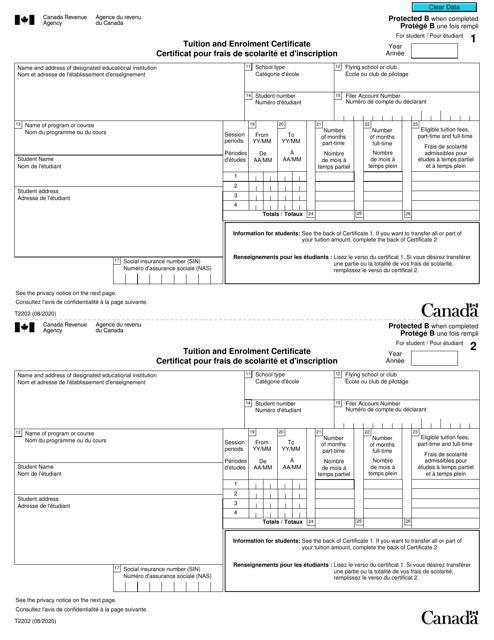

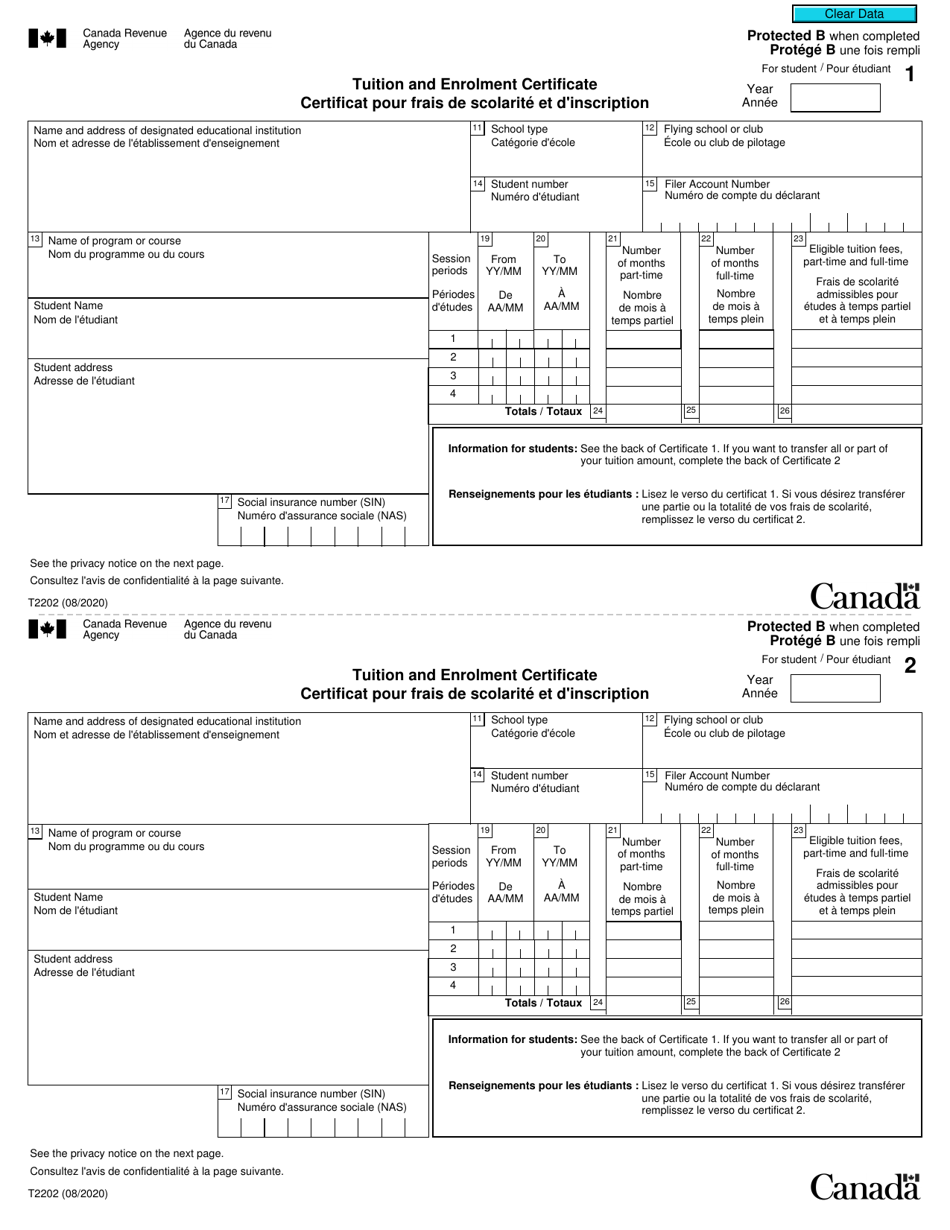

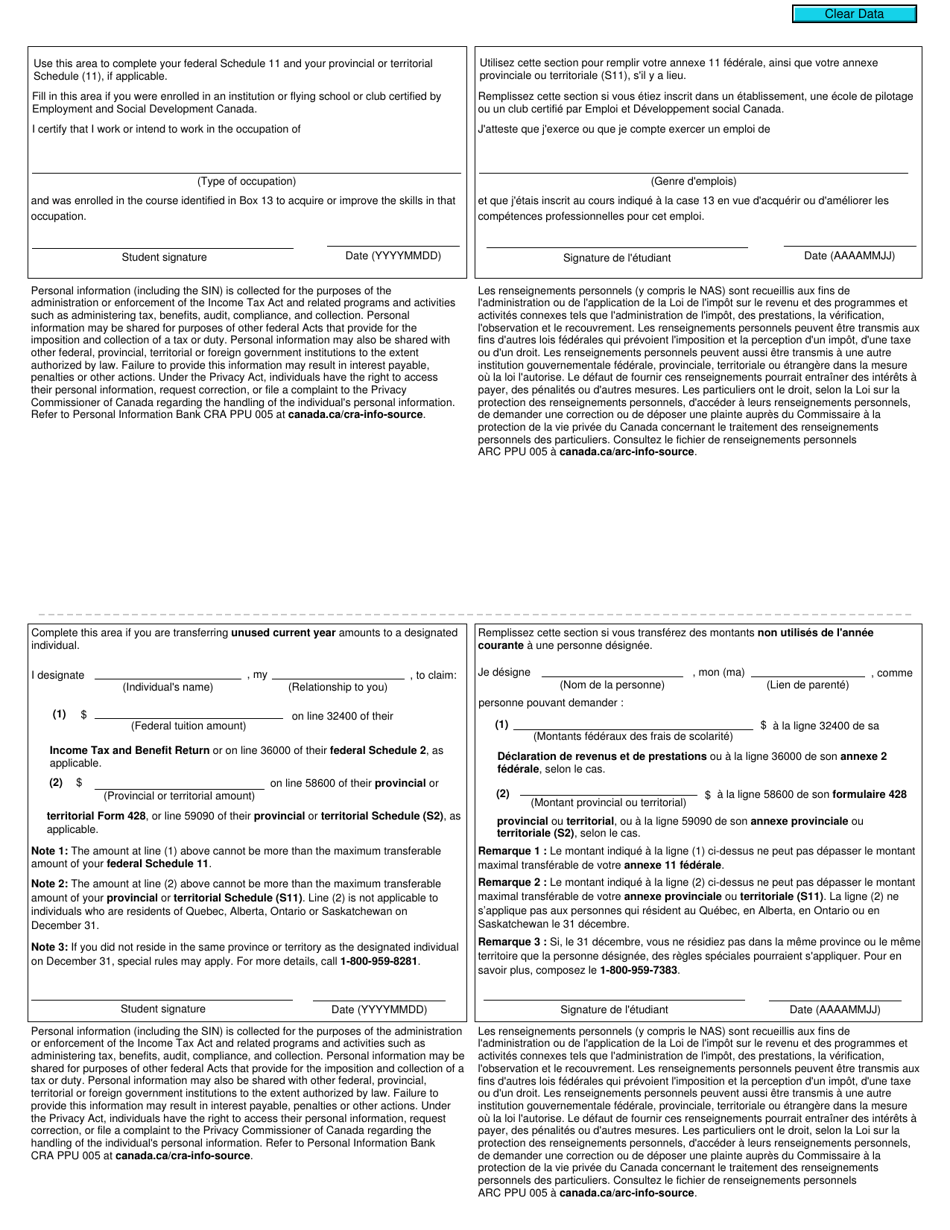

Form T2202 Tuition and Enrolment Certificate - Canada (English / French)

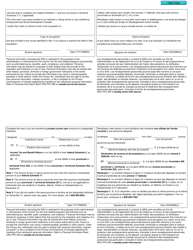

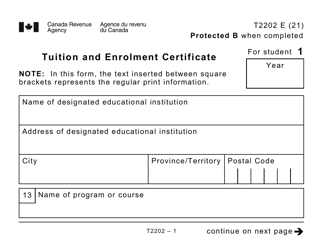

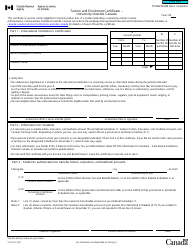

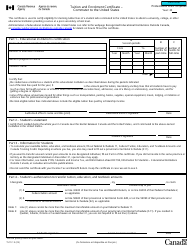

Form T2202 Tuition and Enrolment Certificate is a document used in Canada to claim educational expenses for tax purposes. It provides information about the amount of tuition fees paid by a student, as well as the number of months in which they were enrolled in eligible educational programs. This form helps students in Canada to claim deductions and credits on their income tax return.

The Form T2202 Tuition and Enrolment Certificate is filed by the individual student for their personal tax purposes.

FAQ

Q: What is Form T2202?

A: Form T2202 is the Tuition and Enrolment Certificate issued by Canadian educational institutions.

Q: Why do I need Form T2202?

A: You need Form T2202 to claim tuition fees and education-related expenses on your Canadian income tax return.

Q: Who issues Form T2202?

A: Form T2202 is issued by Canadian educational institutions, such as colleges and universities.

Q: What information is included in Form T2202?

A: Form T2202 includes information on the amount of eligible tuition fees, months of enrollment, and other education-related expenses.

Q: What should I do if there is an error on my Form T2202?

A: If there is an error on your Form T2202, you should contact your educational institution to have it corrected.

Q: Can I claim tuition fees without Form T2202?

A: No, you need Form T2202 to claim tuition fees and education-related expenses on your Canadian income tax return.

Q: How long should I keep Form T2202?

A: You should keep Form T2202 and any supporting documents for at least six years in case of a tax audit.