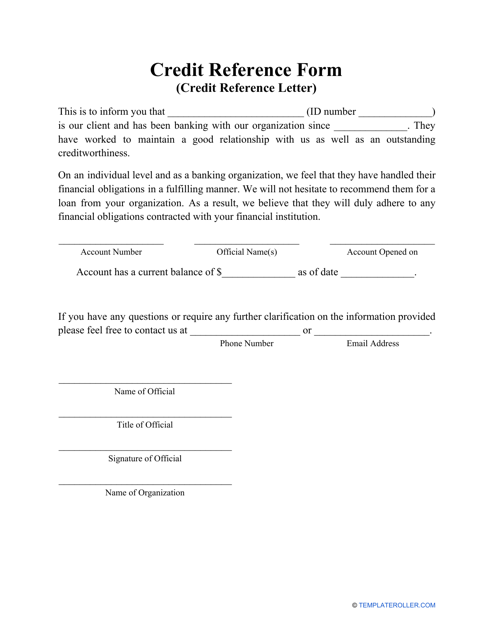

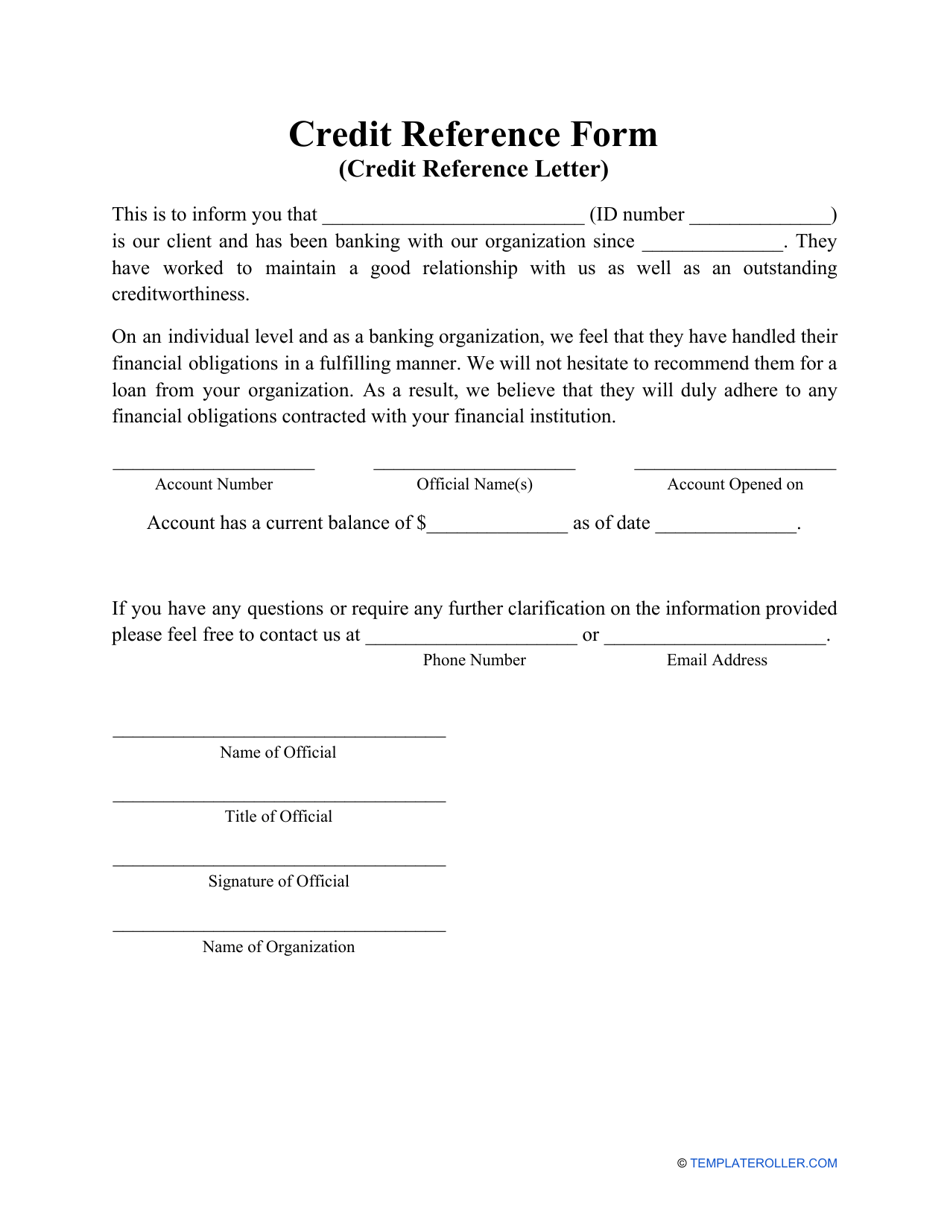

Credit Reference Form

What Is a Credit Reference Form?

A Credit Reference Form is a typed or handwritten document that confirms the lending capacity of a prospective borrower. This statement can be composed by any financial institution (usually, a bank) that provided financial and banking services to the person or organization to prove the borrower has a good credit history.

Alternate Letter:

- Credit Reference Letter.

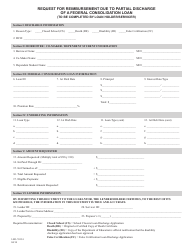

If you are looking for a printable Credit Reference Form template, you can download it below.

Additionally, a Business Credit Reference Form can be drafted by the service provider or any other type of business you have worked with before. Its purpose is to assure the third party - a potential lender - that the borrower is going to pay the money back on time and there are tangible reasons to trust them. A Credit Reference Check Form allows the lender to build confidence and trust in the borrower by learning more about the latter's finances.

How to Fill Out a Credit Reference Form?

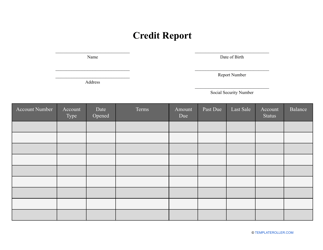

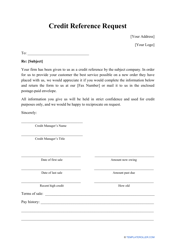

Before providing credit to a new customer, any lender, whether it is a utility provider or supplier, must know your financial history. You have to prepare a Credit Report Authorization Form - this document will let the lender conduct a background check on you and learn information about your former business dealings - in particular, credit reports. Then, the lender will send a Credit Reference Request Form to your former bank or supplier you have already worked with. In some cases, a future borrower can also request a reference from any bank or business they have had a professional relationship with. Reach out to several companies and institutions at the same time - not everyone will accommodate the request for a reference. Once the request is received and accepted, it is necessary to verify the borrower's creditworthiness and payment history - here is how you compose a Credit Reference Letter:

- If you have not received any templates or instructions from the company that requested a reference, you are allowed to create a letter at your own discretion. Otherwise, use the template the lender or the borrower sent you, especially if they need to obtain particular financial details.

- Introduce yourself and add your contact information.

- Specify how long have you known the borrower and outline the nature of your professional relationship.

- Indicate their payment history - do they typically pay on time or are they behind on payments. If there are any late payments at the moment, mention them separately.

- Briefly describe the borrower - how they have handled their financial liabilities and what kind of relationship their representatives have built with your business or institution on an individual level.

- If you are prepared to recommend the borrower, do it explicitly by saying that you are sure they will comply with the financial obligations imposed by the lender.

- Sign the form and offer the lender to contact you if they have further issues or questions.

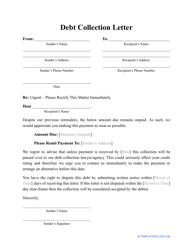

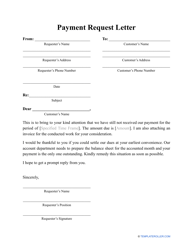

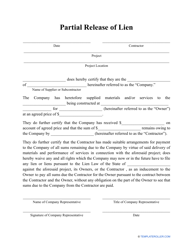

Haven't found the template you're looking for? Take a look at the related documents below: