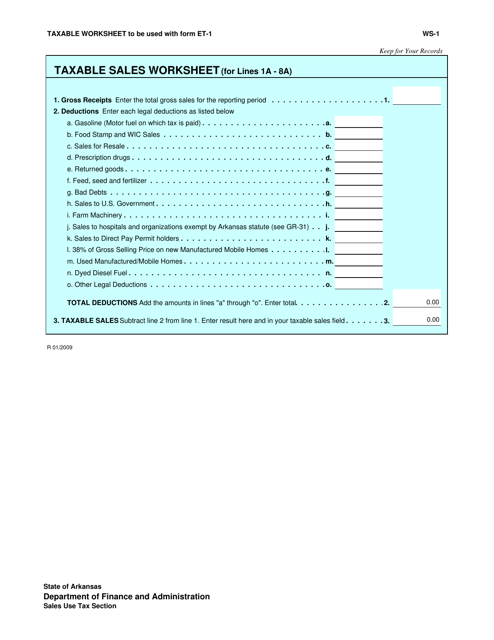

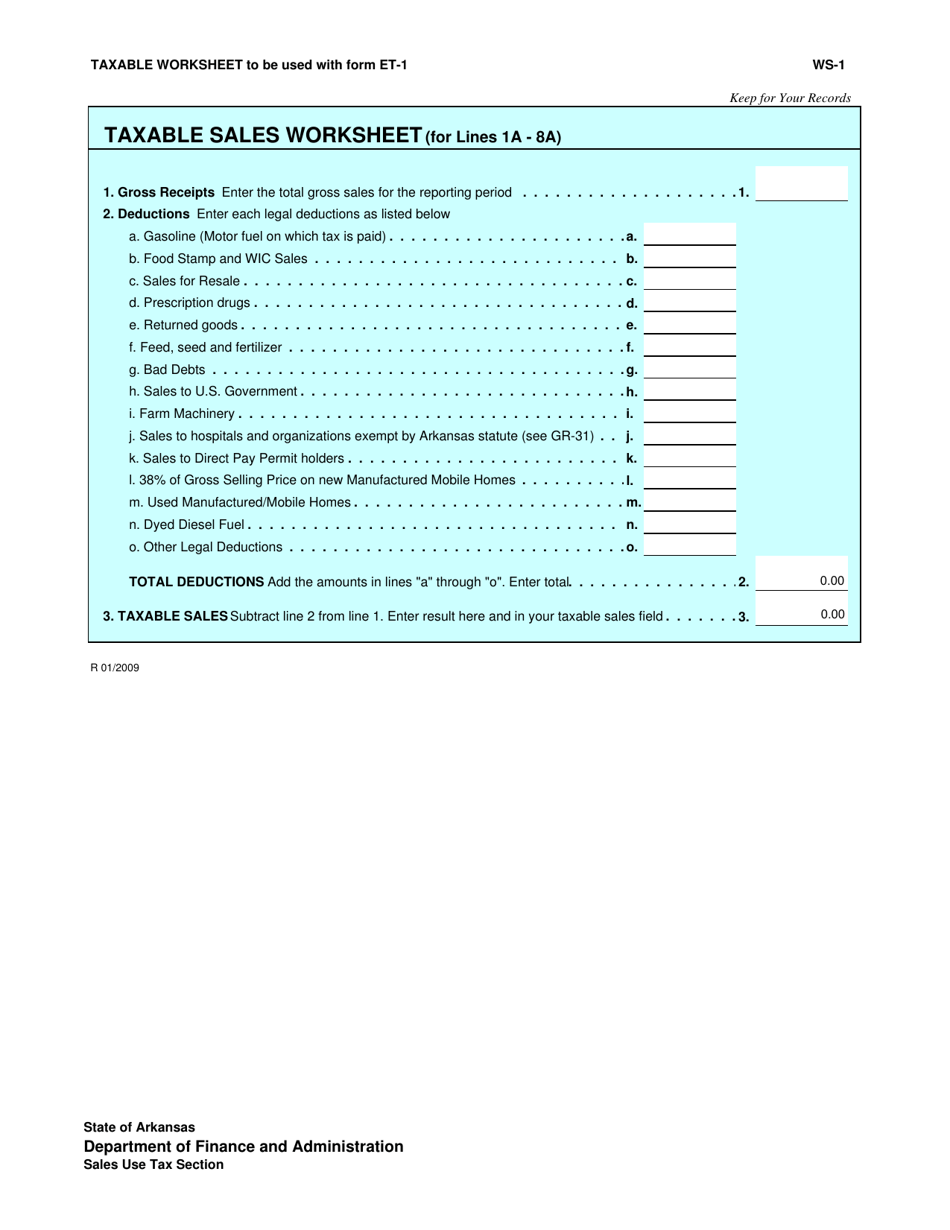

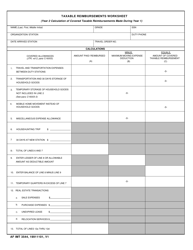

Form WS-1 Taxable Sales Worksheet - Arkansas

What Is Form WS-1?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WS-1?

A: Form WS-1 is the Taxable Sales Worksheet for Arkansas.

Q: What is the purpose of Form WS-1?

A: The purpose of Form WS-1 is to calculate the amount of taxable sales in Arkansas.

Q: Who needs to file Form WS-1?

A: All businesses in Arkansas that have taxable sales are required to file Form WS-1.

Q: How often do I need to file Form WS-1?

A: Form WS-1 must be filed annually by the due date specified by the Arkansas Department of Finance and Administration.

Q: What information do I need to complete Form WS-1?

A: To complete Form WS-1, you will need to provide details on the total sales, exempt sales, and taxable sales for the reporting period.

Q: Are there any penalties for not filing Form WS-1?

A: Yes, failure to file Form WS-1 or filing it late may result in penalties and interest charges.

Q: Is there a fee for filing Form WS-1?

A: No, there is no fee for filing Form WS-1. It is a required tax reporting form.

Q: Is Form WS-1 applicable only to businesses in Arkansas?

A: Yes, Form WS-1 is specifically for businesses operating in Arkansas and calculating taxable sales in the state.

Form Details:

- Released on January 1, 2009;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form WS-1 by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.