Letter of Credit Template

What Is a Letter of Credit?

A Letter of Credit is a document that is issued by a bank where they guarantee that the buyer is able to make a payment. The purpose of the letter is to confirm the payment, and if the buyer is unable to make a payment for some reason, then the bank guarantees to make it instead of them. A printable Letter of Credit template can be found through the link below.

In this relationship, the bank is a disinterested party that releases payment only after certain conditions are met. A Credit Letter is mostly used for businesses that participate in international trade since there are a lot of factors that affect the situation. Those factors can include the distance between the involved parties, not knowing each other adequately, and the different laws that apply in each country.

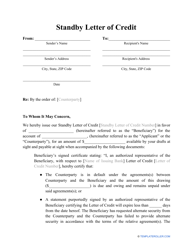

In some cases, the letter is not enough, and to improve their chances of securing payment the buyer can apply for a confirmed Letter of Credit. This document is a type of Letter of Credit where payment is guaranteed by two banks. If the buyer is not able to pay and the first bank fails to transfer the funds, the second bank is supposed to do it.

How Does a Letter of Credit Work?

Whether you have worked with the other party before or not, you both represent one country or are foreign to each other, it is never a bad idea to find more ways to secure your goods, services, and finances. A Credit Letter is a great financial tool that protects the beneficiary and the applicant - if the purchaser cannot pay for the delivered merchandise, the financial institution that issued the deal will pay the seller. Additionally, it protects the buyer - in case the seller cannot provide products they promised, the purchaser will be compensated for the damages suffered, this kind of compensation being similar to a refund.

Typically, a Letter of Credit is prepared by the bank that has worked with either party or both of them in the past - the department that handles business credits and loans must be sure the parties will comply with the conditions of the original contract and only exceptional circumstances can prevent that from happening. To enforce the credit, the parties must forward documentation that proves they either fulfilled their duties or shows evidence of either party's failure to follow through with the agreement - it depends on the provisions of the Letter of Credit. This means the payment via the Credit Letter can be used.

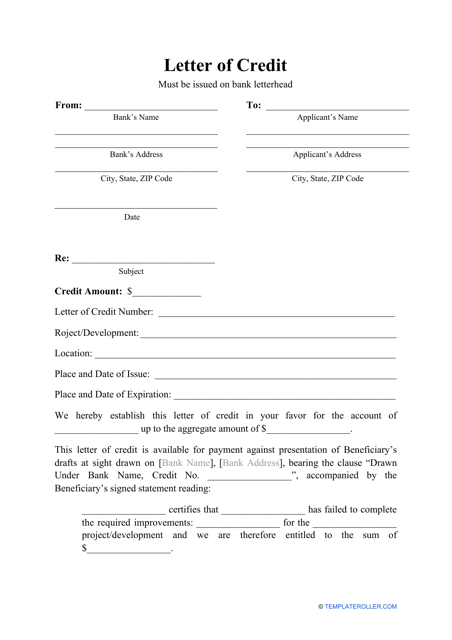

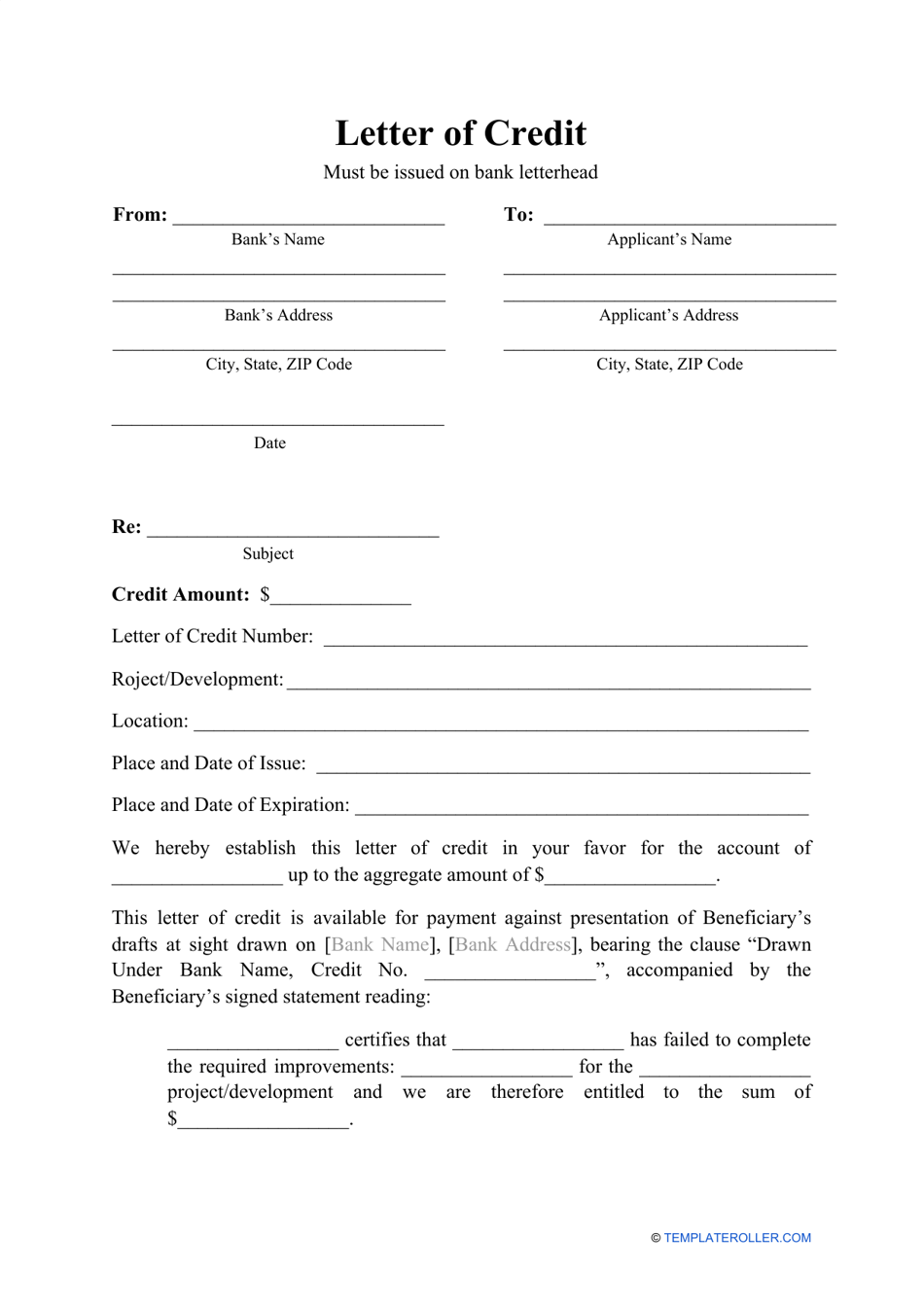

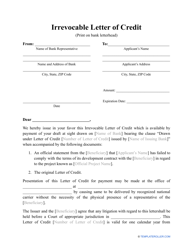

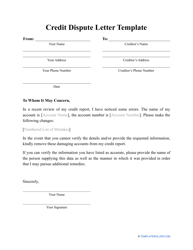

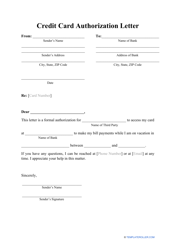

How to Write a Letter of Credit?

Use the template below as a guideline when writing your own letter. If drafting a bank Letter of Credit on your own, be sure to include the following information:

- Issuing Bank. In the first part of the document, the sender is supposed to designate the name of the bank they are representing and its location.

- Applicant. Here the sender can state the name of the business that applied for the Letter of Credit (the buyer) and their location.

- Beneficiary. Senders can use this part to indicate the name of the seller and their location.

- Amount. The sender should designate the payment that is supposed to be transferred by the bank to the seller, in case the buyer fails to do it.

- Receiving Bank. The sender is supposed to state the name and the location of the seller's bank.

- Terms and Conditions. The sender should provide the seller with information about what they are supposed to do if they did not receive the payment from the buyer, what requirements they must follow to receive the payment from the buyer's bank, how and when the payment will be proceeded, etc. All of the conditions that must be followed by the seller should be included in this part of the letter.

How to Get a Letter of Credit?

In order to get the letter, the buyer should contact their bank. In most cases, the bank requires the buyer to provide a request where they will indicate how the Letter of Credit will be used, and all of the documentation connected with the agreement between the buyer and the seller.

In addition to requesting documents that will help to understand the nature of the deal, the bank can request the buyer to pay a Letter of Credit fee or remit the funds on their account in order to secure the upcoming payment (or both). The fee is usually presented as a percentage of the purchase price and is determined by the bank. While some buyers can be required to pay up to 100% of the purchase price as a fee, well-established bank clients can be asked to pay no more than 5%.

After receiving all of the documents, the bank will inspect them thoroughly and, if the buyer meets the requirements, a Letter of Credit will be issued. If the buyer would like to get a confirmed letter, then they are supposed to go through the same procedure again but with a different bank.

Related Letter Templates: