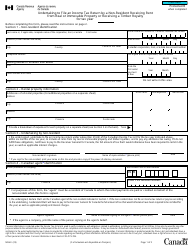

Form T4036 Rental Income - Canada

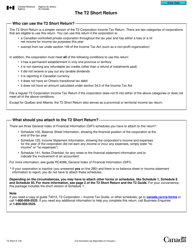

What Is Form T4036?

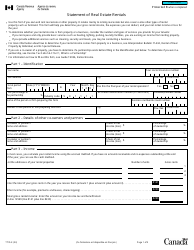

Form T4036, Rental Income, is a guide that covers all of the questions connected with rental income across Canada. The purpose of the document is to provide taxpayers who have received income from renting out real estate or other property with information on how to fill out applicable forms, determine their gross rental income, figure out possible deductions, losses, and other amounts.

Alternate Name:

- Canada Rental Income Tax Form.

This form was issued by the Canadian Revenue Agency (CRA) and was last revised on 2019. The document does not replace the law but provides plain explanations of various tax situations. A Rental Income Tax Form is available for download through the link below.

Form T4036 Instructions

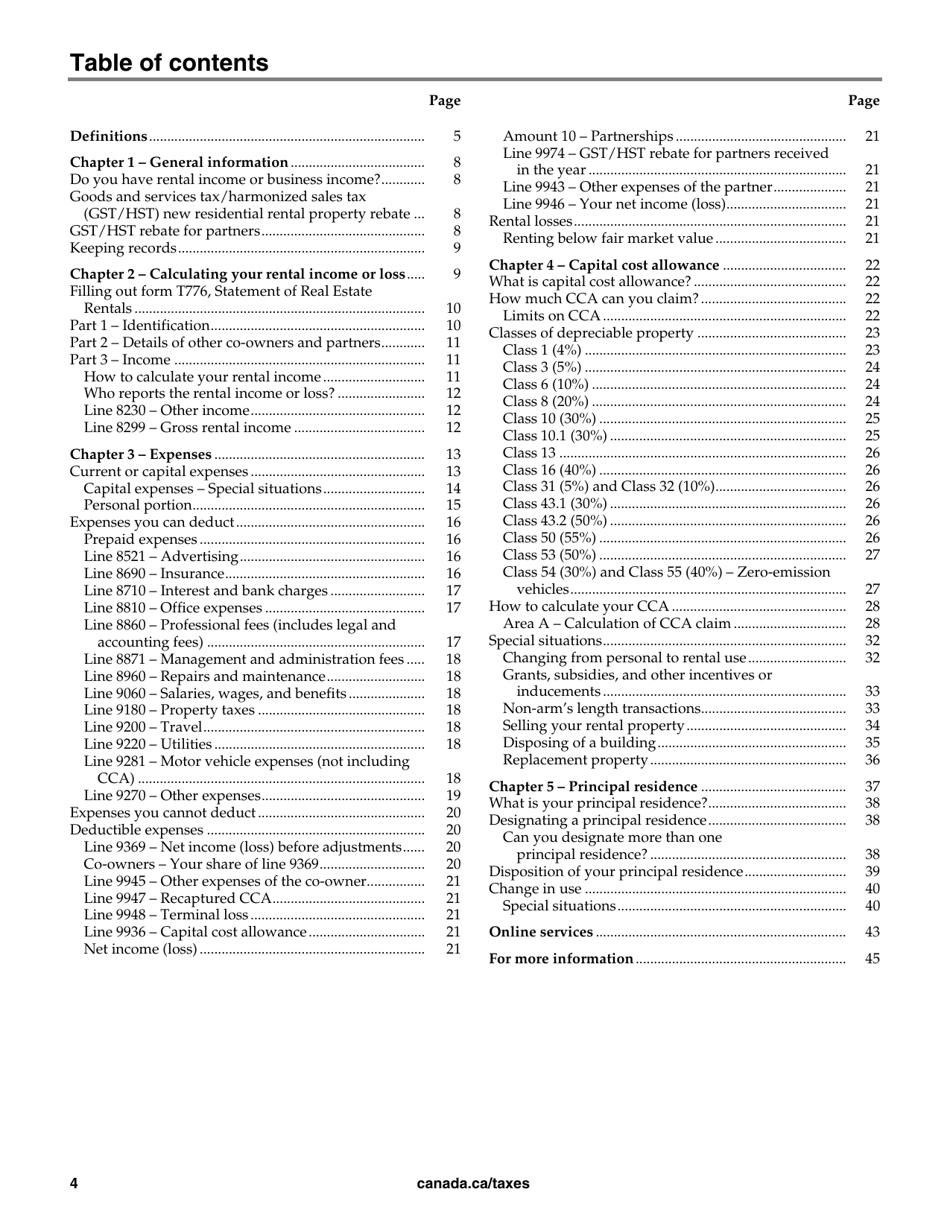

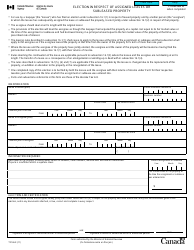

This Canada Rental Income Tax Form contains 46 pages, which are easy to navigate if the taxpayer is using the table of contents. The form contains several chapters, including the following:

- General Information . The first part of the guide explains to taxpayers what is considered to be rental income, where it comes from, and other general statements.

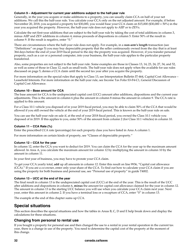

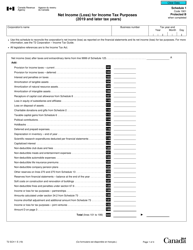

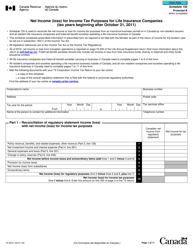

- Calculating Rental Income or Loss . Here, taxpayers can find information about calculating rental income or loss that can be determined by gross rents and rental expenses.

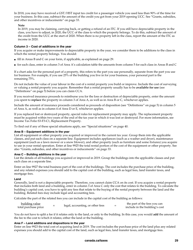

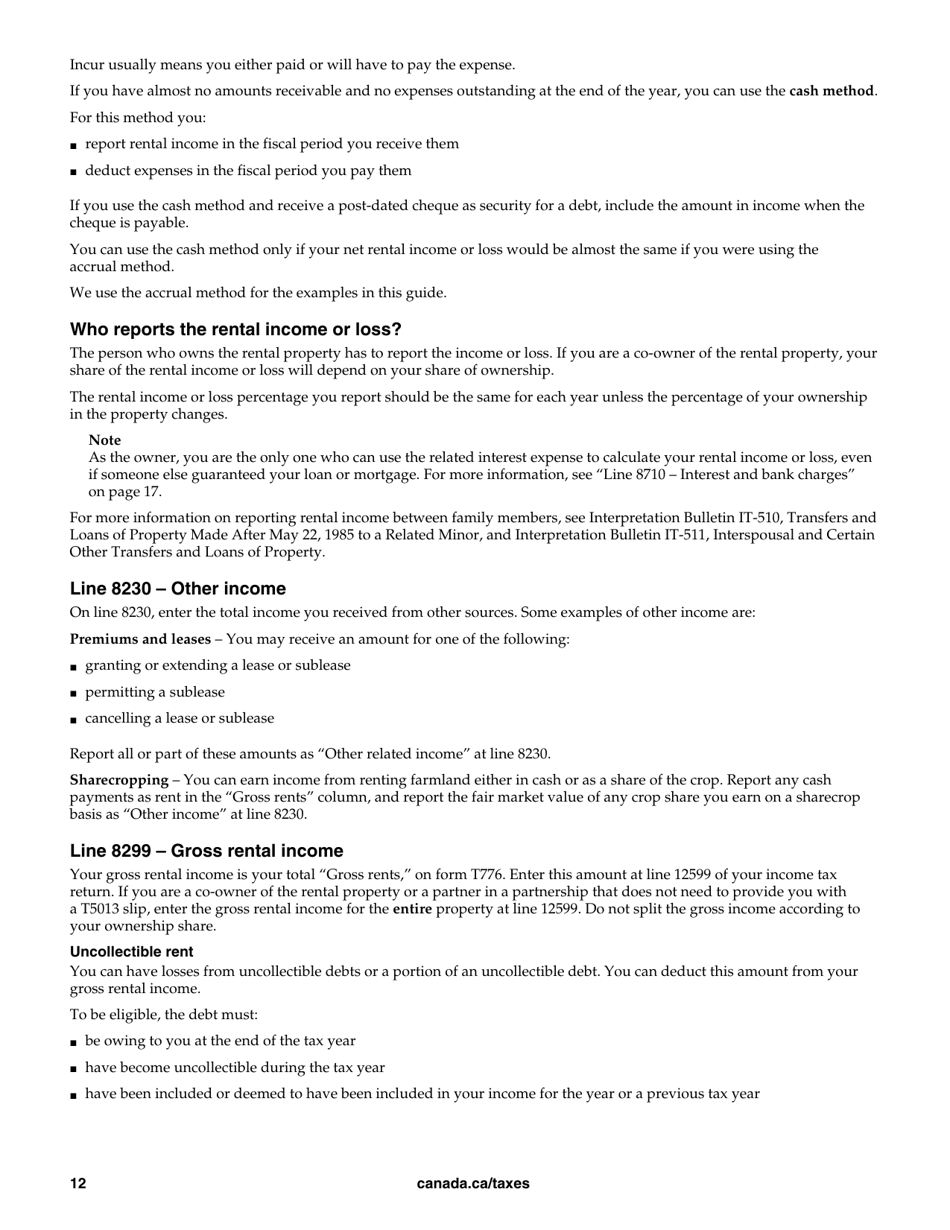

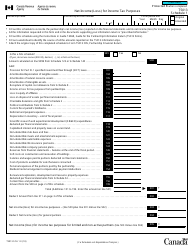

- Expenses . Taxpayers can use this part of the guide to learn the difference between current and capital expenses, deductible expenses, expenses that cannot be deducted, etc.

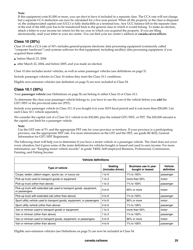

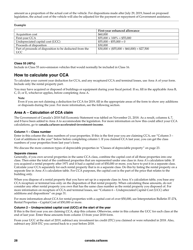

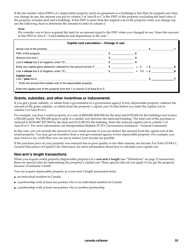

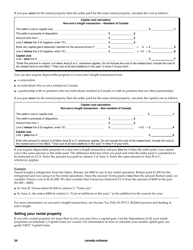

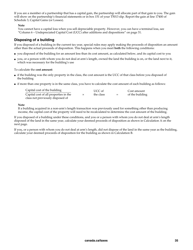

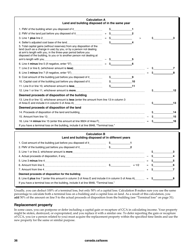

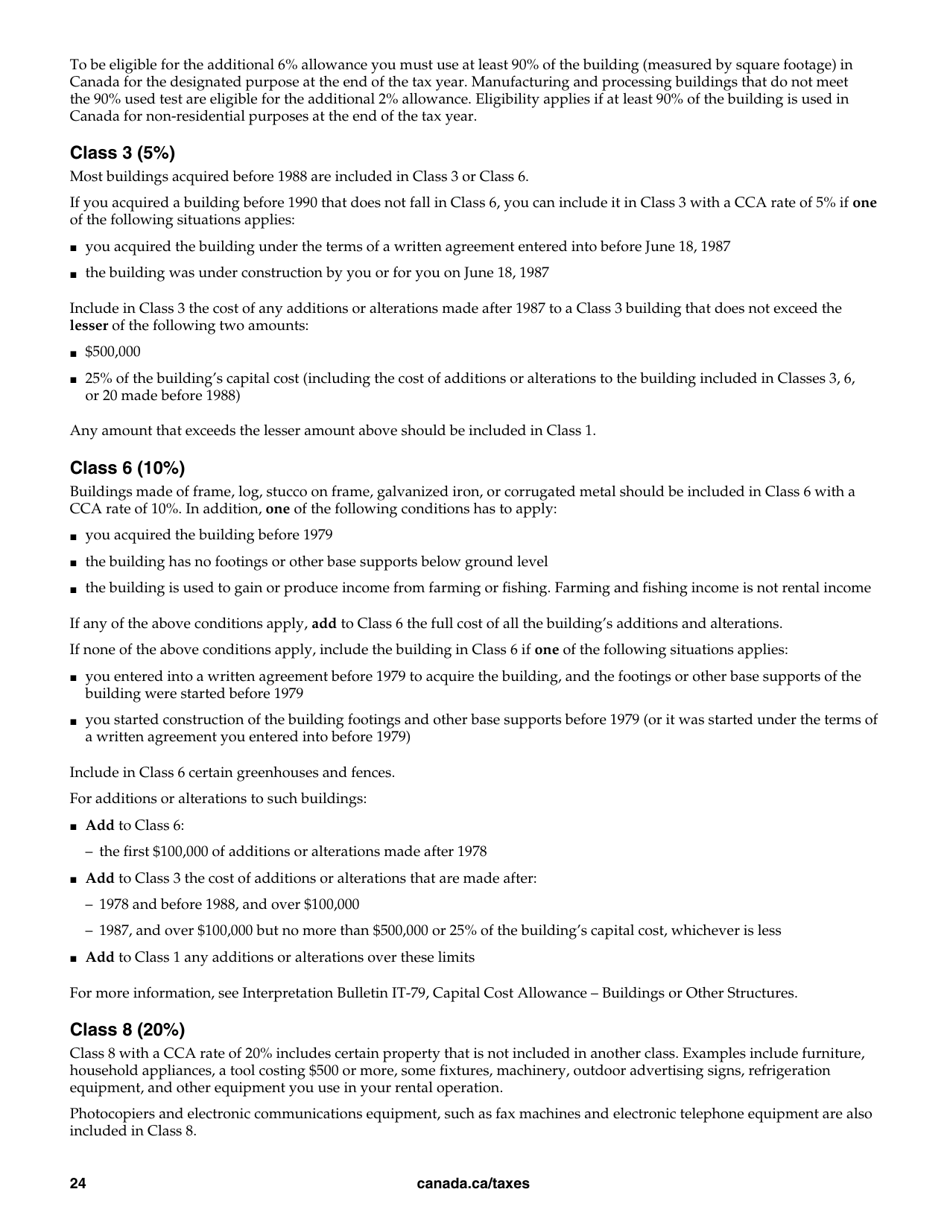

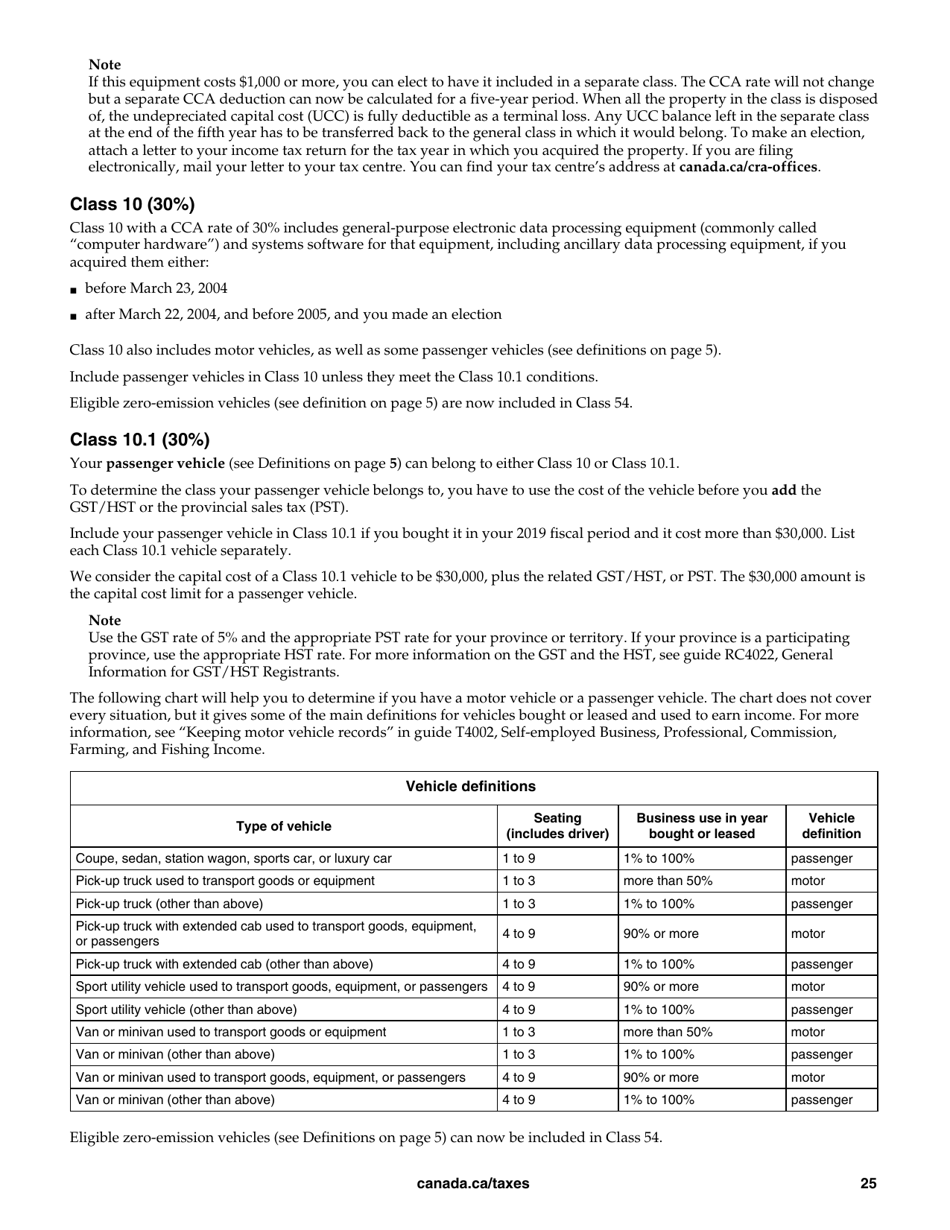

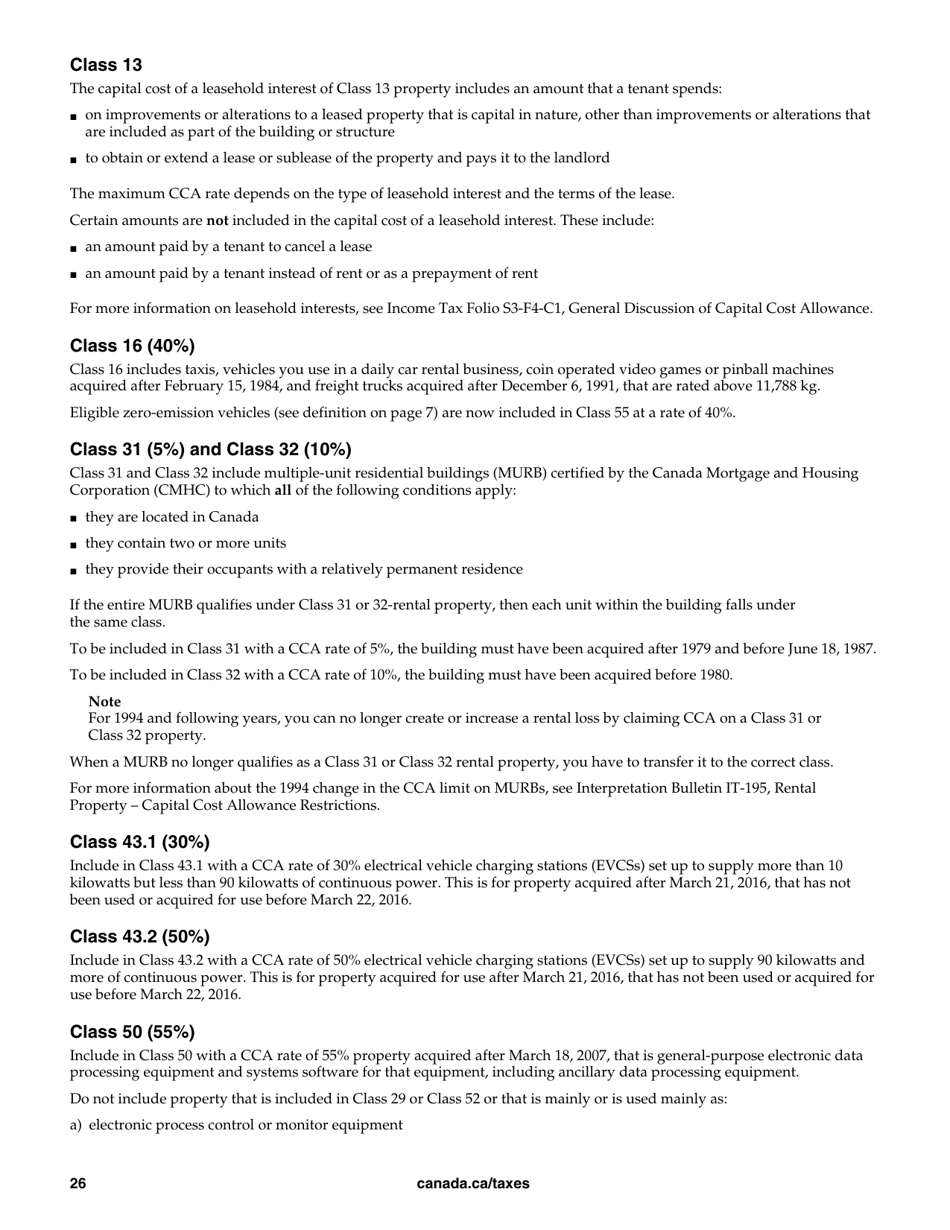

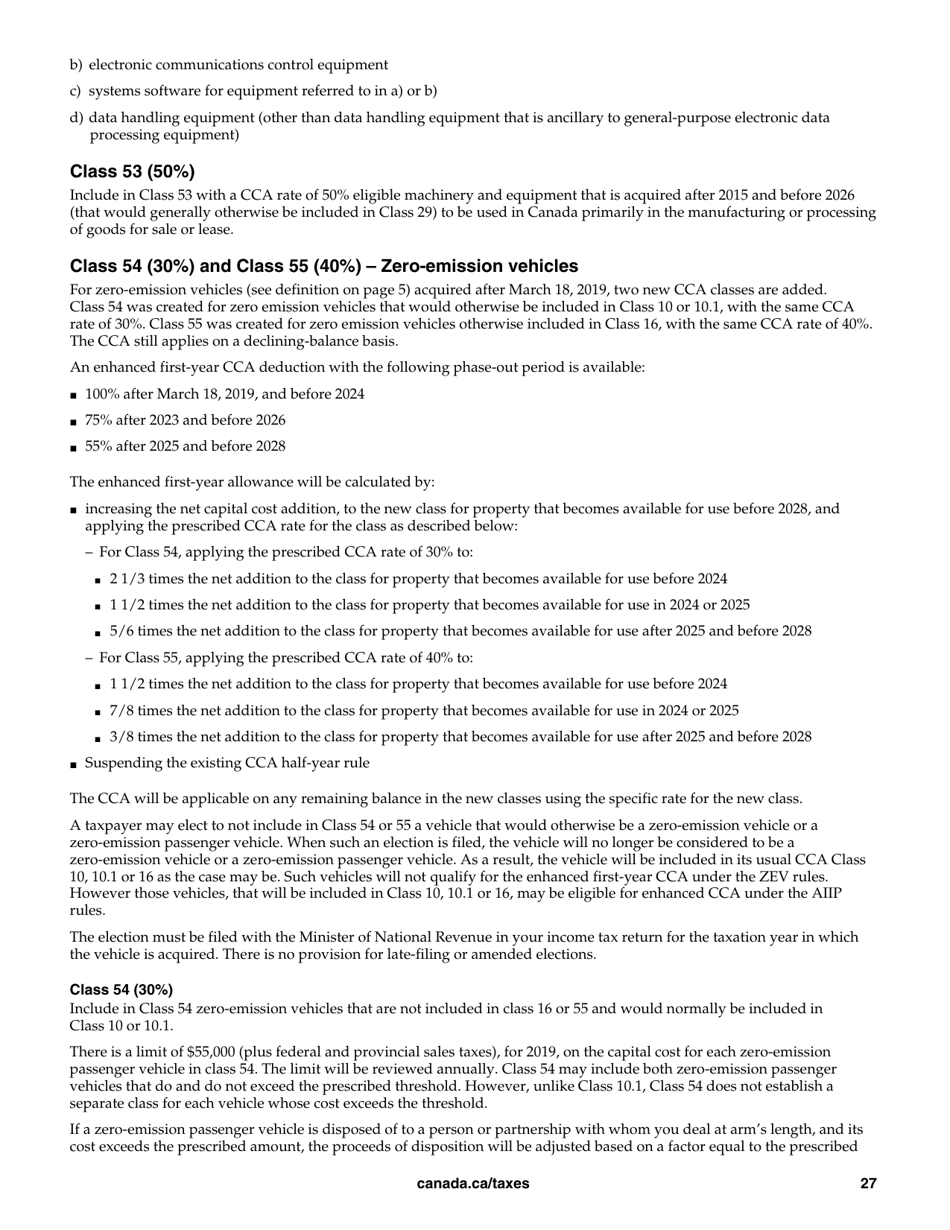

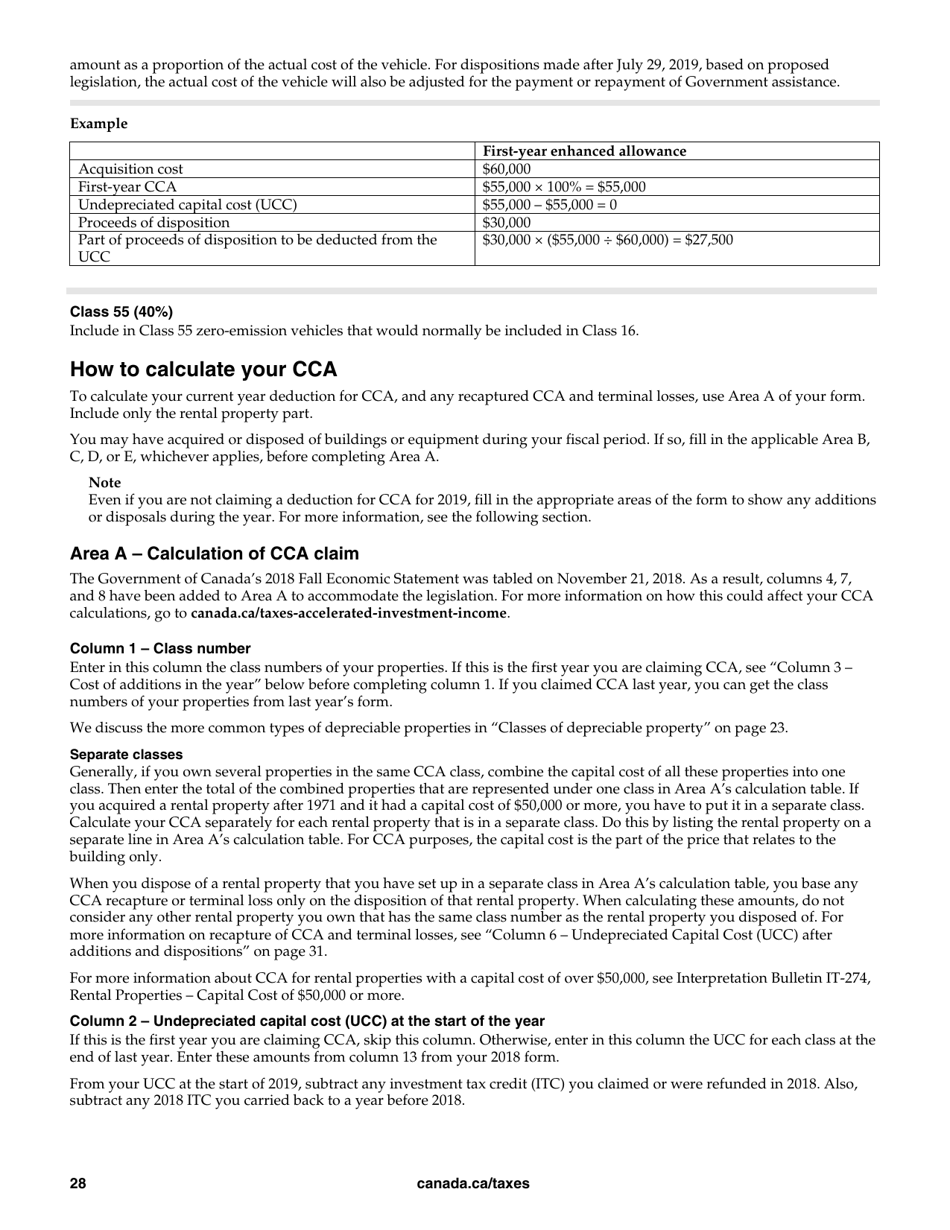

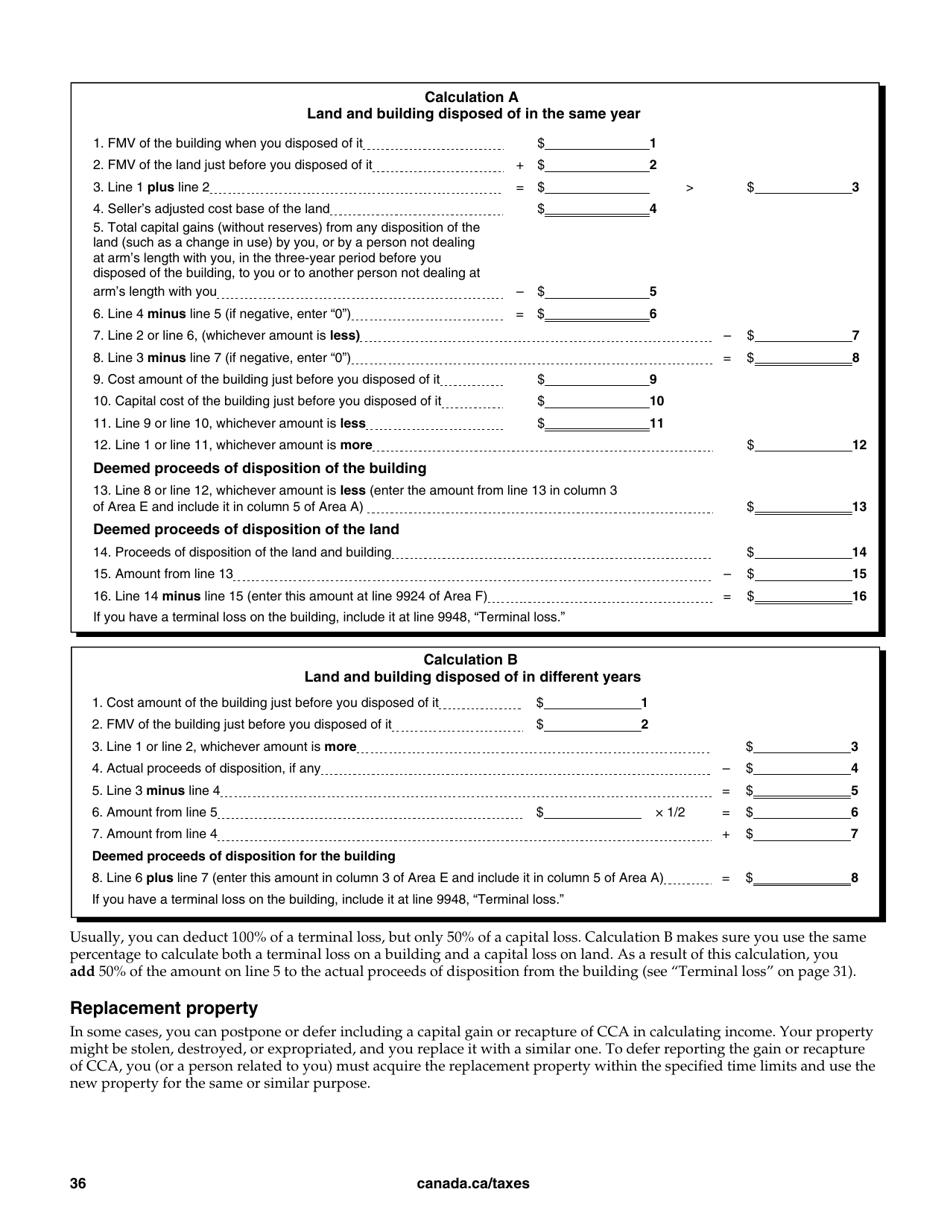

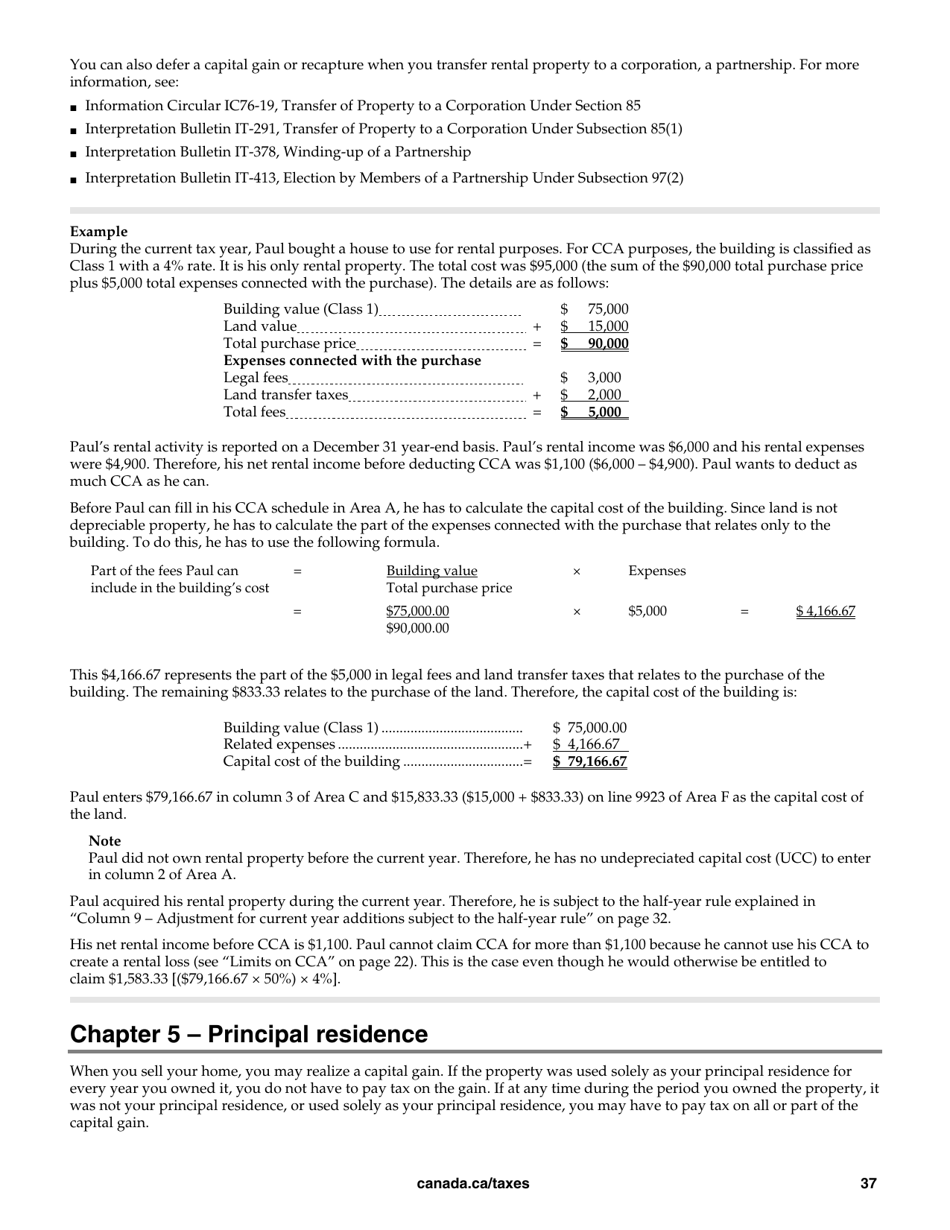

- Capital Cost Allowance (CCA) . If the taxpayer does not know what CCA is and how it can be applied to their situation, they can check out this part of the guide.

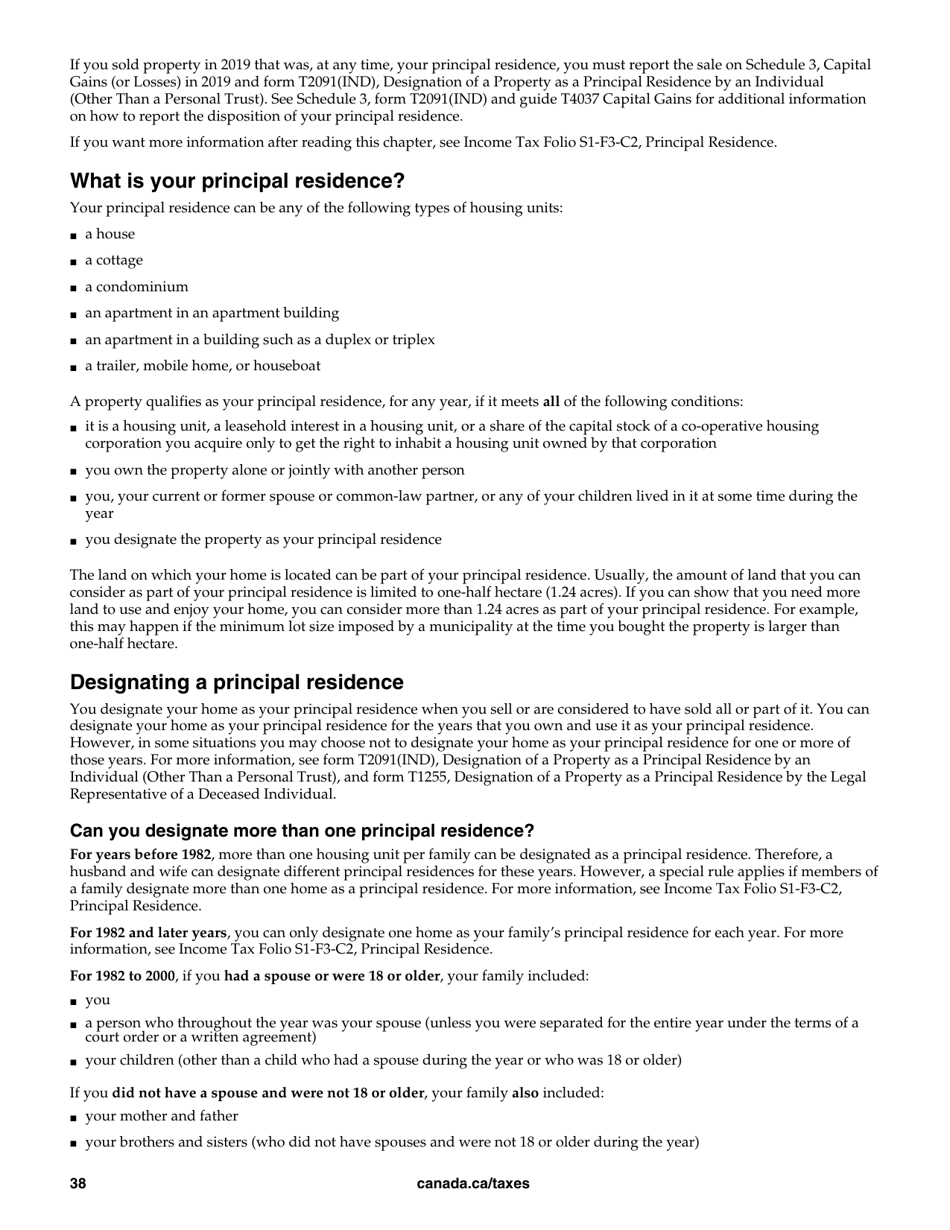

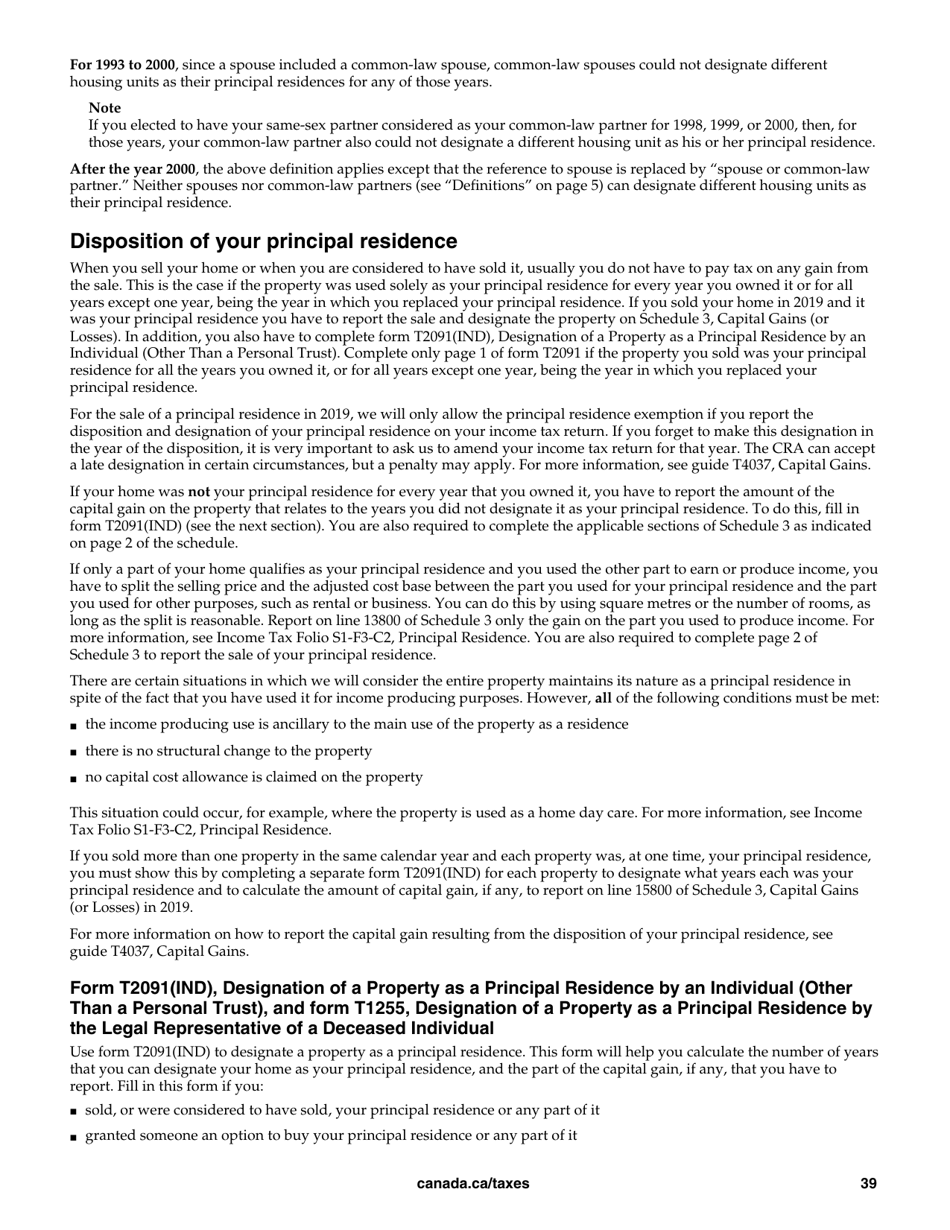

- Principal Residence . The last part of the guide defines what a principal residence is and which document can be used when the taxpayer has sold their principal residence.

In addition to everything mentioned above, a rental income tax form provides taxpayers with definitions that are most commonly used through the document and available online services. Information from the guide can be used when taxpayers wish to fill out Form T776, Statement of Real Estate Rentals.