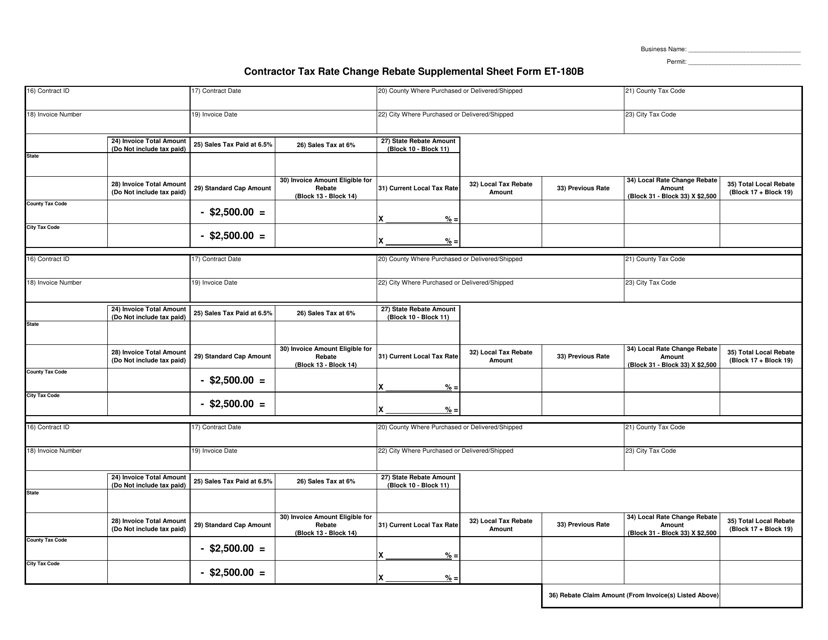

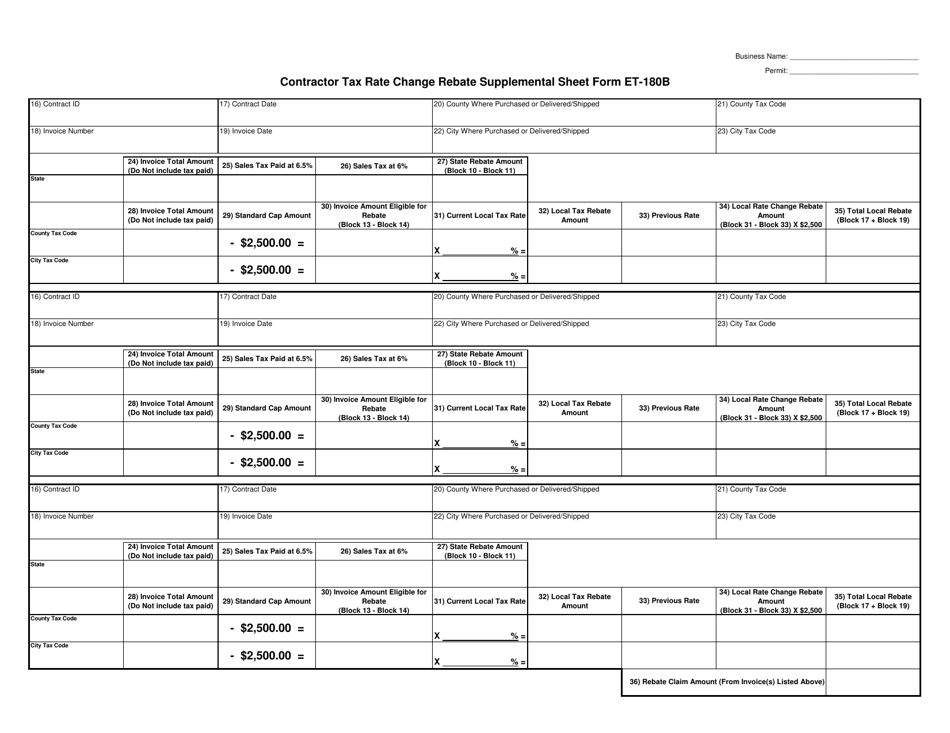

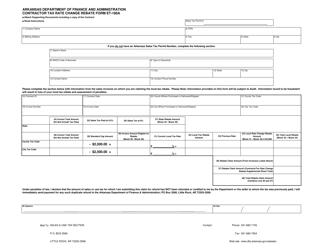

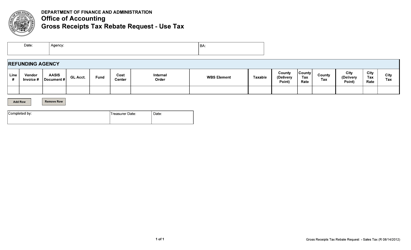

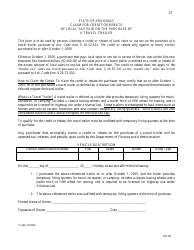

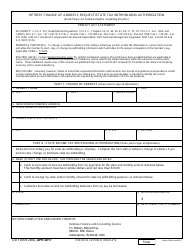

Form ET-180B Contractor Tax Rate Change Rebate Supplemental Sheet - Arkansas

What Is Form ET-180B?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ET-180B?

A: Form ET-180B is the Contractor Tax Rate Change Rebate Supplemental Sheet for Arkansas.

Q: What is the purpose of Form ET-180B?

A: The purpose of Form ET-180B is to provide supplemental information for the Contractor Tax Rate Change Rebate in Arkansas.

Q: Who needs to use Form ET-180B?

A: Contractors in Arkansas who are eligible for the Tax Rate Change Rebate need to use Form ET-180B.

Q: What information do I need to provide on Form ET-180B?

A: You need to provide information such as your contractor registration number, the tax period, and the amount of tax collected.

Q: Are there any filing deadlines for Form ET-180B?

A: Yes, Form ET-180B must be filed within 30 days after the close of each calendar quarter.

Q: Is there a fee for filing Form ET-180B?

A: No, there is no fee for filing Form ET-180B.

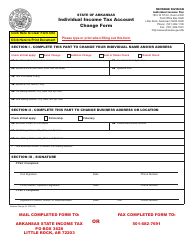

Form Details:

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ET-180B by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.