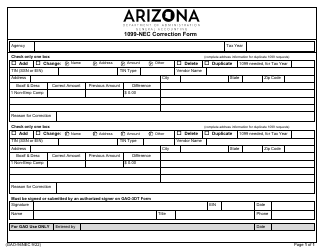

This version of the form is not currently in use and is provided for reference only. Download this version of

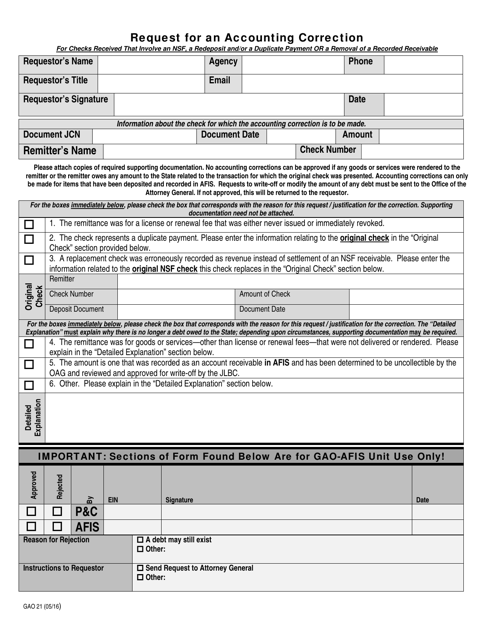

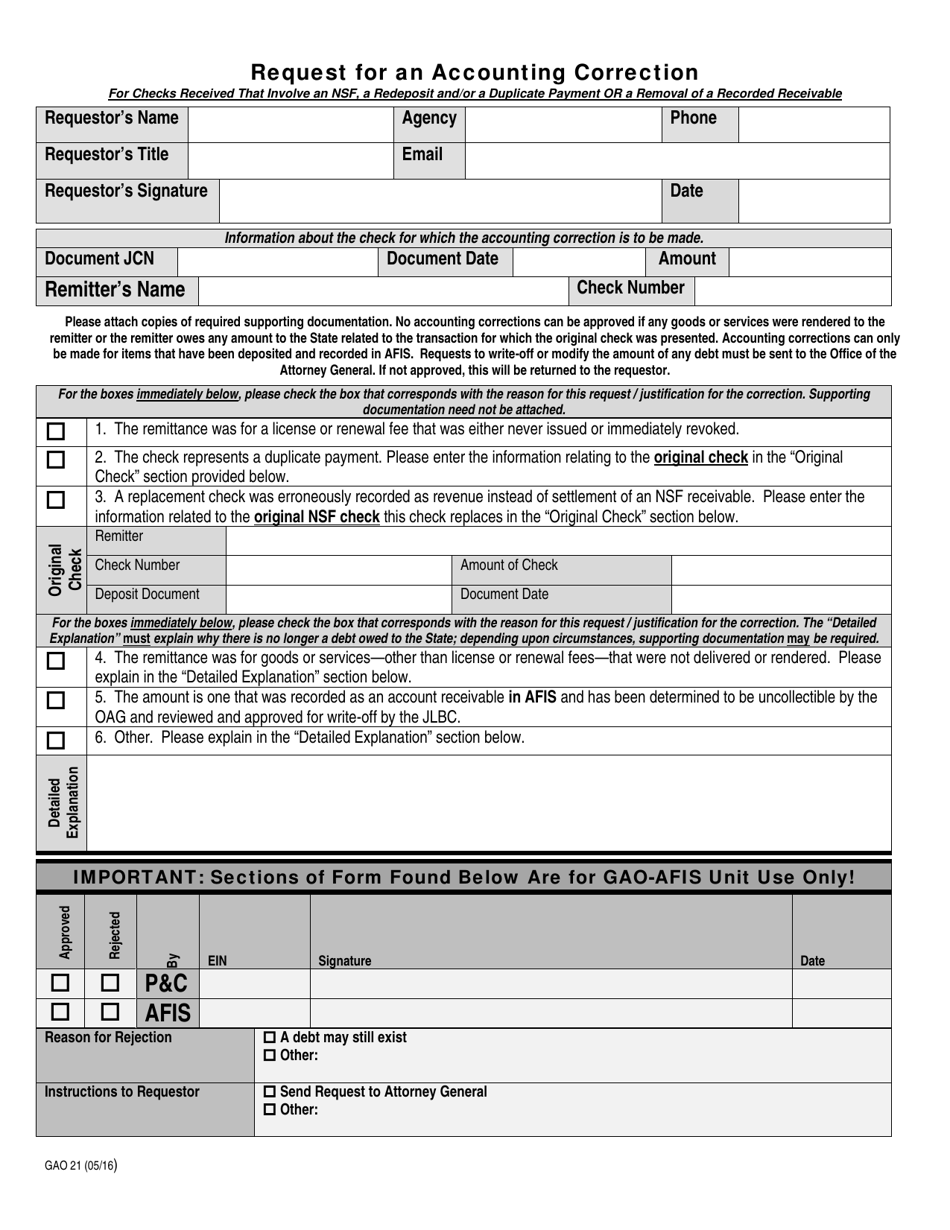

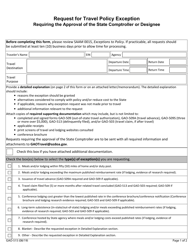

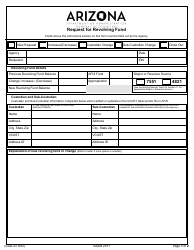

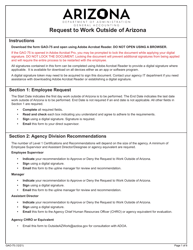

Form GAO-21

for the current year.

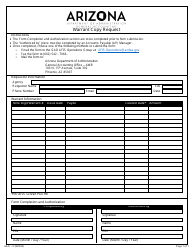

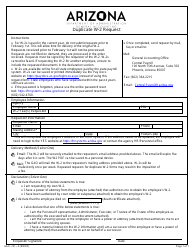

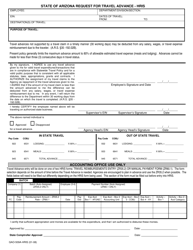

Form GAO-21 Request for an Accounting Correction - Arizona

What Is Form GAO-21?

This is a legal form that was released by the Arizona Department of Administration - General Accounting Office - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GAO-21?

A: Form GAO-21 is a request form for an accounting correction in Arizona.

Q: Who can use Form GAO-21?

A: Anyone who needs to request an accounting correction in Arizona can use Form GAO-21.

Q: Why would someone need to request an accounting correction?

A: Someone may need to request an accounting correction to rectify errors or discrepancies in their financial records.

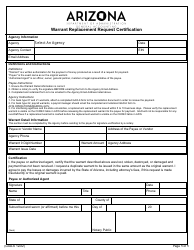

Q: What information is required on Form GAO-21?

A: Form GAO-21 requires information such as the requester's name, contact details, description of the correction needed, and supporting documentation.

Q: How long does it take to process a request for an accounting correction?

A: The processing time for a request for an accounting correction may vary depending on the nature and complexity of the correction. It is best to consult the official instructions or contact the relevant government office for an estimate.

Form Details:

- Released on May 1, 2016;

- The latest edition provided by the Arizona Department of Administration - General Accounting Office;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GAO-21 by clicking the link below or browse more documents and templates provided by the Arizona Department of Administration - General Accounting Office.