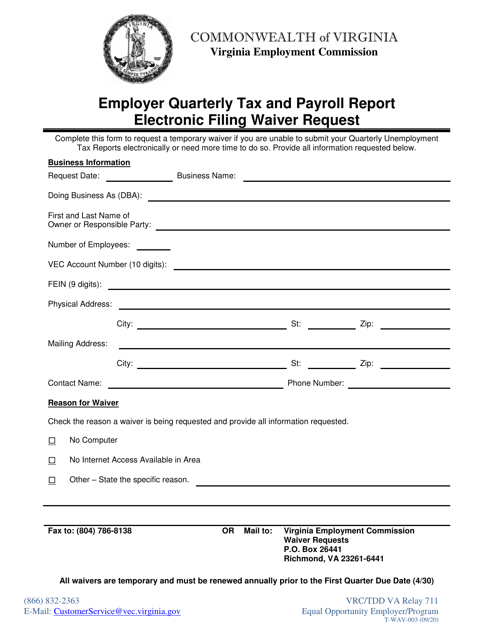

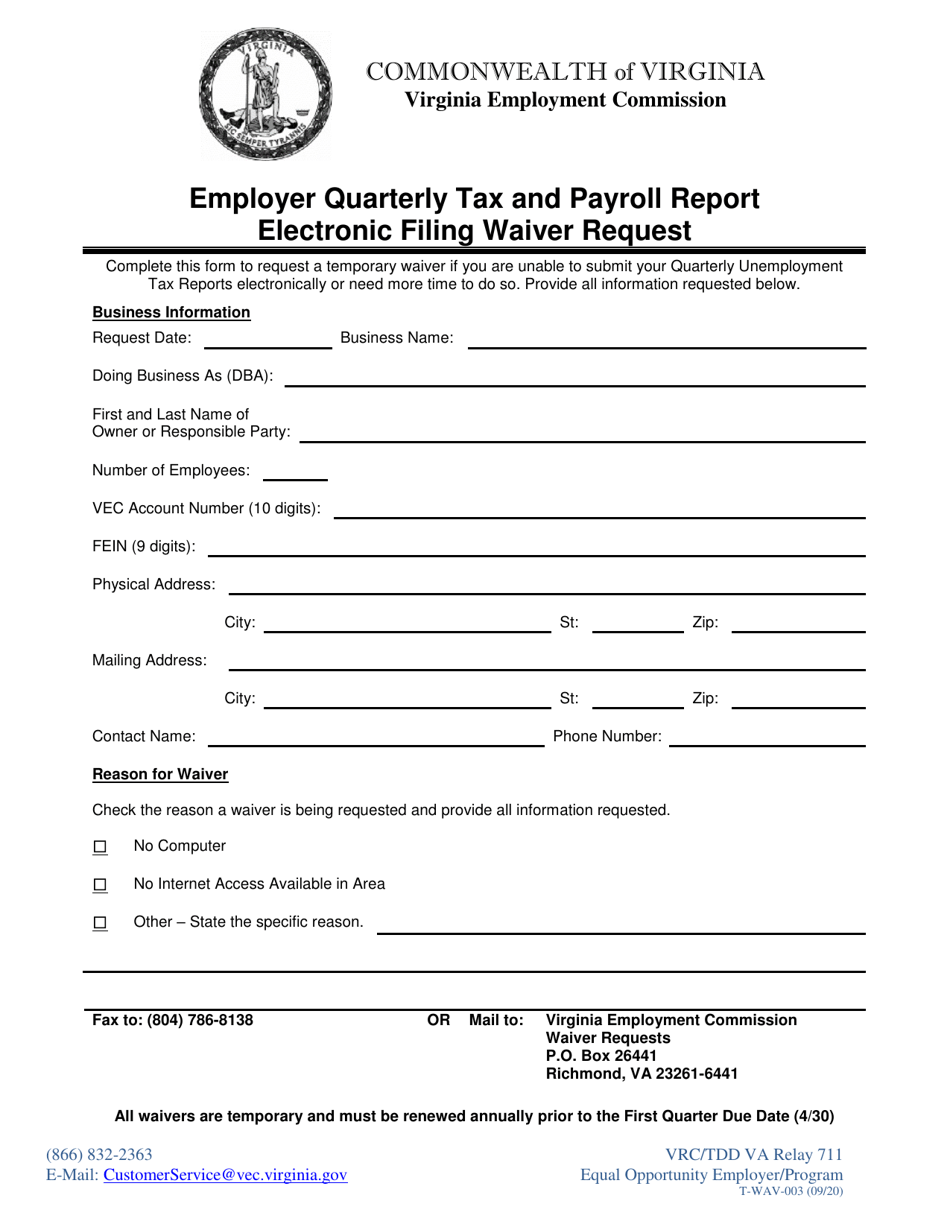

Form T-WAV-003 Employer Quarterly Tax and Payroll Report Electronic Filing Waiver Request - Virginia

What Is Form T-WAV-003?

This is a legal form that was released by the Virginia Employment Commission - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form T-WAV-003?

A: Form T-WAV-003 is the Employer Quarterly Tax and Payroll ReportElectronic Filing Waiver Request specifically for Virginia.

Q: What is the purpose of Form T-WAV-003?

A: The purpose of Form T-WAV-003 is to request a waiver from the requirement of electronically filing the Employer Quarterly Tax and Payroll Report in Virginia.

Q: Who needs to file Form T-WAV-003?

A: Employers in Virginia who want to be exempted from the electronic filing requirement for the Employer Quarterly Tax and Payroll Report need to file Form T-WAV-003.

Q: What is the electronic filing waiver?

A: The electronic filing waiver allows employers to request an exemption from the requirement of filing the Employer Quarterly Tax and Payroll Report electronically in Virginia.

Q: Are there any fees associated with filing Form T-WAV-003?

A: No, there are no fees associated with filing Form T-WAV-003.

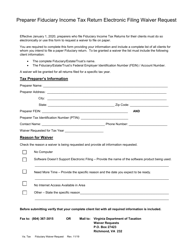

Q: What information is required on Form T-WAV-003?

A: Form T-WAV-003 requires information such as employer details, contact information, and the reason for the waiver request.

Q: When should I file Form T-WAV-003?

A: Form T-WAV-003 should be filed before the due date for the Employer Quarterly Tax and Payroll Report in Virginia.

Q: How long does it take to process Form T-WAV-003?

A: The processing time for Form T-WAV-003 may vary, so it is recommended to submit the form well in advance of the due date to allow for processing and approval.

Q: Can I submit Form T-WAV-003 electronically?

A: No, Form T-WAV-003 cannot be submitted electronically. It must be submitted via mail or fax to the Virginia Department of Taxation.

Form Details:

- Released on September 1, 2020;

- The latest edition provided by the Virginia Employment Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form T-WAV-003 by clicking the link below or browse more documents and templates provided by the Virginia Employment Commission.