This version of the form is not currently in use and is provided for reference only. Download this version of

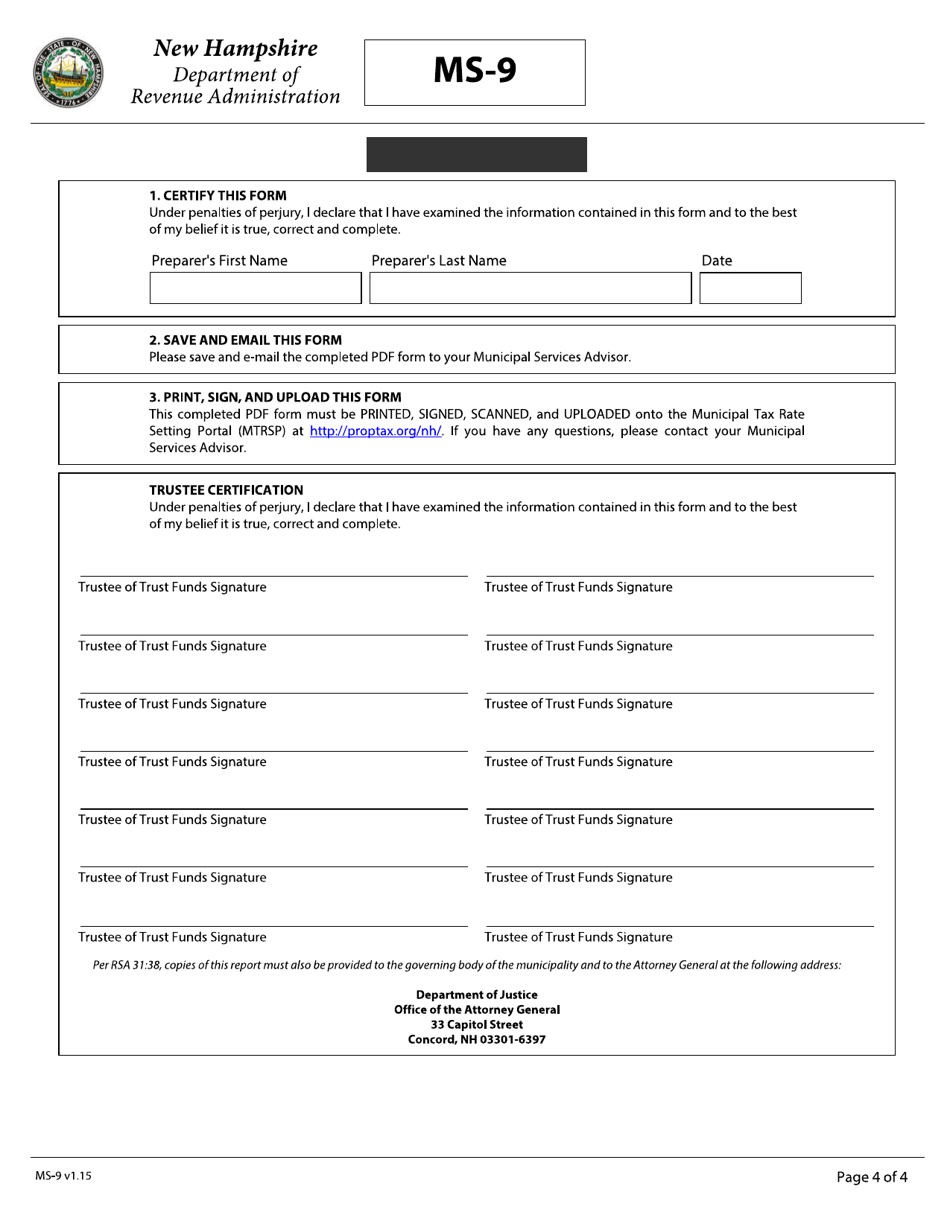

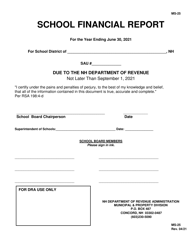

Form MS-9

for the current year.

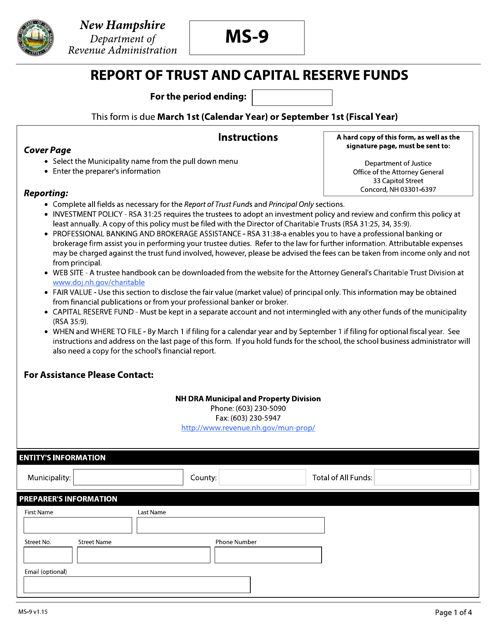

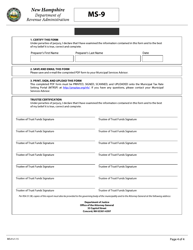

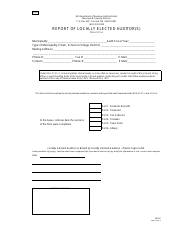

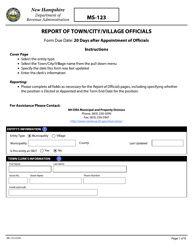

Form MS-9 Report of Trust and Capital Reserve Funds - New Hampshire

What Is Form MS-9?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MS-9?

A: Form MS-9 is the Report of Trust and Capital Reserve Funds.

Q: Who needs to file Form MS-9?

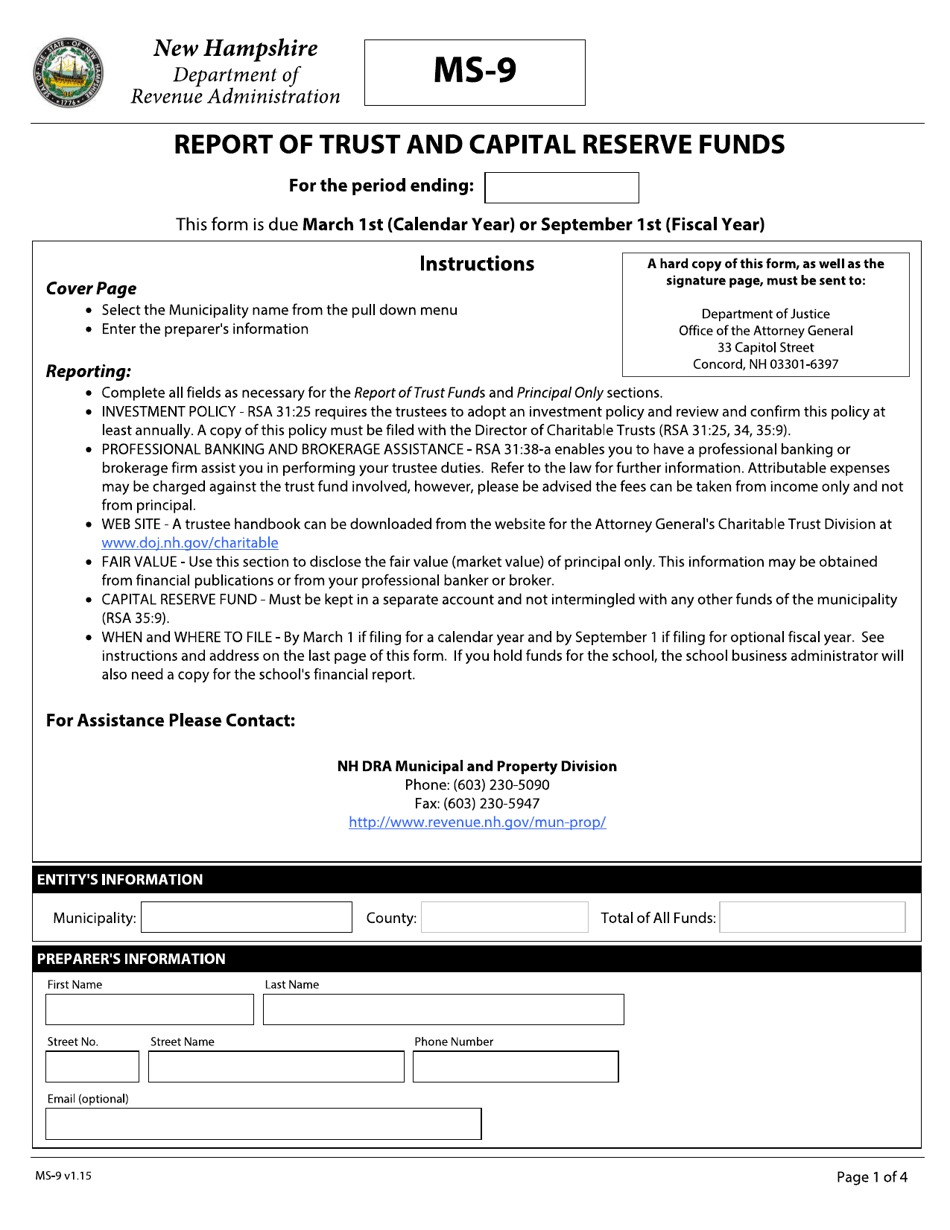

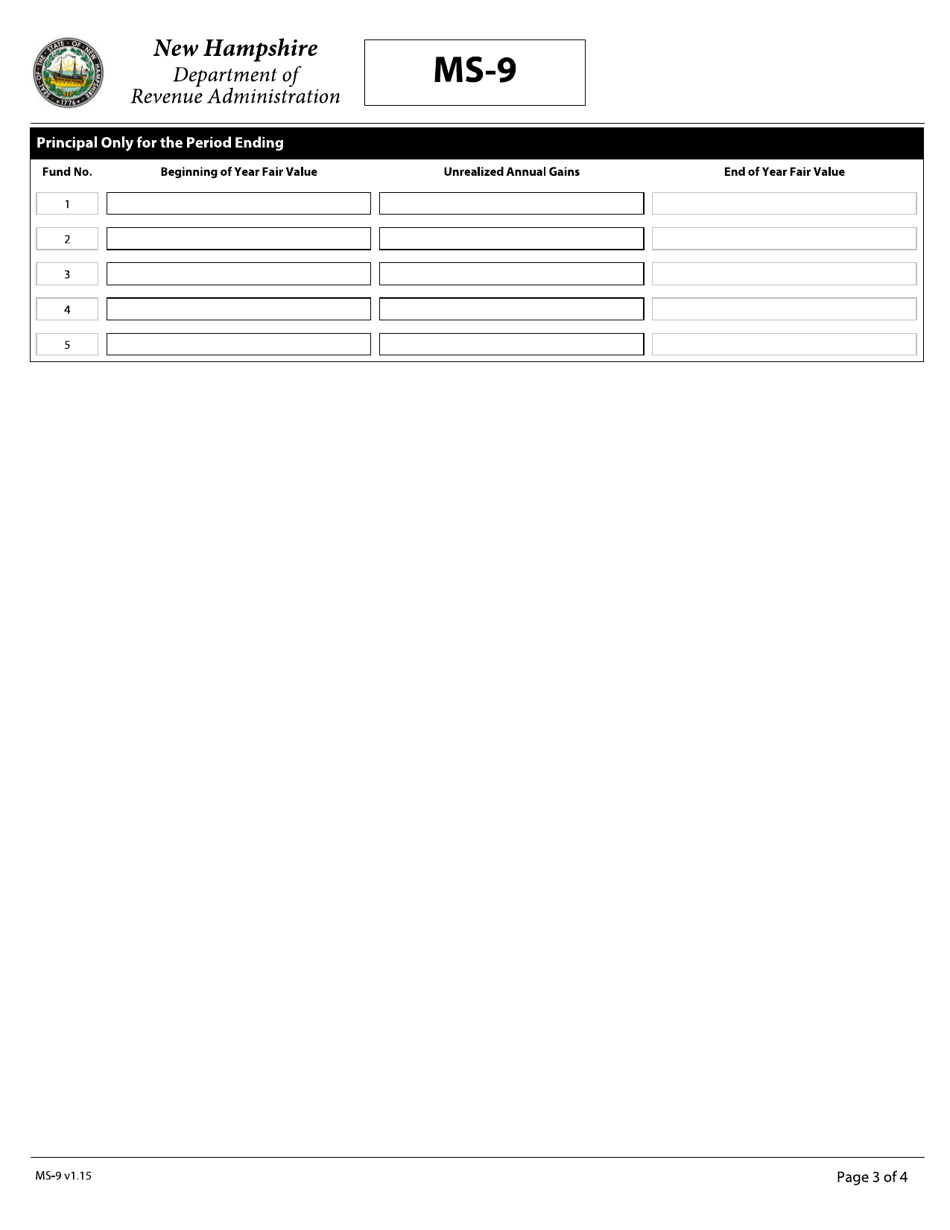

A: Individuals or organizations that maintain trust and capital reserve funds in New Hampshire need to file this form.

Q: What is the purpose of Form MS-9?

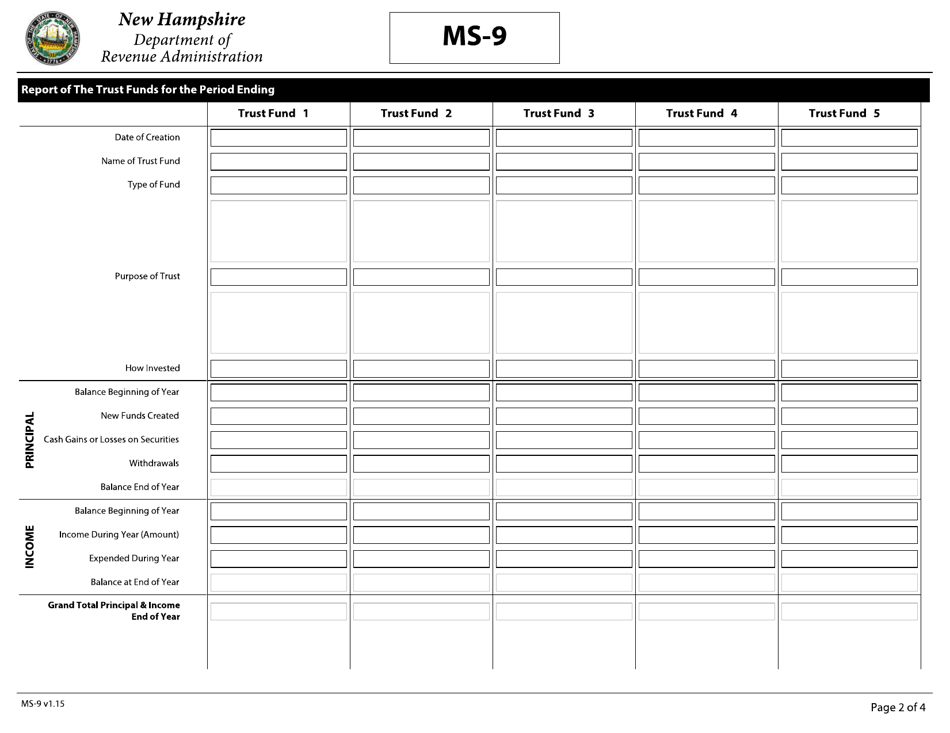

A: The purpose of Form MS-9 is to report the details of trust and capital reserve funds held in New Hampshire.

Q: Do I need to file Form MS-9 if I don't have trust or capital reserve funds?

A: No, you only need to file Form MS-9 if you maintain trust or capital reserve funds in New Hampshire.

Q: Are there any penalties for late filing of Form MS-9?

A: Yes, there may be penalties for late filing of Form MS-9. It is important to file the form on time to avoid any penalties.

Q: Are there any fees associated with filing Form MS-9?

A: No, there are no fees associated with filing Form MS-9.

Q: Is Form MS-9 specific to New Hampshire?

A: Yes, Form MS-9 is specific to New Hampshire and is used to report trust and capital reserve funds held in the state.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MS-9 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.