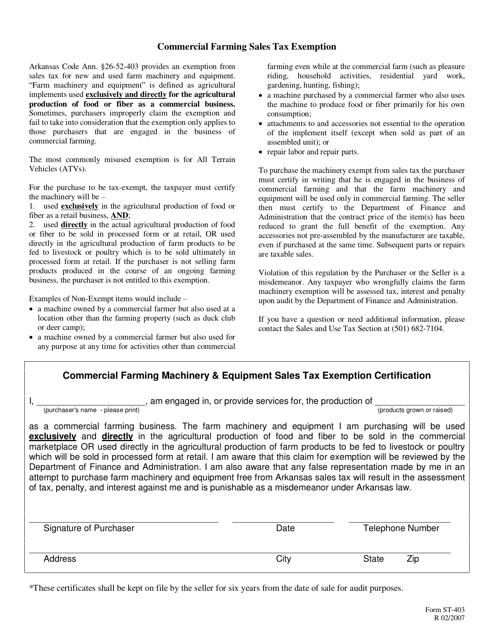

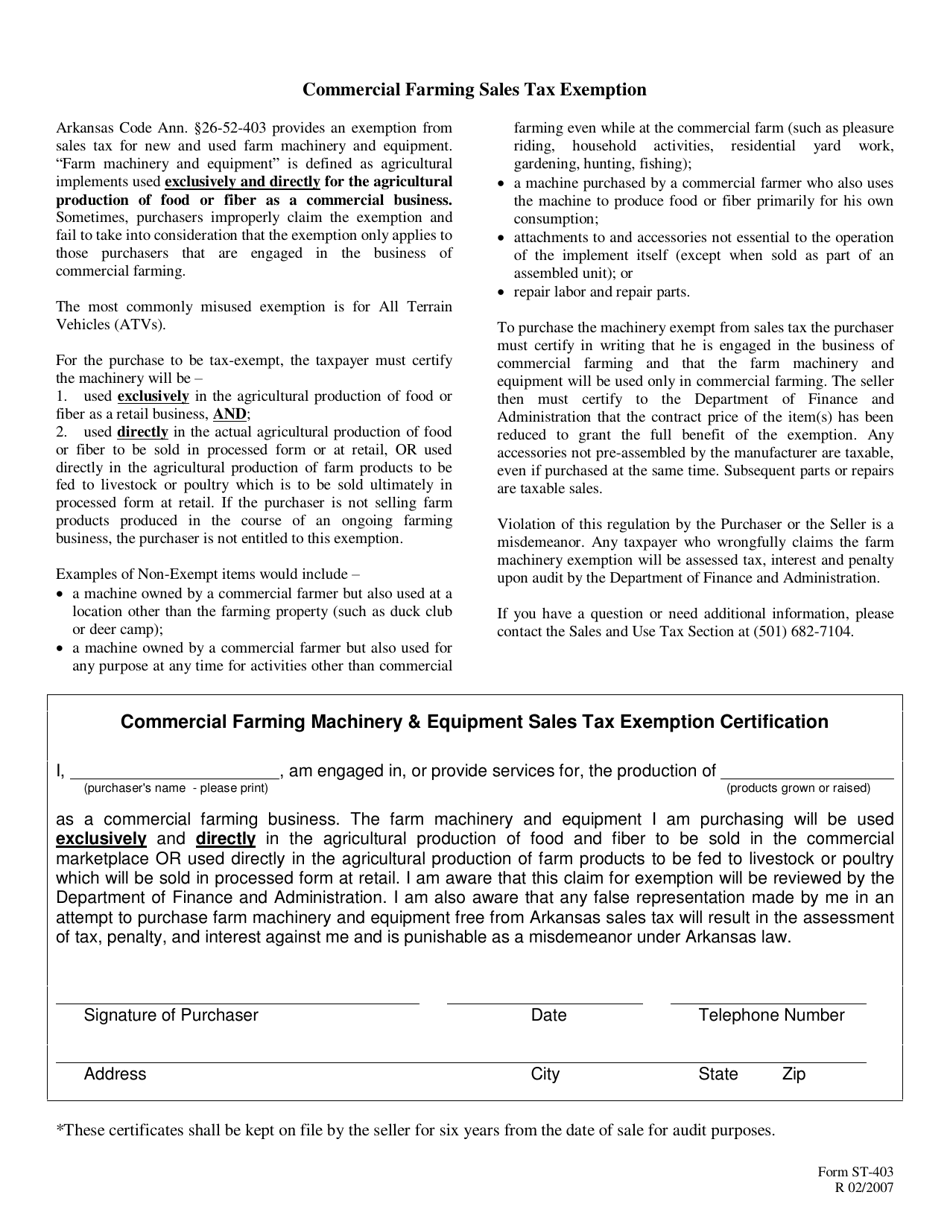

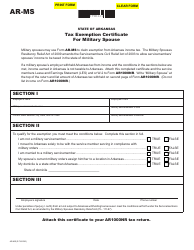

Form ST-403 Commercial Farm Exemption Certificate - Arkansas

What Is Form ST-403?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form ST-403 Commercial Farm Exemption Certificate?

A: Form ST-403 is a document used in Arkansas to claim exemption from sales tax on certain purchases made by commercial farmers.

Q: What is the purpose of the Commercial Farm Exemption Certificate?

A: The purpose of the Commercial Farm Exemption Certificate is to allow commercial farmers in Arkansas to avoid paying sales tax on qualifying purchases for farm-related activities.

Q: Who is eligible to use Form ST-403?

A: Commercial farmers in Arkansas who meet the requirements outlined by the state are eligible to use Form ST-403.

Q: What purchases can be exempt from sales tax using the Commercial Farm Exemption Certificate?

A: Purchases of items used directly in agricultural production, such as seeds, fertilizers, and animal feed, may qualify for sales tax exemption using the Commercial Farm Exemption Certificate.

Q: Is there an expiration date for the Commercial Farm Exemption Certificate?

A: Yes, the Commercial Farm Exemption Certificate is valid for five years from the date of issuance.

Q: Can the Commercial Farm Exemption Certificate be used for purchases made out of state?

A: No, the Commercial Farm Exemption Certificate is only valid for purchases made within the state of Arkansas.

Form Details:

- Released on February 1, 2007;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-403 by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.