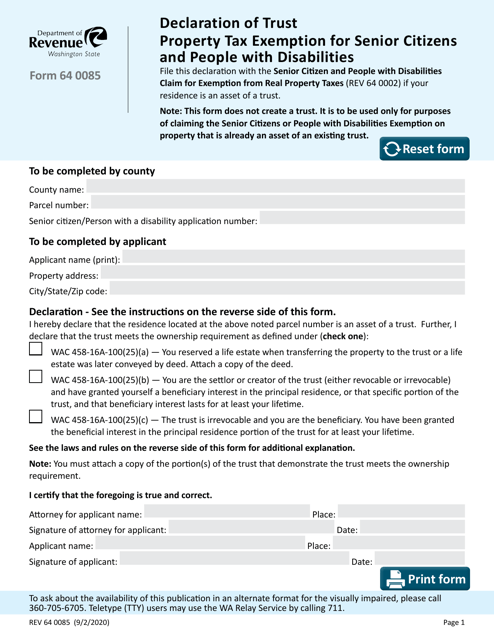

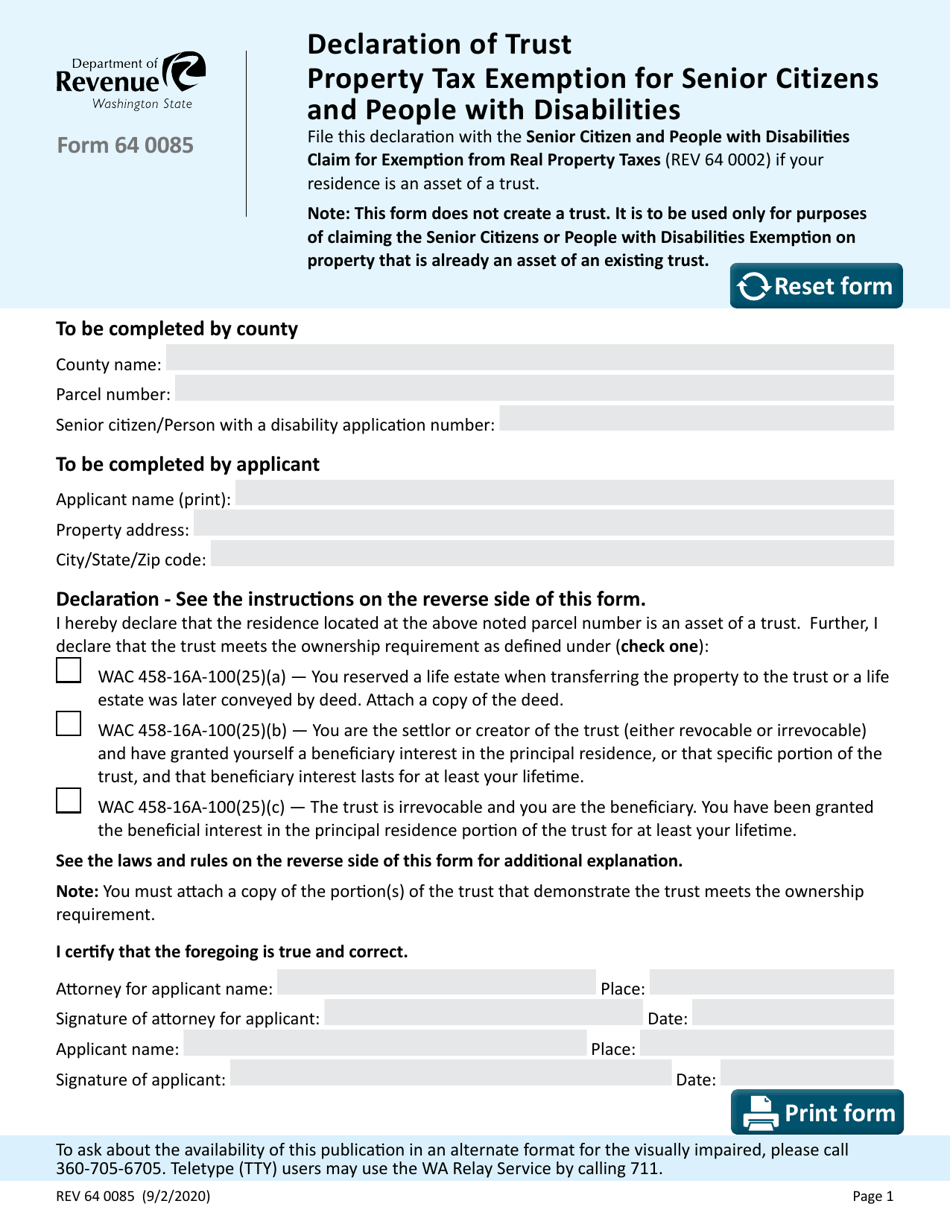

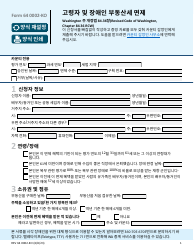

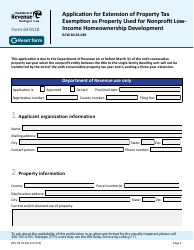

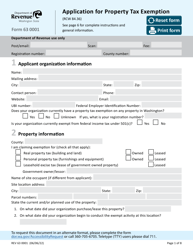

Form REV64 0085 Declaration of Trust - Property Tax Exemption for Senior Citizens and People With Disabilities - Washington

What Is Form REV64 0085?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is REV64 0085 Declaration of Trust?

A: REV64 0085 Declaration of Trust is a form used to apply for property tax exemption for senior citizens and people with disabilities in Washington.

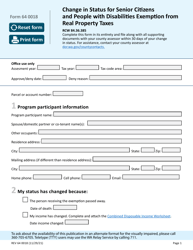

Q: Who is eligible for property tax exemption under this form?

A: Senior citizens and people with disabilities are eligible for property tax exemption under this form.

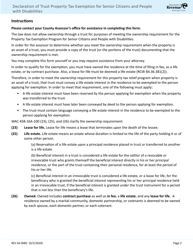

Q: What are the requirements for eligibility?

A: To be eligible, you must be a senior citizen or a person with a disability, and meet certain income and ownership criteria.

Q: What does the property tax exemption provide?

A: The property tax exemption provides relief from property taxes for eligible senior citizens and people with disabilities.

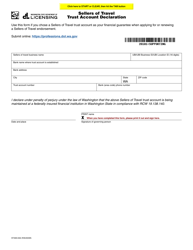

Q: What is the purpose of the Declaration of Trust?

A: The purpose of the Declaration of Trust is to declare that the property is held in trust for the benefit of the owner and to establish eligibility for property tax exemption.

Q: Can I receive property tax exemption for multiple properties?

A: No, you can only receive property tax exemption for one property.

Q: Are there any income limits for eligibility?

A: Yes, there are income limits for eligibility. The specific income limits depend on the county where the property is located.

Q: What is the deadline for submitting the Declaration of Trust?

A: The deadline for submitting the Declaration of Trust varies by county. You should contact your local county assessor's office for the deadline.

Q: Is there a fee for filing the Declaration of Trust?

A: No, there is no fee for filing the Declaration of Trust.

Form Details:

- Released on September 2, 2020;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV64 0085 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.