This version of the form is not currently in use and is provided for reference only. Download this version of

Form NH-1310

for the current year.

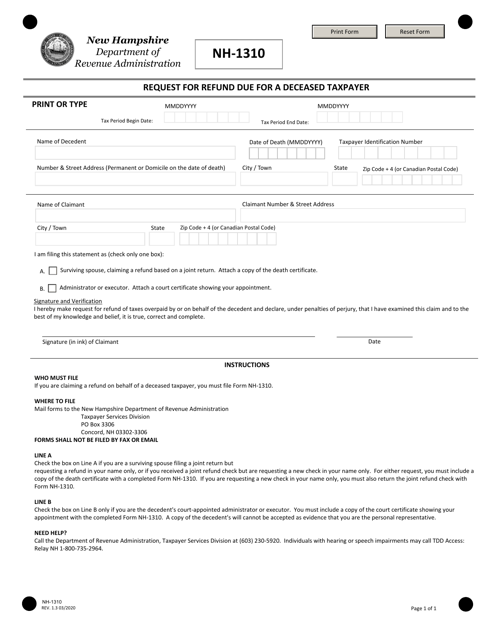

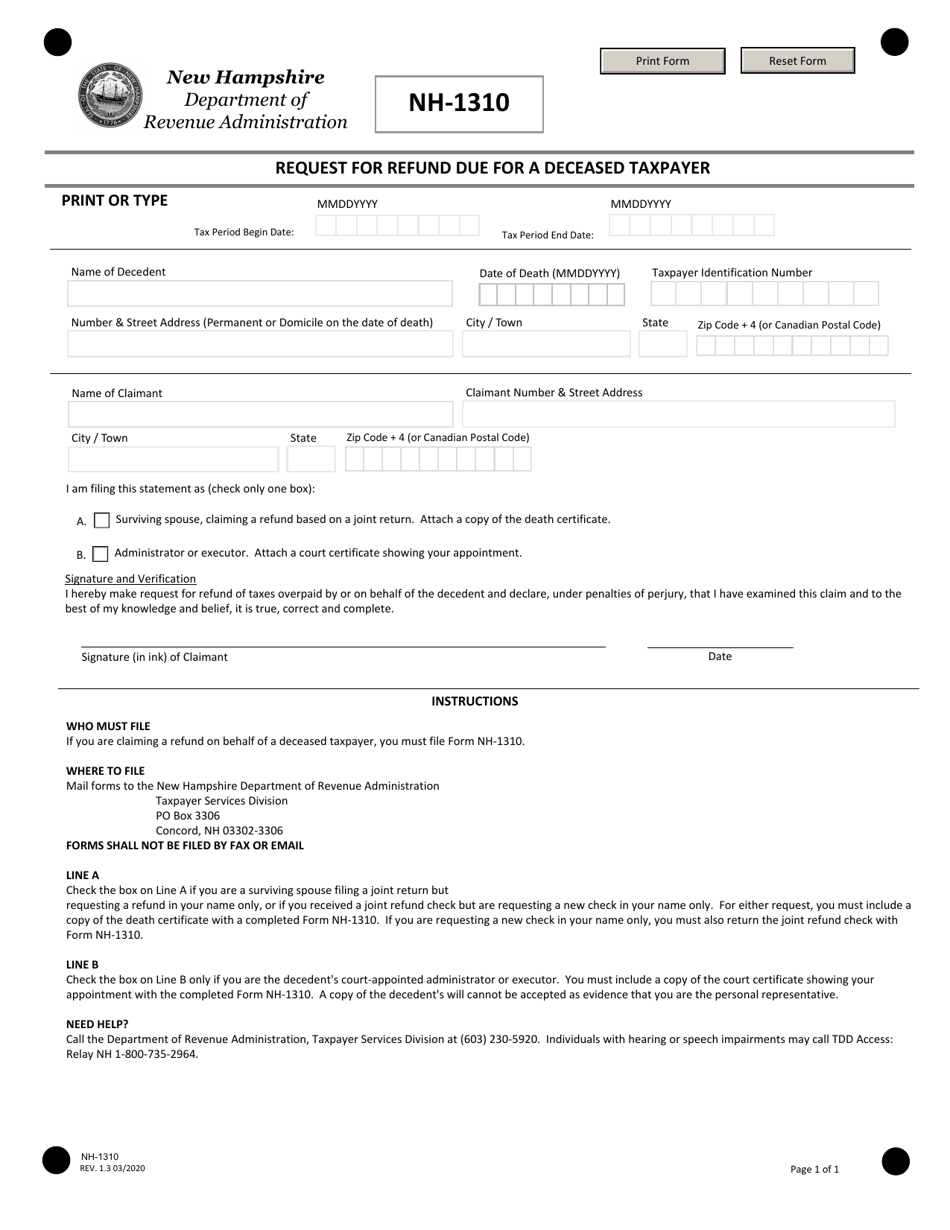

Form NH-1310 Request for Refund Due for a Deceased Taxpayer - New Hampshire

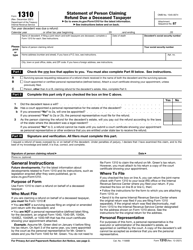

What Is Form NH-1310?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NH-1310?

A: Form NH-1310 is a request forrefund due for a deceased taxpayer in New Hampshire.

Q: Who can file Form NH-1310?

A: Form NH-1310 can be filed by the estate or legal representative of a deceased taxpayer.

Q: What is the purpose of Form NH-1310?

A: The purpose of Form NH-1310 is to request a refund of any overpaid taxes on behalf of a deceased taxpayer.

Q: What information is required on Form NH-1310?

A: Form NH-1310 requires information such as the taxpayer's name, Social Security number, date of death, and details of any overpaid taxes.

Q: Is there a deadline for filing Form NH-1310?

A: Yes, Form NH-1310 must be filed within 3 years from the due date of the original tax return or 2 years from the date of payment, whichever is later.

Q: Can Form NH-1310 be filed electronically?

A: No, Form NH-1310 cannot be filed electronically. It must be filed by mail or delivered to the New Hampshire Department of Revenue Administration.

Q: How long does it take to process Form NH-1310?

A: The processing time for Form NH-1310 varies, but it generally takes several weeks to receive a refund.

Q: Are there any fees associated with filing Form NH-1310?

A: No, there are no fees associated with filing Form NH-1310.

Q: What should I do if I have questions or need assistance with Form NH-1310?

A: If you have questions or need assistance with Form NH-1310, you can contact the New Hampshire Department of Revenue Administration for guidance.

Form Details:

- Released on March 1, 2020;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NH-1310 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.