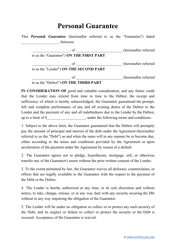

Security Agreement Template

What Is a Security Agreement?

A Security Agreement is a formal document signed by the lender and the borrower - the latter provides their property or interest in an asset as collateral for the loan. Many financial institutions need more than the promise of the borrower and constant payments, and this financial tool allows them to secure their funds by taking the borrower's property in case they fail to repay their debt. You can download a printable Security Agreement template via the link below.

Alternate Name:

- Security Contract.

A debtor has a better chance to secure the loan and prove their creditworthiness to a creditor if they offer their assets as collateral - the lender can be more willing to provide them with funds for personal and commercial loans if they know they can cease the property of the debtor after delinquency. Then, the lender can sell the assets to recover the funds borrowed by the debtor and compensate for their financial loss.

How to Write a Security Agreement?

Follow these steps to draft a Security Contract:

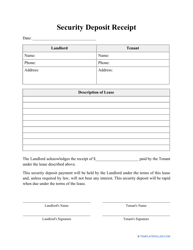

- Identify the parties - the debtor and the lender. Write their names and addresses. You may add other contact information for the convenience of counterparts who may need to remain in contact.

- Confirm that the debtor grants a security interest in the property to a lender. Describe the property - for instance, if it is a house, you have to write down its location the way it appears in legal documentation; record the main characteristics of the motor vehicle if you choose to pledge it as collateral. Note that you may choose between all kinds of property to determine proper collateral - this list includes but is not limited to equipment, financial instruments, investments, trademarks, intellectual property, etc.

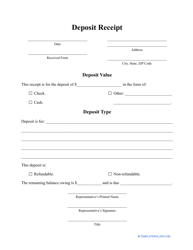

- Explain that this arrangement secures a particular loan - identify it by the date and amount. Since most loans are documented in writing, refer to the existing documentation to avoid confusion.

- Indicate the debtor's commitment to the agreement - they must promise not to sell, license, lease, or otherwise transfer the collateral in question. This provision also includes the debtor's promise not to grant any third parties security interests or liens in the property which is to be kept in good condition. It is recommended that the lender inspects the property before the document is signed to attest to its current state. If the price of the collateral is high, it may be a good idea to obtain an insurance policy - offer this possibility to the lender if they have any doubts regarding the arrangement.

- Determine the default for the purposes of your agreement. You need to list all situations that qualify as a default - for example, the debtor fails to make a payment and does not contact the lender to provide them with a reasonable cause, so the lender has a right to take possession of the collateral.

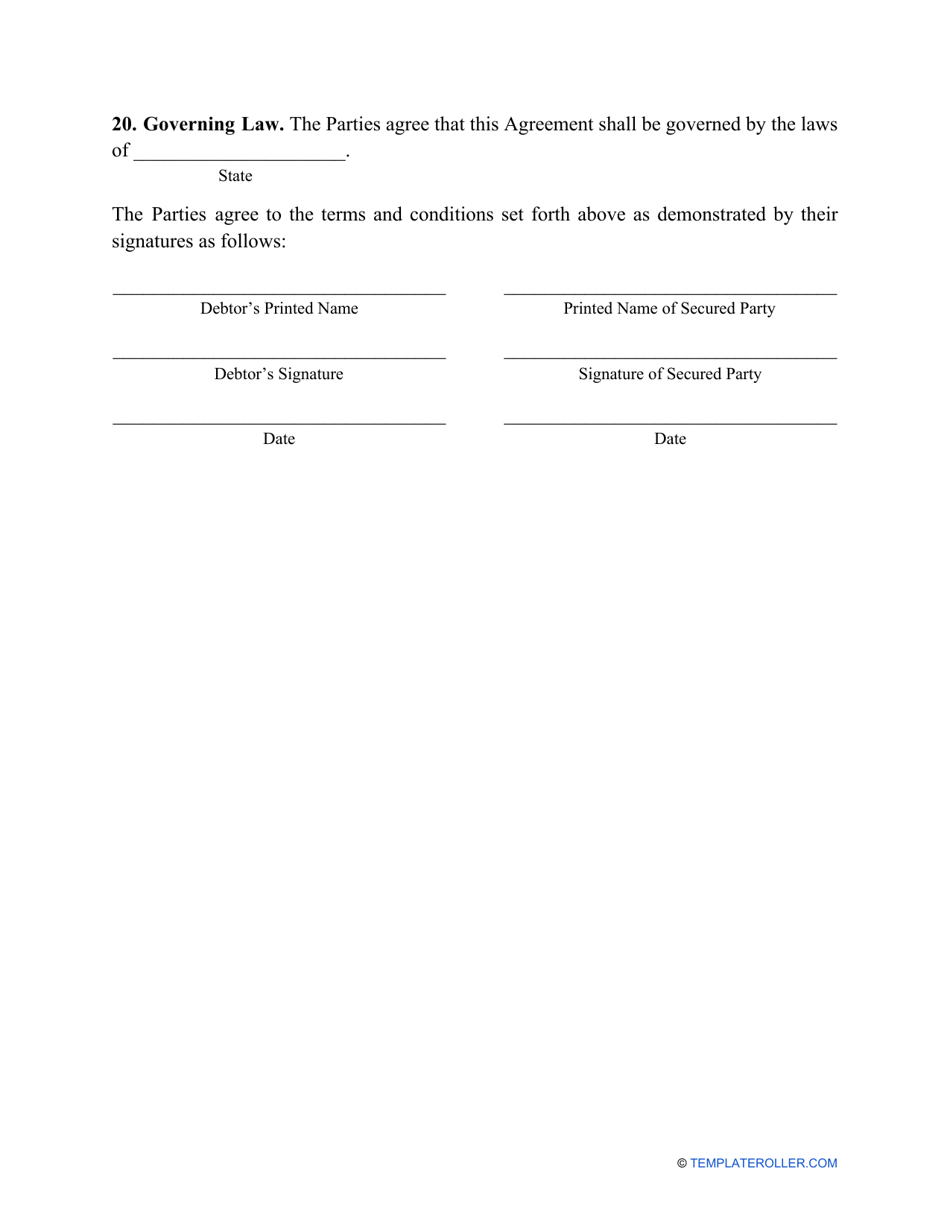

- Confirm both parties understand the contract in its entirety, sign and date the Security Agreement form.

Still looking for a particular form? Take a look at the related templates below: