

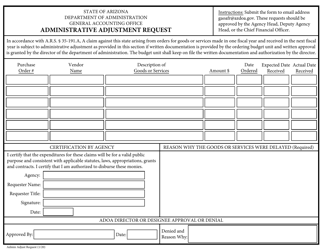

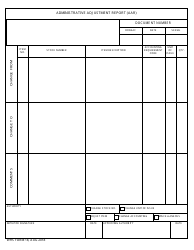

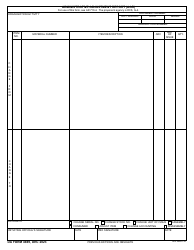

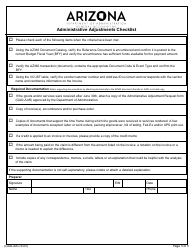

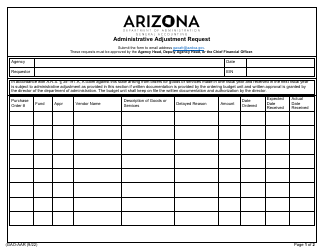

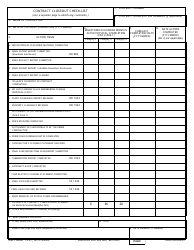

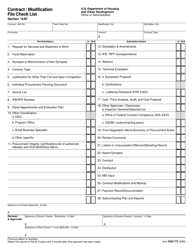

Administrative Adjustments Checklist - Arizona

Administrative Adjustments Checklist is a legal document that was released by the Arizona Department of Administration - General Accounting Office - a government authority operating within Arizona.

FAQ

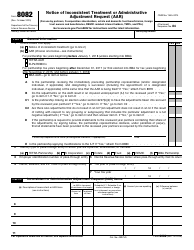

Q: What is an Administrative Adjustment?

A: An Administrative Adjustment is a correction made by the Arizona Department of Revenue to a taxpayer's return.

Q: How do I request an Administrative Adjustment?

A: You can request an Administrative Adjustment by completing and submitting Form 140X, Amended Individual Income Tax Return.

Q: What types of errors can be corrected through an Administrative Adjustment?

A: Administrative Adjustments can be used to correct errors related to income, deductions, exemptions, and credits on your tax return.

Q: Is there a time limit to request an Administrative Adjustment?

A: Yes, you must request an Administrative Adjustment within three years from the original due date of the tax return or within two years from the date the tax was paid, whichever is later.

Q: Are there any fees associated with requesting an Administrative Adjustment?

A: No, there are no fees associated with requesting an Administrative Adjustment.

Q: How long does it take to process an Administrative Adjustment?

A: The processing time for an Administrative Adjustment can vary, but it typically takes about 8 to 12 weeks.

Q: What should I do if I disagree with the outcome of my Administrative Adjustment?

A: If you disagree with the outcome of your Administrative Adjustment, you can file an appeal with the Arizona Department of Revenue's Administrative Appeals Tribunal.

Q: Can I request an Administrative Adjustment for a tax year that has already been audited?

A: No, you cannot request an Administrative Adjustment for a tax year that has already been audited. You will need to follow the appropriate procedures for disputing the audit findings.

Q: Are there any limitations on the amount of an Administrative Adjustment?

A: No, there are no limitations on the amount of an Administrative Adjustment. However, if the adjustment results in a refund, interest will only be paid on the amount of the refund due from the date the adjustment request is received.

Form Details:

- The latest edition currently provided by the Arizona Department of Administration - General Accounting Office;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Arizona Department of Administration - General Accounting Office.