This version of the form is not currently in use and is provided for reference only. Download this version of

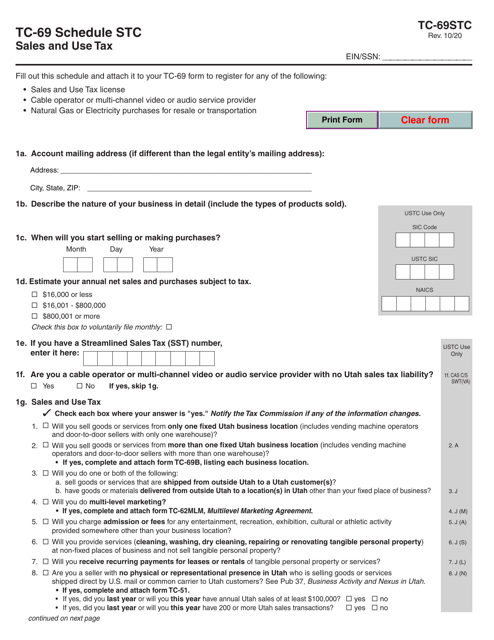

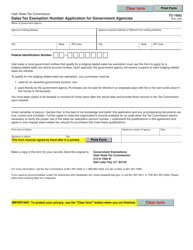

Form TC-69 Schedule STC

for the current year.

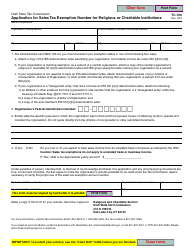

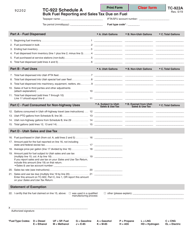

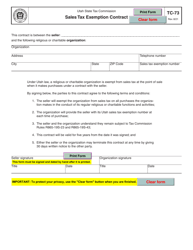

Form TC-69 Schedule STC Sales and Use Tax - Utah

What Is Form TC-69 Schedule STC?

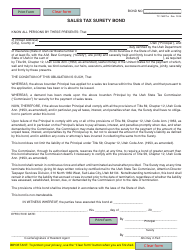

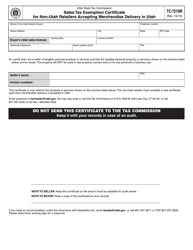

This is a legal form that was released by the Utah State Tax Commission - a government authority operating within Utah.The document is a supplement to Form TC-69, Utah State Business and Tax Registration. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

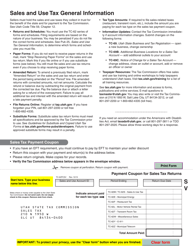

Q: What is Form TC-69 Schedule STC Sales and Use Tax?

A: Form TC-69 Schedule STC Sales and Use Tax is a form used in the state of Utah to report and pay sales and use tax.

Q: Who should use Form TC-69 Schedule STC?

A: Businesses operating in Utah that are required to collect and remit sales and use tax should use Form TC-69 Schedule STC.

Q: What is the purpose of Form TC-69 Schedule STC?

A: The purpose of Form TC-69 Schedule STC is to report and remit sales and use tax to the state of Utah.

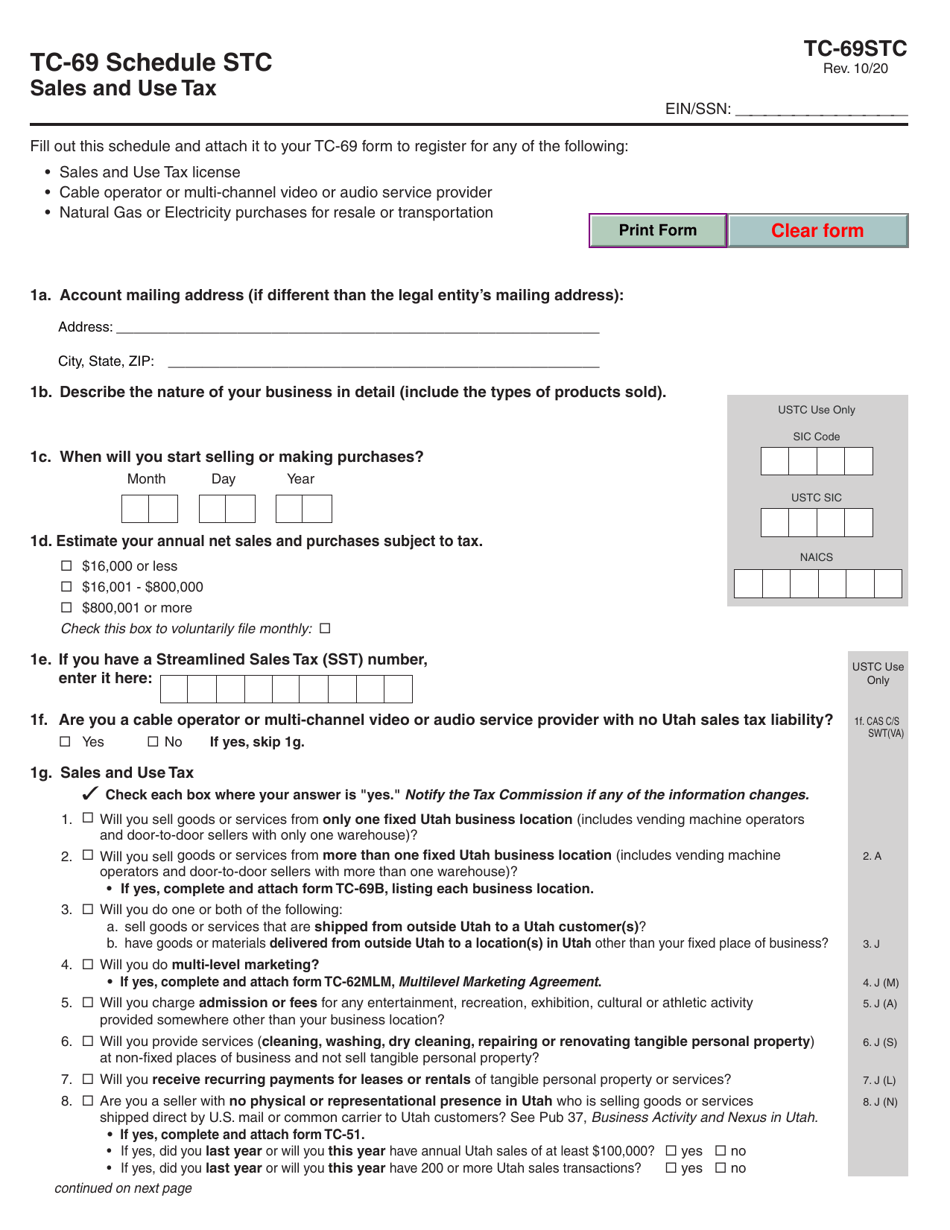

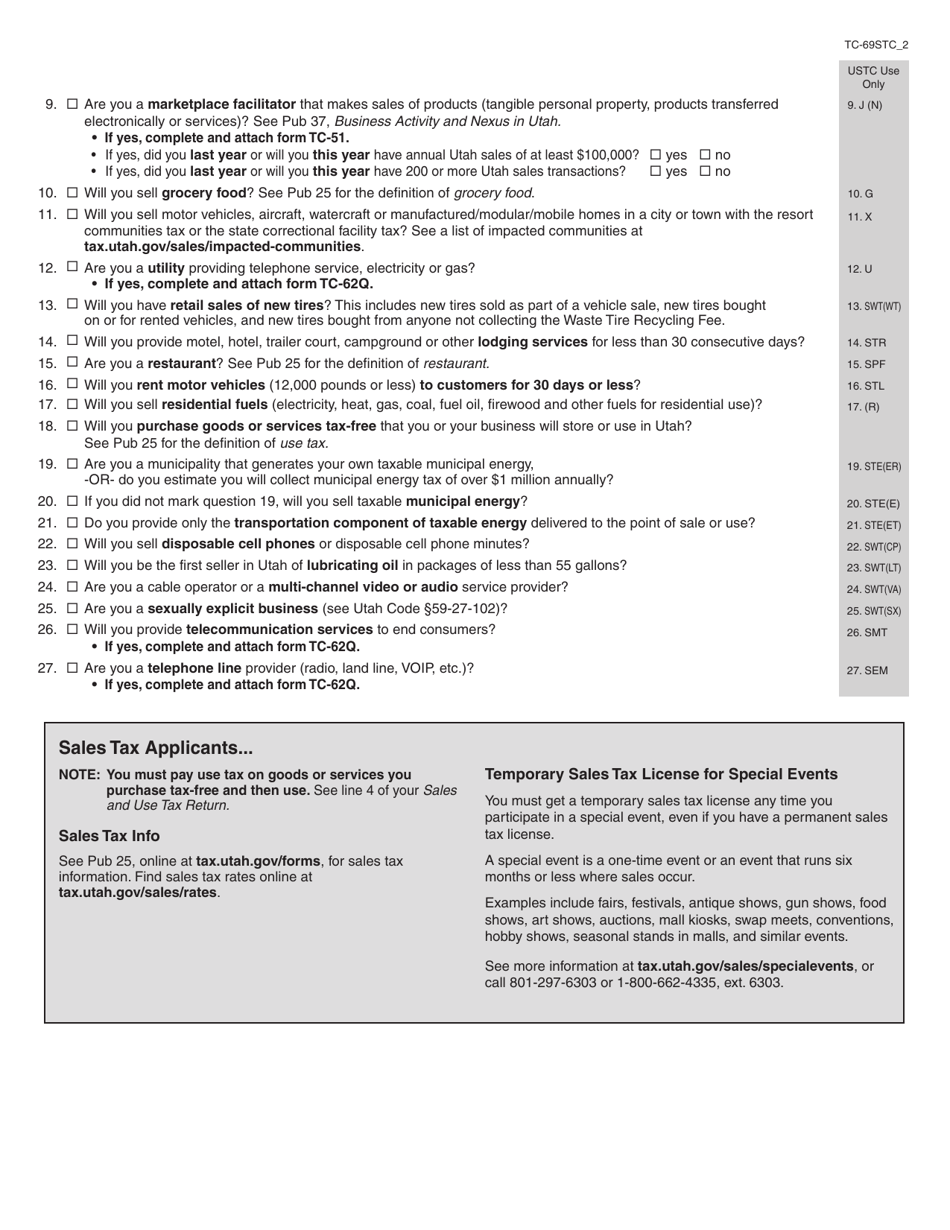

Q: What information is required on Form TC-69 Schedule STC?

A: Form TC-69 Schedule STC requires information such as the total sales and purchases subject to sales and use tax, the tax due, and any other relevant details.

Q: When is Form TC-69 Schedule STC due?

A: Form TC-69 Schedule STC is generally due on a monthly basis, with specific due dates depending on the reporting period.

Form Details:

- Released on October 1, 2020;

- The latest edition provided by the Utah State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TC-69 Schedule STC by clicking the link below or browse more documents and templates provided by the Utah State Tax Commission.