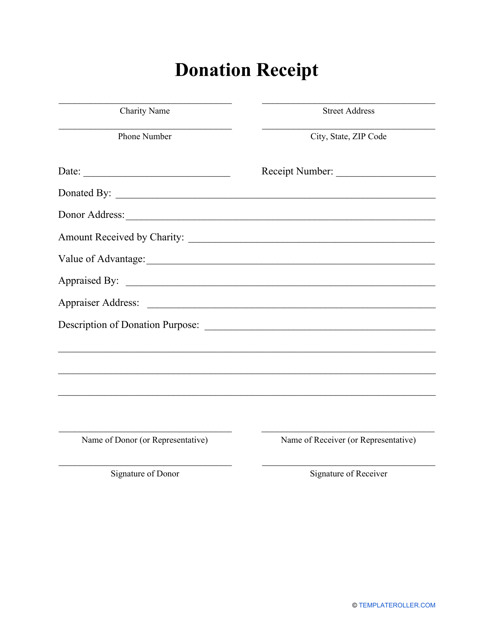

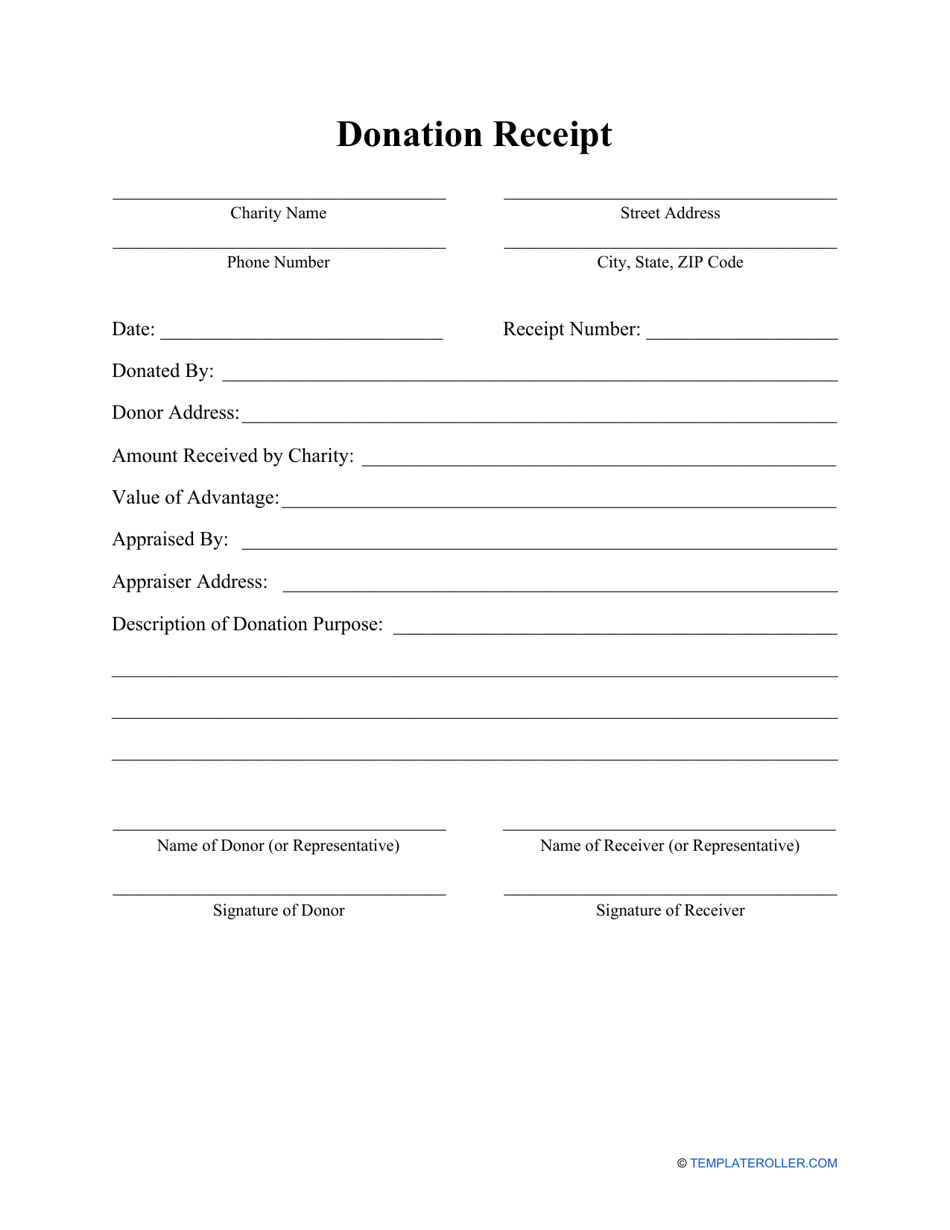

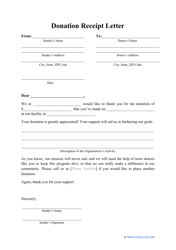

Donation Receipt Template

What Is a Donation Receipt?

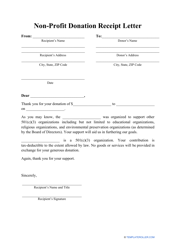

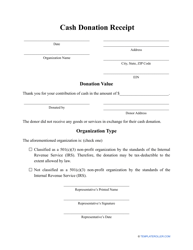

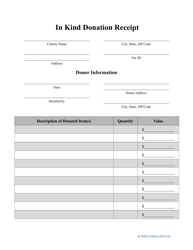

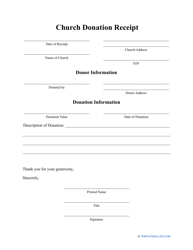

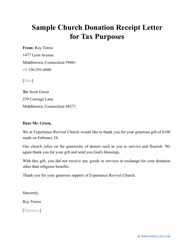

A Donation Receipt is a document that contains a record of a gift being donated to a charitable organization. The purpose of the application is to document a charitable contribution being made to a certain type of organization. In the future, that written record can be used as proof of a donation. A printable Donation Receipt template can be downloaded through the link below.

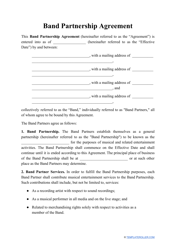

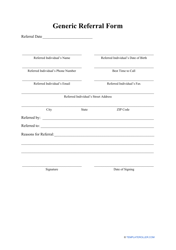

Similar Documents:

One of the reasons an individual might need proof of a contribution is to claim a tax deduction with the Internal Revenue Service (IRS). The IRS has developed a list of requirements for the content of a written acknowledgment of a charitable contribution, as well as for the certain written records of an organization that received a donation. To learn more, visit the official IRS website.

How to Write a Donation Receipt?

Even though the IRS does not have a form for charitable contributions less than $500, they do have a list of sections that must be included in the document. A Donation Receipt Form should be filled in by a charitable organization that has received a gift and should contain the following:

- Donor's information. In the first part of the document, the filer should state a donor's full name and mailing address.

- Information about the charitable organization. Here charitable organizations should provide their name, location, and Employer Identification Number (EIN).

- Description of the contribution (if it is non-cash). An applicant should include a donation date, and a detailed description of each item that has been gifted, in this case, the filer should be very specific. However, they should not provide a cash value for non-cash items.

- Donation amount. If a donor has contributed a cash donation, an applicant should state how much the organization has received.

- A statement that the contribution is voluntary and non-compensated. The filer should make a statement that no services were provided in exchange for the received donation, if so.

- Description of the services that an organization has provided in return for the contribution. If an organization has provided any services or goods in exchange for the contribution, it should designate its value.

- Religious benefits. If the provided services consisted entirely of intangible religious benefits, an applicant should include a statement about it.

The content of a non-profit Donation Receipt can slightly change depending on the type of charitable organization receiving the contribution, type of gift, location, etc. Before making a charitable Donation Receipt, the filer should check their applicable state laws and make sure they are operating in accordance with them.

What Amount of Donation Requires a Receipt?

According to the IRS, a charitable donation of $250 or more requires a Donation Receipt with certain contents, as described above. However, such a receipt is necessary only if an individual is planning on applying for a tax deduction.

For donations smaller than that, a donor can use a receipt as well or a bank record. The contribution acknowledgment can be provided to the donor by paper or electronically. As long as it contains the required information, the IRS will accept it.

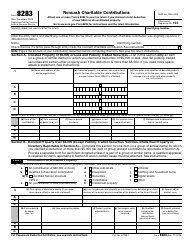

Nevertheless, if a noncash charitable contribution is more than $500, to claim a deduction an individual should use IRS Form 8283, Noncash Charitable Contributions. It should be attached to their tax return.

Haven't found what you were looking for? Take a look at the related templates below: