This version of the form is not currently in use and is provided for reference only. Download this version of

Form GAO-802

for the current year.

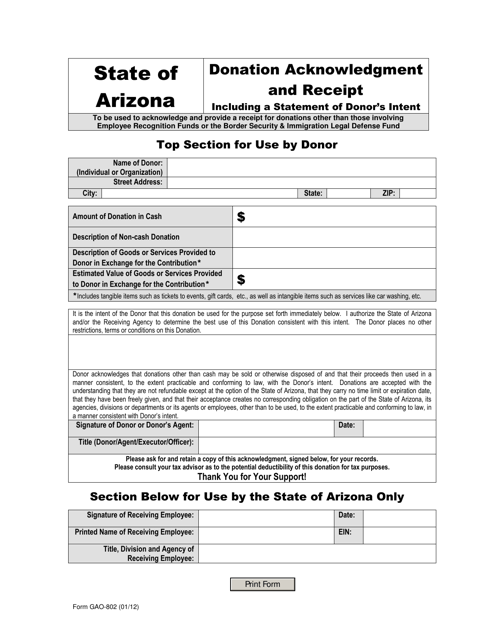

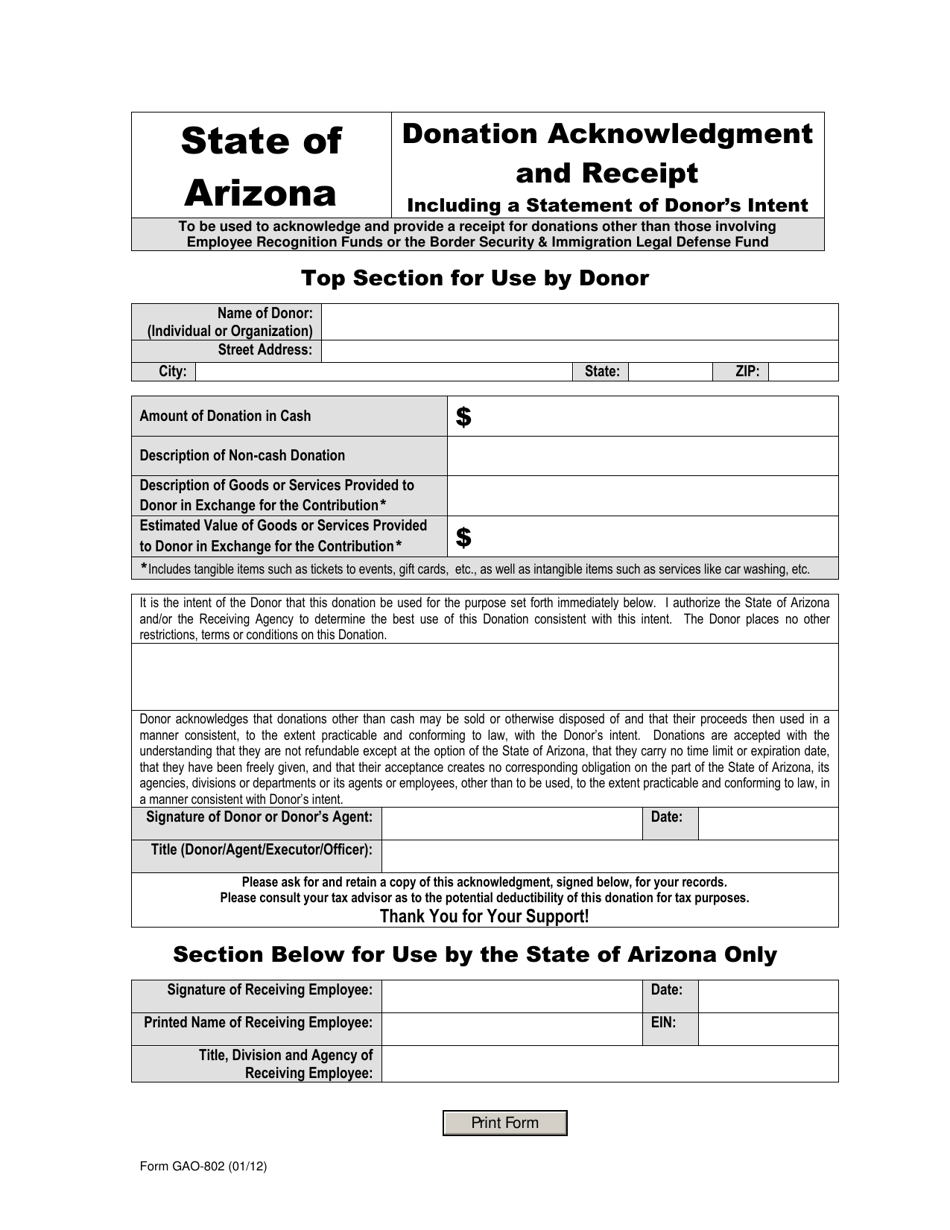

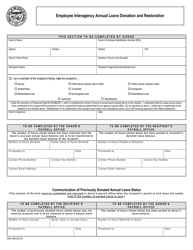

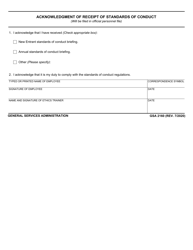

Form GAO-802 Donation Acknowledgment and Receipt - Arizona

What Is Form GAO-802?

This is a legal form that was released by the Arizona Department of Administration - General Accounting Office - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GAO-802?

A: Form GAO-802 is a Donation Acknowledgment and Receipt form for the state of Arizona.

Q: What is the purpose of Form GAO-802?

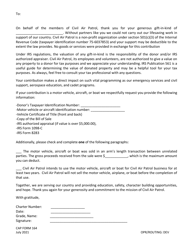

A: The purpose of Form GAO-802 is to provide a written acknowledgement to the donor for a charitable contribution and to provide a receipt for tax purposes.

Q: Who needs to use Form GAO-802?

A: Any individual or organization in Arizona that receives a charitable contribution and wants to provide a written acknowledgement to the donor should use Form GAO-802.

Q: Is Form GAO-802 specific to Arizona?

A: Yes, Form GAO-802 is specific to the state of Arizona.

Q: Are there any filing fees associated with Form GAO-802?

A: No, there are no filing fees associated with Form GAO-802.

Q: Can Form GAO-802 be submitted electronically?

A: Yes, Form GAO-802 can be submitted electronically.

Q: Can Form GAO-802 be used for non-charitable contributions?

A: No, Form GAO-802 is specifically for charitable contributions only.

Q: What information is required on Form GAO-802?

A: Form GAO-802 requires the donor's information, the recipient's information, a description of the contribution, and the date and amount of the contribution.

Q: How long should copies of Form GAO-802 be kept?

A: Copies of Form GAO-802 should be kept for a minimum of three years from the filing date.

Form Details:

- Released on January 1, 2012;

- The latest edition provided by the Arizona Department of Administration - General Accounting Office;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GAO-802 by clicking the link below or browse more documents and templates provided by the Arizona Department of Administration - General Accounting Office.