This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

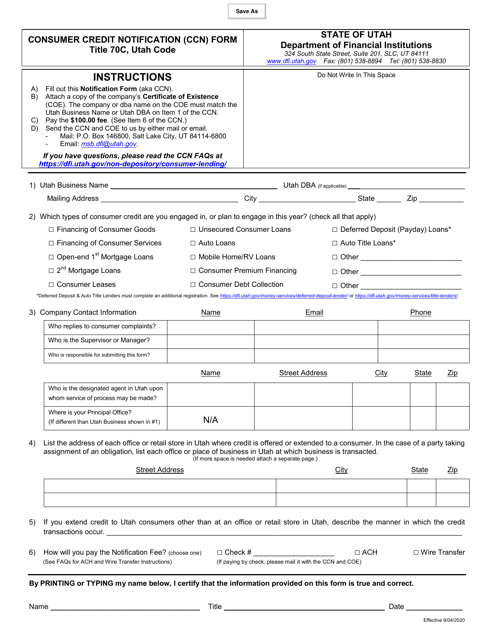

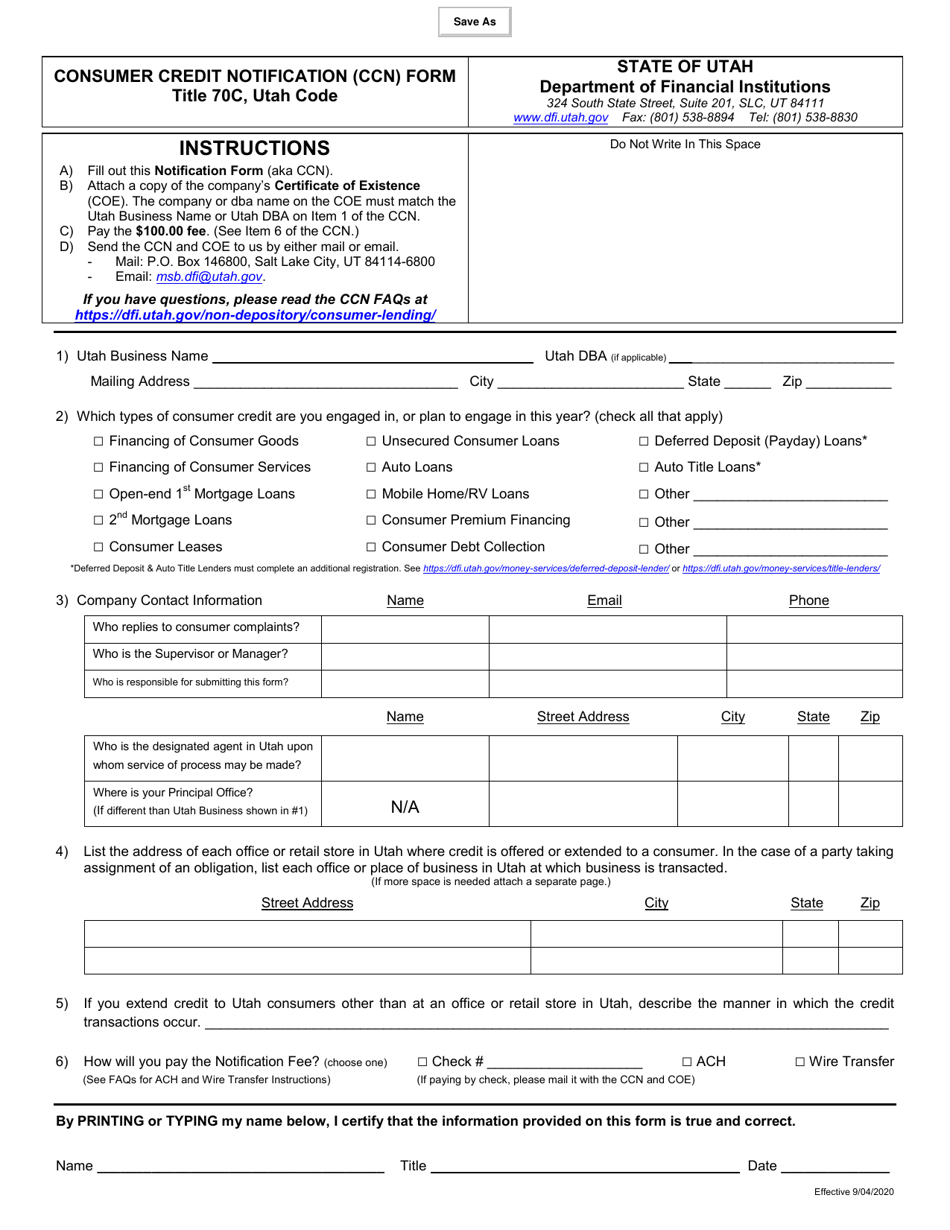

Consumer Credit Notification (Ccn) Form - Utah

Consumer Credit Notification (Ccn) Form is a legal document that was released by the Utah Department of Financial Institutions - a government authority operating within Utah.

FAQ

Q: What is the Consumer Credit Notification (CCN) form?

A: The Consumer Credit Notification (CCN) form is a document used in Utah to inform consumers about their rights and obligations when obtaining credit.

Q: Who is required to provide the CCN form?

A: Creditors in Utah are required to provide the CCN form to consumers when extending credit.

Q: What information is included in the CCN form?

A: The CCN form includes information about the cost of credit, the consumer's rights under the law, and the creditor's contact information.

Q: Why is the CCN form important?

A: The CCN form is important because it helps consumers understand the terms and conditions of the credit they are obtaining, as well as their rights and responsibilities.

Q: When should I receive the CCN form?

A: You should receive the CCN form before or at the time you sign a credit agreement or make any payment on the credit.

Q: What should I do if I did not receive the CCN form?

A: If you did not receive the CCN form when obtaining credit in Utah, you should contact the creditor and request a copy of the form.

Q: Can I cancel a credit agreement after receiving the CCN form?

A: Yes, in some cases you may have the right to cancel a credit agreement within a certain time period after receiving the CCN form.

Q: Is the CCN form specific to Utah?

A: Yes, the CCN form is specific to Utah and is required by Utah law.

Q: Are there any fees associated with obtaining the CCN form?

A: No, there should not be any fees associated with obtaining a copy of the CCN form.

Form Details:

- Released on September 4, 2020;

- The latest edition currently provided by the Utah Department of Financial Institutions;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Utah Department of Financial Institutions.