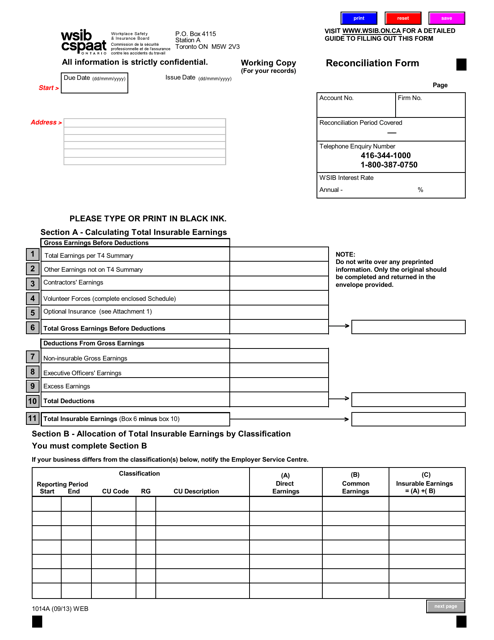

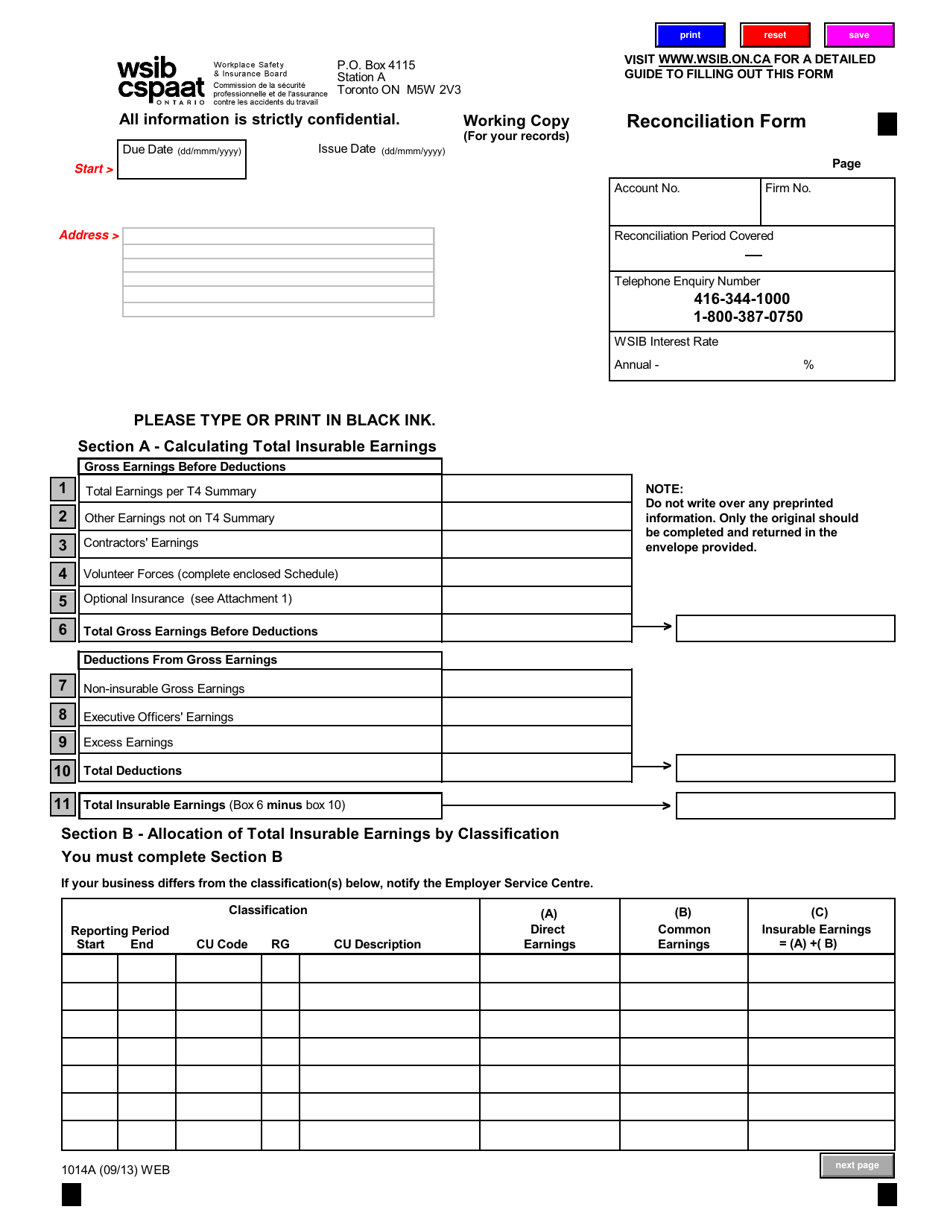

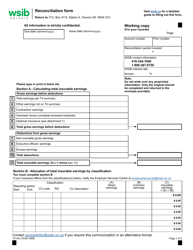

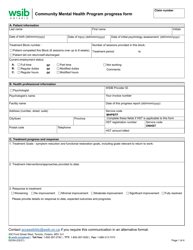

Form 1014A Reconciliation Form - Ontario, Canada

What Is Form 1014A?

Form 1014A, Reconciliation Form , is a formal statement Canadian employers submit to the Workplace Safety and Insurance Board (WSIB) to report the total amount of earnings received by their employees for the last reporting period after they calculate their premium and separate it by classification units and find out the difference between the premium amount they have already reported with the amount owed. Send this document to the WSIB no later than March 31 of the year that follows the reporting year.

Alternate Name:

- WSIB Reconciliation Form.

The latest version of the document was issued on September 1, 2013 , with all previous editions obsolete. A fillable WSIB Reconciliation Form can be downloaded through the link below.

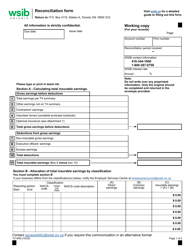

How to Fill Out WSIB Reconciliation Form?

Here is how you need to complete Form 1014A:

- Start with computing the total earnings that can be insured. State the total earnings from the T4 Statement of Remuneration and other earnings not included in that summary. Indicate how much contractors and volunteer forces have earned. Calculate the total earnings adding the optional insurance if the amount is pre-printed in your document.

- Outline all deductions from gross earnings - earnings that cannot be deducted, executive officers' and excess earnings. Find out the total amount of earnings that can be insured by subtracting the deductions from the gross earnings.

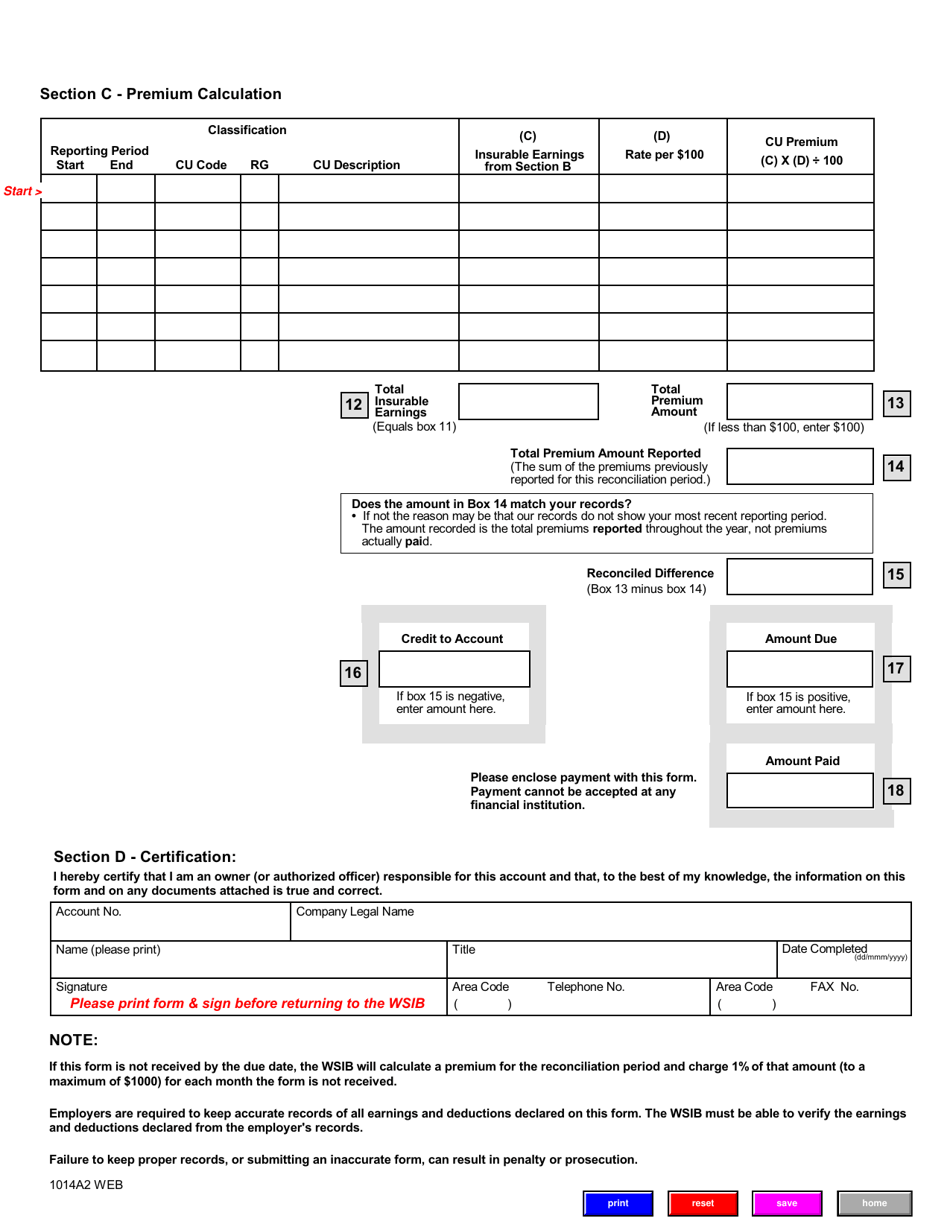

- Allocate the earnings you have calculated by classification. List all earnings, enter their description, the classification unit number, and the duration of the reporting period. Find out the insurance earnings for each position in the table - add direct earnings (those you can assign to the classification unit) to common earnings (earnings that cannot be directly assigned to a specific category because they do not relate to the specific business activity).

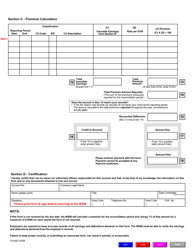

- Calculate the total premium amount - multiply the insurable earnings by the premium rate, and then divide the number you get by 100.

- Report the total premium amount you have already reported throughout the year. If this number does not reflect your records, indicate the reconciled difference - subtract the reported amount from the computed premium amount.

- If the reconciled difference is negative, enter the WSIB account number - the reconciliation credit will be applied to the account balance.

- Record the amount of money you owe to the WSIB if the reconciled difference is positive.

- Write down the amount you are paying and attach the payment with the form.

- Confirm your responsibility for the account in question and the accuracy of the statements you have provided in the form.

- Enter the account number assigned by the WSIB and the legal name of your business. Record your name and title, the actual date, contact details, and sign the document.