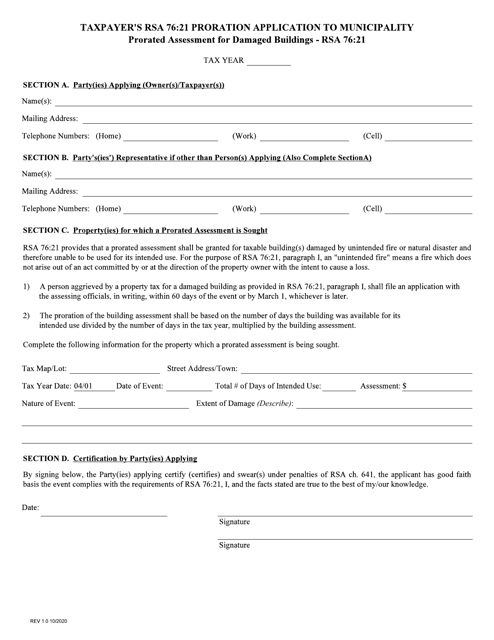

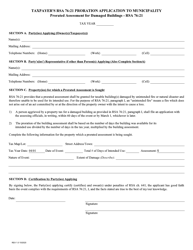

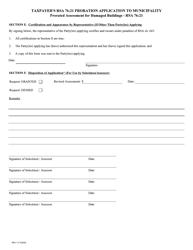

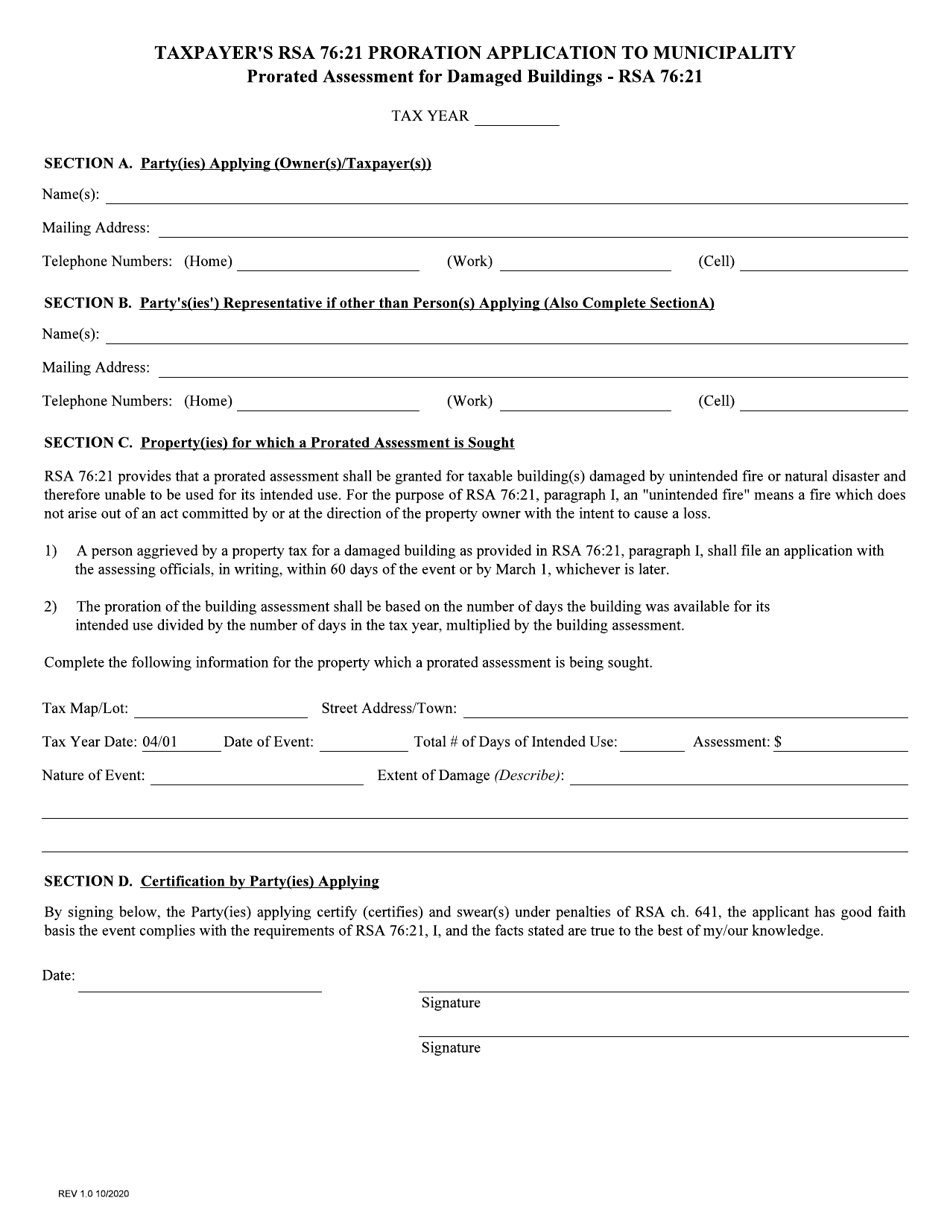

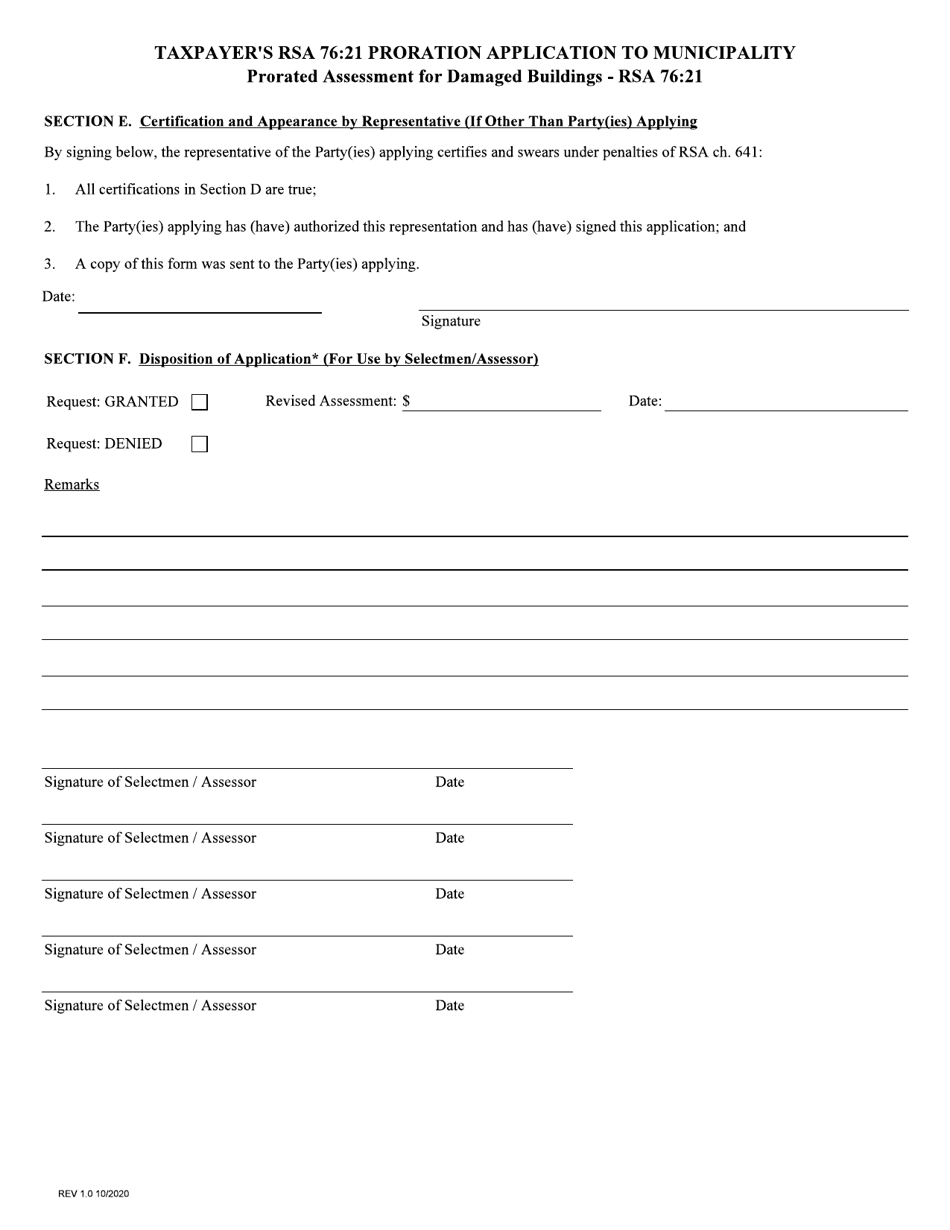

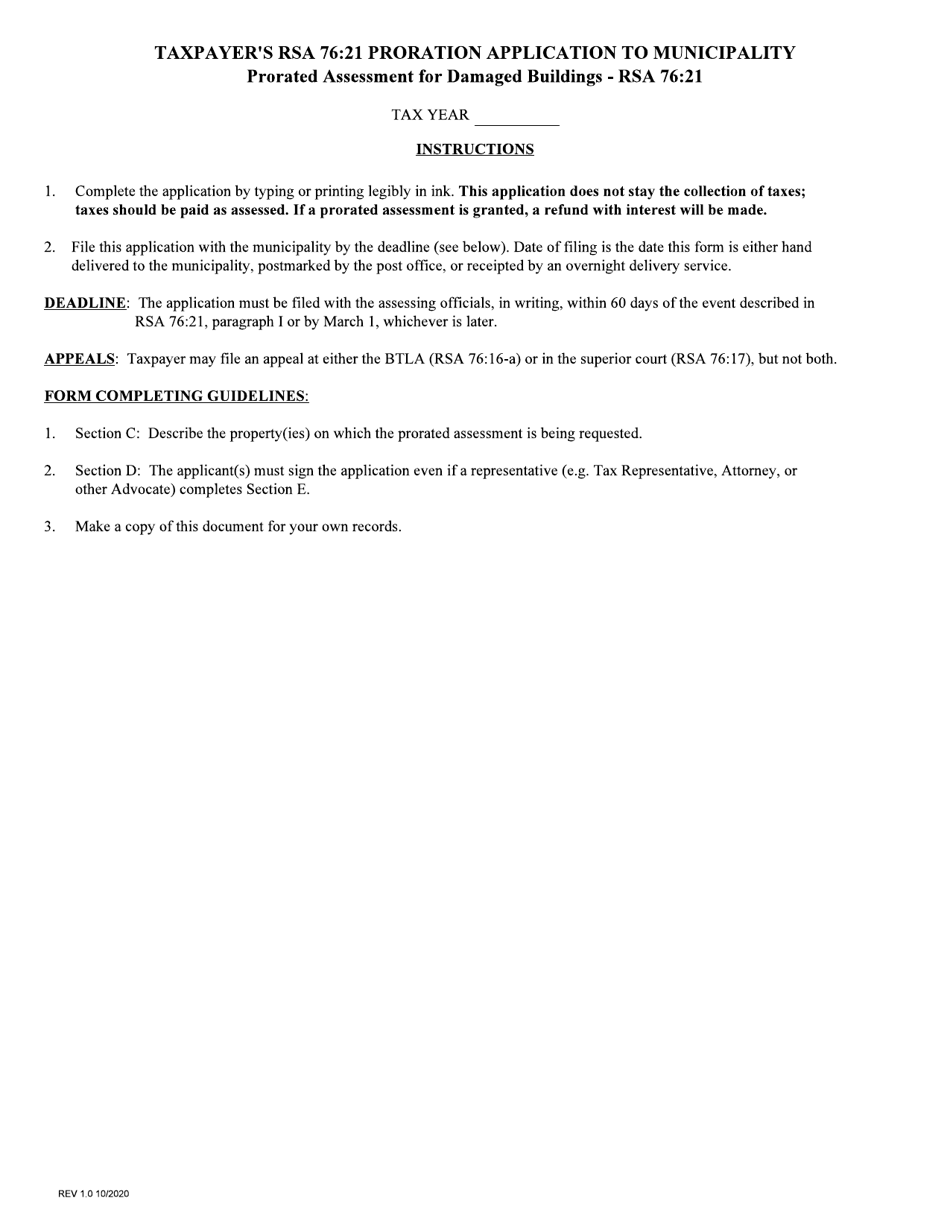

Proration Application to Municipality - Prorated Assessment for Damaged Buildings - New Hampshire

Proration Application to Municipality - Prorated Assessment for Damaged Buildings is a legal document that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire.

FAQ

Q: What is proration?

A: Proration is the act of dividing or distributing something proportionally.

Q: What is prorated assessment?

A: Prorated assessment is a method used to calculate the value of a damaged building based on its condition.

Q: How does prorated assessment work?

A: Prorated assessment works by taking into account the percentage of damage to a building and adjusting its assessed value accordingly.

Q: Why is prorated assessment used for damaged buildings?

A: Prorated assessment is used for damaged buildings to ensure a fair and accurate valuation that reflects the actual condition of the property.

Q: What is the proration application to municipalities in New Hampshire?

A: The proration application to municipalities in New Hampshire allows property owners to apply for a prorated assessment for their damaged buildings.

Q: Who can apply for prorated assessment in New Hampshire?

A: Property owners in New Hampshire who have experienced significant damage to their buildings can apply for prorated assessment.

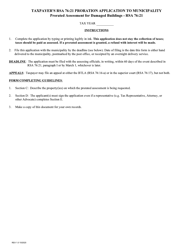

Q: How can I apply for prorated assessment in New Hampshire?

A: To apply for prorated assessment in New Hampshire, you will need to submit a completed proration application to your local municipality.

Q: What documentation is required for prorated assessment application?

A: Typically, you will need to provide supporting documents such as photographs, estimates of repair costs, and evidence of the cause of damage.

Q: Is there a deadline for submitting a proration application in New Hampshire?

A: Yes, there is typically a deadline for submitting a proration application in New Hampshire. It is important to check with your local municipality for specific details.

Q: Does prorated assessment result in a reduction in property taxes?

A: Yes, prorated assessment can result in a reduction in property taxes since the assessed value of the damaged building is adjusted based on its condition.

Form Details:

- Released on October 1, 2020;

- The latest edition currently provided by the New Hampshire Department of Revenue Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.