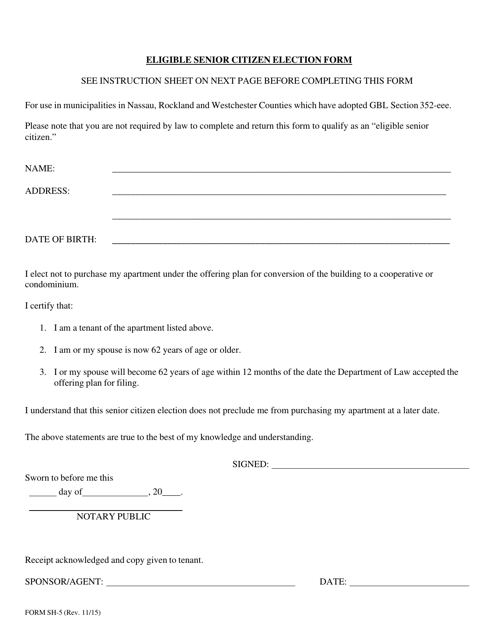

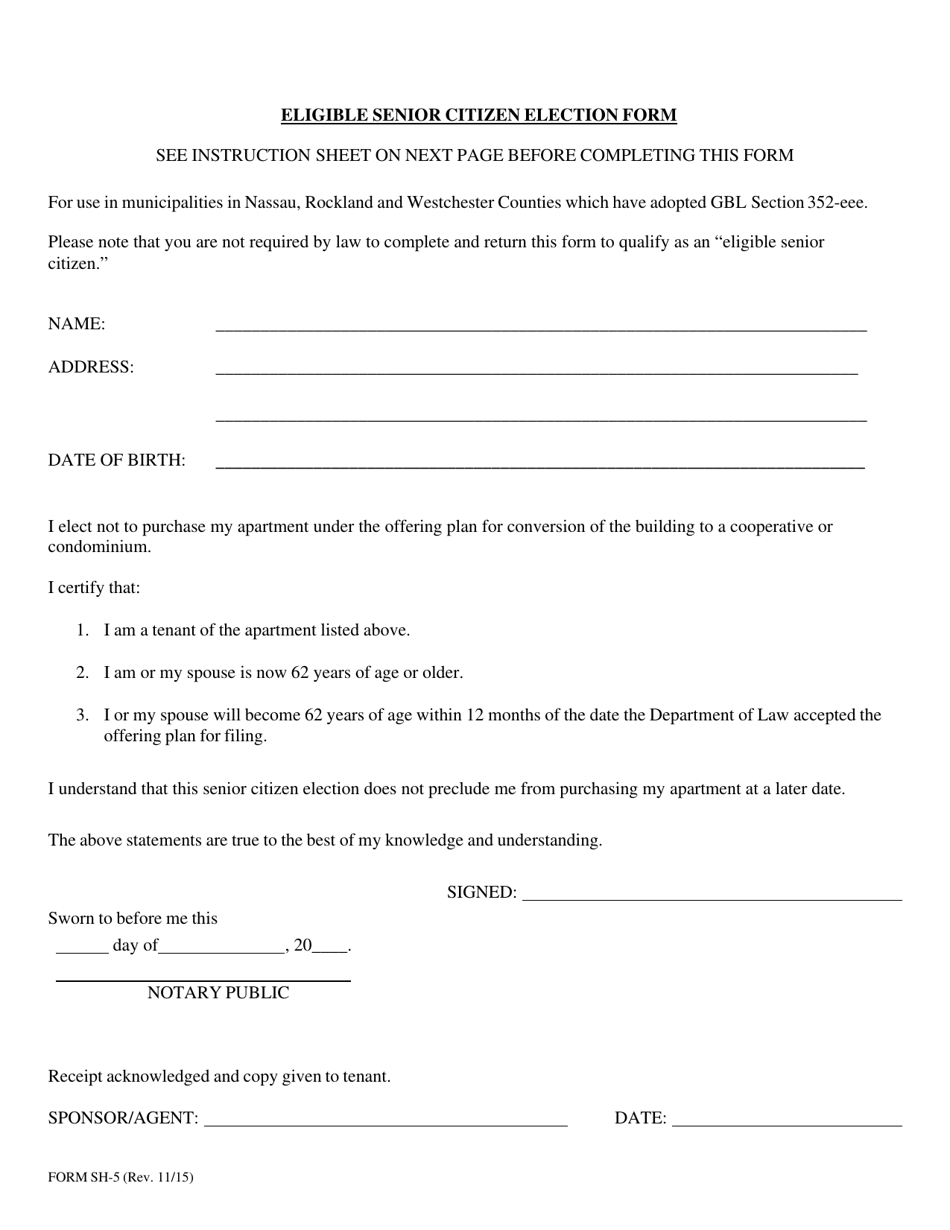

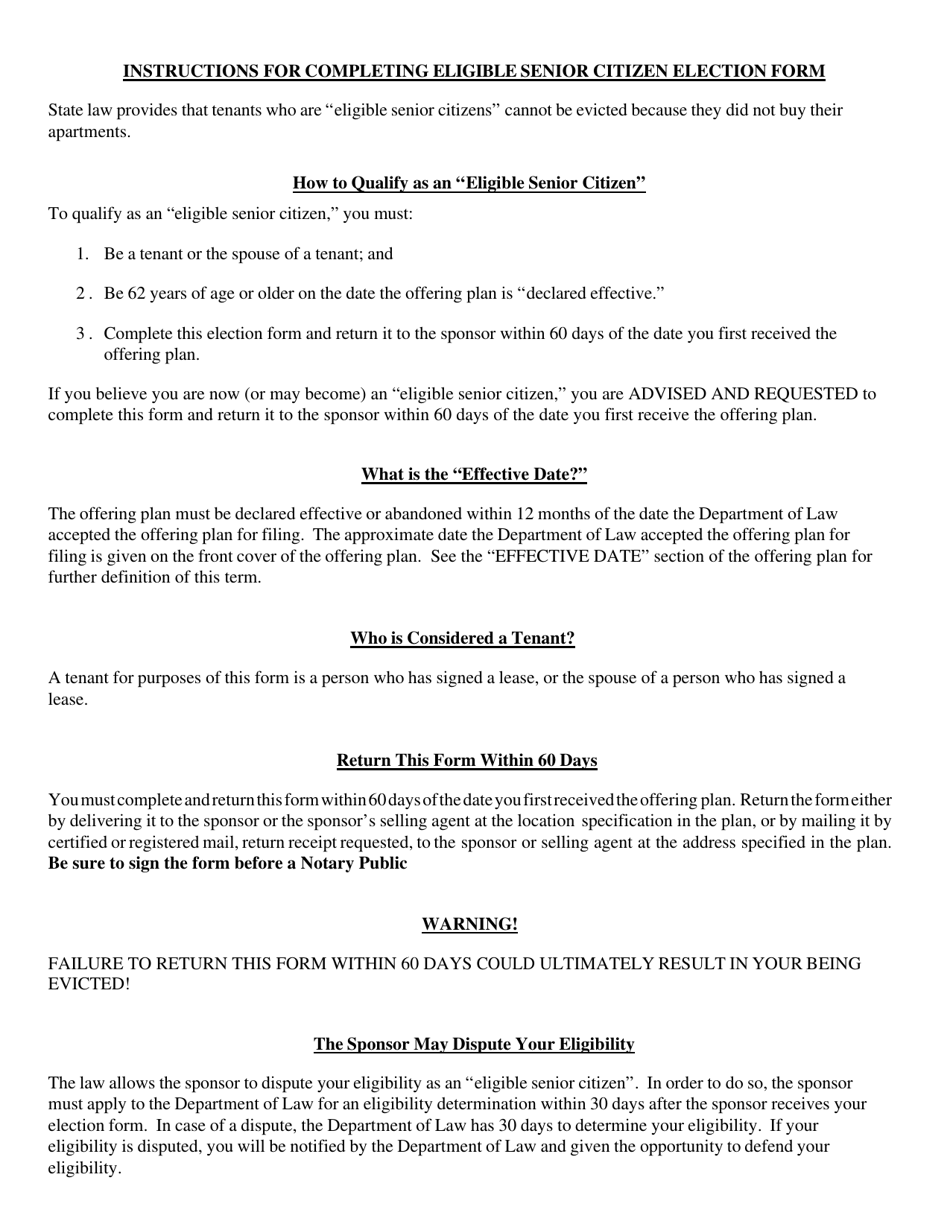

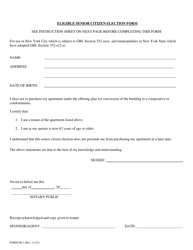

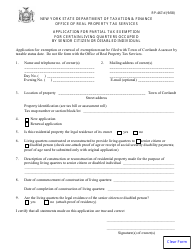

Form SH-5 Eligible Senior Citizen Election Form - New York

What Is Form SH-5?

This is a legal form that was released by the New York State Attorney General - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

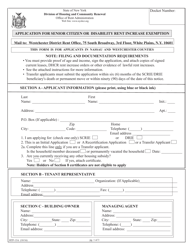

Q: What is Form SH-5?

A: Form SH-5 is the Eligible Senior Citizen Election Form in New York.

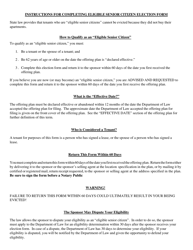

Q: Who is eligible to use Form SH-5?

A: Senior citizens are eligible to use Form SH-5 in New York.

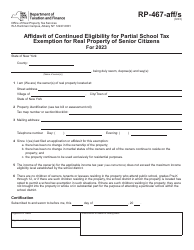

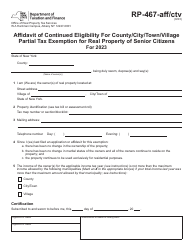

Q: What is the purpose of Form SH-5?

A: The purpose of Form SH-5 is to apply for property tax exemptions available to senior citizens in New York.

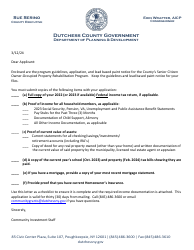

Q: What exemptions can I apply for using Form SH-5?

A: Using Form SH-5, you can apply for the Enhanced STAR exemption, the Senior Citizens Homeowners' Exemption (SCHE), and the Disabled Homeowners' Exemption (DHE) in New York.

Q: What is the Enhanced STAR exemption?

A: The Enhanced STAR exemption is a property tax exemption specifically for senior citizens age 65 or older with qualifying income in New York.

Q: What is the Senior Citizens Homeowners' Exemption (SCHE)?

A: The Senior Citizens Homeowners' Exemption (SCHE) is a property tax exemption for senior citizens age 65 or older with qualifying income in New York.

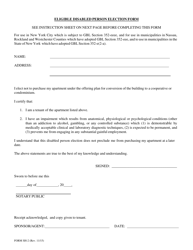

Q: What is the Disabled Homeowners' Exemption (DHE)?

A: The Disabled Homeowners' Exemption (DHE) is a property tax exemption for disabled homeowners with qualifying income in New York.

Q: Are there any income requirements to qualify for the exemptions?

A: Yes, there are income requirements to qualify for the Enhanced STAR exemption, the Senior Citizens Homeowners' Exemption (SCHE), and the Disabled Homeowners' Exemption (DHE) in New York.

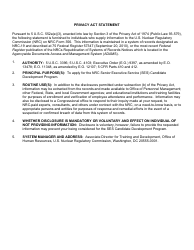

Form Details:

- Released on November 1, 2015;

- The latest edition provided by the New York State Attorney General;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SH-5 by clicking the link below or browse more documents and templates provided by the New York State Attorney General.