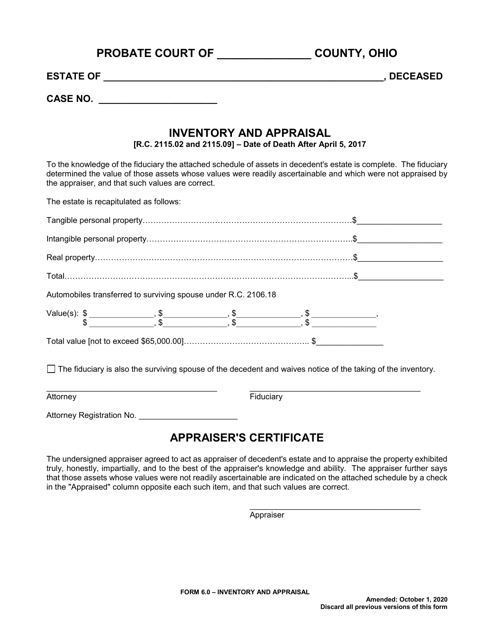

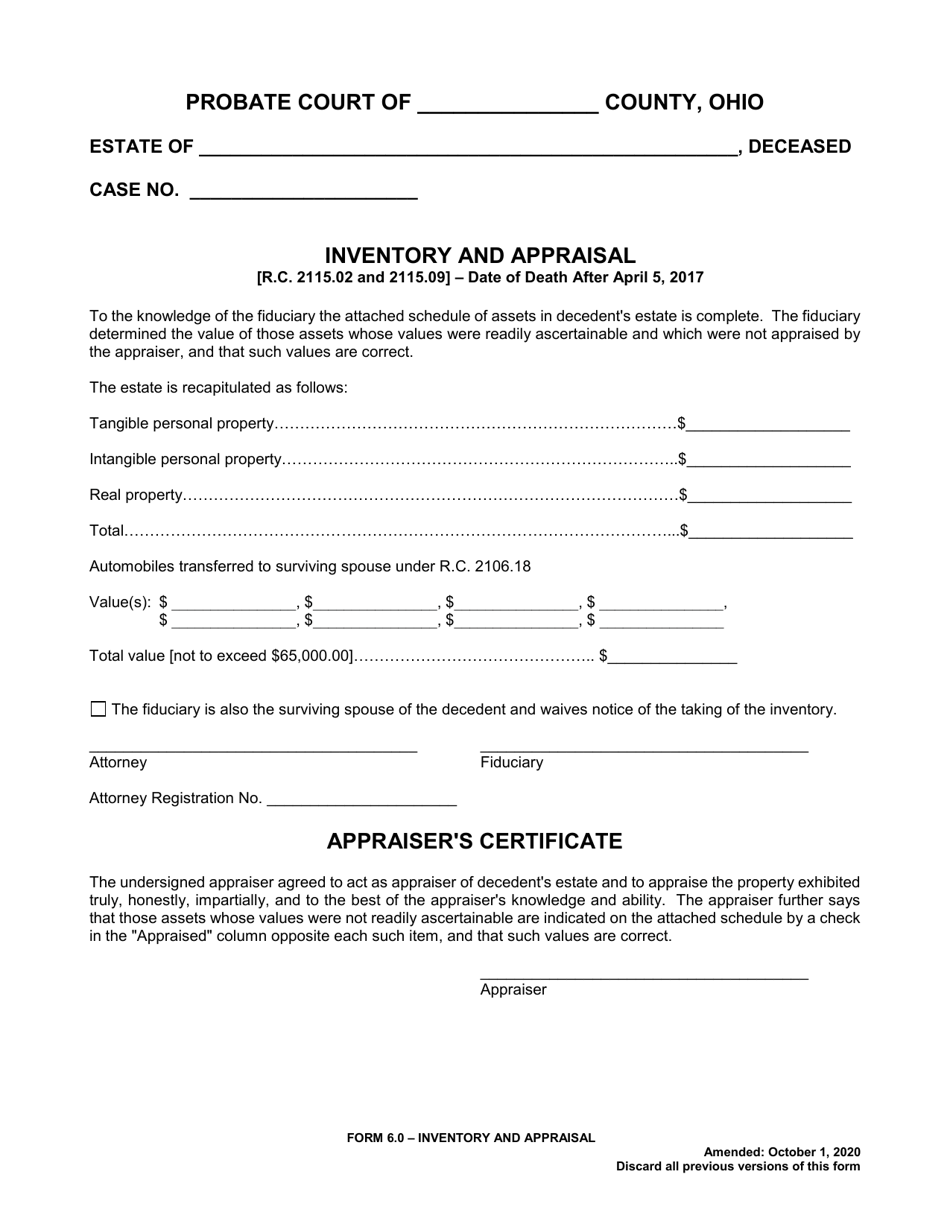

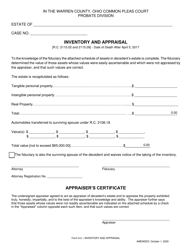

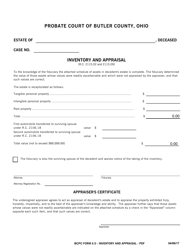

Form 6.0 Inventory and Appraisal - Ohio

What Is Form 6.0?

This is a legal form that was released by the Ohio Courts of Common Pleas - Probate Division - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 6.0 Inventory and Appraisal?

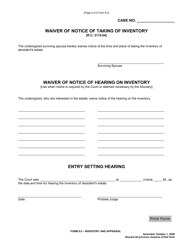

A: Form 6.0 Inventory and Appraisal is a legal document used in Ohio to list and evaluate the assets of an estate.

Q: When is Form 6.0 Inventory and Appraisal required?

A: Form 6.0 Inventory and Appraisal is required when someone passes away and their estate needs to be settled.

Q: What information is included in Form 6.0 Inventory and Appraisal?

A: Form 6.0 Inventory and Appraisal includes a detailed list of the assets and their values, such as real estate, bank accounts, investments, and personal belongings.

Q: Who is responsible for completing Form 6.0 Inventory and Appraisal?

A: The executor or administrator of the estate is responsible for completing Form 6.0 Inventory and Appraisal.

Q: Are there any filing fees associated with Form 6.0 Inventory and Appraisal?

A: Yes, there may be filing fees when submitting Form 6.0 Inventory and Appraisal to the probate court.

Q: What is the deadline for submitting Form 6.0 Inventory and Appraisal?

A: The deadline for submitting Form 6.0 Inventory and Appraisal varies depending on the probate court, but it is usually within a certain number of months after the appointment of the executor or administrator.

Form Details:

- Released on October 1, 2020;

- The latest edition provided by the Ohio Courts of Common Pleas - Probate Division;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 6.0 by clicking the link below or browse more documents and templates provided by the Ohio Courts of Common Pleas - Probate Division.