This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

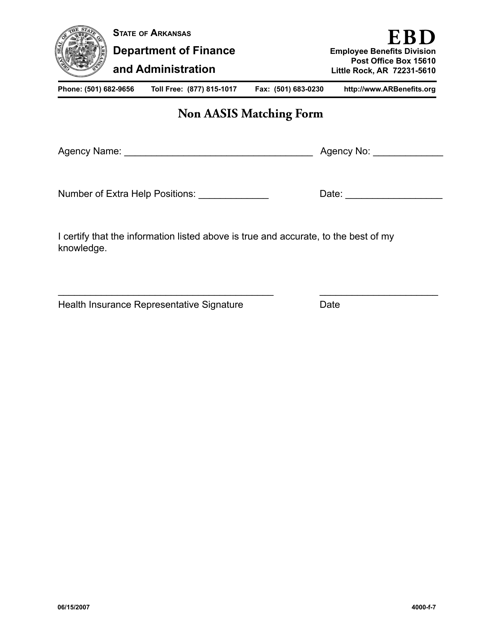

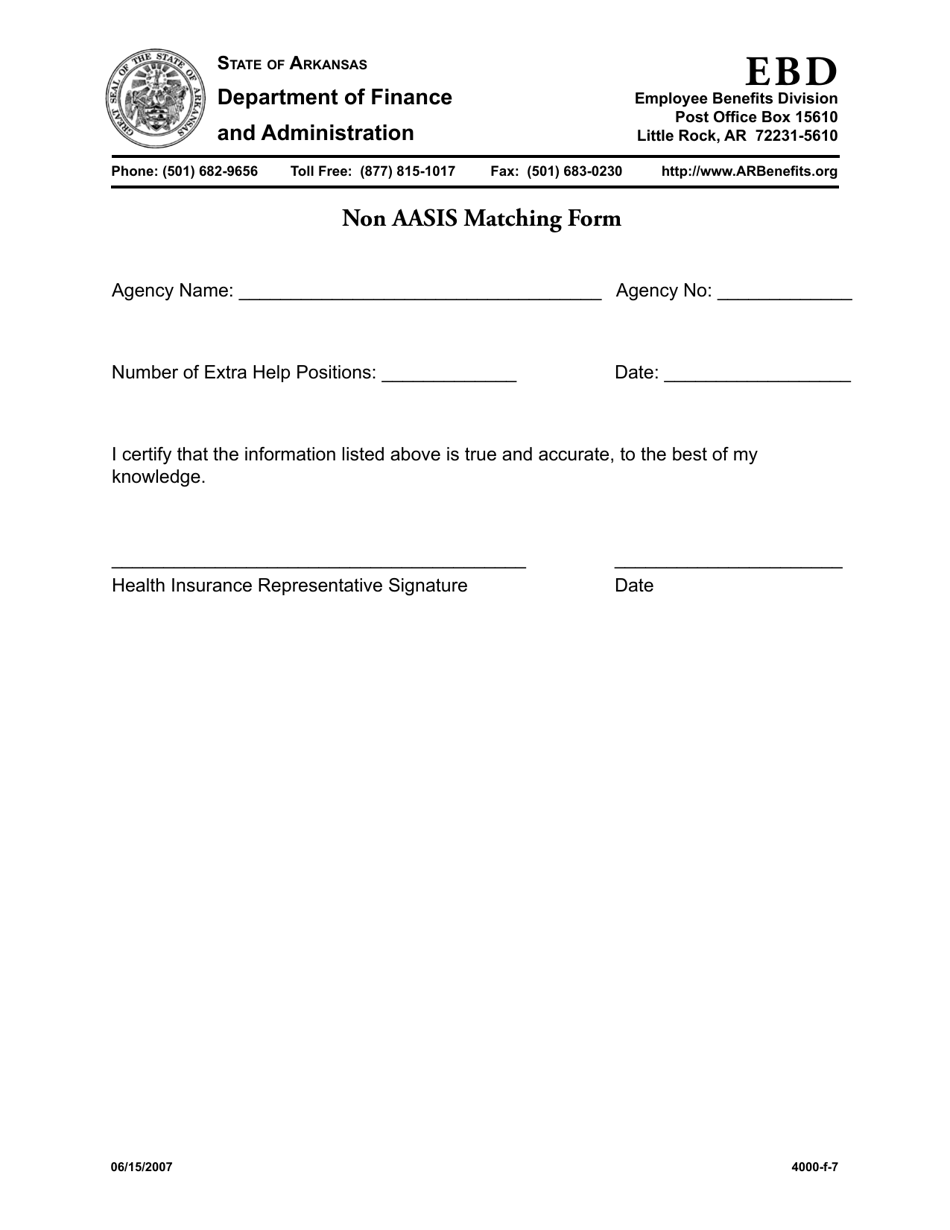

Non Aasis Matching Form - Arkansas

Non Aasis Matching Form is a legal document that was released by the Arkansas Department of Transformation and Shared Services - a government authority operating within Arkansas.

FAQ

Q: What is a Non AASIS Matching Form?

A: A Non AASIS Matching Form is a form that is used in Arkansas to report wages paid to employees for whom there is no matching tax information available in the state's Automated Accounting System (AASIS).

Q: Who needs to use the Non AASIS Matching Form?

A: Employers in Arkansas who have employees for whom there is no matching tax information in the AASIS system need to use the Non AASIS Matching Form.

Q: When is the Non AASIS Matching Form due?

A: The Non AASIS Matching Form is due by January 31st of each year, for wages paid during the previous calendar year.

Q: What information do I need to provide on the Non AASIS Matching Form?

A: On the Non AASIS Matching Form, you need to provide details of the employees for whom there is no matching tax information, including their names, social security numbers, and the wages paid to them.

Q: Are there any penalties for not filing the Non AASIS Matching Form?

A: Yes, there are penalties for not filing the Non AASIS Matching Form, including fines and potential legal action.

Q: Do I need to submit any additional documents along with the Non AASIS Matching Form?

A: No, you do not need to submit any additional documents along with the Non AASIS Matching Form.

Q: Who can I contact for help or more information about the Non AASIS Matching Form?

A: You can contact the Arkansas Department of Finance and Administration for help or more information about the Non AASIS Matching Form.

Form Details:

- Released on June 15, 2007;

- The latest edition currently provided by the Arkansas Department of Transformation and Shared Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Arkansas Department of Transformation and Shared Services.