This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

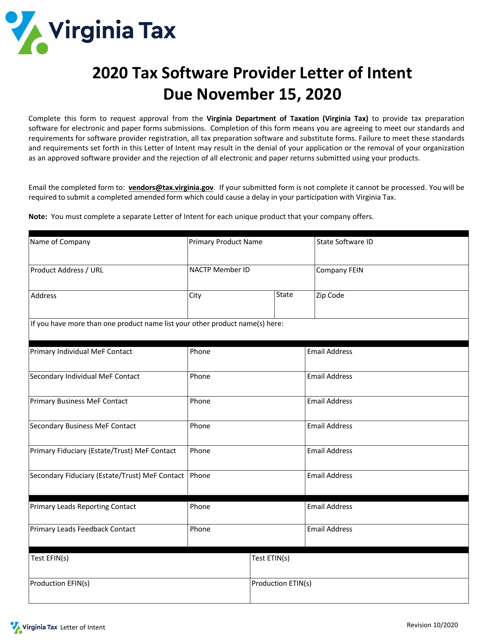

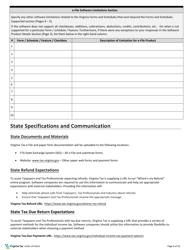

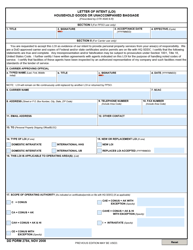

Tax Software Provider Letter of Intent - Virginia

Tax Software Provider Letter of Intent is a legal document that was released by the Virginia Department of Taxation - a government authority operating within Virginia.

FAQ

Q: What is a Letter of Intent?

A: A Letter of Intent is a document that outlines the terms and conditions of a proposed business transaction or agreement.

Q: What is the purpose of a Letter of Intent?

A: The purpose of a Letter of Intent is to express a party's intention to enter into a business transaction or agreement, and to provide a framework for further negotiations.

Q: Who is the tax software provider mentioned in the document?

A: The tax software provider mentioned in the document is not specified.

Q: What is the relevance of this document to Virginia?

A: The document is specific to Virginia because it mentions that it is a Letter of Intent for Virginia state law purposes.

Q: What is the significance of the tax software provider's intent to enter the Virginia marketplace?

A: The tax software provider's intent to enter the Virginia marketplace means that they plan to offer their services or products in Virginia for tax-related purposes.

Form Details:

- Released on October 1, 2020;

- The latest edition currently provided by the Virginia Department of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.