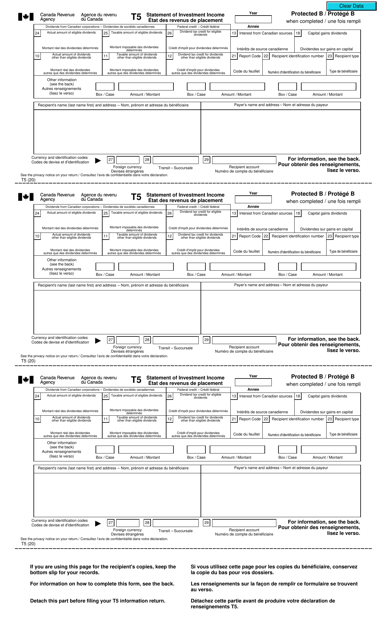

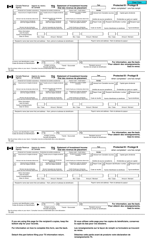

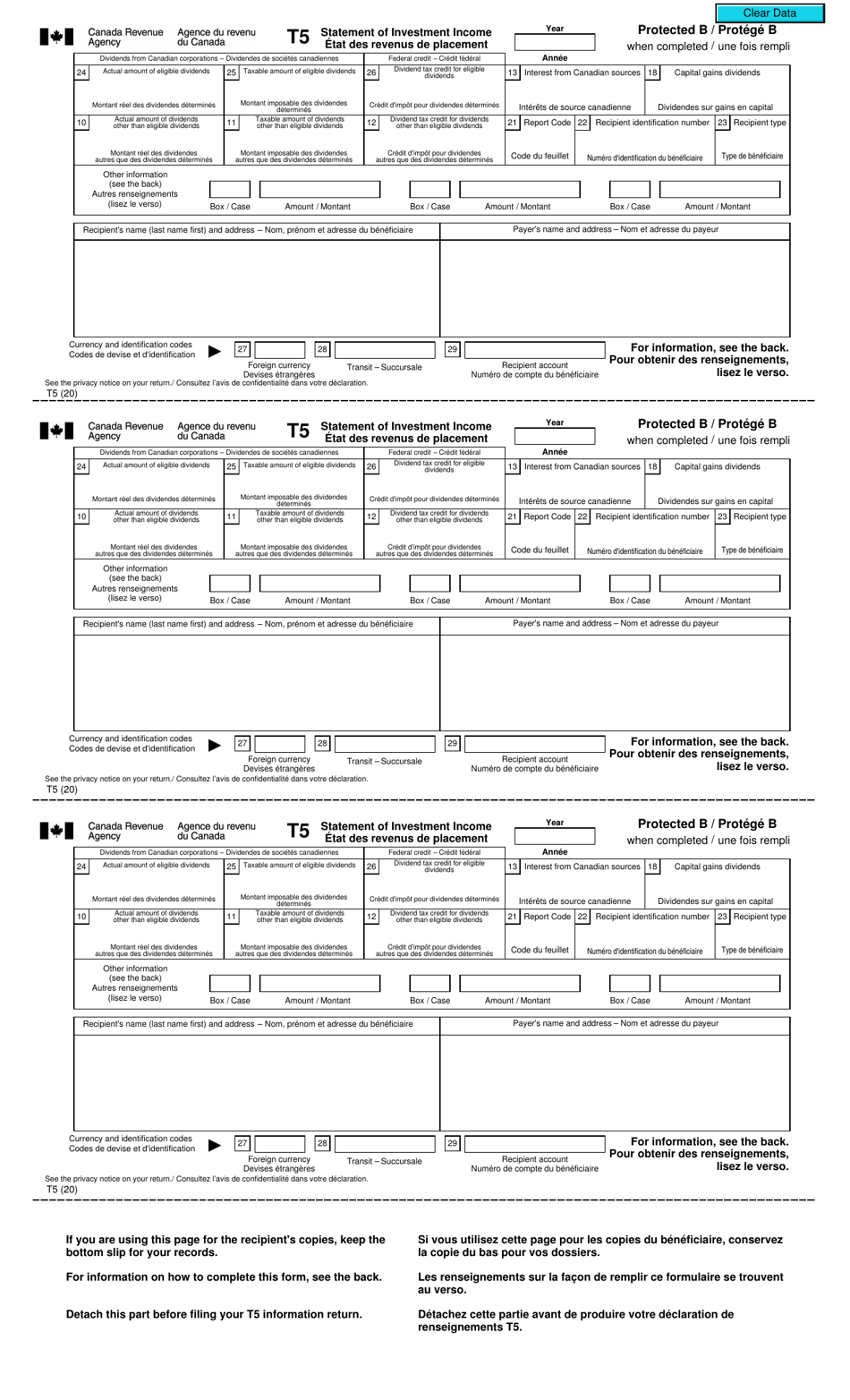

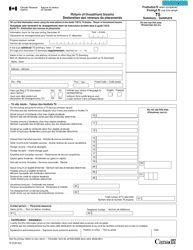

Form T5 Statement of Investment Income - Canada (English / French)

What Is Form T5?

Form T5, Statement of Investment Income , is a legal document that can be used when individuals wish to provide information about certain investment income payments they have made to a Canadian resident, or if they are a Canadian resident who has received certain investment income payments.

Alternate Name:

- T5 Tax Form.

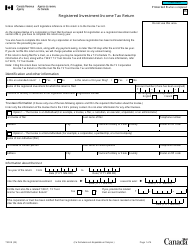

The form was issued by the Canadian Revenue Agency (CRA) and was last revised on January 1, 2020 . Its main purpose is to provide the CRA with information about the payer, the recipient of the payment, and the payment itself. A T5 fillable form is available for download below.

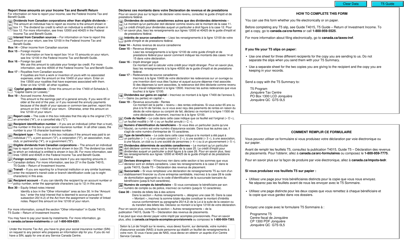

If an individual files more than 50 information returns per year they must file them via the internet, otherwise they might be liable for penalties. If they file from 1 to 50 information returns per year they can file them on paper, however, the CRA strongly recommends individuals to file documents via the internet.

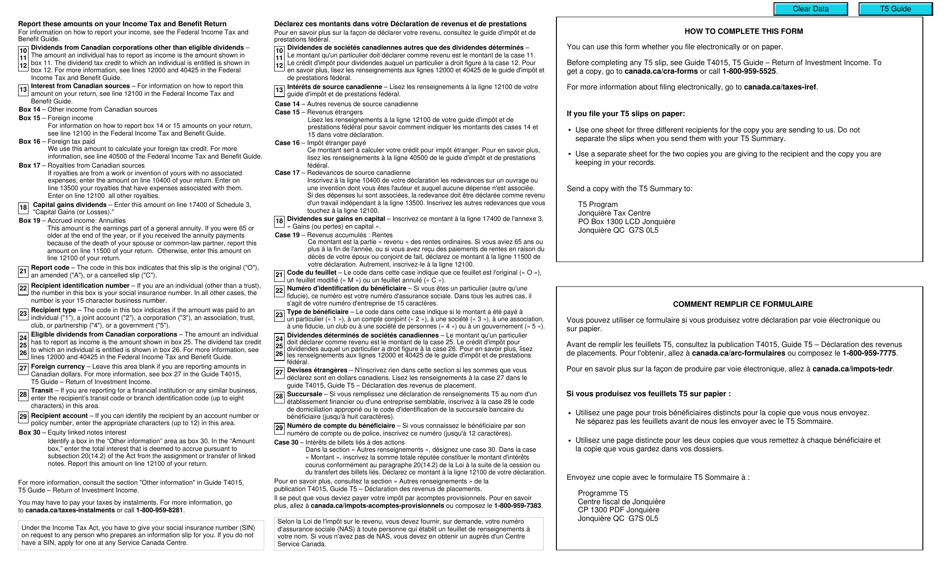

How to Complete T5 Form?

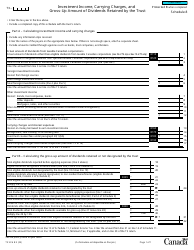

- Dividends From Canadian Corporations. In the first part of the document, the individual is supposed to designate all payments they have received from Canadian corporations that are considered dividends. Dividends are usually defined as sums of money that shareholders receive regularly from their company during the process of distributing profits.

- Foreign Income. If the individual has received any income from sources outside Canada, they must state it here.

- Foreign Tax Paid. If any foreign income tax was withheld from the gross income the individual has received from a source outside Canada (the amount they indicated in the previous part), they must report it here.

- Capital Gains Dividends. Here, individuals can designate capital gains dividends they have received from an investment corporation, a mortgage investment corporation, or a mutual fund corporation.

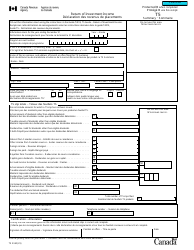

- Year. The individual must state the year during which the recipient has received the investment income.

- Recipient's Information. The document must contain information about the recipient of the payment. It includes their full name, identification number (social insurance number, trust account number, or program account number), and address.

- Payer's Information. The payer's information must also be included in the document. It must contain their full name and address.

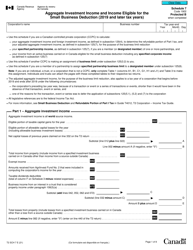

The individual must make an effort and gather as much information about the payment they have received (or paid) and the other party as they can. Failing to do so can make them liable to penalties. In case individuals are struggling with completing Form T5, they can check out Form T4015, T5 Guide - Return of Investment Income. The guide explains how the information return can be filled out, which amounts should be designated, how to submit the document, and provides other necessary details.