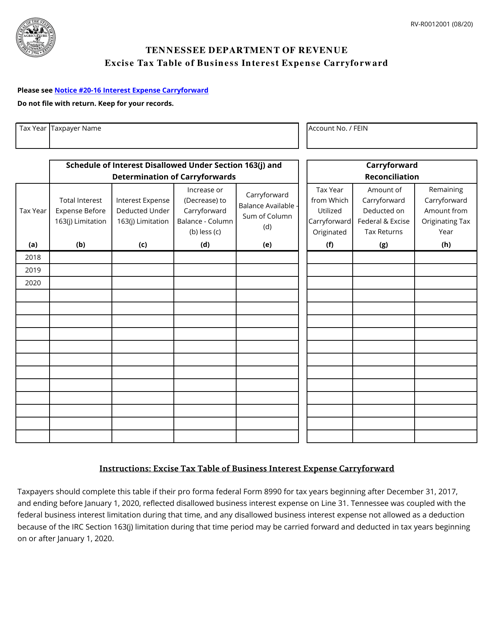

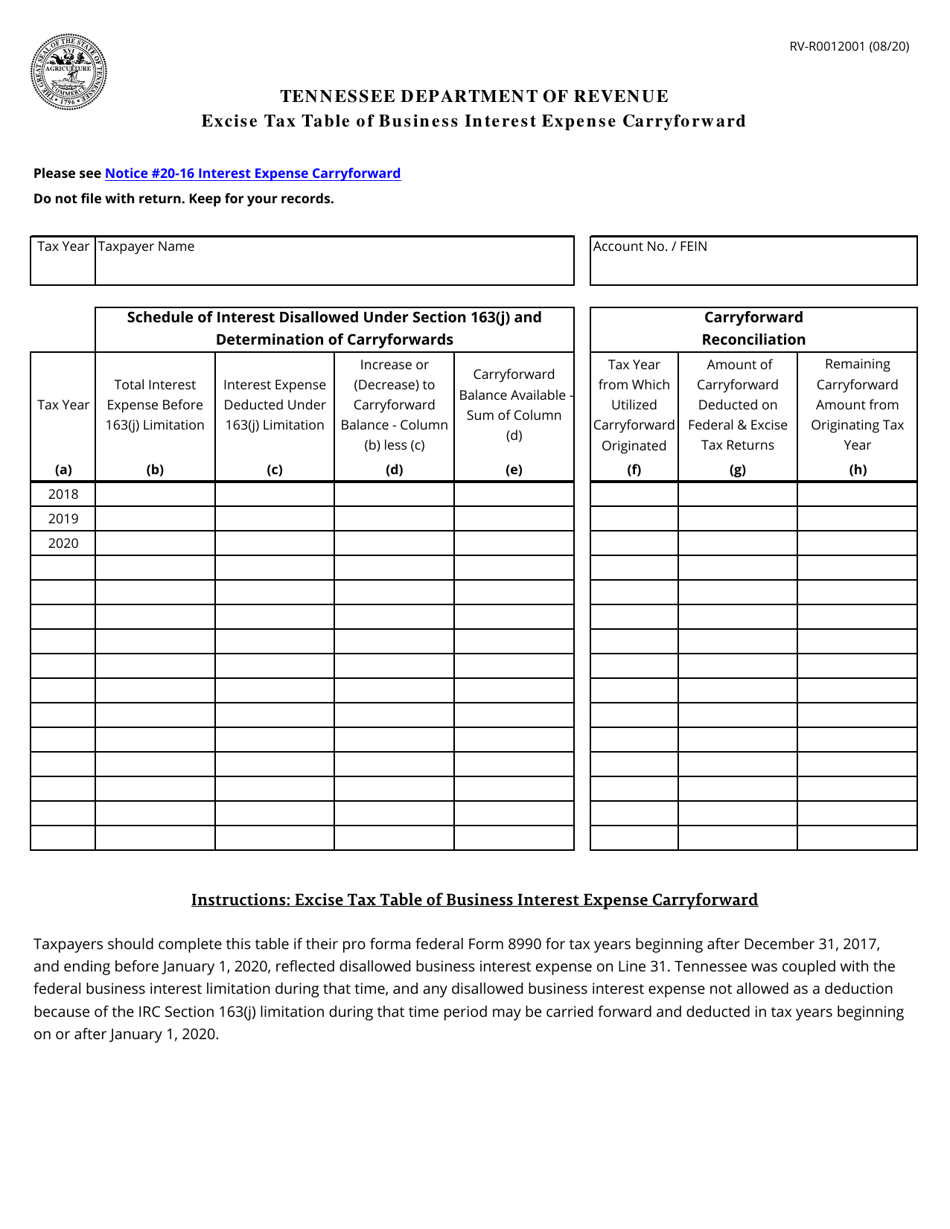

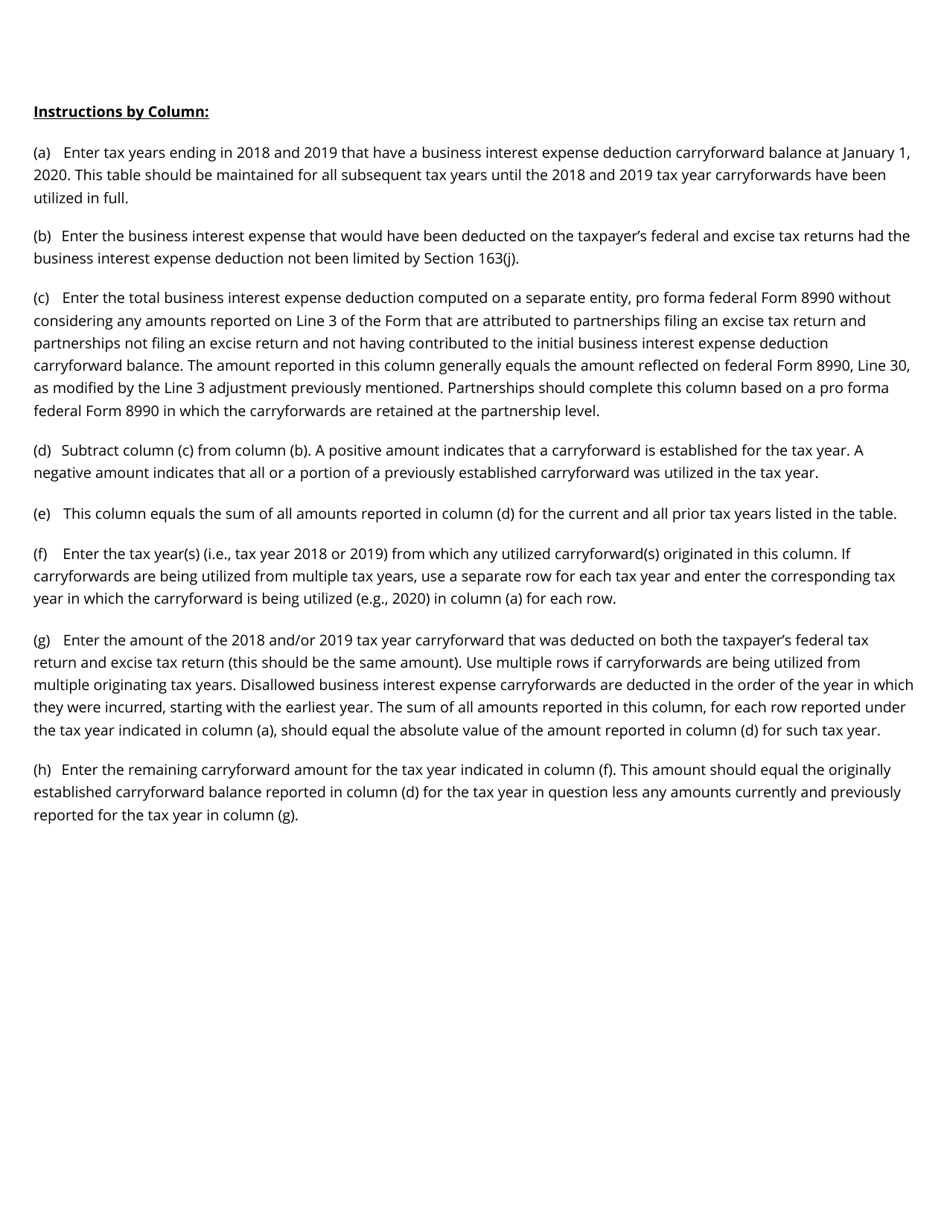

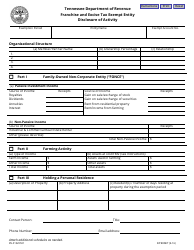

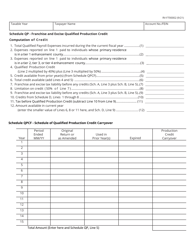

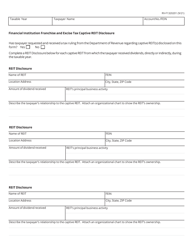

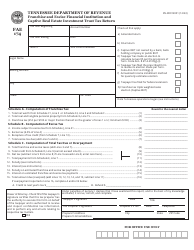

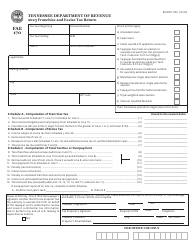

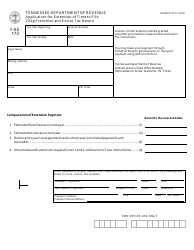

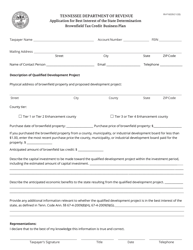

Form RV-R0012001 Excise Tax Table of Business Interest Expense Carryforward - Tennessee

What Is Form RV-R0012001?

This is a legal form that was released by the Tennessee Department of Revenue - a government authority operating within Tennessee. Check the official instructions before completing and submitting the form.

FAQ

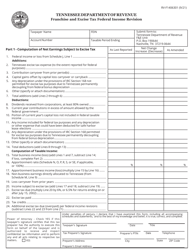

Q: What is the RV-R0012001 form?

A: The RV-R0012001 form is the Excise Tax Table of Business Interest Expense Carryforward form in Tennessee.

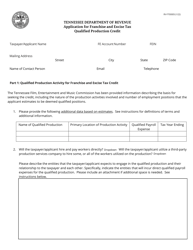

Q: What is the purpose of the form?

A: The purpose of the form is to calculate and report the business interest expense carryforward for excise tax purposes in Tennessee.

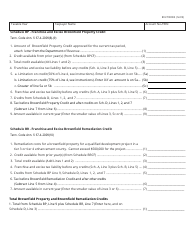

Q: What is the business interest expense carryforward?

A: The business interest expense carryforward is the amount of interest paid or accrued by a business in one tax year that exceeds the allowed deduction and can be carried forward to be deducted in future tax years.

Q: Who needs to file the RV-R0012001 form?

A: Businesses in Tennessee that have incurred business interest expenses in excess of the allowed deduction and want to carry forward those expenses for excise tax purposes need to file the RV-R0012001 form.

Q: Is the form specific to a certain type of business?

A: No, the RV-R0012001 form can be used by businesses of any type in Tennessee.

Q: Are there any filing deadlines for the form?

A: Yes, the RV-R0012001 form must be filed by the due date of the excise tax return for the tax year in which the business interest expense carryforward is being claimed.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Tennessee Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RV-R0012001 by clicking the link below or browse more documents and templates provided by the Tennessee Department of Revenue.