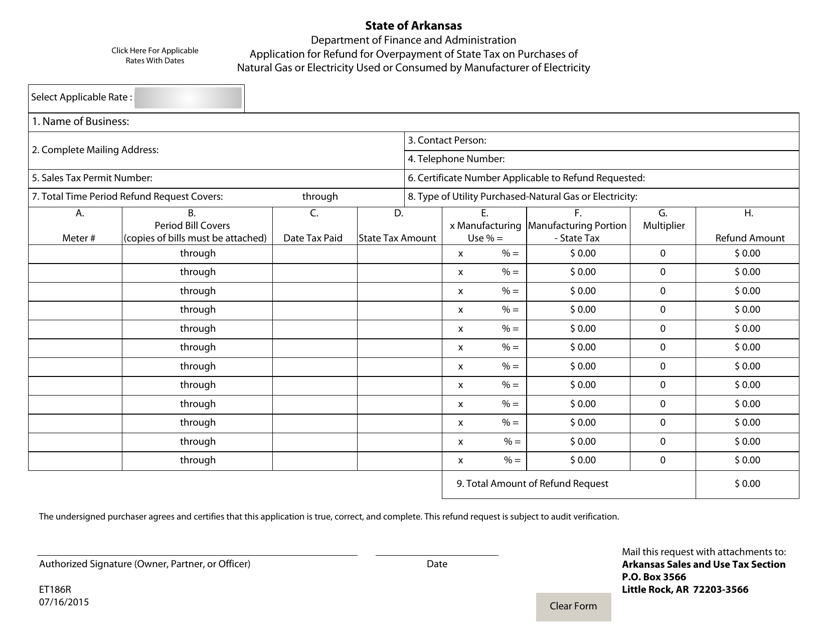

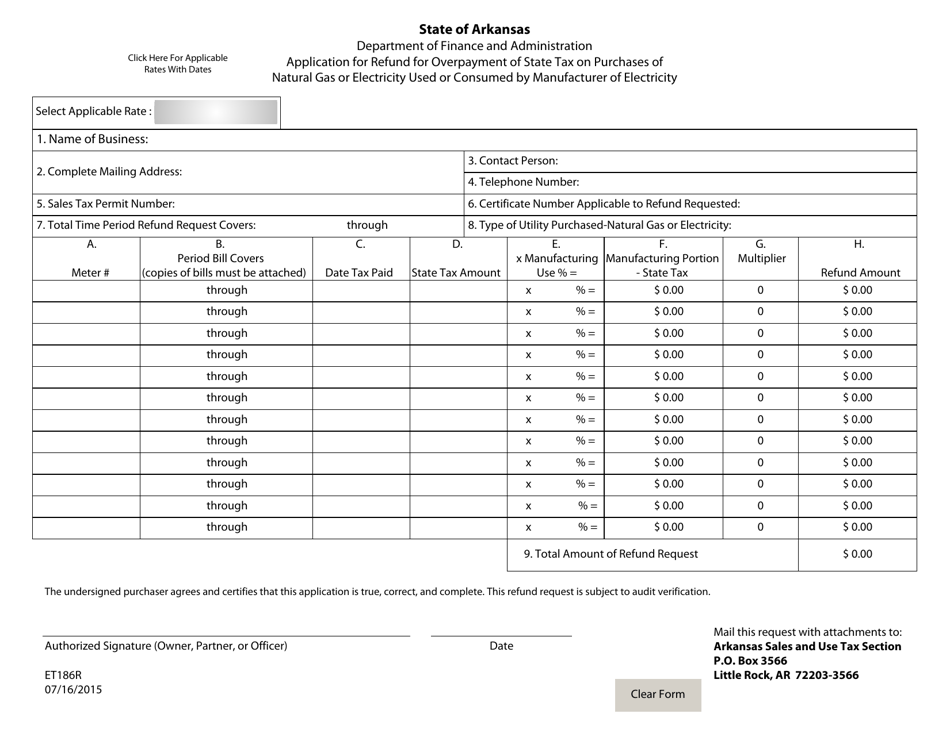

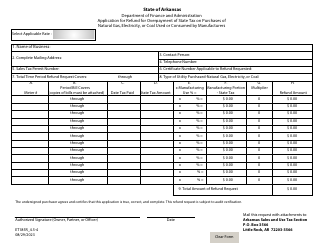

Form ET186R Application for Refund for Overpayment of State Tax on Purchases of Natural Gas or Electricity Used or Consumed by Manufacturer of Electricity - Arkansas

What Is Form ET186R?

This is a legal form that was released by the Arkansas Department of Finance & Administration - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ET186R?

A: Form ET186R is the application for refund for overpayment of state tax on purchases of natural gas or electricity used or consumed by a manufacturer of electricity in Arkansas.

Q: Who can use Form ET186R?

A: This form can be used by manufacturers of electricity in Arkansas who have overpaid state tax on their purchases of natural gas or electricity.

Q: What is the purpose of Form ET186R?

A: The purpose of Form ET186R is to claim a refund for overpaid state tax on purchases of natural gas or electricity used or consumed by a manufacturer of electricity.

Q: What information do I need to provide on Form ET186R?

A: You will need to provide your business information, purchase information, and calculate the amount of refund you are eligible for based on the overpaid state tax.

Q: How do I submit Form ET186R?

A: You can submit Form ET186R by mail to the Arkansas Department of Finance and Administration along with any supporting documentation and payment details.

Q: Is there a deadline to submit Form ET186R?

A: Yes, Form ET186R should be submitted within three years from the later of the date of payment or the due date of the tax return associated with the overpayment.

Q: Can I claim a refund for overpayment of state tax on natural gas or electricity used or consumed by other types of businesses?

A: No, Form ET186R is specifically for manufacturers of electricity in Arkansas.

Q: Are there any additional forms or documents I need to include with Form ET186R?

A: You may need to include supporting documentation such as invoices or receipts for the purchases of natural gas or electricity.

Q: What should I do if I have any questions or need assistance with Form ET186R?

A: For any questions or assistance with Form ET186R, you can contact the Arkansas Department of Finance and Administration.

Form Details:

- Released on July 16, 2015;

- The latest edition provided by the Arkansas Department of Finance & Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ET186R by clicking the link below or browse more documents and templates provided by the Arkansas Department of Finance & Administration.