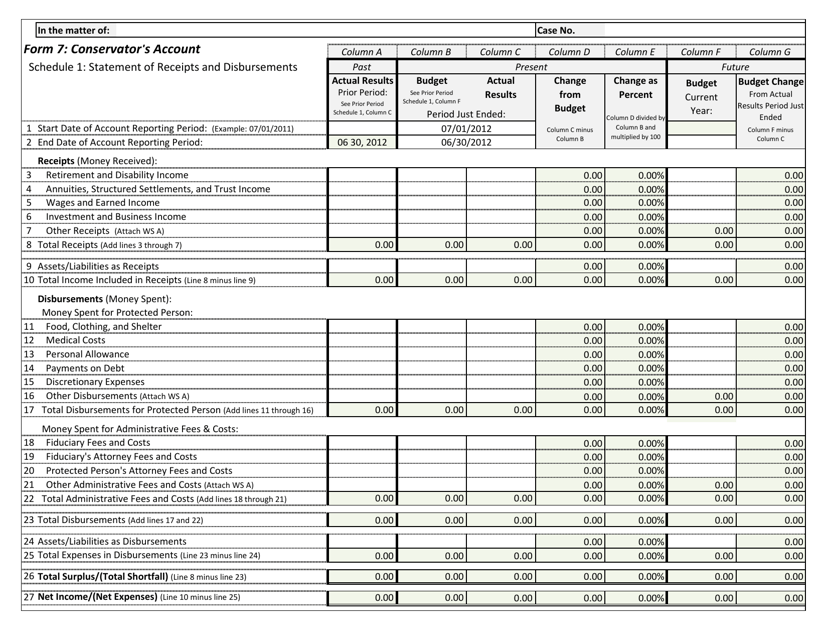

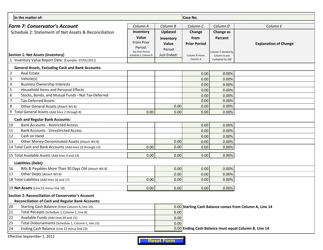

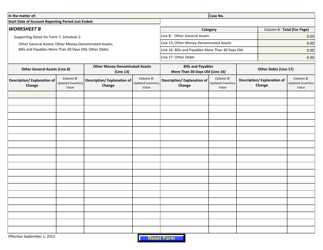

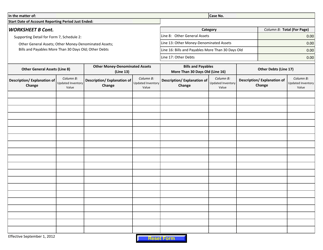

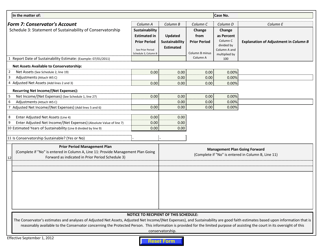

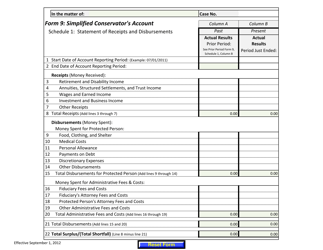

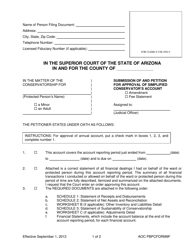

Form 7 Conservator's Account - Arizona

What Is Form 7?

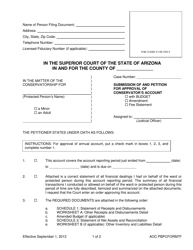

This is a legal form that was released by the Arizona Superior Court - a government authority operating within Arizona. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

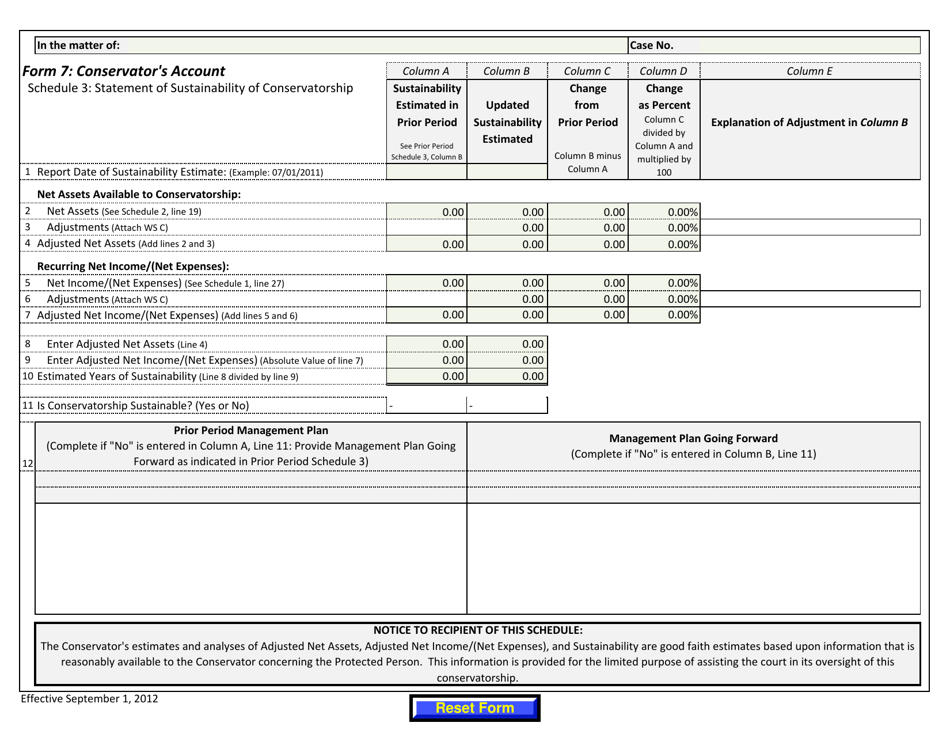

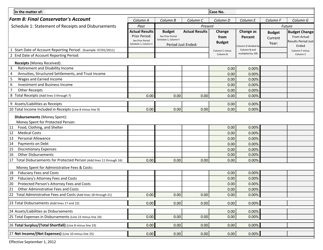

Q: What is a Form 7 Conservator's Account?

A: A Form 7 Conservator's Account is a financial statement filed by a conservator in Arizona to report and document the financial activities of a protected person.

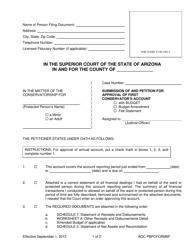

Q: Who needs to file a Form 7 Conservator's Account?

A: A conservator in Arizona who has been appointed to manage the financial affairs of a protected person needs to file a Form 7 Conservator's Account.

Q: What is the purpose of filing a Form 7 Conservator's Account?

A: The purpose of filing a Form 7 Conservator's Account is to provide transparency and accountability for the management of the protected person's financial affairs.

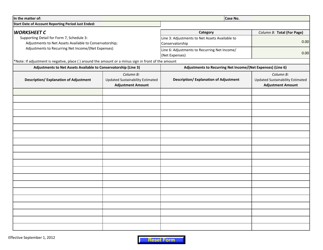

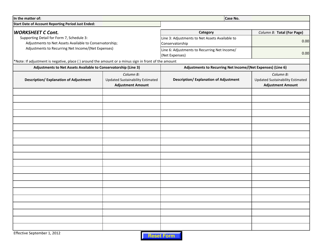

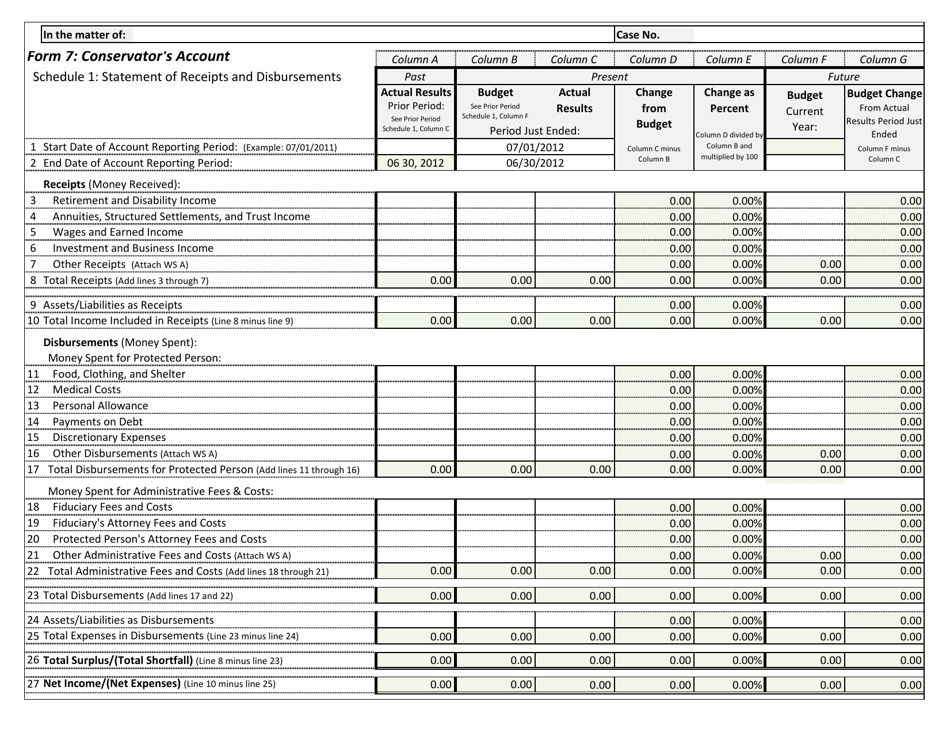

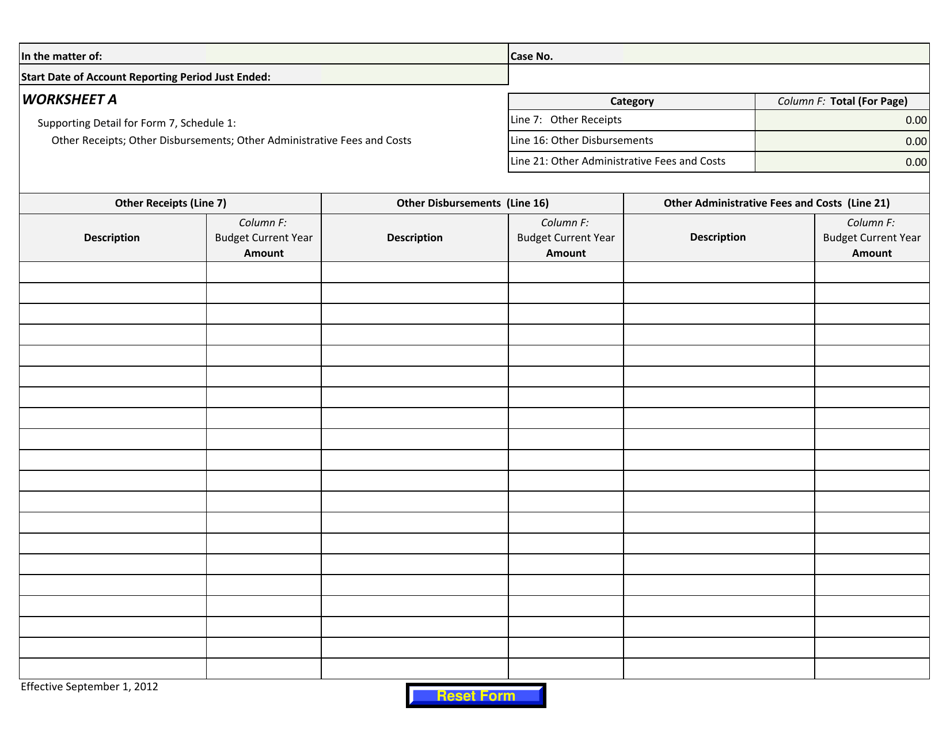

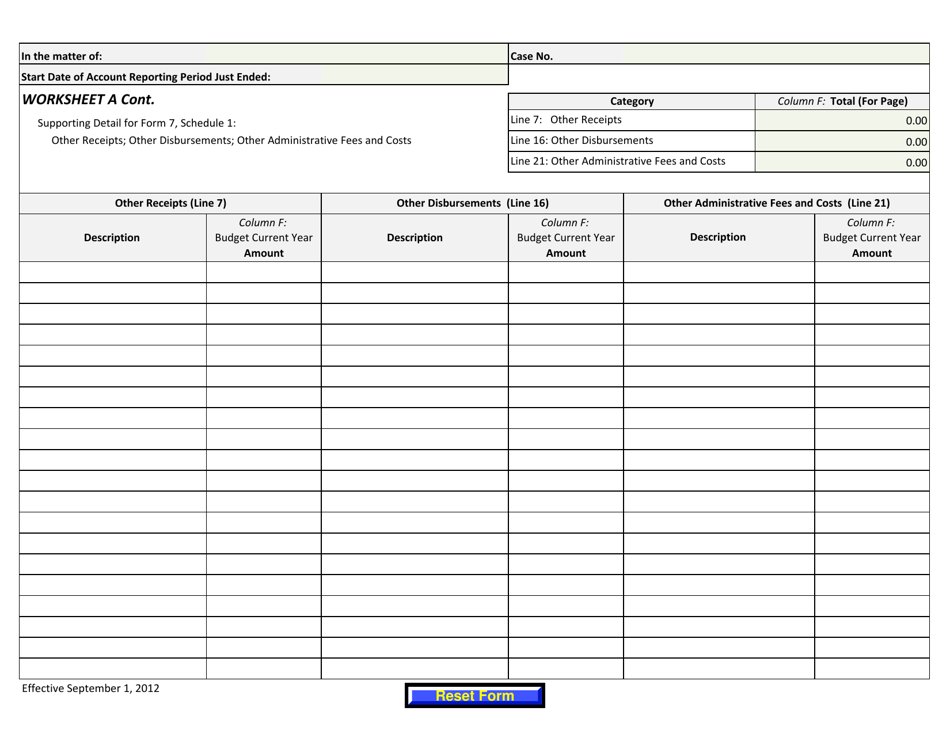

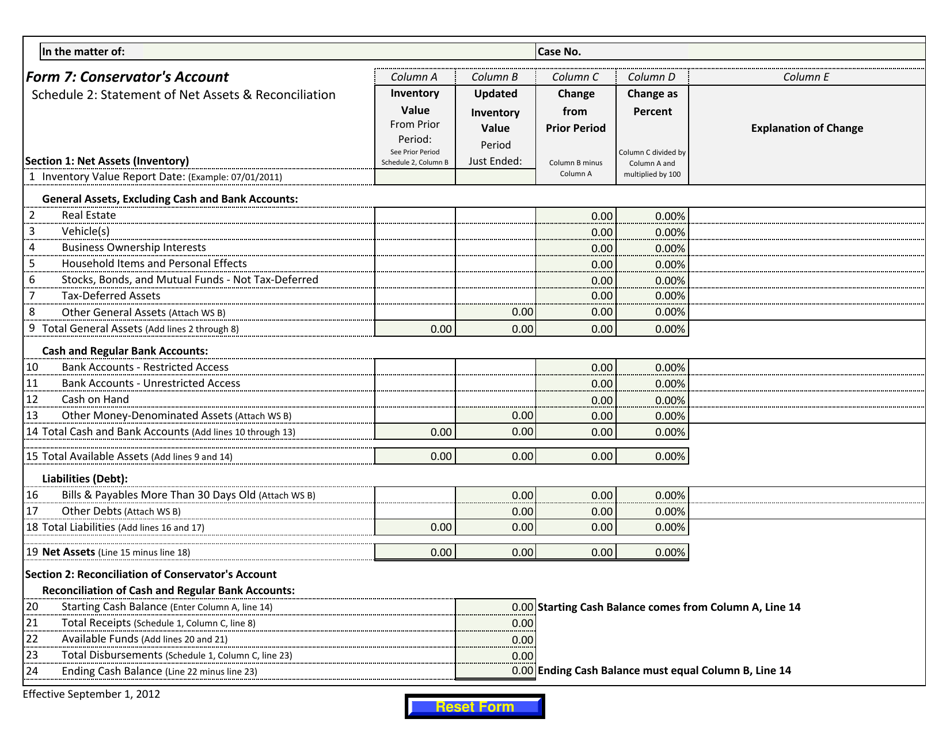

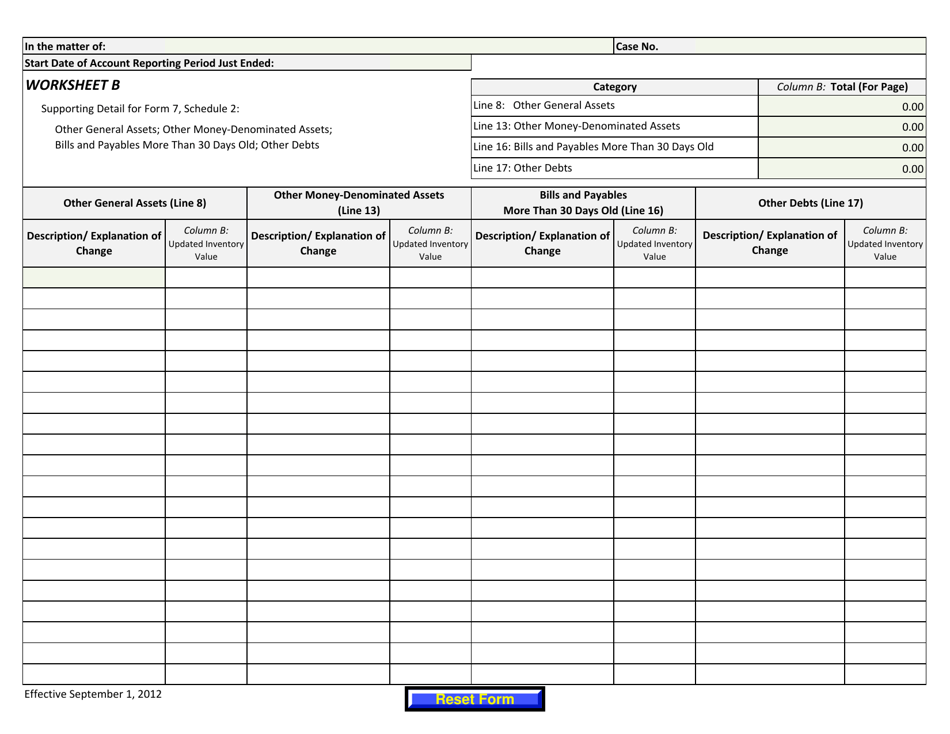

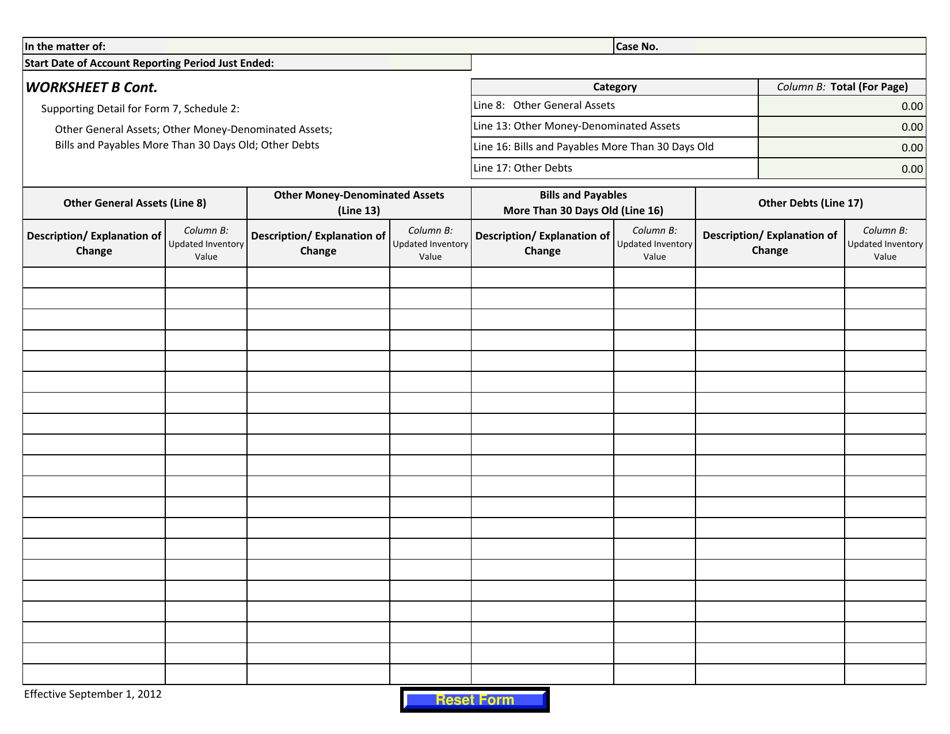

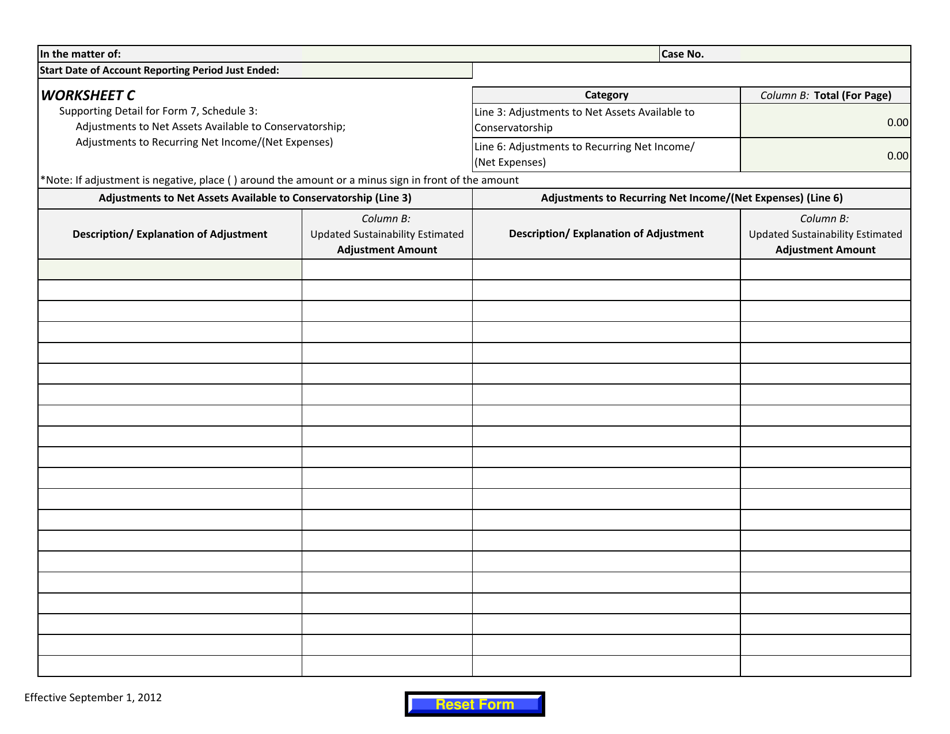

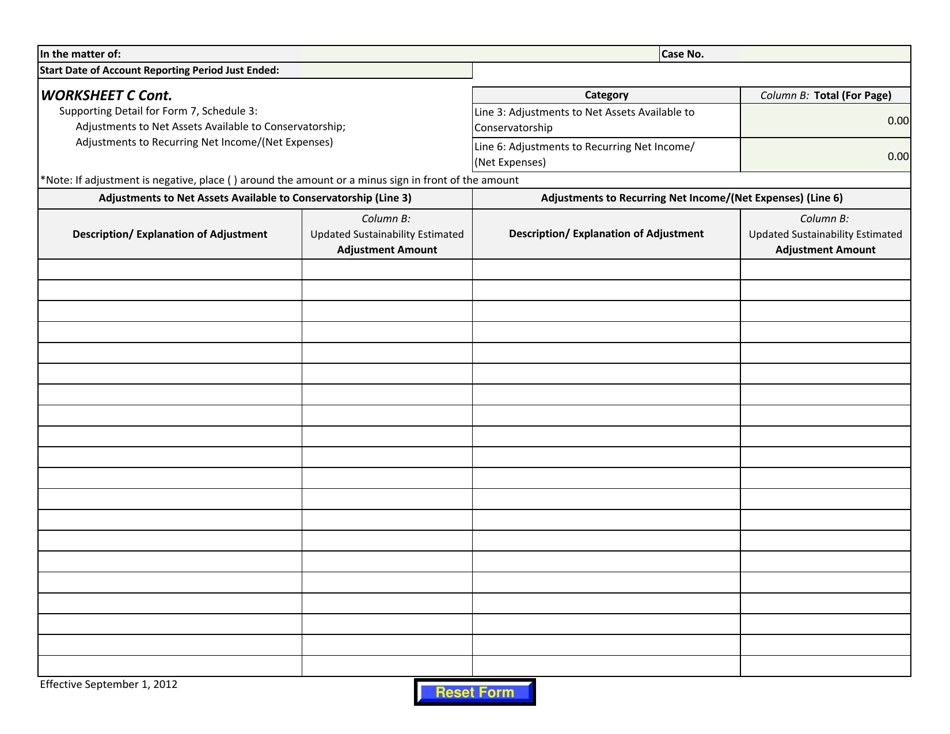

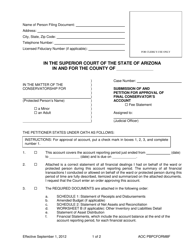

Q: What information is included in a Form 7 Conservator's Account?

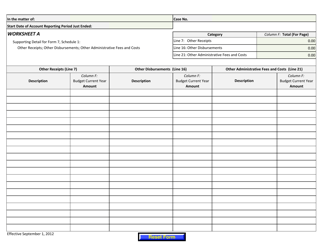

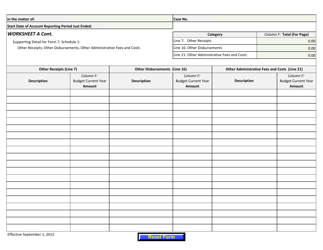

A: A Form 7 Conservator's Account includes details of the conservator's financial transactions, income received, assets held, and expenses incurred on behalf of the protected person.

Q: When is a Form 7 Conservator's Account due?

A: A Form 7 Conservator's Account is typically due annually, within 60 days after the close of the accounting period, unless otherwise specified by the court.

Q: What happens if a conservator fails to file a Form 7 Conservator's Account?

A: If a conservator fails to file a Form 7 Conservator's Account, they may face penalties, fines, or potential removal as the conservator of the protected person.

Form Details:

- Released on September 1, 2012;

- The latest edition provided by the Arizona Superior Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 7 by clicking the link below or browse more documents and templates provided by the Arizona Superior Court.