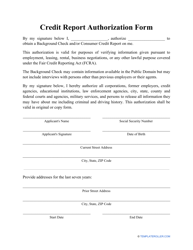

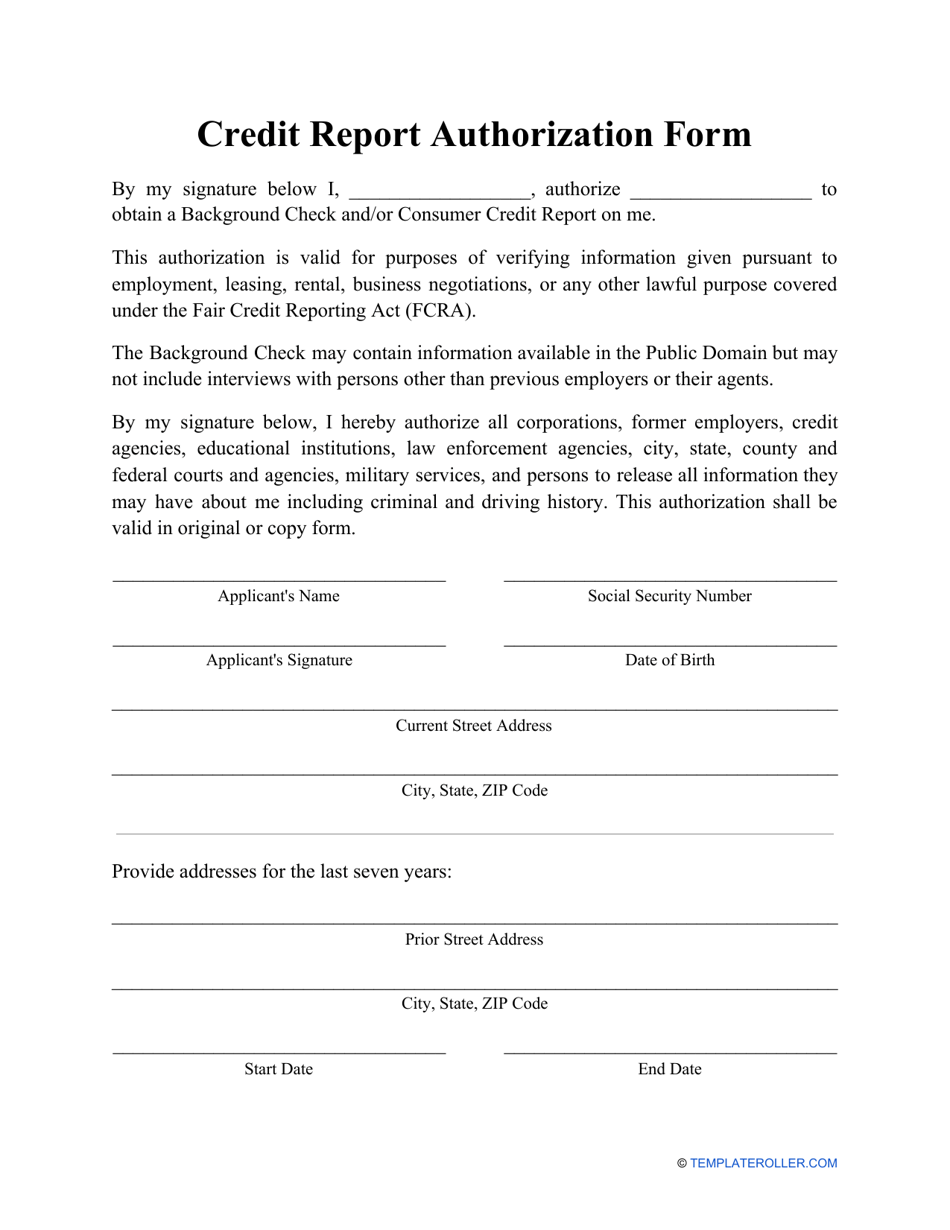

Credit Report Authorization Form

What Is a Credit Report Authorization Form?

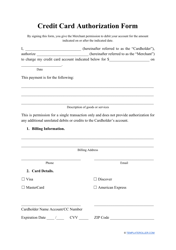

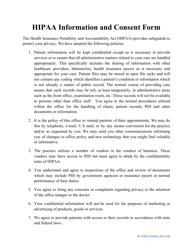

A Credit Report Authorization Form is a typed or handwritten document completed to provide consent to a potential lender to learn more about the prospective borrower's credit history. Before the lender can request a Credit Reference Form from any business or person the borrower has had a professional relationship with, they must obtain written consent of the person whose financial details they will examine.

Before the lender can send a Credit Reference Request Form - a document designed to seek references from the borrower's counterparts and former banks - the borrower has to fill out a special authorization. This consent to disclose personal information may clarify which records can be shared and specify the purpose of the disclosure.

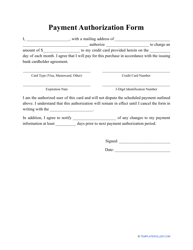

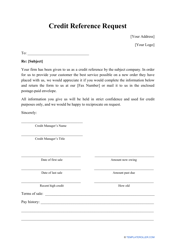

If you are looking for a printable Credit Report Authorization Form template, you can download it through the link below.

How to Fill Out a Credit Report Authorization Form?

Follow these steps to complete a Credit Report Authorization Form:

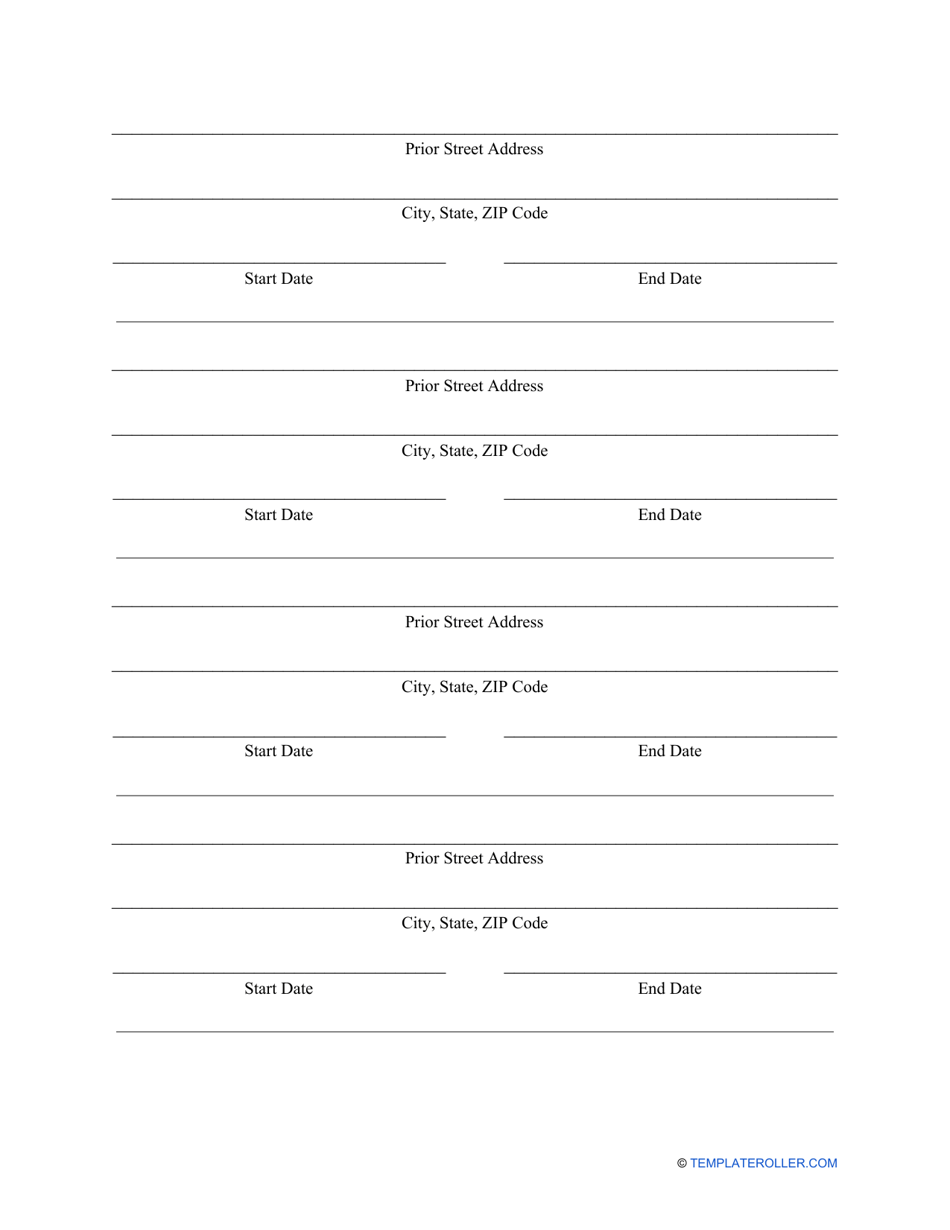

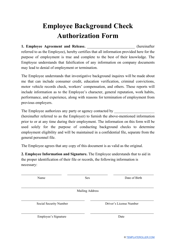

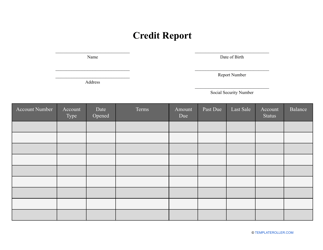

- Write down your personal information - full name, date of birth, and social security number. To facilitate identification, you can also add your driver's license number and addresses of the past 5-10 years - it will provide the lender with alternative ways to verify your credit history, especially if you have used different names in the past.

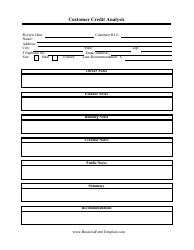

- Enter the full name of the individual or business name of the entity that gets permission to obtain a credit report on you. Note that they will have to provide identification when using the authorization.

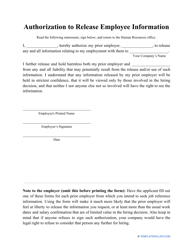

- Confirm your authorization for any financial institutions, former employers and landlords, governmental agencies, and individuals - any person or company must make your personal details, including driving and criminal history available for the authorized individual or organization indicated in the form.

- Sign and date the authorization. This document can be valid both in original and copy form - however, it is better to submit an original authorization - a copy will most likely not be accepted during the background check. Usually, a Credit Report Authorization is valid for a year, but you can state its exact expiration date if you want to. You can also revoke your authorization at any time to cease future disclosures and checks.

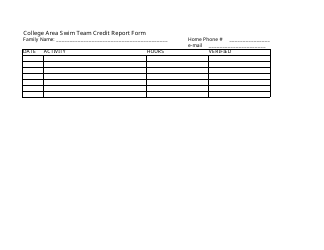

A Credit Report Authorization Form for tenants is often used to complement a Rental Application. This kind of document allows the future landlord to check the credit history of the potential tenant. Unlike an authorization for a moneylender, bank, or some other financial institution, it will involve a fee to cover expenses of the landlord who will personally or with the help of a special agency perform a background check of the tenant. A tenant's authorization also lists other occupants who will live along with a tenant, describes their relationship, records the tenant's employment history (past jobs and current employment, including salary information), and contains several references of people that can confirm a tenant is a reliable person.

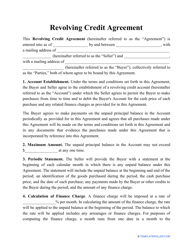

Haven't found the template you are looking for? Take a look at the related templates below: