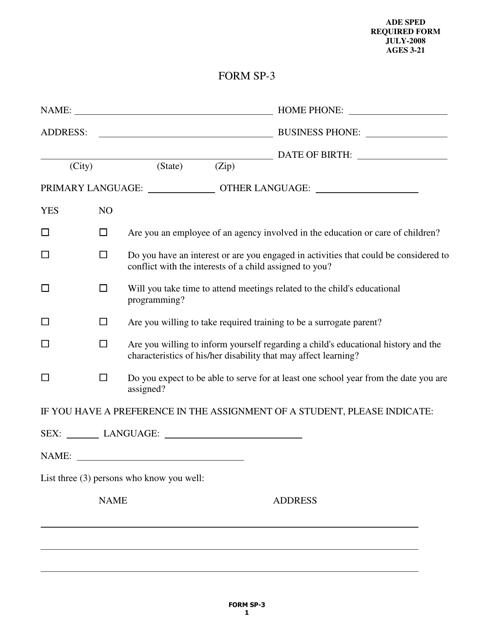

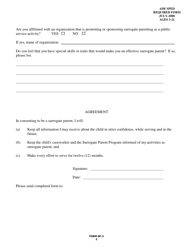

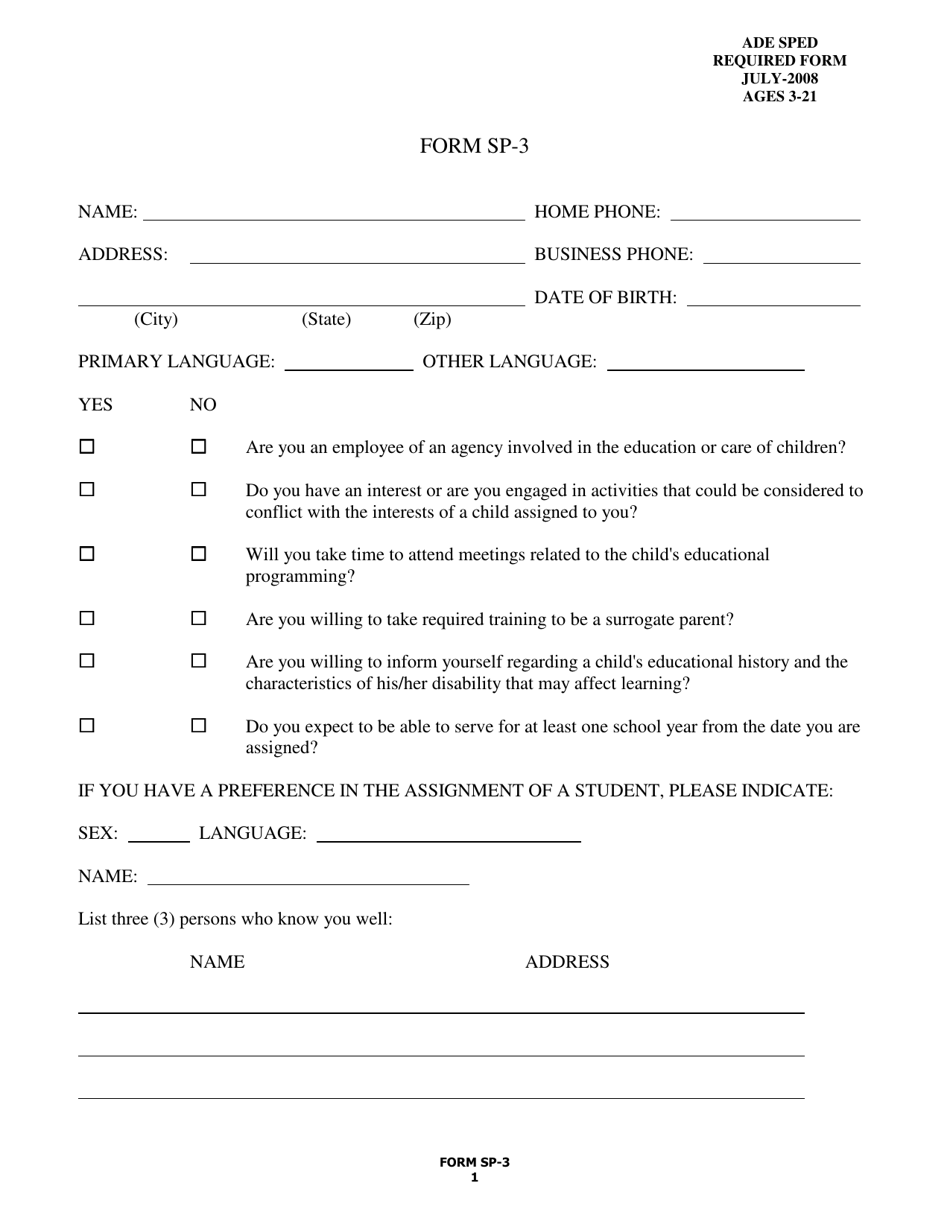

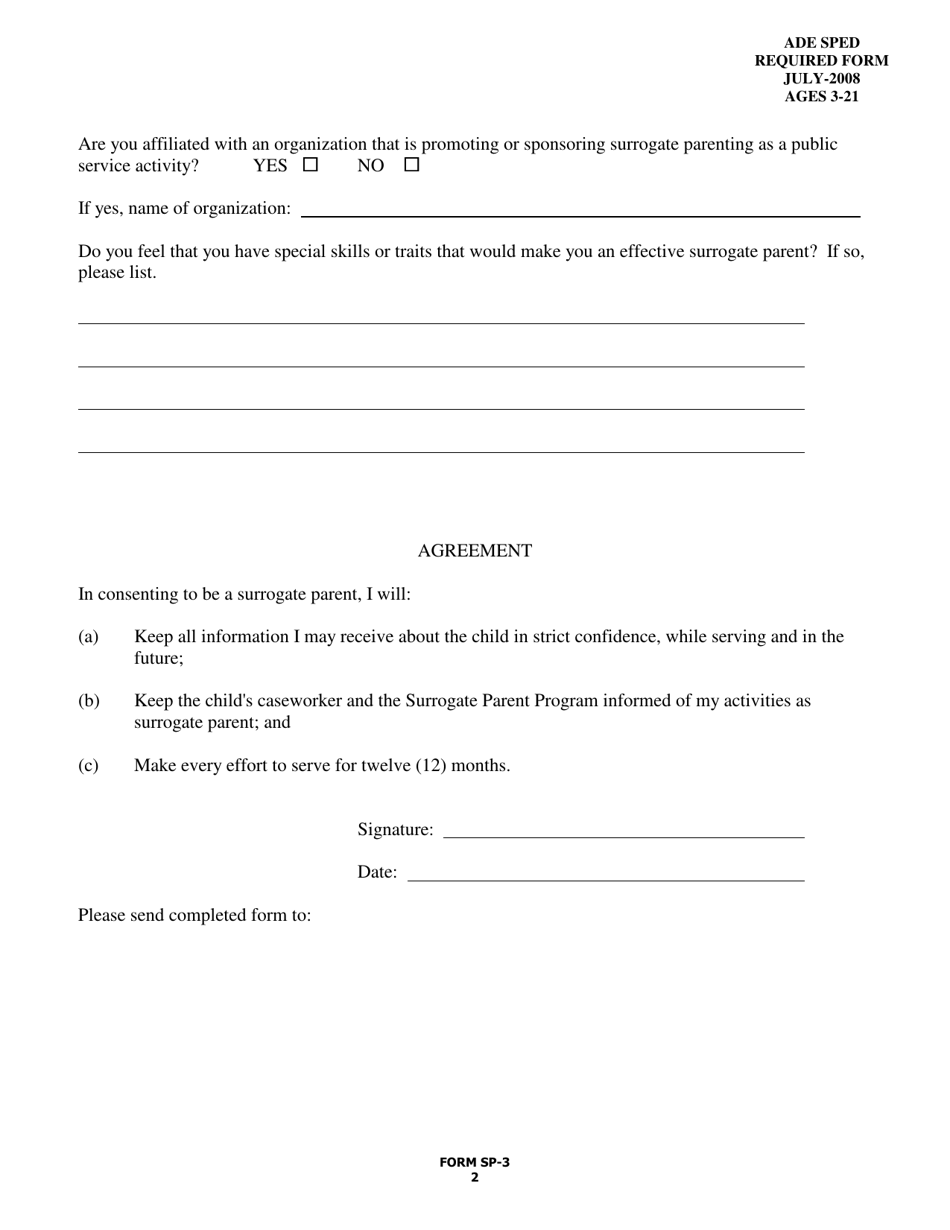

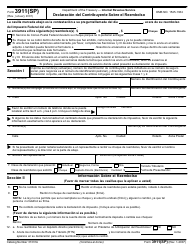

Form SP-3 - Arkansas

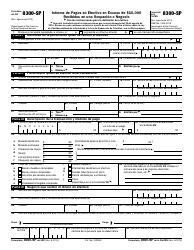

What Is Form SP-3?

This is a legal form that was released by the Arkansas Department of Education - a government authority operating within Arkansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

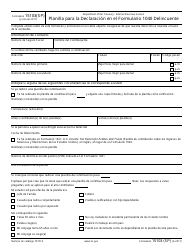

Q: What is Form SP-3?

A: Form SP-3 is a document used in the state of Arkansas.

Q: What is the purpose of Form SP-3?

A: The purpose of Form SP-3 is to report state and local sales tax.

Q: Who needs to file Form SP-3?

A: Businesses in Arkansas that collect state and local sales tax need to file Form SP-3.

Q: How often does Form SP-3 need to be filed?

A: Form SP-3 needs to be filed monthly.

Q: What information is required on Form SP-3?

A: Form SP-3 requires information about sales made, tax collected, and any credits or exemptions claimed.

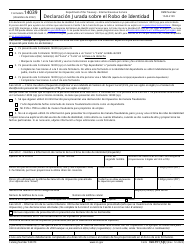

Q: Are there any penalties for not filing Form SP-3?

A: Yes, there are penalties for not filing Form SP-3 or filing it late.

Q: Can Form SP-3 be filed electronically?

A: Yes, Form SP-3 can be filed electronically through the Arkansas Taxpayer Access Point (ATAP) system.

Form Details:

- Released on July 1, 2008;

- The latest edition provided by the Arkansas Department of Education;

- Easy to use and ready to print;

- Available in Spanish;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SP-3 by clicking the link below or browse more documents and templates provided by the Arkansas Department of Education.